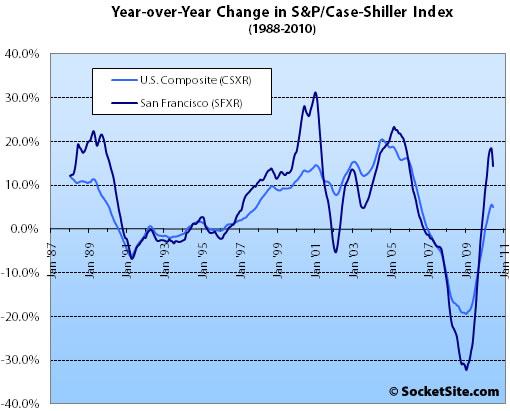

According to the June 2010 S&P/Case-Shiller Home Price Index, single-family home prices in the San Francisco MSA rose a nominal 0.3% from May ’10 to June ’10, down 34.7% from a peak in May 2006 but up 14.3% year-over-year (YOY) versus an 18.3% YOY gain reported in May.

For the broader 10-City composite (CSXR), home values rose 1.0% from May to June for a third straight monthly gain but remain down 28.8% from a peak in June 2006 (up 5.0% year-over-year).

“The monthly Composites cover June and the national index covers the second quarter, when the government’s program for first time home-buyers was winding down. While the numbers are upbeat, other more recent data on home sales and mortgages point to fewer gains ahead,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “Even with concerns about near term developments, we recognize that the housing market is in better shape than this time last year. Further, California’s cities have moved from some of the hardest hit to three of the four leading cities based on year-over-year gains. Among the other hard hit cities, the news is also a bit encouraging – Las Vegas, however, remains among the weaker cities.

“Seventeen of the 20 MSAs and both Composites saw home prices increase in June over May – Las Vegas was down 0.6%, Phoenix and Seattle were both flat. Through the second quarter, 15 of the 20 MSAs and both Composites have positive annual growth rates, and no market is registering a doubledigit decline. The worry starts when you remember that the Homebuyers’ Tax Credit has expired, foreclosures are still at high levels, and July data on home sales and starts were very, very weak. The inventory of unsold homes and months’ supply data were particularly troubling. If this relative weakness in demand continues, it will likely filter through to home prices in coming months.”

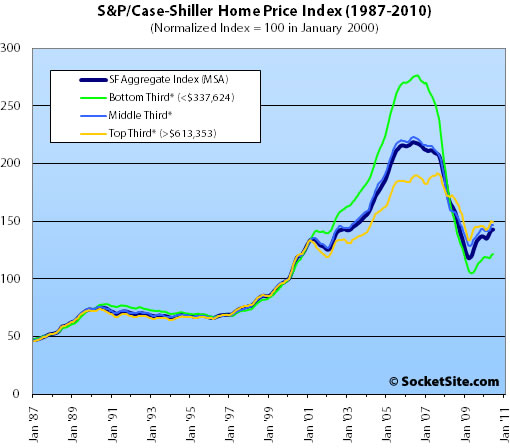

On a month-over-month basis prices were relatively flat across the market tiers with nominal gains at the bottom and nominal declines at the top for single-family homes in the San Francisco MSA.

The bottom third (under $337,624 at the time of acquisition) gained 0.8% from May to June (up 14.7% YOY); the middle third was unchanged from May to June (up 9.7% YOY); and the top third (over $613,353 at the time of acquisition) fell 0.6% from May to June (up 5.1% YOY versus 8.3% in May).

According to the Index, single-family home values for the bottom third of the market in the San Francisco MSA remain just above September 2000 levels having fallen 56% from a peak in August 2006, the middle third is back to just below April 2003 levels having fallen 34% from a peak in May 2006, and the top third is back to April 2004 levels having fallen 22% from a peak in August 2007.

