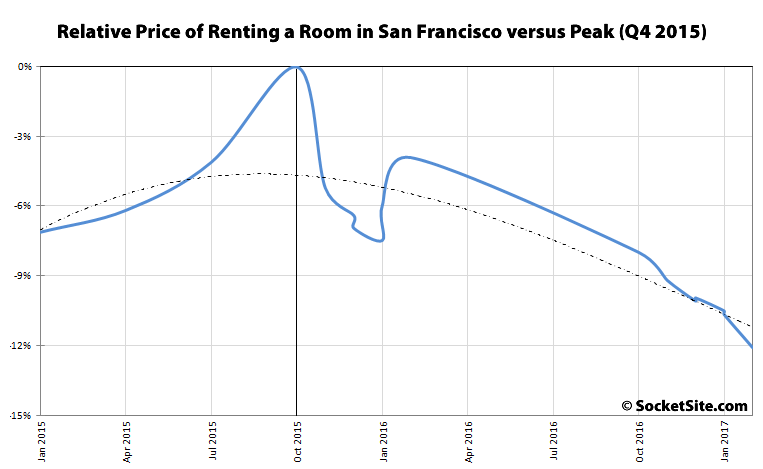

With the weighted average asking price of renting an apartment in San Francisco having now dropped over 8 percent since peaking in the fourth quarter of 2015, which brings us back to late 2014 prices, we thought we’d slice the data in a different way.

And in fact, if we look at the trend in San Francisco rents on a “per room” basis, the decline in cost would appear to be closer to 12 percent since late 2015 and climbing.

For the purposes of our analysis, we considered a studio to be a single room, a one-bedroom two, a two-bedroom three, and so on and so forth, as have plenty of roommates over the past couple of years.

And while the cost per room hasn’t declined as much in Oakland, it has been declining since the beginning of the year and is currently running around 6 percent.

Just wondering, since Oakland rents are down too, what is the situation in the Silicon Valley?

Is this a Bay Area phenomena and not just SF? The Oakland drop is somewhat counterintuitive since many have chosen to rent in the East Bay to escape the high costs in SF.

If the Bay Area as a whole is seeing a rent decline, then the question is what about other large metro areas? Depending on the answer to that question, other questions would come to mind.

It’s not just the Bay Area. NYC rent has declined and anecdotally, I think Philly has peaked as well. My guess is a nationwide rent correction, with the most extreme markets leading the way.

And the dotted line is? (I considered a moving average but on the left it moves outside the data line so that doesn’t seem to be it)

It’s the (polynomial)

moving averagetrendline.Were you high when you made this? The blue line isn’t even a function – there are multiple points in time when there is more than one Y value given an X axis point. Or is there a third SocketSite dimension at work here? CAN SOCKETSITE DATA TRAVEL THROUGH TIME?!

[Editor’s Note: If it would make it easier for you to follow, we could un-smooth the line to (mis)impact a higher level of precision. But if we did, you might have to address the actual trend.]

I accept the trend, but that is no excuse for using the wrong smoothing. A smoothed timeseries is still a timeseries and this is not. It may not matter in this graph but it might matter down the line. The editor is normally more on the ball with this stuff.

The blue line seems to zig-zag backwards in time in Q4’15. Is that a rendering error or did some of the data that month come from renting out a Delorean?

[Editor’s Note: As noted above, it’s simply a smoothed line.]

LOL – Back to the Future – I was expecting a Star Trek reference since they are progressing through an alternate timeline…

It’s not “simply” a smoothed line. It’s ridiculous and indefensible, well below SocketSite’s normally high standards.

The line jumps around because that’s how the market was moving. After the big stock crash in August 2015 we saw a large dip, which then partially recovered.

The line simply consists of single data points that are connected. You could smooth out the line itself by applying a moving average (average the data points over a certain time period looking back and then connects those dots instead) or you could just put the moving average on the chart right next to the line like they did.

On ~Dec 7, did try market go down 6.2% or 7.3%? As someone stated above, it’s not a function.

So you’re saying it’s little messy and a muddled at a couple points in time and there isn’t always an absolute answer but a range of a percent? That’s insane!

The underlying data points and time series are sound. The backtracking above is, in fact, an artifact of the graph being smoothed between a number of points. And once again, if you’re focused on two extremely narrow bands of time rather than the overall trend over a couple of years, you’re focusing on the trees.

Well, y isn’t a function of x. But it is a parametric function.

i.e. x=f(n), y=g(n)

I’ll let you argue with the editor about the choice to use a parametric curve fit, but it seems doubtful that that choice changes the overall trend-line.

Perhaps you’ll notice some similarity between the line in question and this popular graph of speculative manias.

I’m a professional statistician (in biotech) and totally back this line smoothing as a proper way to show data trends

And did your professional eye catch that this line moves backward in time?

Let me see if I get the right take-away: If rents per apartment fell 8% and rents per room fell 12%, can I conclude that rents for multi-room apartments fell more than for single-room apartments?

This would go against two important dynamics:

1) New apartment construction has mostly increased the supply of 0-1 bedroom apts. Therefore, I would expect prices to fall more for single-bedroom condos.

2) Prices for SFH have remained stable (or at least fallen less then for condos). If prices of multi-bedroom apartments are falling the most, I would expect prices of SFH to be impacted too, as they are comparable/substitutable for multi-bedroom apartments.

What am I missing?

maybe the recent new construction of 0-1 bdrm apts helped to keep down their price increases before this decline.

What you’re missing is that

1. most people don’t want to live with roommates if they don’t have to, so if the rents (and concessions) for studio or 1BR come down a bit, people will choose those instead.

2. investors for SFR and small income in SF are not as concerned with cash flow and GRM as they are in cheaper markets, but are more motivated by appreciation, safe haven for cash, and other such factors.

The appreciation factor may be gone for a good while. At least in terms o relative appreciation. A number of markets are strongly outperforming the BA in appreciation.

Are there any figures to what a bedroom costs to rent in SF aside from the fact that rents have dropped?

I wonder if all the folks who have been calling for a “slight decline” in the market of maybe 5 or 10% realize that we’re pretty much already there (and with momentum still pointing down).

Good. Supply and demand at work. Build more to bring down our outrageous rents.

There’s no smoothing estimator in existence that would give you two different values for y for the same point on x. Something is wrong here.

If you like, point me to the raw data and I’ll fix it for you.