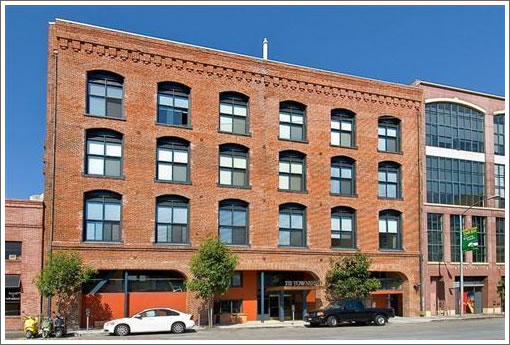

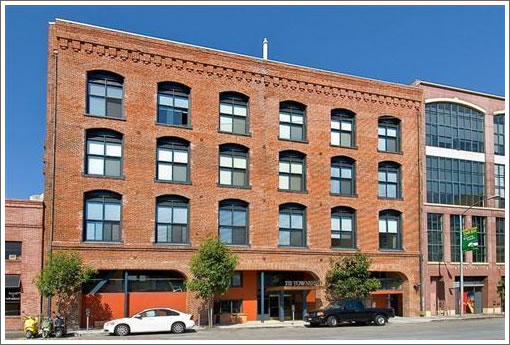

With a list price of $645,000 when the 45 condos at 310 Townsend first hit the market in early 2007, unit number 309 ended up selling for a recorded $640,000 that July (reported as $645,000 on the MLS).

Returned to the market this past March asking $465,000, the list price on the one bedroom was reduced to $425,000 in April and was pending two weeks later. Falling out of contract, the condo was relisted in June at $500,000.

Reduced to $475,000 in July, two weeks later 310 Townsend #309 was back in contract only to fall out once again. Relisted at $450,000 this past September, in November its list price was reduced to $435,000 and on Monday it was reduced to $399,000 (38 percent under 2007). And yes, it’s listed as a “short sale” but without mention of being “pre-approved” at this price.

Interestingly enough, the 803 square foot #308 at 310 Townsend which was purchased for $615,000 in 2007 resold for $494,000 a year ago (a drop of “only” 20 percent at the time) while 1,136 square foot #303 which was purchased for $850,000 in 2007 resold for $670,000 five months ago (a drop of 21 percent).

We’re still waiting for 310 Townsend #202 to report its “best price ever” sale.

∙ Listing: 310 Townsend #309 (1/1) 789 sqft – “$399,000” [MLS]

∙ 310 Townsend: Available And Selling [SocketSite]

∙ 310 Townsend #303 Is Booked [SocketSite]

∙ “Best Price Ever” At 310 Townsend (Assuming It’s Approved) [SocketSite]

Wait, is that fire escape and brick wall the view?

“office knook”

I Can’t believe #202 has been pending for a year now. Makes it pretty obvious that short sales are a waste of time at this point.

not true-remember that clay street house that just closed.

these prices are getting down to tic levels. i wonder why so many are reselling after such a short hold?

Maybe because the market is tanking and they want out?

Perhaps because they bought things they couldn’t actually afford based on the hope that the appreciation fairy would shower them with unearned wealth?

“i wonder why so many are reselling after such a short hold?

Two educated guesses:

2/28 or 3/27 loan recasts (refi is not an option unless they want to bring a quarter million dollars to the loan closing)

and/or

Owners just got tired of paying double the rent value on a place that is declining in value by $5000 every single month.

But I agree that at 399k this sale price makes sense if you are single and are confident that you would not be moving for ~10 years or more.

Does this place get any direct natural light? I’d pass regardless of the price if the only window view was a fire escape and a brick wall.

At least it better be quiet. There’s a constant humming coming from the trains that either would be a real nuisance or take some getting used to.

“at 399k this sale price makes sense if you are single and are confident that you would not be moving for ~10 years or more”

Maybe if it wasn’t a short sale. But you still have $363 HOA for a building with 0 amenities and no parking spot, not to mention “i wonder why so many are reselling after such a short hold”

You actually wonder that??? “Known Short Sale: Yes” Maybe, just maybe, they are being forced out by financial reality…

It looks like the unit doesn’t face Townsend, so it may not be as loud as the units that do. So it’s got that going for it.