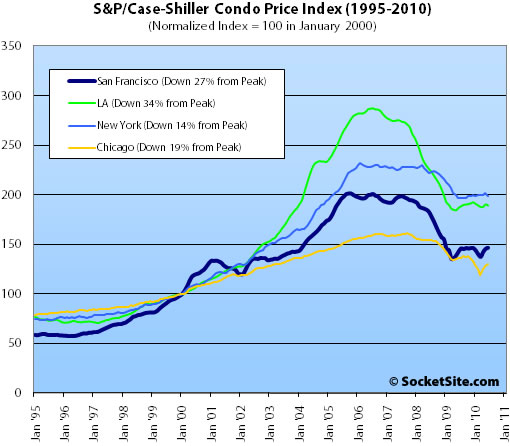

Condo values in the San Francisco MSA rose 0.7% from May ’10 to June ’10, falling to a 2.5% gain on a year-over-year basis (down 27.2% from an December 2005 high).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

∙ Second Quarter of 2010 Saw Modest Improvement in Home Prices [Standard & Poor’s]

∙ May Case-Shiller: San Francisco Tiers Up But Gains Moderating Atop [SocketSite]

∙ Existing U.S. Home Sales Pace Plunges 27.2% In July (25.5% YOY) [SocketSite]

dusk dark comes early

fluffy stiff and coming down

bears see clear at night

Boy, this was the period of time when the gubmint was handing out $18,000 to people who bought a home ($10k of that would be paid over 3 years). And mortgage rates were at record lows. Yet we still had very anemic results. We now know that sales volume plummeted right after this period, and CSI puts out data that is a few months in arrears. The giveaways and foreclosure moratoria worked; they delayed the trend for a while. Look for these SF MSA numbers to fall pretty significantly in the months ahead.

Numbers Up or Down

SocketSite Perma Bears speak

In Echo Chamber

If Socketsite were a place to plug in to San Leandro, Antioch, San Bruno, Union City, Colma and Walnut Creek real estate, this index would be perfect for the site!

I’m sorry – I know I sound cranky pants, and I know this is a highly regarded regional index, but it’s just too broad for me. Residential real estate is so extremely local (particularly here in SF), I don’t get much from this index beyond what I could read in USA Today.

It’s why I love Socketsite – specific SF focus.

So the only thing gone are the credits and their macro effect. Low rates still exist and will continue to do so for some time. The tax incentives did nothing really for the top tier. I’m interested to see how C/S impacts the top tier. My guess is that we will see a big drop in bottom and middle tiers next period and top tier not as large. But it will follow. I think the larger issue is that we’re starting to see finally the flushing of pent up inventory and foreclosed/shorts. Inventory seems to be running at 12-13 months supply so it will be interesting to see if the market continues to get flooded, or if the supply get consumed. Still feels like we’re in a sideways slide till 2012.

eddy, you saying 12-13 months supply for SF MSA or SF county? Cause it doesn’t look that much in SF county.. Granted, mixing and matching numbers here, but Dataquick has 452 sales in July, and SS has 1561 properties available, something more like 3.5 months. Understand this isn’t perfect methodology, but it’s nowhere near 12 months.

“So the only thing gone are the credits and their macro effect.”

My income is down more than 50% this year. Last year it was down 30%. Two years ago, I could have qualified for 99% of the homes in the bay area. This year, a banker would look at my financials and worry about loaning me anything.

Every business owner I know is experiencing the same thing. Customers continue to go out of business. One customer of 11 years has stopped paying and we just cut them off. Another one is a private company operating for 5 years and now being acquired for pennies on the dollar.

I’m not hiring at all this year. Not replacing anyone who leaves either.

The tax credits were nothing compared to this.

Lots of different ways to measure “months of inventory.” Anyone know the “official” or “standard” method? For example, SS posts only “active” listings, but is that usually the denominator, or does it include those in contract and/or those that were active at any point during the month? And the numerator (sales) will be smaller in August than it was in July. Looking like somewhere in the neighborhood of 375 per redfin.

This site is good for recent historical context, but he does things by week, which makes for way too much noise:

http://www.andrewlamont.com/Nav.aspx/Page=%2fPageManager%2fDefault.aspx%2fPageID%3d1953256

@R, I was speaking about SF specifically and I was largely referencing inventory months I’ve read about SF specifically. I almost never comment on anything other than Prime SF aka D1-D10

AT: yeah, little too much noise in there, but he’s in the range of 3-5 months for single families, and 5-8 for condos, so nowhere near the 12 months eddy referenced..

Eddy: Where did you get that?

We still need the new chart from Morgan Stanley that shows organic sales vs. foreclosures/short sales. That chart showed what was really happening.

[Editor’s Note: Mix? Pshaw! Who’s Ever Heard Of Such A Ridiculous Thing…]

“Dataquick has 452 sales in July, and SS has 1561 properties available, something more like 3.5 months.”

I calculated this for July ’09 vs. July ’10 on a recent thread and it had gone up from 2.9 months to 4 months YOY (see the link).

