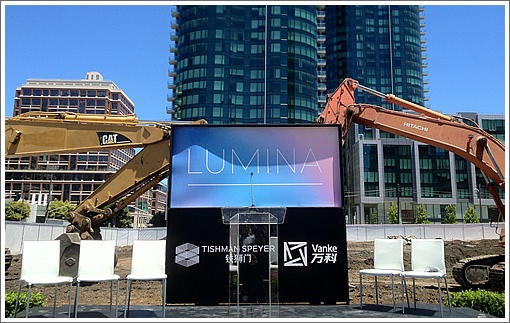

The name for the development heretofore known as 201 Folsom Street has been revealed. Presenting LUMINA, a joint venture between Tishman Speyer and China Vanke.

LUMINA’s 656 condos, studios to three-bedrooms, will average 1,275 square feet and should be ready for occupancy by summer of 2015. The building’s sales office is slated to open mid-2014.

The development’s two commercial spaces include a 1,000 square foot space at the corner of Folsom and Beale envisioned as a cafe and a 9,500 square foot space along Folsom Street envisioned as “a restaurant or upscale market.”

I love it!

Nothing like the name of an old Chevy to convey a sense of luxury…

Brings to mind my old car … Maroon paint, maroon cloth interior, and it had a habit of stalling when it got hot (ie always).

Thank God I don’t have to drive that POS anymore.

The combination of the Infinity and Lumina could be:

Infimina

Luminity

is there any practical use for the development names other than the developer referring to it for marketing purposes? i’m just trying to imagine in what situation i would refer to a building by name, as opposed to address, after the building has been all sold.

When a friend tells me he lives in the ORH or Infinity or the SOMA Grand or the Beacon, I know exactly what he is talking about. An address is a bit harder to process if you do not have a GPS embedded in your brain.

Who cares? (I guess I do).

I’d recommend “201 Folsom Street”

Nema, Illumina, Icon, Lovely, Lumina, Luminate, Habitat, Habitly, Peekaboo. Whaaat?

Let’s retire the marketing silliness and restore the historical addresses that are plain, enduring, grounding and informative.

Building names change with the marketing winds – real addresses do not.

@lol, you’d have to be with a very specific crowd, namely one that follows real estate developments in SOMA, in order for it to be sufficient to say only “Beacon”. But in your case you said they are your friends, so you should already know where they live. It would be much awkward at best and pretentious sounding at worst if you said it to a stranger at a social event.

If I told my specific address to a neighborhood resident, basically no one would know which building it is. If I told them the building name they would know exactly what building it is.

“It would be much awkward at best and pretentious sounding at worst if you said it to a stranger at a social event.”

Condo shopper: It is pretty much de rigueur to mention what building you live in at parties. You will be really surprised how savvy people in the SF social scene are when it comes to real estate. Is it pretentious? Most definitely but very much an accepted norm…

I was hoping for Beyonde

How about “Lunacy”?

It’s an acronym?

ok Willow, thanks for shedding some light for me. i am not in tune with said social circles as i am of the lower to lower-middle class group.

Ugh,

According to their website, they’re implementing valet parking.

Naming noteworthy buildings does have historic precedent. In the long run, I’d guess that the unremarkable ones will have their names forgotten, while actual landmarks will continue to be referred to with their names.

Nailed it.

For my next prediction about this place, I’ll make a wild guess that Vanke will pre-sell a big chunk of it to “investors” in China. They won’t live here, won’t rent it out, they won’t even come to visit. Combine that with other pied-a-terrors and condo collectors, and this will be a ghost building with very few full-time residents and minimal contribution to neighborhood/community development. Time will tell if I’m right or not…and I hope I’m not!

But if I am, and so long as we’re playing the naming game with Latin cognates, I would suggest Vacua or maybe even Aleatora instead of Lumina. A ghost building isn’t going to have a lot of lights on…

What do you think the price/sq foot will be?

I liked Beyond better…

blech.

So cheesy. I must not be their target market because I would never live in a building named Lumina. Sounds like a soap, pharmaceutical, or low-end 4-door sedan.