It makes sense these go for less. People probably cooked in them 5 days a week and used the bathrooms.

I’d be concerned that owners will stop making their HOA payments leaving a heavier burden on the owners that actually want to stay in the building. This is a valid concern at almost every SF condo development that opened in the last 5 years.

if the bank lets it go at that price, it is a decent deal.

Define “decent deal”. It’s listed for $399K.

Rent vs buy parity is about $340K for an owner occupier. It cash flows for a long term investor at under $300K.

That doesn’t include the costs of depreciation, which is pretty much guaranteed.

Short sales are not a waste of time. I bought one and got a great deal.

Let’s see … cost of ownership. I’m going to assume a 5% fixed rate mortgage with 30-year amortization and 20% down:

$399k purchase

$320k mortgage

Monthly payment: $1717 mortgage + $363.25 HOA + $360 taxes = $2440/mo,

of which:

$1687 is tax deductible interest and taxes,

$390/mo is principal, and

$363/mo is HOA

Assuming a 20% state+federal tax bracket, the tax deduction is worth $337 to the buyer.

Net out-of-pocket monthly cost: $1713/mo

Net principal repayment: $390/mo (year 1)

I won’t even factor in the opportunity cost of the $80k downpayment because CD interest rates are so low as to be meaningless. Call it $75/mo (taxable) if you must.

Could you rent it for under $1713/mo? Doubt it, but craigslist will the final arbiter of the “rent” discussion.

And regarding depreciation, that is in fact guaranteed — by the IRS.

You can normally depreciate the improvements on the property (in the case of a condo I suppose that’s all of it) on a 27-year schedule as I recall.

Although the depreciation you claim has to be recaptured upon sale.

assuming a monthly rental of $2000 per month and assuming no costs other than hoa and property tax, the cap rate is about 3.7%.

but of course, there are costs for interior wear and tear, transactional costs for buying and selling, and management of the rental.

Why would you assume $2000 a month? Are there any such listings for that building on craigslist or anywhere else? Maybe its $2300/mo?

yes, on cl $2000 seems to be the minimum in the area. don’t really know, but it could go for $2300 a month.

I personally wouldn’t buy any real estate as an investment but if someone, for whatever inexplicable reason, wanted a small apartment near the Caltrain on a long-term basis (these people do exist), I would suggest that buying at $399k is more favorable than renting.

Since people are assumed to have an extra $80k, that is not important because CD rates are low this year, they can use it towards rent and still come out ahead over paying $399k + HOA + taxes.

J — Put a number on opportunity cost of the $80k, then we can have an intelligent discussion. Or not.

agree with your analysis, jimmy. at this point, may indeed sell over asking but a bank would be stupid not to take a strong offer at this price.

I looked at one of these condo apartments about a year ago; it might have been this one. I thought that I was going to like it, but this is not a very nice building. The apartments are not well proportioned and drab.

I don’t think that people like living there. It seemed depressing.

Jimmy, what do you figure is the typical hold time on a 1/1. 5 years?

So you have 5% for selling costs, and at least 1% for financing costs and transfer taxes (just the transfer taxes are more than half of that at $2713).

So you need to add another $400 per month in transaction costs.

So for putting $80K at risk (kiss that goodbye when you sell) and another $30K in principal payments over the 5 years (also kiss that goodbye), and locking in a low 1% interest rate on the original down and earning nothing on the principal you are paying in, you can pay $2450 for this dark 1/1 with parking down the block when there is one around the corner asking that with parking that you could probably get for $2200 and put nothing down and put nothing at risk.

http://sfbay.craigslist.org/sfc/apa/2132219916.html

Sorry tipster dude, I didn’t quite follow your little screed. I personally just bought one house, and sold another, and paid total real estate-related fees of about 1.3% on $1.3M in transactions.

Now, I may be a better negotiator than some people who just fork out the rack rate of 5%, but 5% is not a given.