@Longtime_Lurker While your point is taken several posters have shown time and time again that SF RE follows the same national and MSA trends as everywhere else aka ‘gravity exists here too’.

While the CSI isn’t going to give you a clear picture of SF county or the specific district(s) in SF you are looking it is going to give you an indication of the trend.

If you want detailed specifics you need to pull neighborhood comps the CSI, as always, is merely an indicator.

And let’s be clear it’s not like the SF county medians provided by Data Quick are giving you a clearer indication of prices or trends.

SF’s MLS currently has 1529 condos and SFRs on the market in D1-10. View it versus 400 sales in July of same. That’s looking like 3.825 mo’s of inventory.

“several posters have shown time and time again that SF RE follows the same national and MSA trends as everywhere else aka ‘gravity exists here too'”

The same group of posters, of which you are a member, have also looked at occasional CSI upticks and talked as if things are trending down in SF proper. Repeatedly.

“SF’s MLS currently has”

The problem with that is “currently,” isn’t it? Inventory changes month to month, as do sales. That’s why I did a comparison between mid-July inventory and July sales.

To quote myself:

SocketSite gave inventory on July 12, 2010 as 1799. With 452 sales in July, we had just shy 4 months of inventory.

To compare to 2009, inventory on July 12, 2009 was 1569 with 543 sales for July 2009, giving 2.9 months of inventory.

At least YOY, SF inventory in increasing just like national inventory.

@anonsf because the long term trend for RE in general, in my opinon, is still down.

Why do I feel that way?

1) because even the relatively minor bubbles of the 80’s and early 90’s each took 5 years to unwind. Unless you think prices peaked in 2005, while the CSI indicates that prices peaked in July of 2006, we haven’t even reached the 5 year trough of a typical housing bubble bursting and this bubble was anything but typical

2) Since the 1940’s real housing prices tends to settle around the 110 mark on the CSI which means housing, nationally, has another 25% to fall in real terms.

3) Housing can only rise with income rises and inflation. Since incomes and inflation are doing anything but rising I don’t see the stimulus for rising prices

4) The recent upticks we have seen in the CSI is completely logical when the massive and temporary government stimulus is taken into account. That intervention has or is ending meaning prices will again be subject to market forces of supply and demand. With supply increasing and demand falling prices are likely to fall.

I could go on and on actually but I think you get the idea. Every indicator shows substantial weakness in housing and downward pressure on prices; inventory higher, new home sales falling, existing home sales falling, job market weakness, income growth weak or falling, inflation weak or non existent, government stimulus ending.

When taken all together the trend of prices is clear, nominal prices flat likely falling and real prices definitely falling. You can argue all you want that SF is different and it is. But all those differences were already baked into the prices in 1995, 2000, 2005, and 2010. It is not news to anyone that SF is surrounded by water, that construction costs are higher, the avg incomes are higher, Prop 13 creates a disincentive to sell keeping inventory artificially low, etc. While these things justify the higher prices in SF in the aggregate, they are by no means ‘new’ information that has not been factored into SF housing prices for decades and are not a factor in the current economic downturn.

@everyone, I’m going to take back my comment on the 12mo inventory comment. I read a lot of data and I’m fairly sure I came across this stat somewhere but I cannot validate it or back it up. My bad. If I find my source again I will ‘source’ it, but I remember it being a blended inventory of all homes on MLS / average closed sales. It may have been a national stat that I was referring to…

However, this does bring up an interesting point, do we not have a reliable “Months Inventory” stat? If not, I propose we create a standard as this is an extremely useful metric.

“It may have been a national stat that I was referring to… ”

I believe 12-13 months is the national stat.

“However, this does bring up an interesting point, do we not have a reliable “Months Inventory” stat?”

The editor publishes the data we need — see my post above.

Has anyone seen stats like this for SF County?

http://www.pacificariptide.com/pacifica_riptide/2010/08/more-housing-bubble-value-wiped-away-assessment-declines-slow-in-2009.html

The post I linked discusses tax reassessment values for San Mateo County. What it shows is that while general reassessments decreased in both number and value for 2009 vs. 2008 for San Mateo County as a whole and individually in lower priced cities. However, in high priced cities like Atherton and Hillsborough, the value of the reassessments increased in 2009 even though the number of reassessments still decreased. In fact, for Atherton, assessed values fell for 2009 by more than $2.12M per house, whereas in Hillborough it was more like $1.19M/house, but it was more like half those amounts in 2008.