It’s not even a real word or name.

That name is so dated it already sounds out of date. I’m not averse to naming prominent buildings, but the name should stand the test of time, and should be names based on actual names, places, etc. Like, “The Hamilton,” “The Pacific,” “The Russ Building,” etc. Even the name “One Rincon Hill” will stand the test of time. At least “Infinity” is a real word that has some timelessness to it. “Lumina” is just so… insubstantial.

“ok Willow, thanks for shedding some light for me. i am not in tune with said social circles as i am of the lower to lower-middle class group.”

Condoshopper: There’s definitely a pecking order for buildings in SOMA/South Beach from Millennium to BayCrest and everything in between. Heck, I’ve been to social functions where people have told me they specifically live on the north slope of Bernal Heights…San Francisco can be much like LA in certain ways.

Globulous I and II.

The name is kind of funny… It’s a bit 80’s sounding… I immediately thought of Illustra, the name of the department store from the movie Mannequin, which, unfortunately shows how my brain works (or doesn’t).

Also, do Russian Hill dwellers say they live in Royal Towers or The Summit or do they say, “I live at 999 Green/1750 Taylor.” I usually hear the latter…

it is an acronym:

Luxurious

Uber

Modern

Interesting

New

Apartments

Nailed it!

So after 2 ground-breakings, is this thing actually under construction for real? No delays, no interruptions, no 535 Mission-style dig some dirt and quit action?

After all, it could NEMA (complete with photos of a nearby, cooler neighborhood) 😉

Luminestra (with apologies to Clytemnestra)

I choose not to associate with people who have to constantly share/promote their labels, be it clothes, car or building name, especially at someone else’s expense. See, there’s more to life than being that insecure and self absorbed. Chances are very slim Willow and I would ever be swinging in the same social circles. I’d have it no other way.

LUMINA (all caps, of course) is just another residential tower in SF. Nothing more, nothing less.

In Mandarin, Lumina sounds like ‘Auspicious Golden Dignity.’*

*This is not at all true.

“Chances are very slim Willow and I would ever be swinging in the same social circles. I’d have it no other way.”

Mark, I agree that a lot of social conversation can be mind-numbingly shallow whether that comes to property or the latest app someone is developing. You just have to take everything with a grain of salt…

Since the parking is valet, are there no deeded spaces for the residents then?

Legacy Dude, I LOVE the neologism “pied-a-terrors”! That is going to have legs, I predict, even if foreign absentee buyers don’t turn up in the same kind of volume here that they have in cities like London.

As of the 2010 census, San Francisco, one of the most in-demand places in the country to live in, has more than 30,000 empty homes and I’m sure in 2013 that number has only gone up.

This is one of the reasons I’m skeptical of supply-siders on socketsite and elsewhere always saying that the “solution” is for the city to “massively upzone”. The city can upzone all it wants to, that doesn’t mean developers or owners have to let that capacity get built or the resulting inventory reach the market, especially if it would result in lowering prices.

You can lead a horse to water, but you can’t make it drink.

Well, punitive rules for landlords do have an impact, Brahma.

If you want to rent out your place for the few months in the year you’re not in SF and have the greatest difficulty getting back into your home, you’re going to leave that place empty if you can afford to. I know, because that’s what I am doing when I spend a few months in my other homes. Both my European dwellings are occupied when I am not there but my SF home stays empty when I am overseas (apart from the house-sitting friend).

Yes, that sucks a little for my cash flow, but better lose a few thousands than getting screwed by a sticky sftu-supporting tenant.

You reap what you sow.

I still think upzoning plus some kind of non-resident tax might be a good answer, as suggested by noe mom on the other thread. Purely hypothetical, but suppose our progressive board of supes and their progressive constituency passed a law where you had to occupy or lease out your SF property at least 8 months/year or pay a $50K annual fine every year that you didn’t.

Full-time residents and landlords would not be affected, so no issues there. The really rich people wouldn’t care, either, since $50K is some painting or a dinner to them – their mansions on outer Broadway could remain empty.

