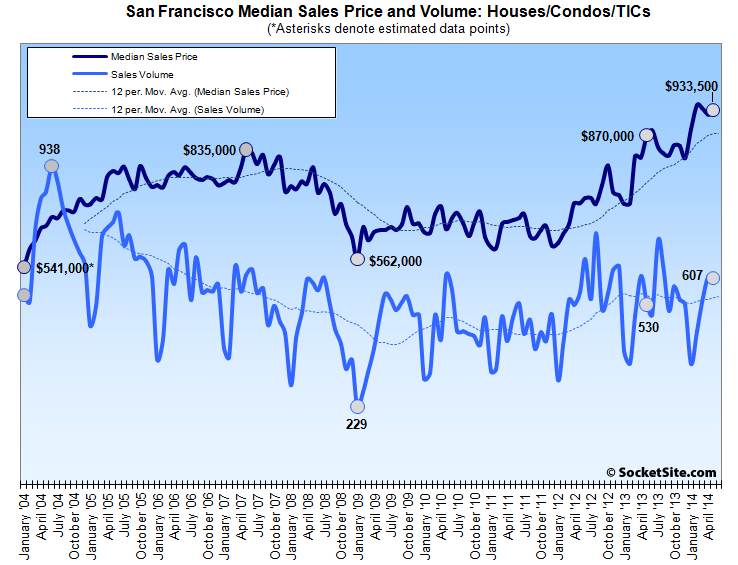

While Bay Area home sales were down 7.5 percent on a year-over-year basis last month, and listed sales in San Francisco were down twice as much, recorded sales in San Francisco were up 14.5 percent as a backlog of pre-construction sales in new developments closed escrow (see last paragraph below).

In fact, San Francisco was the only Bay Area county to record a year-over-year gain in sales volume in May.

That being said, at a time when the sales of homes should be increasing based on seasonality, the recorded sales volume in San Francisco dropped 0.8 percent from April to May. Over the past decade, sales volume has increased an average of 12.6 percent over the same period of time.

The median price paid for a property in San Francisco was $933,500 in May, 1.2 percent higher than the month before and 7.3 percent higher year-over-year, but 1.2 percent below the record of $945,000 set in February. The uptick in the median is being driven in part by an increase in the mix of higher priced home sales and new construction. And as always, keep in mind that while movements in the median sale price are a great measure of what’s in demand and selling, they’re not a great measure of actual appreciation.

Having peaked at $665,000 in July of 2007, the median sale price for a home in the Bay Area increased 1.1 percent to $617,000 in May, up 18.9% year-over-year and the highest median price since November of 2007. The median price had fallen to $290,000 in March of 2009.

At the extremes around the Bay in May, sales volume was 28.2 percent lower on a year-over-year basis in Sonoma (a loss of 193 transactions) while the median price of the properties that sold was 12.8 percent higher. And while the median price paid for a home in Napa was 31.2 percent higher, sales volume dropped 22.3 percent year-over-year, a loss of 29 transactions.

As always, keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) months prior but are just now closing escrow (or being recorded) and any properties that were sold “off market.”

Why sell when prices will be up more 6-12 months from now by another 5-10%?

I don’t have the data, but I am not sure that the increase in median price is being driven by mix as the editor asserts. If the increase in sales volume is driven out of new condo developments closing, then that would likely lower the median price. Condos typically are less expensive the SFH, and the mix of condos would be higher in this case. And either way, the market is still red hot.