What also makes this data interesting is that tax values are divorced from home values in California because of Prop 13, so we’re specifically talking about purchase prices (plus 2% adjustments) being breached here when a reassessment happens, not potential sale prices.

It would be interesting to see this data in SF, especially on a district or neighborhood basis. This data fits with the narrative that higher priced areas held out longer but still fell and still fell somewhat hard.

“@anonsf because the long term trend for RE in general, in my opinon, is still down”

That is not the same thing as,

“several posters have shown time and time again that SF RE follows the same national and MSA trends as everywhere else aka ‘gravity exists here too'”

not in light of CSI showing the opposite. There’s show (data) and then there’s tell (your opinion, often this summer running contrary to what data shows).

4) The recent upticks we have seen in the CSI is completely logical when the massive and temporary government stimulus is taken into account. That intervention has or is ending meaning prices will again be subject to market forces of supply and demand. With supply increasing and demand falling prices are likely to fall.

Any analysis of the CSI, up or down, has to take into the context of when the data was acquired. The recent period of the home buyer tax credit expirations temporarily goosing the CSI

That was a surprise. The line starts to trend down…

The day the government stops being the only lender and stops subsidizing low rates, we will know what real values are.

Until then we will have a zombie market and people paying 2X or 3X rent to own their piece of SF just because the bank/govt containment denies them a real market.

Bring back 6 or 8% rates and prices will not depend on how much you can borrow, but how much a house is really worth as a home.

The powers that be want to delay the day of price recognition. Fine. But these past 3 years have proven gravity always catches up on you, and hard.

“The powers that be want to delay the day of price recognition.”

I’d include the realtor lobby in those p-t-b. Which is ironic — if they had a brain in their collective head they’d be lobbying against these government malinvestment programs. No one will be making deals until the feds finally say uncle and allow the markets to clear. As for finding a politician willing to lead the charge, good luck.

I’d include the realtor lobby in those p-t-b. Which is ironic — if they had a brain in their collective head they’d be lobbying against these government malinvestment programs. No one will be making deals until the feds finally say uncle and allow the markets to clear.

Good point. But the realtor lobby wants their 2005 back. They’ll settle for nothing less than ever increasing prices in their “onward and upward” fashion. That’s their DNA, even if it goes against any basic law of economics.

They could have looked at the past 10 years of salary stats (hint: flat) and extrapolated rents, then property price. People have been squeezed out for the dream of an easy buck. Now they’re tapped out. Period.

A record?

This place just sold at a 58 1/2% discount to its 2005 price.

http://www.redfin.com/CA/San-Francisco/1351-Revere-Ave-94124/home/741301

Yes, it’s in the Bayview, although it does not appear to have been trashed or anything. For the last several years, D10 (along with D9) has been a “leading indicator” of SF RE. Look for the rest of the rollercoaster to follow the lead car.

“D10 (along with D9) has been a “leading indicator””

You keep wanting to link D9 as a whole with D10. It’s bogus.

The person who paid $600k to buy this place is crazy:

http://www.mapjack.com/?7KqmWA9FcF6DBDLA

That said, we’ve already see legit 20-30% discounts and I’m sure we’ll see some -40% deals but I do not think this will become the standard, or even close. Heck, even 1351 Revere is up 65% from its 1999 sale!

“Heck, even 1351 Revere is up 65% from its 1999 sale!”

1999 Sale: 218K * 7.5% interest +1.2% property tax/12 = $1616

2010 Sale $260K * 4.5% interest + 1.2% property tax/12 = $1235

http://mortgage-x.com/trends.htm

You can see how much poorer we are today.

The only thing even remotely propping it up is low interest rates. That’s going to change.

At 7.5% interest rates, to get the same payment as today, the price will have to fall to $167K, about 35%.

SF real estate is doomed.

People do occasionally refinance their homes when interest rates decline. But I do agree that the home prices are impacted by interest rates. Obviously many factors at work and I think your over-simplification of the situation in your math above is a stretch to state that SF RE is doomed. By the same token you would think that it would very smart to buy now and lock in these low rates if you believed you were going to live in the home for 15 years.

Also, the most recent sale I see is 360k in July 2009. Did 1351 recently trade again at $260k?

I thought the sale was listed as all cash?

