As we first reported two weeks ago:

While conspicuously absent from the Mayor’s Housing Trust Fund proposal, according to a plugged-in reader, condo conversion lottery bypass legislation will be introduced before San Francisco’s Board of Supervisors in the next few weeks. It remains unclear, however, whether the Mayor will be openly supportive or not.

Keep in mind that despite the then Mayor’s support, it was San Francisco’s Budget and Finance Committee that killed a proposed lottery bypass in 2010.

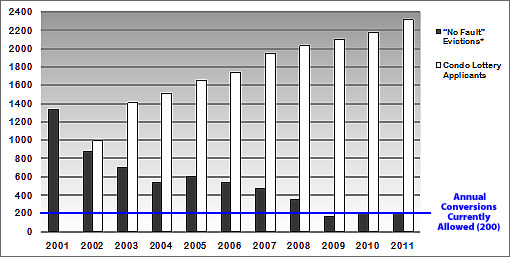

This coming Tuesday, Supervisors Farrell and Wiener will introduce legislation to San Francisco Board of Supervisors which would allow any of the roughly 2,500 units which either participated in, or could have qualified for, the 2012 condo lottery to convert for a fee.

∙ Condo Lottery Bypass Legislation Coming, Mayoral Support Unclear [SocketSite]

∙ The Mayor’s Housing Trust Fund And Missing Lottery Bypass Fee [SocketSite]

∙ TIC Conversion Lottery Bypass And Mayoral Take Two [SocketSite]

∙ Condominium Conversion 2012 Lottery Deadline And Odds (Against) [SocketSite]

∙ Condo Lottery Bypass For A Fee Resurfaces In Mayor’s New Budget [SocketSite]

∙ Budget and Finance Committee Kills Condo Lottery Bypass For A Fee [SocketSite]

∙ Condominium Conversion 2012 Lottery Deadline And Odds (Against) [SocketSite]

As a 2-unit TIC owner (own both units) this makes me happy and I hope the Mayor support it. Not that I want to evict our tenant or sell the unit, but down the line it would be nice to have the option, as we can’t condo convert currently because we don’t owner-occupy both units. Our neighbors across the street bought a 2-unit TIC, but they each bought one unit (not married couple) and live in one and rent out the other to a friend and are now done condo converting. I don’t think this is legal, but whatever. I just wish SF wouldn’t make owning property/doing what you want with your OWN building so difficult. Okay, end rant.

One thing I don’t understand about the whole condo conversion process is that the owners get to keep their TIC tax basis then when become a condo (somehow tied into proposition 13). It would be great if the city could tie condo conversion to a ‘voluntary’ increase in the property tax basis to market value….

@around 1905 – the property gets taken up to market value with respect to property taxes when the TIC gets sold, not when it converts. Conversion doesn’t create any change in ownership that would trigger a reassessment under current Prop 13. While your proposal may sound like a good idea, it would require a statewide action to amend Prop 13 and therefore is unlikely to gain traction. This proposed condo bypass fee is a local (city of SF) initiative that doesn’t require statewide legislation.

Presumably TIC to condo conversion is done so it can be sold, so I would guess that allowing a condo conversion would increase the total property tax taken by the state by quite a bit. Not only would the conversion make it easier to sell units, but they would also be able to get higher prices (and also financing at a lower rate) which also would increase the total taxed amount.

selling a TIC after a conversion is definitely happening, especially since the windfall can make you dream of bigger better things to do.

But were I in that case, I’d think twice before doing it. Something very valuable in SF is a low property tax. A resale is done only once. A low property tax keeps giving year after year after year…

I hope this proposal gains traction; it would allow we TIC owners access to the same historically low interest rates that condo owners enjoy, not to mention the added security of not being a TIC.

this is doa, it doesn’t have the votes.

@Brad:

Me too, but I suspect inc is correct that it doesn’t have the votes… yet.

I think TIC owners should have the same rights to stable housing costs that low fixed rate mortgages provide to other SF homeowners and that rent control provides to tenants.

