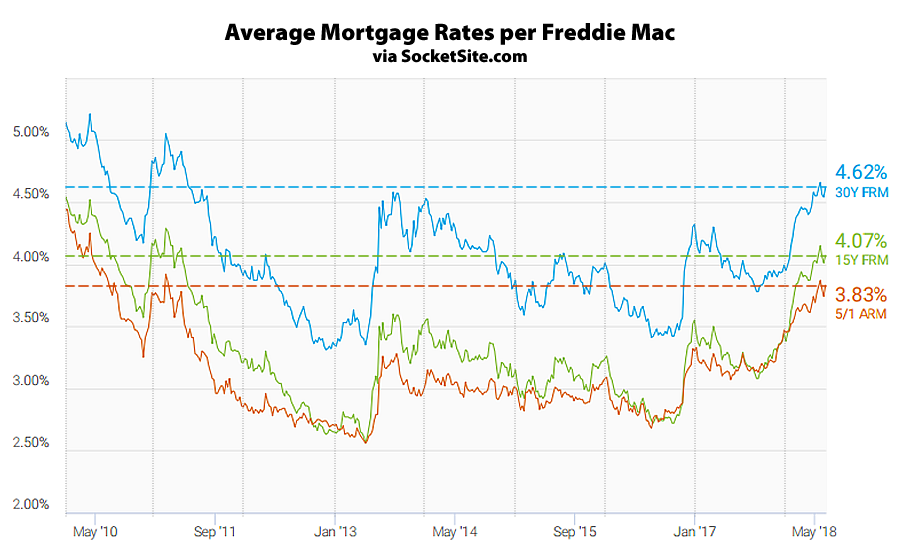

While measured prior to the Fed’s announcement yesterday, the average rate for a benchmark 30-year mortgage had ticked up 8 basis points over the past week to 4.62 percent, which is 71 basis points above its average rate of 3.91 percent at the same time last year and within 4 basis points of the seven-year high it hit last month, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage ticked up 6 basis points to 4.07 percent and is running 89 basis points above its market at the same time last year while the average rate for a 5-year adjustable ticked up 9 basis points to 3.83 percent, which is 68 basis points higher, year-over-year.

And as we noted yesterday, the Fed has now signaled accelerated expectations for two more rate hikes by the end of this year. But we’ll also note the yield on 10-year Treasury notes, which drives the 30-year mortgage rate, is currently trading down a couple of basis points for the day.