But I bet a good chunk of those 30,000 empty homes would probably hit the sales or rental market. What would that do to affordability for the people who actually live and work here? The pied-a-terrors could stay at the Four Seasons for their semi-annual visits and buy REIT stocks instead.

Tough for horses to drink water that’s been fenced off by wealthy outsiders.

Legacy Dude, I haven’t thought about how that’d play out economically, but politically it’d make for interesting theater.

The objectivists and libertarians would go insane: “Oh my gawd, the jack-booted thugs of the gol-durn city government are going to have big brother checking on whether or not I am occupying my pied-à-terre and forcing me to lease it to the no-good moocher class if I am not! This is totalitarianism and I am going Galt!”

Wouldn’t it be better to just not apply prop 13 to vacant property?

You can’t tax grandma out of a home she doesn’t occupy

it doesn’t surprise me there are so many rich people who can afford and want to buy expensive sf condo units as much as it would blow my mind that so many are willing to shell out the cash for condo fees and property taxes while leaving them empty.

Legacy Dude,

Of course wouldn’t it also be fair to penalize those people with empty bedrooms or extra space in their home? We already have property tax (albeit distorted by Prop 13) to encourage people to utilize their property to the fullest. But telling someone who opts for two small units in different cities that they need to pay a penalty while allowing someone with a large single family home to be exempt would strike me as somewhat unfair.

I can’t stop laughing at the last posts.

As long as you have furniture, personal possessions, utilities and your US mail all going to your SF address, there’s no way to prove this is a second home empty most of the time.

And what is it to you anyway? Why do you want to have control over Other People’s Property? This is America, everyone has a shot.

Frankly, I am completely in favor with foreign interests buying up properties in SF and leaving them empty. They are paying property taxes, HOAs, and other property sales/transfer taxes to subsidize city services that the rest of SF residents, like me, use and enjoy. This is a hell of a better deal than having crime-infested neighborhoods that suck up all of the police and social worker resources, and do not produce anything of tangible value.

^ Agreed.

But why should these or other vacant units get to pay under market property tax due to prop 13.

^ And why would anyone pay under market property tax for that matter.

But for 2 owners purchasing the same year, one a resident 100% of the time, and the other one only 50%, why make a difference? As long as all taxes are paid, as “Live Smarter” said, it’s pure profit for every actual SF dweller.

As usual, some folks can’t see past their personal pecuniary interests to the larger point.

I am not in favor of foreign interests buying up properties in SF and leaving them empty, even if they pay their property taxes, HOAs, and other property sales/transfer taxes to subsidize city services if there is a shortage of housing available (which we all agree there is) and people who live and work here can’t find housing or can only do so at exorbitant price levels.

Yes, I can understand why people who are here and already have a place would see the value in having a large class of absentee owners.

All other things being equal (taxes paid, etc.), public policy should give greater weight to the interests of people living and working here vs. the purely economic interests of speculators (which is what someone buying property and then leaving it empty in the expectation of a future capital gain upon sale is doing).

Yes, this is America. And an American city is a real place that people do live in, not just another abstract market with assets trading back and forth.

^ Obviously people who live and work here have already obtained housing, so really you are just arguing that it should be less expensive. I’m not certain that penalizing foreign owners is the way to reduce the cost of housing. That is what they are doing in Hong Kong and Singapore and it doesn’t seem to have worked to make those cities more affordable to the average resident.

LD,

First of all, why concentrate on owners? A person who wants an occasionally used pied-a-terre would probably be better off renting one, at least initially. A rented unit that is rarely used deprives the market of supply just as much as one that is owned. So to be effective, your hypothetical $50K fine would have to apply to anyone who either owns or rents a dwelling in SF. My guess is that the kind of monitoring needed to ensure that SF residents actually use their dwellings for the required 8 months per years would be more Orwellian than even the progressive supes could stomach, although nothing would surprise me. (And without the ability to monitor compliance, such a law would be pretty toothless.)