Eddy, click AT’s link above. It closed at 260, not 360. It NEVER sold at 360. Are we talking about the same property?

Jane,”All Cash” can mean the bank’s cash. Cash is cash. What an all cash sale means is there is no financing contingency. That means if it doesn’t appraise for the sale price, you may have to make up the difference in the LTV. Example: you make an “all cash” offer for 260. The bank will loan you max LTV 90% and it only appraises for 250. That means the bank will loan a max of 225 and so your down is therefore going to be not 25K but 35K. Got it? That’s an “all cash offer”. Doesn’t mean it’s your cash, or that you have to bring a suitcase full of unmarked bills to the closing. It can mean it’s the bank’s cash. You just have to make up the difference between your offer and the appraisal.

BTW, all cash 1st offers are stupid. If it doesn’t appraise for 260, no one else will buy it for 260 either, they won’t be able to get a loan above the appraised price. So if the appraisal comes in under your offer, if you had made your offer subject to a financing contingency, and it won’t appraise, you bail on your offer, drop your price to one cent over the appraisal and THEN make an all cash offer. It’s going to be more than the seller will get from almost any other buyer.

Of course, ALL SF offers are dumb. SF real estate is doomed. There simply isn’t any hope any longer. Whatever your downpayment is, you should assume you’ll never see it again, and waiting 1 year will mean you save a ton of money and will lose less of your life savings.

ATs link requires a sign up. I referenced Trulia who has an 09 sale @ $360k. See name link. Like Redfin and any more reliabe than Trulia? Beats me!

Propertyshark doesn’t show the MLS records (so it doesn’t show yesterday’s sale yet) but it otherwise matches redfin. PS doesn’t show the $360 sale either. So I think trulia is not reliable.

From Redfin:

Date Event Price Appreciation Source

Sep 01, 2010 Sold (MLS) $260,000 — Inactive San Francisco MLS #367985

Aug 04, 2010 Delisted — — Inactive San Francisco MLS #367985

Aug 03, 2010 Relisted — — Inactive San Francisco MLS #367985

Jun 10, 2010 Delisted — — Inactive San Francisco MLS #367985

May 27, 2010 Relisted — — Inactive San Francisco MLS #367985

Apr 12, 2010 Delisted — — Inactive San Francisco MLS #367985

Mar 19, 2010 Listed $320,000 — Inactive San Francisco MLS #367985

Mar 17, 2005 Sold (Public Records) $625,000 20.6%/yr Public Records

Aug 06, 1999 Sold (Public Records) $218,000 — Public Records

MLS data (via cleanoffer.com) shows the sale as 260k — listed at 320k.

Of course the 2005 625k sale price was crazy. But so were 1000/sf crummy condos in SOMA, $2M 3-BRs in Noe, etc. They are all variations on the same thing. No/low-down easy money lent to anybody with a pulse. Sure, not all buyers fit that profile, but many, many did and those buyers set the “market.” They are gone now, and the “market” has been falling ever since. Takes a while to fall just like prices took several years of free money to hit the stratosphere. I’ve been saying for a while that soon we will all be looking back at these prices (even 2010 prices) and shaking our head in disbelief at how people can be so foolish.

Weird. Signing up for Redfin 🙂

The other interesting thing about 1351 Revere is that there appear to be odd, possibly tax-related, transfers here. There was a transfer from Person A to Person B in October 11 2007 (more than 24 months after the 2005 sale), and then a transfer back from Person B to Person A in October 3, 2008 (less than 12 months).

The same people also had a transaction for 1514 Shafter, the next street up. In that case, Person A sold the house to Person B in July 2001.

They could easily be family members or something, but the timing is suspicious. This is the second day in a row I’ve seen something like this.

The comment about the transfers reminded me of some great coverage of a mortgage fraud scheme in Florida by NPR’s Planet Money last month.

http://www.npr.org/blogs/money/2010/07/23/128720556/atc-flipping

P.S. Thanks for explaining the all cash bit.

Wow, tipster’s income down over 65% in 18 months. I didn’t realize the economy was that bad. I guess that explains his negative bias.

Every business is different. My company (linked to banking) is still hiring and is encouraging remote work to help overcrowding. A contractor friend has managed to pull himself out of a dry dry spell but is still licking his financial wounds. Another created her own job and is doing fine thanks to part time Government pork.

I can tell you one thing: SF is doing much better than most of CA. That’s no reason to move there if you don’t have the right skills.