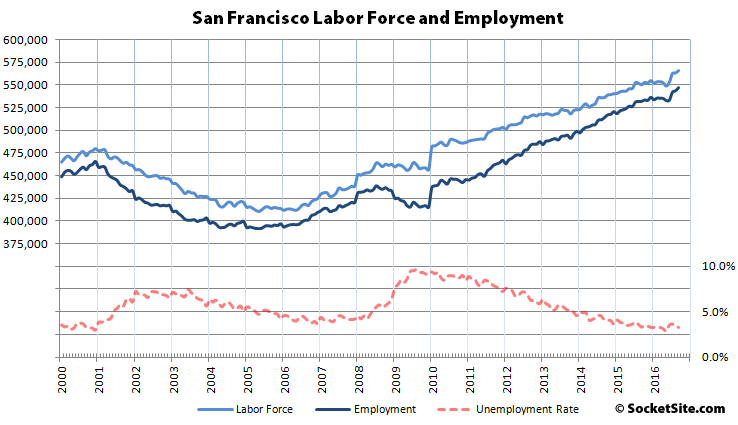

The number of people living in San Francisco with a job increased by 3,500 last month to a record 547,100.

As such, there are now 81,600 more people living in San Francisco with paychecks than there were at the end of 2000, an increase of 110,400 since January of 2010 and 15,200 more than at the same time last year while the unemployment rate has dropped to 3.3 percent.

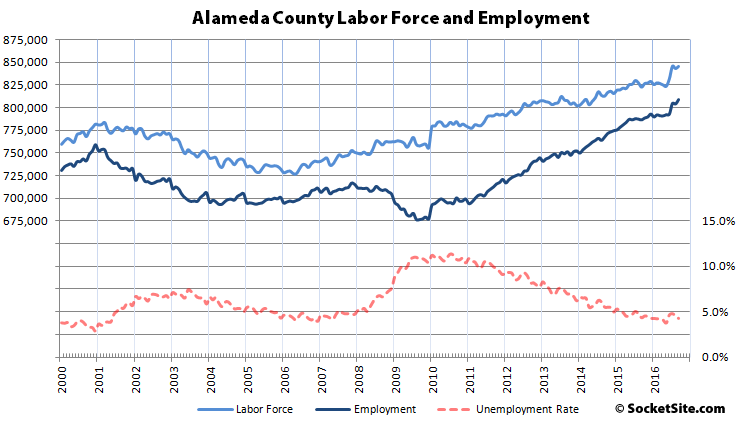

In Alameda County, which includes Oakland, employment jumped by 4,800 in September to a record 809,200, which is 22,400 higher than at the same time last year and an increase of 117,200 since January of 2010 while the unemployment rate has dropped to 4.3 percent.

Including Alameda, employment across the greater East Bay gained 7,800 to a record 1,347,000 with 4.4 percent unemployment.

Up north, employment in Marin County actually slipped from a record 140,700 in August to 140,400 in September, but the unemployment rate dropped to 3.3 percent as the labor force shrank.

And down in the valley, employment in San Mateo County ticked up by 2,700 to a record 442,100 with 3.1 percent unemployment and jumped by 5,600 in Santa Clara County to a record 1,015,600 with an unemployment rate of 3.8 percent.

And lookit, Airbnb plans to cash out ~ 500 early employees, and still avoid going public. If über and a couple other unicorns do the same, that’ll put a dent in the SF RE market. I sayz…keep ’em coming!

Good for you as a landlord here, good for me as a homeowner here – yes. But good for the City as a whole and for young folks trying to buy a home or condo here? Methinks not. We have different outlooks on this and that is what makes the world go round.

What do you mean? This action actually enables some of these “young folks” to go out and buy a place here!

That link doesn’t talk about cashing out 500 early employees?

Does too. Hit “show full article” link and read the end.

ahhh. Thanks!

NP. The question is, if we have a few of these semi liquidity events, if it will make an impact on the housing market. I think it can, if inventory slows down next year. As we slow down more people who wanted to sell rush to market, but after a perceptible slow down, people that don’t have to sell usually pull back and thus inventory gets reduced. And if then we get a few unicorn liaquidities, that may make a difference. Tricky timing, my friends, tricky timing!

These are happening all the time here. Not on this scale for one company, but a dozen or more people each at scores of companies are partially cashing out in any given month. There is no shortage of real, substantial money continuing to flow into SF residents’ pockets in this tech cycle. I’m not predicting a new round of massive housing price hikes, but there is nothing I see to trigger a meaningful price decline in the near future either.

These unicorns must be doing great if they are putting off the IPO until 2018 at the earliest. Speaking of liquidity, I wonder how liquid the market will be when the greater fools finally want out of their private shares?

Sabbie, as you may (or may not) be aware, there are plenty of reasons companies put off an IPO as long as possible. It has nothing to do with the financial health of the company.

(Example: Google postponed its IPO as long as it could, and surely even you would agree that Google is a successful company.)