Now as far as “specuvestors” I don’t think that leaving places in a brand new shining condo towers empty would be the typical case. Let’s say you bought a unit for $1M and can rent it out for $6K per month. Are you really going to forgo that cash-flow just to avoid the wear-and-tear of having a tenant? I just don’t think that people who buy units purely as investments would be stupid enough to leave them empty.

And then there is Prop. 13 which makes the property tax of a lot of properties inexpensive to keep around if you’ve owned them long enough (in contrast to the new condo towers). In other words, are empty dwellings caused by speculators or by Prop 13?

Punitively taxes people for leaving a unit empty is ludicrous for all sorts of reasons but the most glaring is SF would never be able to enforce it.

The city can’t even keep tabs on all the people abusing the BMR (renting out units, hiding income to qualify, etc).

Like it or not, you can’t have your cake and eat it too. If the city is really an international city, you’re going to attract international money looking to park some of it somewhere.

This wasn’t my idea, it’s already been implemented in Paris. I just happen to think it could work here as well. I wonder how the French enforce this? lol might know.

But I bet PG&E could take a glance at power usage for all housing units across the city (I’d wager they already track this) and pretty easily show which units aren’t occupied more than a few days a year.

And let’s please dispense with the obfuscating rhetoric and false analogies about large houses, prop 13, and international appeal. Everyone is aware that human beings are self-serving hypocrites who exploit any angle to our own benefit. We can all drum up plenty of examples as to why some system slanted in our benefit is fair.

The issue, as Brahma correctly framed it, is that we live in a very expensive city with a shortage of housing. Is it good public policy to allow rich outsiders to buy up a large portion of the housing stock and leave it empty while full-time residents are forced out or live in converted garage space? I don’t think so. So if we can’t stop people from collecting condos, why not charge them a fee for doing it?

But let’s maybe table this issue until this building and its new neighbors are complete. Let’s see how many Luminati actually move in and revisit then.

“But I bet PG&E could take a glance at power usage for all housing units across the city … and pretty easily show which units aren’t occupied more than a few days a year. “

If power monitoring was implemented to identify residency then I see a new business model: install hydroponics and grow lights programmed to mimic normal energy usage. You don’t have to worry about Mr. C. Sativa and Ms. C. Indica bringing home a puppy to ruin the newness of their apartment and they always pay their rent on time.

LD,

Here is how the french are enforcing the tax on empty dwellings.

First there are 2 taxes applied to dwellings:

– A property tax. Paid by the owner only

– An occupancy tax. Paid by whoever lives there.

If the occupant is a tenant, he has to pay this tax. If the owner is the occupant he has to pay it. One can only pay ONE occupancy tax based on the actual residency on jan 1st.

Now a few years ago there was an outcry against the 1000s of owners who kept their pied-a-terres empty in Paris. Hence the vacant dwelling tax which basically amounts to the occupancy tax.

Enforcement is straightforward. If the city doesn’t have an offcial occupant on record the landlord gets a letter asking to clarify who lives in the place. More often than not he gets a bill instead. If there was a tenant in the dwelling, the landlord is entitled to charging that amount.

Now, that cannot be implemented as such in SF because the owner and occupancy taxes are all one.

In short owners are already being charged an occupancy tax even if they are leaving their place empty.

@Brahma,

I am not in favor of foreign interests buying up properties in SF and leaving them empty, even if they pay their property taxes, HOAs, and other property sales/transfer taxes to subsidize city services if there is a shortage of housing available (which we all agree there is) and people who live and work here can’t find housing or can only do so at exorbitant price levels.

Well,

One of the reasons housing is expensive and in short supply is lack of turnover created by Prop 13 and Rent Control.

One of the reasons some dwellings are left empty is renter protection and rent control (for pre-1979).

You want to address the symptoms when it would be so much easier to address 2 of the causes.

Of course one of the reason for high prices is that SF is so darn desirable. Maybe letting 1000s of mentally hill homeless roam freely in the streets would scare off people from moving here. Wait. They’re doing that already. Didn’t work.

“In other words, are empty dwellings caused by speculators or by Prop 13?”

Exactly!

I’d guess that more empty dwellings are long time prop 13’ed owners rather than foreign speculators.