So I won’t factor any selling costs into the rent v. buy equation because the duration of the hold is entirely up to the buyer and will vary on a case-by-case basis.

Second, while the monthly cashflow is in fact, $2440/mo, you continue to erroneously neglect principal payments and tax deductions in your analysis. You get a D in math until you fix that.

what was commission rate on your sale?

Well, through a series of transactions which I won’t discuss in detail here (involving, briefly, contracts for deed, downpayment credit from the agent/investor/owner/vendor of the house we bought, a seller-financed sale of our old house, etc. etc.), I ended up paying out 1.32% in commissions on two transactions. 1.4% if you include lawyers fees.

I didn’t say paying less than 5% was easy or likely… just that I did it.

Then you shouldn’t assume it in the calculations here.

And a 5 year hold is a good assumption on a 1/1. You don’t just knock 20% off because you aren’t sure of all of the details. You make a reasonable assumption and use that.

Figures don’t lie, but liars figure.

It is incredibly misleading to try to average together your closing costs on a sale and purchase. I doubt many would look past that.

Jimmy, my calculations are always as follows:

(Purchase price *(current interest rate + 1.2% for property tax)/12 months per year*0.78 adjustment for tax deductions + hoa + parking. If it’s a home, I’ll add the cost of fire insurance intead of the HOA.

You may quibble with the fact that I use a zero down, interest only loan, which means I am paying myself 5% for the down payment. However, I can tell you that NO, and I mean NO private investor would consider 5% to be an acceptable return on a first loss downpayment because they know that the down is very likely to evaporate, so I don’t use a safe CD 1% rate on the down, I use a very conservative 5% on the downpayment and just roll it into the cost of the loan.

A hard money lender might give you a second mortgage at 20%. Why? Because he knows it’s likely to disappear. So using 1% on a very risky investment that no investor would touch is undercompensating yourself for the risk you are taking and that’s just dumb.

The idea that you should value that downpayment at 1% because that’s what you would lose when getting a CD will cause many overly risky investments to be made where the investor will not get compensated for his risk. In an environment in which people are losing their entire lifes savings, that is a very dumb idea when your best case is that you come out even with renting.

I realize that using an opportunity cost that is equal to the cost of funds makes sense in certain analyses, but that only works when you have a minimum internal rate of return that compensates you for your risk of withdrawing those funds from a riskless investment and applying them to a risky investment. Where, as here, your IRR is zero (best case: it costs the same as renting), using a cost of funds equal to a safe alternative investment for purpose of analysis is for idiots.

You are using an minimum IRR of zero. That is a recipe for losing every penny you own. It’s flat out wrong and I don’t do it.

What if they do away with mortgage interest deduction or a gradual phase out based on income ? AMT already wiped out property tax deduction if you are a high earner.

See now you’re conflating two ideas — investing for profit, and buying to live.

I wouldn’t make an investment with an IRR of 0% and neither would anyone else. But if I intended to live in the place, then I might. I view my risk of defaulting on my own primary residence mortgage as ‘zero’ even if the bank doesn’t.

What if they do away with mortgage interest deduction or a gradual phase out based on income ?

That’ll happen right after they repeal Prop. 13. The mortgage-interest deduction has been in place for over 100 years. It’ll never change.

The mortgage interest deduction for housing is sort of a historical accident, and there has been much discussion about either getting rid of it or somehow reducing it. Prop. 13 is a completely different set of issues.

“I don’t think that people like living there. It seemed depressing.”

You’d be depressed too if your “investment” was down 40% and you were shelling out double the equivalent rent cost for the privilege of likely losing another 20% before this slide has run its course!

Obviously, the “they” involved in repealing Prop. 13 would be quite different from the “they” involved in repealing the mortgage interest tax deduction.

But more interesting to me is the prospect of privatizing Fannie Mae and Freddie Mac. Former Federal Reserve Chairman Alan Greenspan floated a proposal not too long ago that would break the companies up and sell the pieces off, and during the Presidential campaign John McCain endorsed it. Now perhaps since Greenspan’s been almost completely discredited and McCain lost the election that idea won’t go as far as it could have, but maybe someone in the incoming Republican-controlled House will pick it up since they tremble in fear of the Tea Partiers and Glen Beck can’t seem to stop talking about it.

