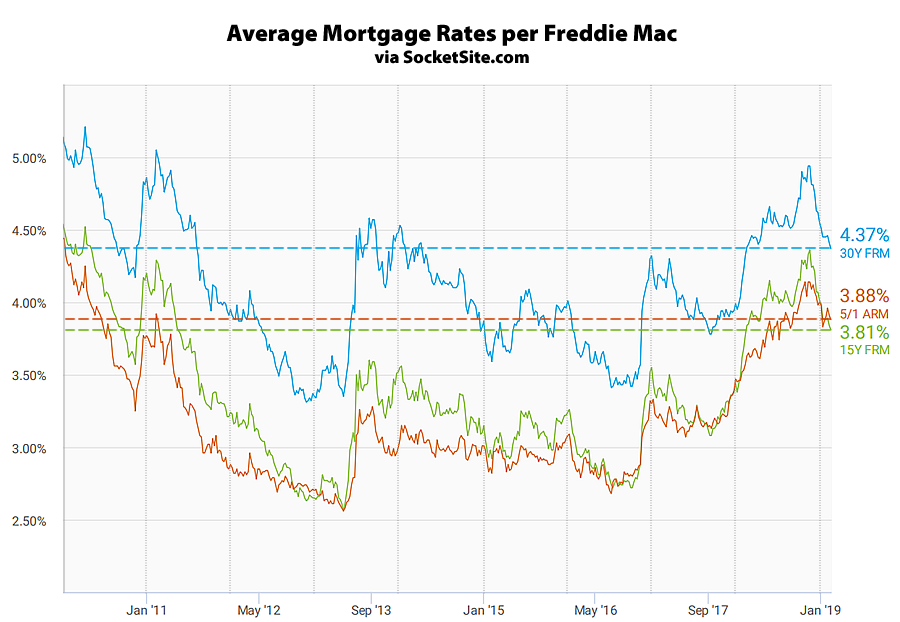

The average rate for a benchmark 30-year mortgage, which hit a 7-year high of 4.94 percent this past November, shed another 4 basis points over the past week and has dropped 4.37 percent, the lowest rate in a year, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has dropped to 3.81 percent, which is 3 basis points below its mark at the same time last year and down 55 basis points since mid-November. And while the average rate for a 5-year adjustable also slipped 3 basis points over the past week to 3.88 percent, it remains 25 basis points above its mark at the same time last year and 7 basis points above the 15-year rate.

And with the Fed having formally signaled a more “patient” approach with respect to any future rate hikes, with growing signs of a global economic slowdown, the probability of a hike this year has dropped to 2 percent, which is now six times less probable than the possibility of an easing, according to an analysis of the futures market.

“…Fears Grow”? Not a word in your article about growing fears.. Fear that interest rates will drop further and variable mortgage rates won’t reset at rates that forces people out of their homes? Or?

The business cycle is probably coming to an end, but you don’t discuss that in the article.

“And with the Fed having formally signaled a more “patient” approach with respect to any future rate hikes, with growing signs of a global economic slowdown, the probability of a hike this year has dropped to 2 percent, which is now six times less probable than the possibility of an easing, according to an analysis of the futures market.”

Believe it or not, the pullback by the Fed and relative odds of an easing aren’t bullish signs.

“Don’t fight the Fed”

“Fears” of what? Fears of low rates? (Rates which nevertheless are still a full point higher than 2013-2016.) When rates were rising, this blog was sounding the alarm that it was doom for RE sales … now that they’re falling, we have “fears”?

Between these increasingly slanted headlines and the grossly misinterpretive piece on Newsom’s comments on HSR, I’m finding this blog less and less useful.

Again, it helps to read all three paragraphs. Oh, and sales volume in San Francisco has, in fact, been on the decline over the past two years (down 13 percent since 2016) while inventory levels were an average of 38 percent higher last year than in 2015, putting downward pressure on prices, led by the condo market (as we called at the time). But hey, what do we know.

I read all 3 paragraphs – a few times – looking for how any of this results in “fears”. (But thanks for snarkily assuming that I did not – I mean, I’ve only been commenting on this site for 5 years, so maybe I’m a dumb noob.)

Other than bankers, does anyone “fear” the thought that interest rates will go down? Won’t interest rates going down *help* that SF sales curve?

