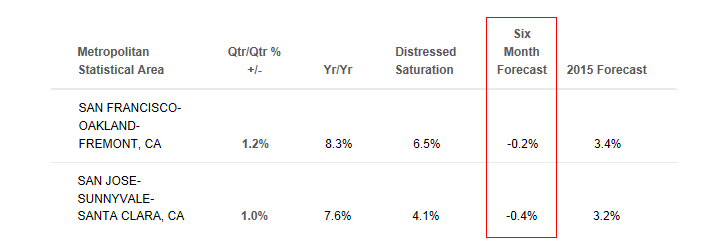

Bearish calls for the Bay Area housing market have been ticking up over the past three months with one of the latest coming from Clear Capital, a national provider of real estate valuations, data and analytics for brokers, lenders and appraisers:

“Both San Francisco and San Jose have been red hot markets, supported in large part by strong job growth. The latest numbers reveal, however, that both markets have reached their apex in the most recent upward price swing and are projected to take a slight dip into negative territory through the second half of 2015, by -0.2% and -0.4%.

While both markets are projected to have total 2015 yearly growth rates of around 3%, entering winter 2015-2016 on the down side is of great concern. What started as ‘red hot’ at the start of 2014 may end as ‘in the red’ come 2016.”

Speaking of revealing, keep in mind that six months ago Clear Capital was projecting that home prices within the San Jose MSA would gain 1.7 percent in 2015 and would drop 0.8 percent in San Francisco, versus their latest forecast which now calls for 3.2 percent and 3.4 percent price growth respectively.

my sense is it will be a percolating top with most short term downside in the suburbs that were lifted by proximity to SF. SF itself will creep higher, just not by as much leaps and bounds. rates are still historically very low. prices are bloated but so are tech salaries.

These national projections are always inaccurate for SF. Zillow’s projections have been much lower than actual prices over the past few years as well.

I don’t see prices dropping at all, unless a larger macro economic trend hits. They may level off slightly.

This real problem I see with these stats are the 2 MSA’s for what is one market. Lumping SF and OAK together while stripping out SJ makes everything apples to oranges. Kind of like the myth of “core inflation”.

Love it when the conspiracy theorists start equating things that are nothing alike to one another.

I could see this happening in north bay and east bay, but think SF and peninsula still have another year or so of 8+% growth

then 1 can see 0-3% growth for mid 2017-2020 unless a macro-event happens to make it go down.

stock market is a leading indicator of housing. while SF housing has gone up, the stock market has beaten the housing rise in past 5 years.

My revelation over the weekend was not about median income. Rather it was a Fortune article about privately-held, billion-dollar “Unicorn” start-up companies. I can sort of understand how Facebook stayed private for a long time and is now pulling in lots of revenue. Uber too has reached a sort of critical mass, I think, that will keep them in business for a long time, though probably at narrower more regulated margins.

What stood out was that Houzz, (that interior design photo site) was valued at a billion dollars. I find Houzz to be useful. People upload pretty pictures, other people tag those pictures with things they like. There’s an occasional ladies-who-lunch fawning article about this or that project. It’s a great place to look if you are thinking about a remodel.

But a billion dollars?

If that’s true, Socket site is worth, like, $250mm at least.

And if Socket Site is worth $250mm then we should treat it like a 5 unit building in the Mission. And by posting here all the time, I have accrued some tenancy rights, so if it ever gets sold, then I want a buyout. I also want a pony. And I intend to occupy the comment section until my friends from the Guardian show up. I mean, Supervisor Campos speaks for me on the rights of anonymous random internet commenters.

I digress.

Houzz is not worth a billion dollars. There is a bubble. It will end, sometime. Marginal jobs will leave, marginal rents will go down. We will continue our slow growth process. Hope it’s a soft landing.

on the other side, what happens when uber goes public. lots of new money to go somewhere, not a lot of supply

Great point. I think the paper wealth is giving some people confidence to “front run” their own liquidity events. I wouldn’t mind if the trend continues, for sure. There will be winners and losers, but now it seems like there are a lot winners.