This legislation is needed help for existing middle class TIC owners who face uncertain housing costs and decreased liquidity, problems which can only be solved by condo converting or selling (which would be at a loss for everyone in my building) and dumping the problem in someone else’s lap.

Granted, there are much worse problems to have, but is it that a reason to withhold help from TIC owners, who are mainly first-time homeowners and young families?

We work, play, shop, raise kids & pay taxes here. How do the supervisors justify turning down our money and refusing to help us?

I really hope the TIC community realizes that they have to speak out if they expect change. Farrell & Wiener are holding a rally/press conference before tomorrow’s meeting at 12:30pm on the VanNess side steps of city hall.

See you there?

Condo conversion is a one-time event that decreases the number of more affordable TICs and produces a windfall for the TIC owner. If the concern is to ensure that there is affordable housing stock for middle class residents then TIC conversion works against this. Over time it incrementally reduces the affordable pool and increases the pool of more expensive condos.

I can see why TIC owners are pushing for easier conversion. Like any entitlement granted by the city it results in a cash windfall, so why not ask? Free money! But the long term effect results in a city that is even harder to afford.

Whether this proposal has the votes depends on whether TIC owners speak up. There are 7,000+ in the City. If they sit back, figuring someone else will pick up the phone and call their supe, or send an email, or go to a hearing, etc., then it’s going to fail. The City could flip a switch and help them – but it hasn’t happened, because the other side is louder. We’ll see if TIC owners are motivated enough to support their own interests this time.

Anyone who bought a condo some time ago also gets a windfall, just like the TIC owner. The TIC owner has to convert and that is an expensive proposition. They also have fractional loans with all other buyers at a premium. So there really is not much of a windfall in my opinion.

And what is an affordable TIC, it’s not like a TIC being sold today will be sold at the price paid for 10 years ago. The price differences are not that great, specially with the goldrush speculative prices that drove the market over the last several years.

On the plus side, TIC owners can benefit from lower mortgages and have the freedom to be able to vacate and sell when they want and not be locked in with the other TIC owners and responsible for any financial hardships of the other owners.

Just because they convert does it mean that they will sell. TIC owners have paid taxes as well so there is no “entitlement”, just people wanting to own their investment without having to be part of a group.

Anyone who bought a condo some time ago also gets a windfall, just like the TIC owner. The TIC owner has to convert and that is an expensive proposition. They also have fractional loans with all other buyers at a premium. So there really is not much of a windfall compared to a condo sale in my opinion.

And what is an affordable TIC, it’s not like a TIC being sold today will be sold at the price paid for 10 years ago. The price differences are not that great, specially with the goldrush speculative prices that drove the market over the last several years.

On the plus side, TIC owners can benefit from lower mortgages and have the freedom to be able to vacate and sell when they want or need, and not be locked in with the other TIC owners and responsible for any financial hardships of the other owners.

Just because they convert does it mean that they will sell. TIC owners have paid taxes as well so there is no “entitlement”, just people wanting to own their investment without having to be part of a group.

grumpy,

The windfall results from the value immediately after conversion substantially exceeding the value immediately before conversion. No amount of analyzing the housing market over the last N years will change this fact.

I am not saying easy conversion should not be allowed. I am just saying there is an obvious and immediate financial benefit to any TIC owner if the conversion rules are changed (absent the City’s clawing back those gains).

nj, realtors have been touting 20% difference between TIC’s and condos for ever, no other windfall, but that 20% is still contingent on market conditions, some get it some don’t. And it may cost 10’s of thousands to get the conversion, the hassle, and the capital gains tax on the windfall, and any updates or upkeep. Pretty soon not much of a windfall at all. And to what benefit, so that someone else gets to buy into the TIC trap under the illusion that it is affordable? I don’t agree. Been there and it did not give me the windfall you percieve.

UPDATE: $20K To Condo Convert From TIC As Proposed.