Either way, the answer is simple. Only apply prop 13 to your primary residence. There are already tax and benefits that depend on the location of your primary residence (capital gains exclusion on sale, in-state tuition,…) So it’s not a radical new thing to determine a primary residence.

Don’t want to tell the government what you do with your property? Fine, then just pay market rate property tax.

A 2-speed property tax system? It’s at the state level. Good luck selling that to all the other counties.

Prop 13 is an obsolete piece of legislation period.

Easy sell.

Most people in other counties probably don’t own multiple properties and even those who do will be less affected since they haven’t seen the property value gains that SF has.

Plus the state gets extra tax revenue. Easy sell.

Any attempt at adjusting Prop 13 has been met with very heavy resistance. The HJTA is pretty touchy. Tough sell.

Agree, the problems are Prop 13 and rent control. The owners (Prop 13) and tenants (rent control) getting what amounts to nearly a free ride are making the cost of housing more expensive for everyone else.

Unfortunately, I doubt Prop 13 as to non-primary residences will fall before it does as to commercial properties, and we seem nowhere close on the latter.

They may have “obtained housing” but it might not be anywhere reasonably close to where they work.

I was thinking about those people who have jobs in San Francisco and are either spending huge portions of their take-home pay on commuting expenses or those who are renting out substandard housing, like those in that recent infamous SFGate article who were renting out other tenant’s closets and laundry rooms.

If you’re commuting and you’re reliant on BART, for example, when there’s a strike you’re almost S.O.L.

Your second point about making rentals less expensive is an interesting one. I’m fascinated by what it takes to actually move markets.

How do you know if “penalizing foreign owners is the way to reduce the cost of housing”? Does Hong Kong have a similar percentage of foreign ownership? I kinda doubt it, but I’ll happily read anything authoritative you can point me to on that topic.

I think that if only about half of the currently vacant homes in The City hit the market and staye on it for a while, that would move the price level. We can argue about how much.

“Does Hong Kong have a similar percentage of foreign ownership? I kinda doubt it, but I’ll happily read anything authoritative you can point me to on that topic.”

I would suspect that HK has a much higher percentage of foreign ownership than SF. I’ve not seen the #’s for SF but I can’t think that 37% or more of the transactions last year were foreign buyers (see link).

The only workable way to release the unoccupied units in SF to the market is to repeal Rent Control and Prop 13 and we’re not going to see that any time soon.

What do prop 13 and rent control have to do with Soma condos?

They make SF real estate more expensive for newcomers. SoMa condos are in SF, and are thus affected, even if rent control laws do not directly apply.

You win on that one, I’m glad I didn’t make a bet.

Assuming that foreign buyers constitute a subset of so-called “absentee buyers” (actually, the latter is really what we’re talking about here, what matters is that housing is held off the market, not that the owner is from another country) the figure for S.F. is about 19.7%, which is taken from The Chronicle’s Carolyn Said in an early June story, New flood of absentee buyers, which unfortunately is mostly behind a pay wall.

Still, every time I hear from a libertarian ideologue going on and on about “Liberty” and what the U.S. should be like, they always refer to Hong Kong as the place that’s doing the most to make things easier for capitalists to exploit others, so I’m not at all sure having fewer foreign owners than Hong Kong is something to be ashamed of.

Brahma,

That article sheds no light on to what extent dwellings owned by absentee owners are sitting unused or are cases of “fix and flip” or “hold and rent” where the dwellings will likely be occupied (at some point).

From the article:

“The basic model: buy cheap foreclosures, rent them out for significant cash flow, and sell them for big gains after several years.”

That’s not exactly a model where rich foreigners let dwellings sit empty.

http://www.sfchronicle.com/realestate/article/Absentee-buyers-snap-up-single-family-homes-4569232.php?t=95453c6cf747b02379

anonanon: you’ve got a good point there.

The conversation wondered off into what share of the buying pool was foreign and I tried and pretty much failed to bring in the share of buyers who were absentee and they aren’t strictly overlapping groups, obviously. I should have left out the parenthetical remark that equated absentee buyers with those holding property off the market and vacant, as well.

