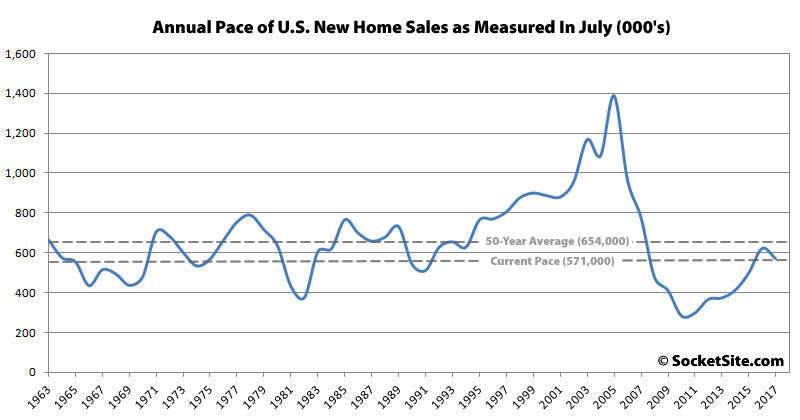

Having ticked up an upwardly revised 1.9 percent in June, the seasonally adjusted rate of new single-family home sales in the U.S. suddenly dropped 9.4 percent in July to an annual rate of 571,000 sales which is 8.9 percent below the pace of sales at the same time last year.

Last month’s pace is now 12.7 percent below the long-term average for this time of the year (654,000) and 58.9 percent below the record-high pace of 1,389,000 sales which was set in 2005.

At the same time, the number of new single-family homes for sale across the county ticked up another 1.5 percent to 276,000, which is the most available inventory since June of 2009 and 16.5 percent higher versus the same time last year.

And in the West, the annual pace of new single-family home sales dropped 21.3 percent to 144,000 in July but remains 1.4 percent higher versus the same time last year (versus 33.3 percent higher on a year-over-year basis in June).

An article that attributes the decline in sales volume to the increasing premium for new homes over resales. Median new home sale price was a July record.

Who is going to sell when they have locked in a generationally low 30-year FRM? Who is going to sell when they are currently sitting on a tax-basis substantially below the “market” tax-basis?

Me. But I’m unlikely to buy a “new” home, rather I’ll buy an existing one.

I’ve always wondering whether “seasonally adjusted” means we’re comparing sales of July 2017 vs July 2016 or is there more math to it?

The seasonal adjustment is on the estimate for the annual pace of sales. So they don’t just take the number of sales in July and multiple it by 12 to get the estimate of how many new homes will be sold in the year.