You guys are getting off topic, which is to say, proving that I’m right and tipster is wrong.

No one out here in SF really cares what the Republicans have to say.

why does tippy think he can reduce the asking rent by 10%? i’m seeing lots of demand for the lower level rentals like these.

“You guys are getting off topic, which is to say, proving that I’m right and tipster is wrong.”

Jimmy, that was one of the funniest posts ever.

I used to think loss of mortgage interest deduction is virtually impossible but the notion is picking up momentum in spite of heavy lobbying against it from the banking and real estate industry. Nowhere else in the world has such deduction. Not in Europe, not in Canada. I hope it doesn’t happen as it is my only true deduction. But a lot of people in the Mid West and South don’t itemize and mortgage interest deduction means nothing to them. If it gets phased out or the deductible loan limit significantly reduced from the current 1.0m to 250 or 400k, real estate prices in SF may take an additional hit…

outsider,

i think they have a type of mortgage interest deduction in france.

i think that govt’s realize that getting rid of the mortgage interest deduction or prop 13 would reduce net tax paid b/c of the adverse effect on pricing these measures would have.

i think that govt’s realize that getting rid of the mortgage interest deduction or prop 13 would reduce net tax paid b/c of the adverse effect on pricing these measures would have.

What is this, the realtor equivalent of the laffer curve???! I call BS!

ok j,

i would say if you repeal prop 13 that property prices in california would fall to such an extent that you would end up with a net decrease in tax revenue. plus, it would be very messy as so many people would be rushing to sell rather than face a double,triple or worse, tax bill.

i could be wrong-but i am no realtor 😉

Are there not two parties involved in the sale of a property? Would the 2nd party not be responsible for paying property taxes(based on present value)?

What we have now is messy – it penalizes people for being young or moving.

Neither prop 13 nor the mortgage interest deduction are going anywhere,* so this is all academic. Nevertheless, if prop 13 were to be repealed in its entirety, I agree that prices and property values would fall substantially. However, it would also permit upward re-assessments to market value. My guess is the net effect on taxes would be a wash or a slight increase in tax revenues. Going forward, the effect would be higher revenues as re-assessments would keep up with inflation (which will return someday).

* caveat: I can fathom the mortgage interest deduction being taken away for second homes.

Removing the interest deduction would increase income tax revenue, no matter what happens to house prices. I think it should be done in a revenue neutral way – remove the deduction and lower tax rates by a few %.

Actually, you are incorrect – this property has been approved by the bank TWICE at 2 different prices. The first time was at 500k. When the first buyer lost their job and had to pull out we brought it back to the market at the approved price. Once it was dropped we got another offer, that time we got it approved at 450k but the buyer and the bank could not find a common ground, thought they were not that far apart, and after many counters back and forth the buyer backed out – the bank’s fault not the property’s.

Every time a Bank of America short sale (like this is) is closed out and a new offer comes into play, it gets assigned to a new negotiator and a new full appraisal is done on the property by a licensed appraiser. Based on the comps that I have pulled recently$ 399k is a very realistic price for the unit.

Yes, unfortunately, this property does look out on the fire escape and the brick building facade so there is not a lot of natural light but it is a great unit for someone who either relies on public transportation vs. their own car (since there is No Deeded Parking but there is limited unrestricted parking on the back of the building in the middle of the street) or loves this area and the conveniences it offers. The unit has been VERY well maintained and has a lot to offer.

As for why people end up in this position – well when you take a look at unemployment numbers over the last few years and you factor in that people’s lives and needs change over time I am sure that you can answer that question for yourself. The Bay Area has been rocked hard and many people here are not making what they were making 5 years ago yet their families and their needs have still grown while their income has declined. This can be said for a lot of people who find themselves in short sale scenarios.

