The average rate for a conforming 30-year mortgage has ticked up to 3.87 percent, the highest average rate in 2015 and 28 basis points above the near two-year low rate of 3.59 percent recorded this past February.

That being said, the rate remains 25 basis points below the 4.12 percent average recorded at the same time last year according to Freddie Mac’s Primary Mortgage Market Survey.

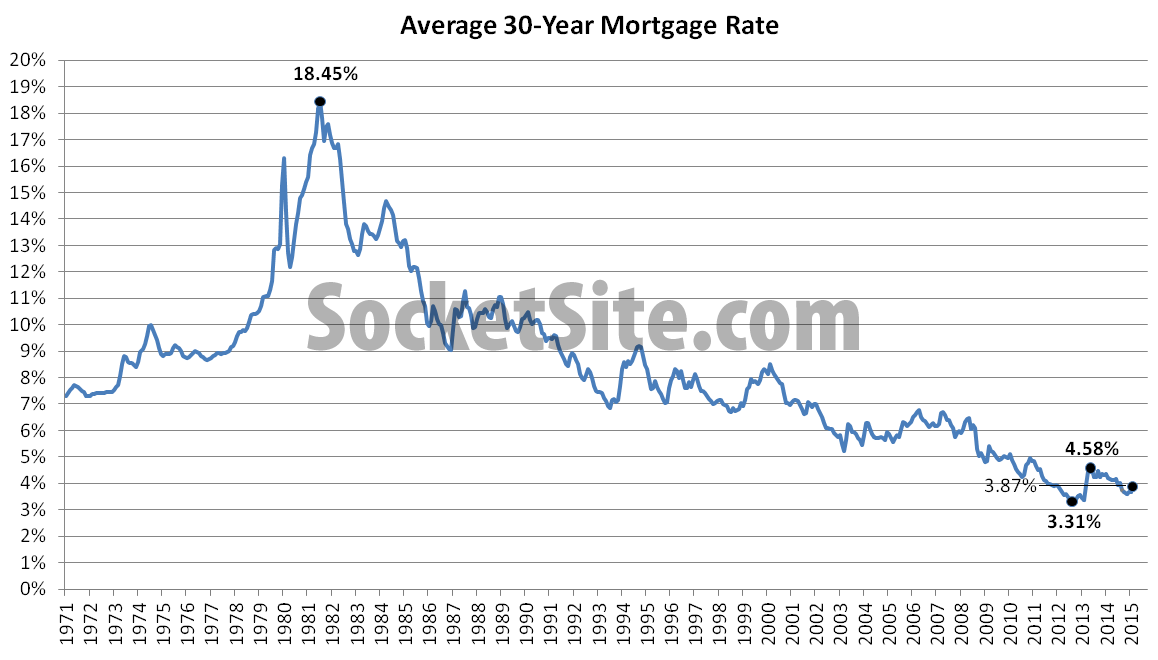

The 30-year rate, which hit an all-time low of 3.31 percent in November 2012, and a three-year high of 4.58 percent in August 2013, has averaged roughly 6.7 percent over the past twenty years.

The avg rate of the past 20 years is a meaningless stat. Why not state “given the 30+ year downtrend mortgage rates would be 2% in x number of years, and 1% in y number of years”. At least there’s a logic to it rather than your throw away line which has nothing attached to it, no meaning, and no proof that we’ll ever see that average rate in our lifetimes. Maybe we will. Maybe we won’t. In either case, that average rate was a whole lot higher if you had mentioned it 10 years ago, and higher still if you mentioned it 10 years before that. And if you quote the avg rate of the past 30 years it would be higher than your number. So what’s the point?