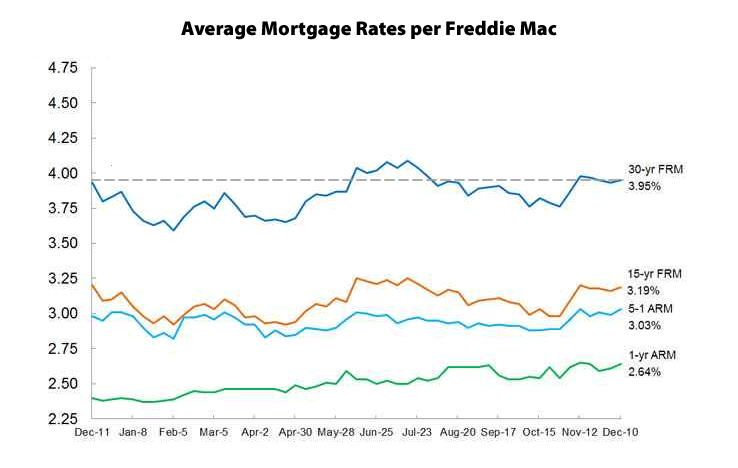

With the probability of a Fed Funds rate hike next week up to 85 percent, according to an analysis of the futures market, the rate for a conforming 30-year mortgage averaged 3.95 percent over the past week, up 2 basis points versus the week before and versus the same time last year.

The benchmark 30-year rate, which hit an all-time low of 3.31 percent in November 2012 and a three-year high of 4.58 percent in August 2013, has averaged around 6.7 percent over the past two decades.

The average 30-year rate is currently 36 basis point above the 2015 low of 3.59 percent which was recorded in early February and within 13 basis points of the 2015 high rate of 4.09 percent recorded in middle of July.

At this point they almost have to raise a bit. No more head fakes.

But the economy is not strong, job creation less this year than last. World economy shaky.

If they raise a bit and things look not so good early in 2016 I could see them pulling back on the raise.

Too much “created” money out there. Some hedge fund managers looking for a place to put it are looking at single family rental properties. There are indicators which say that could be a lucrative investment market over the next few years.

I’ve never understood why they need to raise a bit. Their stated goal is 2% inflation, and we’ve undershot that for like seven straight years, and are still teetering dangerously close to deflation.

I’m curious as there has been no mention on SS of the articles about the recent Zillow housing bubble survey?

tell us about it

I tried posting a link but it didn’t get out of moderation. Google “zillow housing bubble.” Basically, a lot of the experts they surveyed said that SF is in or is very close to being in a bubble. Some other cities were also cited as bubbly, but none nearly as much as SF.

The few Zillow “studies” I’ve seen were not credible, as they are based on their “estimates”, which totally blow. Really useless, even deceitful IMO.

Meant “zestimates”

Data is important of course. Fetkke’s 2015/2016 overview was filled with it from VC funding to immigration to unemployment situation.

All real estate is local. There is no real national market but one thing she agreed on is the Bay Area being one of several potential bubble markets.

I’ll have to check the zillow stuff out.

This was a survey of established outside experts, not an endogenous study.

UPDATE: The Fed Institutes a Rate Hike, Signals Four More in 2016.