A lot of absentee buyers have their properties on the market, and at least some buyers who live here, still, have their properties sitting empty.

An alien capturing the opinions on this thread would deduct SF is a barren and desolate landscape with condo towers sitting empty. They would probably choose to crash-land there vs New Mexico or Area 51, lol.

whereas the reality is a growing SF population where newcomers are making this City wealthier and more vibrant.

lol: The feedback loop goes like this:

1. Growing S.F. population indicates that this city is more, as you’ve said, “vibrant”.

2. This translates into increased demand for housing.

3. Developers build more high-end housing because they can show lenders that demand is present or rising and that’s where the most profit lies.

4. Rich absentee real estate investors rush in to take advantage of the situation by buying up property, whether they are local or foreign and whether the property acquired is high-end or mid, and for any number of reasons, hold them off the market. Why? Because S.F. is “desireable”, and unlike workers, they don’t need financing.

Also, some wealthy buyers buy up existing homes and engage in dwelling unit mergers as a status-displaying tactic. Either way, units are taken off the market.

4. Prices rise as supply is constricted, granted the impact solely due to supply reduction probably starts out small relative to that due to population increases.

5. Nevertheless, the rise in prices attracts attention from even more far-flung “hot money”, which flows in to buy up property here, whether the property acquired is high-end or mid. The market detects this as a demand increase.

6. Goto #3, above.

…Lather, rinse, repeat.

Btw, an alien capturing opinions on this thread wouldn’t deduce that S.F. is a barren wasteland, because barren wastelands would never reach step #3 the first time.

Ha ha. Very funny.

But I once lived in a place where a couple next door was running a comparatively small-time pot growing operation and everybody on the floor knew about it without having access to their power bill. In short: everyone could smell it, even with their pathetic towels on the floor behind the door technique, etc.

They were busted within the first thirty days of my moving into the building (don’t know how long they were resident before I got there). This was before either Prop. 215 or SB 1449 became law, though.

All that said, I don’t think that people buying new, mid-to-high end S.F. condos are going to be running pot growing operations out of them or that tenants would attempt to do so in their landlord’s unit. I’d imagine that the HOA would take a very dim view of that, and add that to the list of prohibited uses in the CC&Rs, if it wasn’t there initially.

You’re describing Miami Beach 2006, not SF 2013.

There’s real wealth being created in SF.

Someone I know put his place this week on airbnb for what he thought was a ridiculous amount. Rented in 2 days with offers coming in every few hours. All candidates are software types moving to SF. Most are in the 150K+ salary-wise with firm job offers and relocation already paid for. The same thing happened to a neighbor who is currently travelling 1 month in South East Asia with his AirBnb money. That and other things I see around me makes me think this is not a speculative cycle. There’s a conjunction of local and global factors we cannot deny.

Brahma,

Anyone who buys a unit in a shiny new condo tower and lets it sit mostly empty is not a serious investor, but more like a consumer of real estate. The serious investors (and there are plenty of them) will rent out their units so that the cash flow will pay for mortgages, HOA fees, property taxes, etc.

Unless you are so rich that you don’t care, it’s a lot more palatable to let a dwelling sit empty if you already paid off the mortgage and your property tax is minimal thanks to Prop.13., but that’s not the case for the new condo towers. Those who buy there and let their units sit empty are consumers, not investors.

To further my last point that SF is benefiting from a very specific increase in the number of affluent workers, just consider these stats from the Bureau of Labor Statistics:

http://www.bls.gov/news.release/cewqtr.nr0.htm

SF county is #7 in terms of weekly average wage

San Mateo, Calif. $3,240

New York, N.Y. 2,107

Santa Clara, Calif. 1,906

Suffolk, Mass. 1,724

Fairfield, Conn. 1,704

Washington, D.C. 1,703

San Francisco, Calif. 1,694

And YoY, SF weekly average wages increased by $119.

Of course the real news here is San Mateo Co. Weekly average wages have doubled. Many newly rich people down there.

Lumina just successfully concluded it’s first phase of sales with 51 released homes receiving over 170 offers….