And I work in real estate finance, so “hey, what do [I] know”?

I stand by my comments.

The fear isn’t that rates drop but rather the root cause that’s driving them back down.

But yes, lower rates should help boost sales (which have been lagging despite the fact that 30-year rates, which were averaging over 6 percent prior to the Great Recession, haven’t broken the 5 percent mark since 2011).

And the typical impact on underlying values when rates start to climb?

Pretty soon, I’m thinking probably as soon as springtime, you’re going to be talking about what looms for 2020 as 2019 shortly begins to appear as yet another peak year.

As always, we’ll stick with the hard data and actual trends at hand, even when uncomfortable or running counter to popular narratives or industry tropes.

* LEIs positive

* S&P 500 up 14% after the Dotard-induced 20% decline

* Lower rates almost everywhere

* Fed put reconfirmed

Who, exactly, is fearful, and of what?

Just to be clear, despite equities trading near all-time highs and mortgage rates still well below average, home sales are down and inventories are growing. At the same time, the price of safer, 10-year treasuries is being bid up and the Fed has suddenly had to retreat from their previously bullish plans for multiple hikes this year. And with all that being said, your best read on the market is, “what’s not to like?”

Why are you avoiding the question? The headline says, “…, Fears Grow”

Who, exactly, is fearful, and of what?

Once again, “with the Fed having formally signaled a more “patient” approach with respect to any future rate hikes, with growing signs of a global economic slowdown, the probability of a hike this year has dropped to 2 percent, which is now six times less probable than the possibility of an easing, according to an analysis of the futures market.”

And of course, it helps to understand that mortgage rates tend to track the 10-year treasury. And when rates drop, it’s not a bullish sign.

Ah, so you’re saying the Fed is fearful. How do you know their fears have grown, as the headline states?

Perhaps the Fed itself begs to differ?

So in Aug 2007 (0.5) the Fed thought the possibility of recession was lower than what it is now! Good to know. They started lowering the funds rate in Aug 2007 to prepare for a recession. As of Oct 2018 the possibility is at 0.8 according to that chart. The Fed started signaling that they are going to be cautious going forward.

You really should learn to read the data you present for your argument especially since it is proving the opposite.

Great chart. The latest read (October 2018) was 0.8 percent, up from 0.0 percent in January of 2018. The read in October 2007? 1.4 percent. Whoops.

Again, back to your headline that claims, “…,[Fed’s] Fears Grow.” Agree or disagree with the Fed’s own model, but don’t misreport the facts.

And once again, it helps to actually understand all the elements in play (drop in rates, investor confidence and the Fed’s move) and what they actually mean. But don’t let that stop you from hanging your hat on parsing a dastardly headline (Damn you meddling kids!) or misclaiming a misreporting of facts.

Which brings us back to the actual drop in rates (while pending sales remain down and inventory grows)…

OR you could say that the Fed’s FEAR of wage pressure and inflation is waning as more people are entering/re-entering the labor force, so they do not see a need for additional rate increases – right? Fears Subsiding!

The bond market is showing fear. That is why rates have come and the fed has paused. The bond market often leads and it is responding to a slowing global and US economy.

Now… how this relates to a Bay Area Real Estate economy which is flush with cash is another story. But there are definite fears in the global economy. Cut the author a break. Armchair economists who sold a few mortgages or the opinion of someone reads the WSJ are just one side of a multifaceted market.

Dear Socketsite,

I’ve been reading you for years, but I have to agree with many of the other commenters here that I’m growing a bit weary of your use of slanted word choices and apparent agenda. I actually do agree that the market and the economy are in peril and fears are growing, but presenting the facts is sufficient. Your headline choices are IMHO just undermining your own credibility.

The readers trying to will the economy to avoid a slow down by being purposefully dense are truly hilarious. Do you really not know what fears the title of this article is referring to? Please, stop covering your ears while screaming ‘la la la la la’.

Perhaps the Fed can successfully manage the oft wished for soft landing?

I think there are definitely foreign fears with Brexit, US China trade war set to actually start in March, China slowing and backing down off a generational productivity peak, and Europe all but already in recession.

This just means the Fed put is back in play.