Short Sales can be a win-win for both a buyer and a seller – when the banks are realistic and they understand that THEY are not in the business of buying and selling Real Estate so they should rely on the knowledge and expertise of people who are. Sometimes they end up shooting themselves in the foot by their unwillingness to listen to reason and that is what has happened here.

We’re looking forward to a new offer and a new buyer and agent to work with so if you want to make this place home than give it a look and another chance – when you look with eyes that are more open you find charms and benefits you’ve never seen before… can’t this be said for most things in life?

[Editor’s Note: Fantastic comment and background, we couldn’t agree more with almost everything you’ve said. In terms of being “incorrect,” however, keep in mind our “pre-approved” quip relates to the current list price. Regardless, and as always, thank you for plugging in. Cheers.]

Unit 309’s Listing Agent, thanks for chiming in, particularly with some good, honest information and helpful insights. I’m always glad to hear the agent on SS properties weigh in as long as it is not the typical shill faux-anonymous cheerleading about the place. Your post was definitely not that!

There is one thing I don’t understand. You state “Every time a Bank of America short sale (like this is) is closed out and a new offer comes into play, it gets assigned to a new negotiator and a new full appraisal is done on the property by a licensed appraiser.” But if the short sale price is “approved” in advance then what is the need for negotiations (at least as to price) or an appraisal?

A.T. wrote: “There is one thing I don’t understand. You state “Every time a Bank of America short sale (like this is) is closed out and a new offer comes into play, it gets assigned to a new negotiator and a new full appraisal is done on the property by a licensed appraiser.” But if the short sale price is “approved” in advance then what is the need for negotiations (at least as to price) or an appraisal?”

The hard reality is that I don’t know where most agents get their sales “pre-approved”. The majority of my business is short sales and while I have come across banks that will give you a verbal figure of where they “believe” they may be able to get approval at; without a signed offer, a HUD, and all the supporting documentation from the seller packages do not get submitted to the investors that actually own the loan for approval.

As for this property – wouldn’t it be awful if the bank came back today saying “well based on the appraisal from the early part of this year and not taking into account the changes in the market or buying trends we will not accept anything lower than $500k for this unit”.

The reason (as is so graciously illustrated in the main post on this property) that the property returned to market at those prices is because that is what the bank approved the sale of the property at that time. Leaving the property on the market at that price and not getting offers supports my argument that while the lender may believe they can get that price – the market is clearly illustrating they cannot.

I think the only lender so far I’ve worked with to find a half-way decent solution to the reality of short sales is Wachovia (and recently GMAC) who gave me a hard written approval in 10 days from receiving the offer.

Banks clearly have not grasped the hard reality yet that they are harming themselves by dragging things out and pushing hard numbers that may make sense on paper but not in practice.

Everyone is always looking for a great deal and just like in a non-distressed property sale the buyer wants to pay as little as possible and the seller wants to be paid as much as possible. True fair market value is what one person is willing to pay and another is willing to accept.

I think what distorts this process from running more smoothly is that there are still a lot of agents out there who do not know how to successfully negotiate a short sale. They over-price the property based on what is owed instead of what fair market value at the time shows and it prevents them from getting offers quickly. Because this was the norm at the tail end of 2007 and start of 2008 a lot of buyers and their agents make the mistake of thinking that they can write super lowball offers on all short sales and take the gamble that it happens to be one in this set of circumstances.

The most important thing to remember when listing or writing an offer on a short sale property is that it should be based on the current market value of the property taking into account all comps and neighborhood or environmental factors that may come into play when determining the property value. This is the baseline that banks will start the negotiating process at.

If I had gotten another offer at the “approved” price shortly after the time that those offers backed out I am sure the process of approval would have gone much faster and without the need of an additional appraisal/negotiations because of the value already listed in their system. Due to the fact that so much time had passed between offers and the market changes, it makes sense that the bank would want to get a new opinion of value to pass on to the investor/owner of the loan in order to ensure they are getting what they feel they will settle with.

There are different guidelines for every lender and every investor so there is not really a general rule of thumb when it comes to what the lender will be willing to take – the only constant is where the baseline begins.

