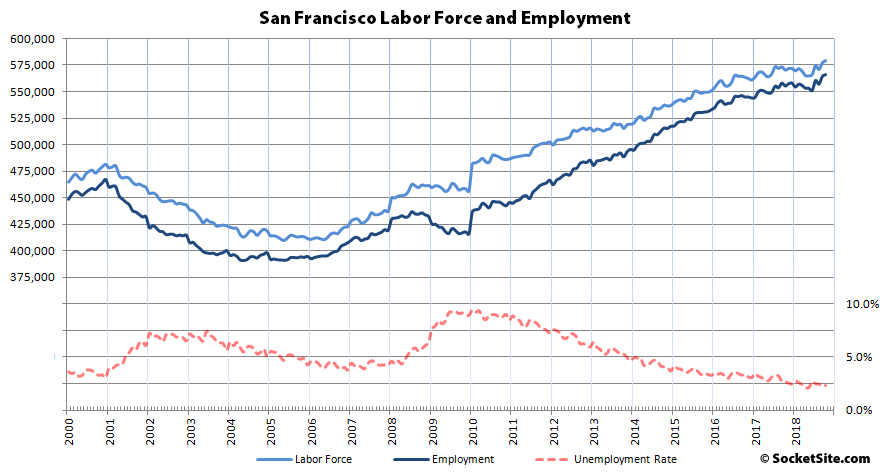

Having jumped in September, the number of people living in San Francisco with a job ticked up by another 1,800 over the past month to a record 565,700 in October while the labor force increased by 2,200 to a record 578,900, pushing the employment rate up from 2.2 to 2.3 percent having dropped to 2.1 percent in April.

And as such, there are now 129,000 more people living in San Francisco with paychecks than there were at the start of 2010 and 10,700 more than at the same time last year versus a year-over-year increase of 10,300 in October of 2017 and 15,000 in October of 2015.

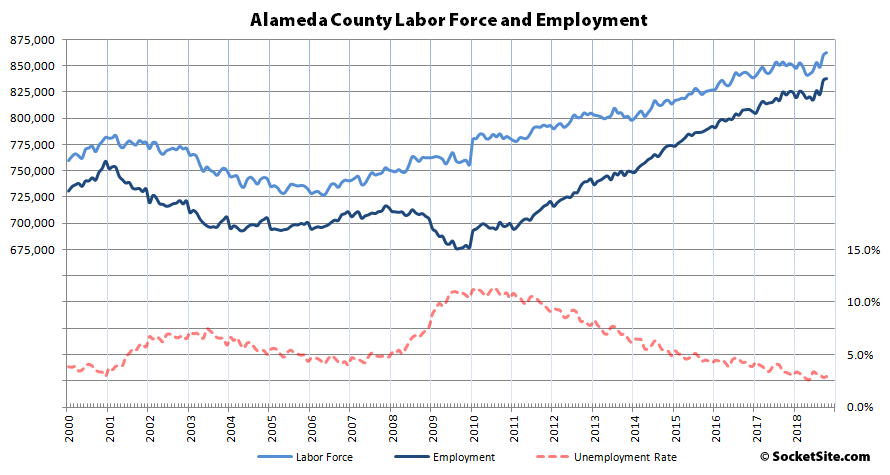

In Alameda County, which includes the City of Oakland, the estimated number of people living in the county with a paycheck ticked up by 1,700 to a record 837,800, which is now 145,000 more than at the start of 2010 and 15,500 above its mark at the same time last year while the unemployment rate inched up to from 2.8 to 2.9 percent.

Across the greater East Bay, total employment inched up by 3,300 in October to 1,349,400, which is 26,000 above its mark at the same time last year, and the unemployment rate held at 2.9 percent.

Up in Marin, the number of employed residents inched up by 400 to 141,800, which is 3,200 above its mark at the same time last year, and the unemployment rate held at 2.3 percent.

And down in the valley, employment in San Mateo County increased by 1,700 to a record 451,200 in October, which is 8,700 above its mark at the same time last year while the unemployment rate held at 2.1 percent, and employment in Santa Clara County increased by 4,800 to a record 1,047,500, which is 32,700 more than at the same time last year, while the unemployment rate inched up from 2.4 to 2.5 percent, resulting in a blended unemployment rate of 2.4 percent across Silicon Valley (versus 2.2 percent this past April) and 2.6 percent across the Bay Area having dropped to 2.3 percent in May.

I’ve always appreciated these charts and their obvious utility to the real estate market, but it would be nice to see median wages overplayed. Is that possible?

