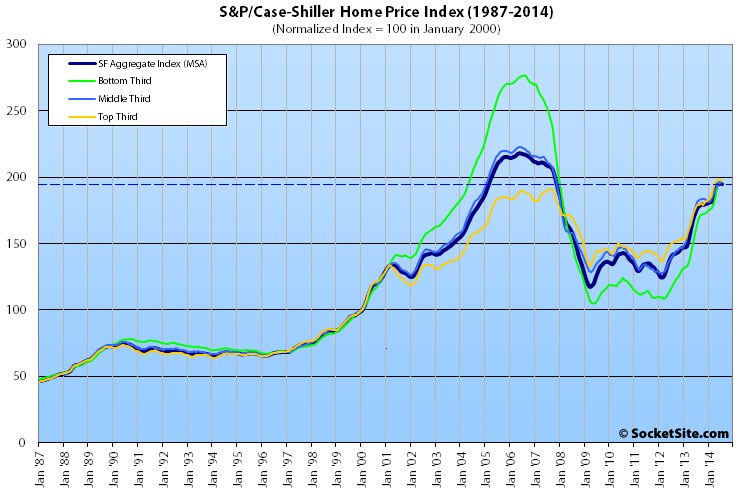

Single-family home values within the San Francisco MSA slipped 0.4 percent from June to July but remain 10.3 percent higher than at the same time last year, the smallest year-over-year gain since 2012, according to the latest S&P Case-Shiller Home Price Index.

And while still 10.7 percent below a 2006 peak, the aggregate index for San Francisco single-family home values has gained 66 percent since early 2009.

The index for the top-tier of San Francisco homes dropped 0.7 percent in July but remains 10.2 percent higher year-over-year. The index for the middle third of the market slipped 0.2 percent in July but remains 8.4 percent higher-year-over-year. And the bottom third of the market gained 0.2 percent from June to July, up 19.0 percent since July 2013.

According to the index, single-family home values for the bottom third of the market in the San Francisco MSA are back to just below May 2004 levels (29 percent below an August 2006 peak); the middle third is back to just above January 2005 levels (12 percent below a May 2006 peak); and values for the top third of the market are 3.1 percent above their August of 2007 peak.

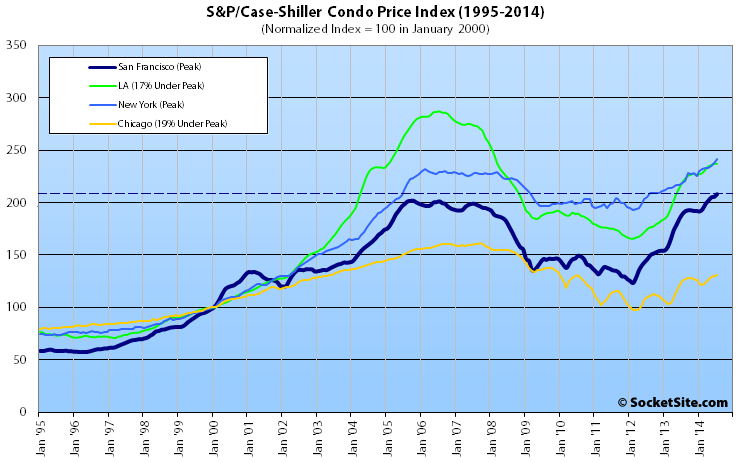

While single-family home values slipped in San Francisco, condo values continued to gain, increasing 1.2 percent in July to a new all-time high, 3.1 percent above the previous peak set in October 2005 and up 10.1 percent over the past year.

For the broader 10-City U.S. composite index, home values ticked up 0.6 percent from June to July and are running 6.7 percent higher on a year-over-year basis, but remain 16.8 percent below a June 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

A turn into negative territory in July is fairly ominous. The last time that happened in the Bay Area was July of 1990.