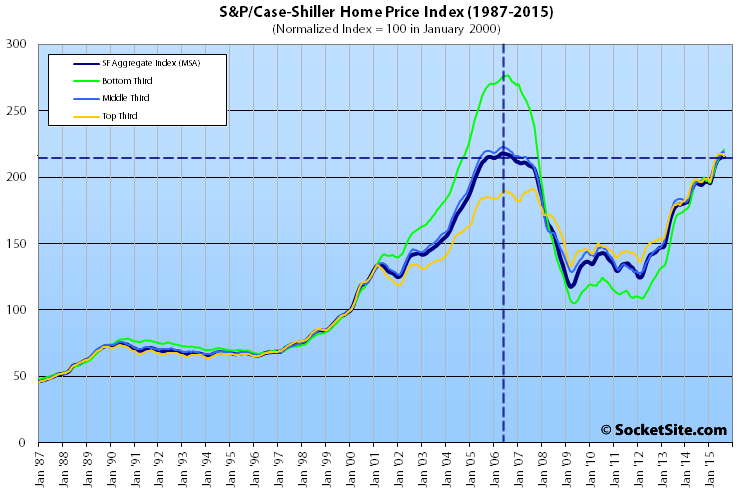

The aggregate Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area slipped 0.1 percent in August, driven by a dip for high-end homes. But the index, which has gained 59 percent since January 2010, remains 10.7 percent higher versus the same time last year and is within 1.4 percent of its 2006 peak.

And while the index for the top third of the San Francisco market slipped 0.5 percent in August, it remains 10.1 percent higher versus the same time last year; the index for the bottom third of the market actually gained 1.0 percent in August and is up 12.2 percent, year-over-year; and the index for middle third of the market ticked up 0.3 percent in August and is 11.3 percent higher, year-over-year.

According to the index, single-family home values for the bottom third of the market in the San Francisco MSA have more than doubled since 2009 and are back to November 2004 levels (20 percent below an August 2006 peak); the middle third is back to February 2006 levels (2 percent below a May 2006 peak); and home values for the top third of the market have slipped from the all-time high set this past May but remain 13.0 percent above the previous cycle peak recorded in August of 2007.

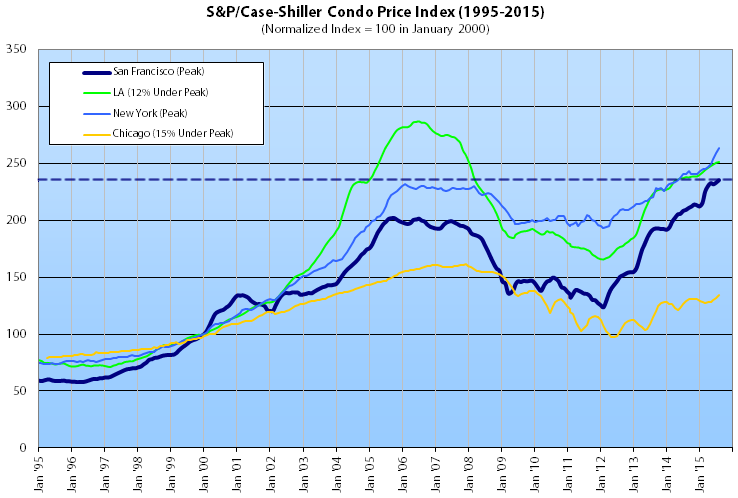

At the same time, San Francisco condo values ticked up 0.9 percent in August to a new all-time high, up 12.5 percent year-over-year and 16.5 percent higher than in October of 2005 (the previous cycle peak).

The index for home prices across the nation gained 0.3 percent in August and is running 4.7 percent higher on a year-over-year basis but remains 5.0 percent below a July 2006 peak. San Francisco was the only market in the U.S. for which home prices slipped in August.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Just a another year or so and prices will begin to drop/correct themselves in SF. Oakland/East Bay will continue to see a rise in values as companies and San Franciscans continue to relocate from SF. My bet is, sell your SF investment now, buy in DTO and sell that within 4 years, before the upcoming bubble bursts.

Is there any data on historical values in SF and Oakland? I would wager they always move in tandem. One may be going up or down faster than the other, but has there ever been a time in the last 50 years when Oakland went up while SF went down?

Yeah, hate to say it but people are moving to Oakland because they can’t afford SF. If SF prices become more reasonable, Oakland will be hit harder because people won’t have the same motivation to relocate there anymore.

Well we’re not at a low, that’s for sure. If you buy now, you’re not buying low. But we measure in dollars and we could always have a currency collapse. Old white get off my lawn men have been predicting a currency collapse for years and it hasn’t happened, but that doesn’t mean it won’t happen.

I remember 2009 and the message boards were full of people screaming sell. Only a couple of posters thought it was a time to buy and they were beaten up like scientists who don’t believe in global warming. It was brutal. A friend of mine bought a building for 2.2m and by chance the zillow was also exactly 2.2m. Now the zillow is 7.8m.

Good points. Human nature is to sell low and buy high. In real estate and the stock market.

Of course one should buy low which is why 2009 was a great time to purchase but most were fearful and did not.

I got involved in my first syndication in 2009, near the bottom, The group purchased 27 almost-completed town homes from the FDIC for $3M (down from $12.8M). The builder had gone belly-up. The location though was great – near downtown and on the river (Willamette)

The group finished the project and members received over 20% IRR during the worst part of the Great Recession. Those townhomes today fetch a pretty price (for Portland).

It looks as the slowdown is typical for this time of year looking 12 and 24 months back.

It’s neither typical nor unusual, with an average 0.0 percent change from July to August over the past ten years. That being said, San Francisco was the only market in the U.S. tracked by an S&P/Case-Shiller Index for which home prices slipped in August (as noted above).

Does this take into account all the new condo buildings which are priced really high, much more so than existing condos that were built years (decades) prior? Can that account for the uptick?

The convergence of the three thirds makes me suspect that if we do see a correction anytime soon, it will be a gradual slowing or slight dip, similar to the early 90s or early 00s.