I guess it’s great that the blended unemployment rate in Silicon Valley is about 2.4 percent, but it’s important to be clear-eyed about what those jobs are paying and the direction that wages are moving. From the Mercury News on Sunday: Silicon Valley wages have dropped for all except highest-paying jobs, first ‘graph:

Empasis mine. it’s not at all clear that just tracking the estimated number of people living in San Mateo or Santa Clara Counties earning a paycheck has obvious correlation with the local real estate market.

One reason for the net domestic out-migration from the Bay Area. And polls showing almost of half of millenials planning to move out of the area in coming years. Not that half will move, but the sentiment is driven by a falling standard of living for many in the middle class here.

Personally I see this with friends who have young adult children. A good number of those young adults, to the chagrin of their parents, have had to move completely away from the Bay Area. Wanting to start a family and buy that first home. They cannot in any way do it here (these are non-techie young adults). Yeah, they can live in their parents’ basement for a while but as one gets near 30 that becomes a less attractive option.

Take a look at the Nasdaq today to see which direction this is heading. Last time around it was bad loans to insolvent borrowers and sold as great investments. This time around it’s bad money thrown anywhere and everywhere, especially zombie companies that will never turn a profit, many of them located right here in SF and the Bay Area.

Not to mention buybacks, leveraged loans, junk and BBB bonds, and even governments that are racking up debt like there’s no tomorrow. Meanwhile in the middle of this artificial cheap money boom, pensions are still underfunded and the average American hasn’t saved $500 for an emergency. The latter is not by accident but rather by design, in a Keynesian centrally planned economy that is meant to punish savers and bring forward tomorrow’s consumption today, with little thought of the long term consequences.

Maybe it’s a huge conspiracy, or maybe we have a President who thinks that trade is bad and is doing his damnedest to drive the economy off a cliff.

Sabbie,

I agree with most of what you wrote, but please educate yourself as to what Keynes actually proposed. Keynes’ most important contribution was probably the concept of counter-cyclical stimulus: the gummint steps in (via mostly fiscal stimulus, but sometimes monetary stimulus, depending on the nature of the recession) when the economy is in the crapper, and steps back out of the way when the economy is purring. The Fed keeping the pedal to the floor for the last six years during an obvious asset bubble is THE EXACT OPPOSITE OF WHAT KEYNES PROPOSED. Keynes wanted to avoid asset bubbles, and he favored policies that would foster a stable economy characterized by low inequality and without boom and bust cycles. Keynes would have adamantly opposed Fed policies (ZIRP & QE 1/2/3) that drove asset prices into the stratosphere.

Sorry for shouting, but the incessant mangling of Keynes on the interwebs is maddening, and it kneecaps your otherwise sensible statements.

I agree that recent actions would not be to Keynes liking, he would have wanted fiscal stimulus alongside monetary during the Obama years not the Trump years, and he said pushing rates towards zero would not work.

However it is his overall theories that have been used to justify this mess. The idea that government can banish the natural business cycle, and the idea that you can bring tomorrow’s consumption forward today by punishing savers. In reality these cannot be done without major unintended consequences, much like introducing foreign species into an ecosystem.

As for Trump, I sometimes wonder if trade wars are a ruse to cool off the economy, with the greater goal of keeping interest rates down. Because if the Fed lost control to the bond market, look out.

Did the GOP use Keynes to justify their tax cut? If so, I missed it.

No, and you didn’t miss it. The justification for the GOP’s tax cut last year was that by delivering more money, in the form of reduced taxes, largely to wealthy business owners and corporate shareholders, the cost of capital would be reduced, and therefore accelerate investment. This speed up in investment was then going to produce increased economic growth. The increased economic growth was supposed to inexorably “trickle down” to increased wages for the middle-class, hence the epithet “trickle-down economics” to describe the same theory supporters call “supply-side economics”.

If they bothered to name an economist at all, it was Arthur Laffer, not John Maynard Keynes.

As a card-carrying – well, ring-wearing – sometime practitioner of that Dark Art, I take exception to the description of Laugher…er, Laffer as an “economist”; but…whatever…methinks Milburn Pennybags was a more likely ‘inspiration’, anyway.

Keynes would have also opposed a deficit-increasing tax cut aimed largely at the rich in the midst of the second or third longest economic expansion in U.S. history (counting the 33 business cycles going back to 1854 for which we have data). The time for such a tax cut was while the economy was contracting, not in November of 2017.

You’re damned right. That tax cut is the exact opposite of Keynesian economics.