From the minutes of the Fed’s last Open Market Committee which were released today:

“Market participants pointed to a number of factors as contributing to the heightened volatility and sustained declines in risk asset prices and interest rates over recent months including a weaker outlook and greater uncertainties for foreign economies (particularly for Europe and China), perceptions of greater policy risks, and the partial shutdown of the federal government. Against this backdrop, market participants appeared to interpret FOMC communications at the time of the December meeting as not fully appreciating the tightening of financial conditions and the associated downside risks to the U.S. economic outlook that had emerged since the fall.”

But again, what do we (and members of the Fed) actually know.

You still don’t get it. There are “greater Uncertainties” and “downside risks” in the market. This is not what you discussed in your graphic and 4 sentences below. And how does that equate fear anyway? There are concerns.. I am concerned that my kids will never be able to afford a place of their own if prices keep going up and up and up. I am hopeful that the housing market will cool and make it possible for young people to get their own place! I would be concerned about their jobs if the economy was in a tail spin, but that is hardly what the Fed is indicating.

Once again, it helps to understand that mortgage rates tend to track the 10-year treasury and when rates drop, it’s not a bullish sign. The fear isn’t that rates drop but rather the root cause that’s driving them back down. And “with the Fed having formally signaled a more “patient” approach with respect to any future rate hikes, with growing signs of a global economic slowdown, the probability of a hike this year has dropped to 2 percent, which is now six times less probable than the possibility of an easing, according to an analysis of the futures market,” as we originally wrote above.

And once again, it is NOT a lack of understanding from your readers of the general economy and where it is heading, but a lack of understanding by the editor of what is good reporting. Belittling your readers is not going to drive home your point, but we do hear your opinion loud and clear.

Is your issue just with the word “fear” vs “concerns grow’?

Regardless of word choice, the bottom line is that the Fed was starting to return towards normalization after years of extreme economic intervention. But this normalization was predicated on a strong economy and they have now paused this process because of increased fear/concern/uncertainty about the global economy.

tl/dr They believe things might take a turn for the worse so they are pausing the normalization process.

If you’ve been in the hospital and the doctors were planning to let you out, but they decide to take a more “patient” approach and keep you in indefinitely. That is not a good sign for your underlying health!

We had several years of slow growth, followed by a couple of years of strong growth – the Fed had to increase interest rates to curb real estate price growth in particular – they seem to have succeeded, while the unemployment rate stays close to historical lows. Further increases in interest rates is not called for as real estate sales and prices appear to be stalling. There are always uncertainty in the future including the economic outlook.

To use the word fear in a headline about falling interest rates (back to 2018 levels) is off the mark, but a bit of concern is fine 🙂

The fed increases interest rates to curb inflation not to manage real estate prices…

Real estate prices/housing cost are part of inflation. There has been much debate about what the true rate of inflation is, same as the true unemployment rate.

“If you’ve been in the hospital and the doctors were planning to let you out, but they decide to take a more “patient” approach and keep you in indefinitely. That is not a good sign for your underlying health!”

If the doctors were going to put you on medication but decided on a more “patient” approach to let you change your diet and get some exercise into your routine, would that be a course for fear?

Let’s suppose that there are analytics demonstrating that a bit of exaggeration in the title garners more clicks. You are just going to have to learn to compensate.

SS headlines are downright calm compared to the headline inflation that you see elsewhere on the net.

Correct – it’s the difference between click bait and good journalism. And considering that the mortgage rate report usually garners zero or very few comments, SS got the response they looked for, but now find themselves on a different level in the spectrum of reporting.

“Simplify, then exaggerate” has been the credo of even “good journalism” for a long time. You’ve chosen an odd place to take a stand.

Even when I don’t agree with the opinions of SS, which happens from time to time, I usually appreciate their reporting – that is why I voiced my opinion on this headline, which I find is misleading.

I know that CNN and Fox News thrive on this type of headlines, and I despise them (for that and other reasons). And criticizing the national news outlets is not going to make them change…

We could honestly care less about optimizing a headline for clicks. At the same time, we’ve never pulled punches or worried about offending people with delicate sensibilities.

Fear of an economic slowdown is pushing rates down and causing the Fed to take a more “patient” approach. And whinging over the word choice of “fear,” while suggesting a synonym would be a more palatable choice, is a waste of everyone’s time.

And now back to the actual topic at hand…