The only real standard is that most second lien holders will not take less than 10% of what is owed on their loan (and YES, they will push for it).

I hope this helps answer your question… and the questions of other people out there. I’m always happy to discuss my business and believe honestly that the more information a person has the better armed they are to make an informed decision. Talk is free – knowledge is priceless.

Thanks again Unit 309’s Listing Agent. From the ed.’s mention of “pre-approvals” and your initial comment that, in fact, there had been “approvals” at two earlier price points, that a common (but far from universal) practice with short sales was for the bank to “pre-approve” a certain list price as acceptable and if an offer came in at that price, assuming other minimum qualifications, then the process was quicker because the price negotiating was all done. From what you write, it sounds like that is a rare or non-existent practice, or the “pre-approval” is a misnomer and is just a soft, maybe, possibly number, at best.

What happened to my post

Not necessarily true … in the case of our short sale (the one I purchased), the price and all the terms of the sale were already pre-approved in writing by the lender. Given that we were able to accept those terms as they were written, the sale proceeded very quickly… our offer was accepted in 2 days and we closed escrow in about 6 weeks. The main challenge was gaming the underwriting of the loan.

The key in my case was that someone else had made an identical offer then backed out at the last minute…. so all the hard work and waiting for approvals was done by others.

Everyone needs to click on the listing and write down the name and phone number of this agent, and then use her for your next transaction.

What a breath of fresh air compared to the SF cartel of misinformation and outright lies we usually get here.

To A.T. – Happy to help you better understand the process… not saying that pre-approval is non-existent; just that coming to the market already approved is very unlikely, in my experience, unless you had an offer into the bank being reviewed before the property even came to market.

To Jimmy – this is ABSOLUTELY possible. In a case where an agent may have multiple offers on a short sale listing (which I have had many times, in fact I had 6 or 7 on my listing on Pennsylvania) it is common for the listing agent to counter all offers on the table at the banks approved terms. It sounds like in your case the other offers did not want to rise to the occasion or you wrote on the property shortly after they backed out and you got in with the initial approval. As I indicated in my last post, “If I had gotten another offer at the “approved” price shortly after the time that those offers backed out I am sure the process of approval would have gone much faster and without the need of an additional appraisal/negotiations because of the value already listed in their system.” Unfortunately for my seller in this case, the bank’s expectations of value were unrealistic and despite my best efforts, I could not get a supervisor to contact me back to explain the situation – something I have had to do more than once to illustrate what I have said from the beginning “THEY are not in the business of buying and selling Real Estate so they should rely on the knowledge and expertise of people who are.” I am happy you were able to take advantage of that foot in the door from another buyer who played the undesired waiting game and hope you find many years of happiness to come in your new home.

To Tipster – thank you for the kudos. I think the job of a good short sale listing agent is a tough one. It’s a fine blend of pacifying a worried seller, continually keeping updated and informed buyers and their agents throughout the process so they don’t feel like they are in the dark and walk away, and being downright relentless with unrealistic banks and negotiators. I got into this business to help others and it’s something I strive to do every day.

On a side note, I AM a San Francisco agent (although my brokerage is in the East Bay – hence the 510 Office number) – I live here, I work here – and I feel it is my duty to support and embrace the community I belong to.

I want to send my thanks to all of you for giving me the opportunity to talk to you about the plight of my poor listing here on Townsend – and about the short sale process in general.

Wishing all of you a very happy and prosperous 2011!

“The mortgage-interest deduction has been in place for over 100 years. It’ll never change.”

That is extremely misleading. All interest was deductible until 1986. After that point, mortgage interest was kept deductible, while most other personal debts were made undeductible. I’m sure that people thought making most interest payments non-deductible was impossible too.

It’s worth noting that the current tax plan from the bipartisan commission suggests eliminating the mortgage interest deduction. It’s expensive and doesn’t really do much to encourage middle class home ownership according to studies.

^ The income tax hasn’t even been around for 100 years (instituted in 1913), and for the first decade or so only applied to no more than 2% of wage earners anyway.