While a couple of the unicorns have had very limited inside sales that have allowed some employees to cash out a percentage, I don’t think it’s broad enough to have much of a housing market effect. I think it’s still pretty much all Google/Facebook/Apple/Salesforce/Biotech/Finance driving the city market, and those companies are all highly profitable. If the unicorns started going public still not profitable, the potential for it affecting the housing market would be much higher.

Well, Salesforce is not profitable at all . . .

If we start seeing a lot of tech IPOs, that’s when I short the nasdaq.

about 25 biotech companies have IPOd in SF over the last 3 years. none of them are profitable, but i would venture to guess that they made many people worth millions of dollars. (including me)

saleforce could be profitable easily as they have tons of revenue, but the market favors growth over profitability, and they are growing well.

Salesforce’s viability is not in question at all; like any SaaS company, to grab market dominance first they are intensively spending resources on growth (i.e. sales) rather than profit. If they were at all threatened, they could turn on the profit spigot at any time.

I was just responding to the assertion that Salesforce is highly profitable. It is not. Your assertion is very different – that it could be profitable, maybe, if it wanted to be.

no, you’re saying “maybe.”

there’s definitely been a slow down in tech firms going public, because of all the private equity. If we have a big slowdown before they go public, my understanding is that the losses will be concentrated in those firms (and among insiders). But will these firms every be ABLE to go public at these current valuations? I’m an ignorant bystander…but it sure seems bubbly to me.

I thought you were going for the “When is a billion dollar valuation really not a billion?” card:

“Private investors have negotiated ample downside protections in the event that a unicorn falters, the study finds. That would mean that private investors would be quite logical in assigning a higher value to a company than the public markets would–because they’re less exposed on the downside.”

It’s different this time. Or not really…

I love soccermom so so much! We’ve lost so many good people over the years (exsfer anyone?), and gained so many trolls ala SF gate. But soccermom always wins the internet. (end of fawning comment, back to bizness).

Yeah soccormom wields her golden quill with flair. She’s the best even though I find a few of her opinions sour.

But if she wants RC tenancy on the SocketSite then she’s going to have to fight with you, eddy, sleepiguy(Denis), fluj(*), noearch(futurist), R, EBGuy, SanFronziScheme(lol), hipster(SFrentier), and a bunch of other people I’ve missed for master tenancy. 🙂

I actually made a few hundred dollars off of free stock that a dot com 1.0 website gave away to attract visitors though am not expecting SS to share any future bounty.

You missed Satchel.

… and ex-SFer and tipster and Trip and diemos and Legacy Dude and a bunch of others who haven’t been around for a while. I was just sticking with the posters who have stuck with SocketSite from the early years.

Houzz’s valuation is predicated on the existence of potential ways they could monetize their users. A similar model would be Pinterest, which has just introduced a ‘buy’ button, i.e. a way to sell goods. We’ll see how that goes. Socketsite has no such obvious potential, sadly for Mr. Socket.

Not sure Houzz is worth a “B” but I’ve used it endlessly; found a major contractor on the site and have purchased many things via their products section. And almost every key designer, architect and builder is on there and advertising. Lots of room to grow. I also haven’t purchased an AD/Dwell/Sunset or other design publication in quite some time as a direct result of Houzz existence. I find it an endless resource for ideas. There are a lot of big differences in this market / bubble than in previous. The question is how many multi-billion dollar liquidity events is required to sustain this market. A single billion dollar unicor isn’t going to get it done. The market will need more linkedin, fb, nflx, and appl like public companies with sustained growth (in market cap) post IPO and post lockup. And the markets will need to stay strong as well.

We’ve seen a 30% drop in 36 months once and I think it’s possible again. Many of the same trade winds are blowing. I think buyers will sense this and may decide to hold a bit. Things move very fast out here in this RE market.

“It’s hard to make predictions – especially about the future.” – Yogi Berra