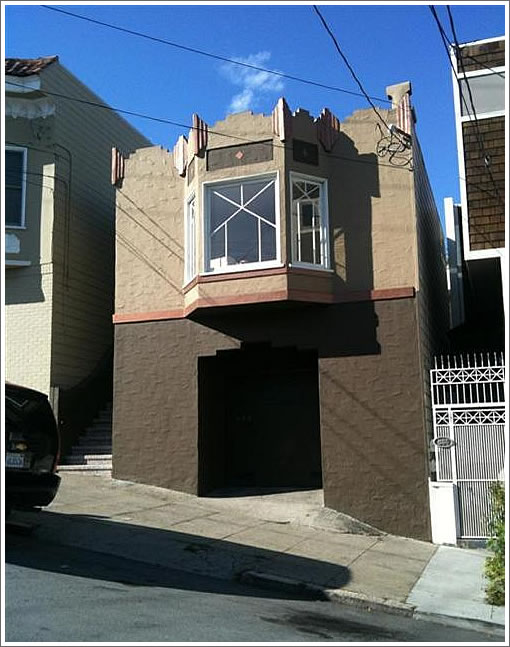

As we wrote about 890 De Haro this past February:

In 2007 the Potrero Hill home at 890 De Haro sold for $1,350,000. The sale is yet another example of a “winning” offer in San Francisco that was financed with 100 percent debt, a first for $1,080,000 and a second for $270,000. And here you couldn’t understand how you kept getting outbid or what was driving appreciation (less than two years before the property had traded for $1,185,000).

A year later the owner posted a “make me move” price of $1,650,000 which was withdrawn in March 2010, three months after a notice of default was filed with $50,289 past due.

The property was subsequently listed as a short sale for $1,150,000 this past November, was in and out of contract, and has now returned to the MLS listed for $1,013,000. And while its courthouse sale has been postponed in the past, the home is once again scheduled to hit the steps in San Francisco next week.

For some reason the current listing for the property doesn’t tout the “sophisticated indoor marijuana cultivation/processing room” which last occupied the back half of the garage. Oh, did we not mention the seller was arrested for cultivating marijuana here and at another home back in 2009?

We’d sure love to see Merrill Lynch’s loan documentation for the purchase in 2007.

On Wednesday the sale of 890 De Haro closed escrow with a reported contract price of $920,000, 32 percent ($430,000) below its year 2007, and pre-processing room, sale.

And of course, a reader’s Six Most Excellent Alternate Head-lines for our original post.

∙ Working All The Angles And Coming Up Short In The Marina [SocketSite]

∙ Groveland Marijuana Investigation Moves To San Francisco [SocketSite]

∙ 100 Percent Doobie Debt Financed On Potrero Hill [SocketSite]

∙ A Reader’s Six Most Excellent Alternate Head-lines For 890 De Haro [SocketSite]

At least we know what they were smoking when they paid that price.

Wow, a fellon committed fraud!

“At least we know what they were smoking when they paid that price.”

Umm, they were smoking Merrill’s money, or at least burning it. Seems to me that ‘they’ never paid that price. Factoring in the money paid on the loan, property taxes, etc versus the money received from the grow operation and I suspect the 2007 ‘buyer’ made quite a bit of money ‘selling’ in the two years before the owner was relocated to a government subsidized boarding house.

Must have been a small time grower to have not put anything down. Usually those who run illicit businesses need a good way to dispose of their cash.

What a facade. Early post-modern bunker. At least the roof has proper crenelations so that the archers can easily shoot at the people trying to storm the battlements.

“Usually those who run illicit businesses need a good way to dispose of their cash.”

They must have thought it was a better idea to dispose of Merrill’s cash.

One of the low points, or perhaps “high” point is more apt, of my early career as an architect was when I was asked to look at and submit a proposal to convert a basement pot farm into a legal apartment.

It was out south in the city where the street names are all european country or city names. The lot dropped down steeply from the front grade. Behind the garage was a large space with 25 foot clear at the low end – an early stilt house with the stilts covered in traditional ship-lap siding.

I never followed through but when I saw it it was like walking through an indoor corn field and you wondered that if they did do the conversion if they would be able to pay for it with just that one harvest.

“This sale was flagged as a possibly abnormal transaction.”

Redfin lists the 2007 sale with the above quote.

Link to a report of the arrest.

http://www.mymotherlode.com/news/local/521824/Groveland-Marijuana-Investigation-Moves-To-San-Francisco.html

His middle name is “Stone”.

Dude.