From the New York Times:

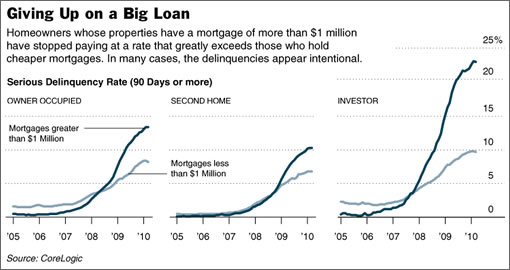

More than one in seven homeowners [in the U.S.] with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

By contrast, homeowners with less lavish housing are much more likely to keep writing checks to their lender. About one in 12 mortgages below the million-dollar mark is delinquent.

Seriously delinquent is considered to be three or more missed payments in a row and the pipeline for foreclosure. The rather important missing statistic that we’d love to see: the difference in cure rates between the two tiers.

∙ Biggest Defaulters on Mortgages Are the Rich [New York Times]

I see the bad moon arising.

Interesting article, but I think the writer’s thesis that “wealthy people are just more ruthless” misses two key points.

First, the loan products used to buy lower-end places and higher-end places were quite different. A lot of lower-end subprime buyers could not afford the mortgage payment on day one. Thus, the defaults started earlier, after 2005-06 peak bubble buyers in this range could no longer just bail or refi based on appreciation. Once the bubble started deflating in 2006, the game was over. Funny loans at the higher-end often had a 3-5 year re-cast period, and most buyers could afford to make the initial lower payments (if they so chose) from income or savings. So the music didn’t stop playing, and values did not start falling, until about a year later, in late 2007 or early 2008. Then defaults started rising at the higher-end because owners couldn’t or did not want to pay the high mortgage on a declining asset (due to re-cast, or loss of income, or simple unwillingness to pay). Hence, prices in Pittsburg started falling earlier than SF or Tiburon. Re-casts of bubble-era purchases are just now starting to really hit.

Second, the financial calculus is different between low-end and high-end places for an underwater owner. For example, if someone owes $300,000 on a place now worth 20% less, it may be worth just paying it since the cost to rent a place would not be that much less, and you get the financial/credit ding from walking away. But the monthly mortgage on a $1.5M place is quite high, and one can rent some place, indeed a very nice place, for much, much less, particularly when one factors in the savings on no longer paying the 20% underwater portion. So the financial benefit of walking away is greater for the higher-end underwater owner, in both absolute and relative terms.

Higher-end places in SF and elsewhere will continue to decline in value for these and other, broader reasons. The incomes are just not there to support current prices. Inventory continues to rise and sales volume continues to decline.

A true strategic would make ever 1/3rd payment just to give the bank some hope and stay in the house as long as possible. The reality is that these walkaways are exactly what the housing market needs to bring a better equilibrium. There are still a lot of buyers out there. Now, the financial markets on the other hand, these walkaways are not good for the banks.

A.T.

Well put.

This separation of low end vs high end can be explained that way:

Low end depends mostly on income. The no-cash down people who have never saved a penny in their lives on a very low income.

High end depends mostly on capital: a lot of cash thanks to personal/business investments. When they put 500K down on a house there’s usually a lot more in other assets which will cushion most blows. The problem occurs when your property loses 20 or 30% on paper and you’re under water. Not only you’re still paying double the rent in expenses, but you lost your downpayment. Why throw good money after bad if you don’t see the market coming back?

^ Are you not aware it can take years after the last payment, before the bank forecloses??? The nationwide average is now 438(415 for CA) days. Hence the term, “shadow inventory”.

http://www.nytimes.com/2010/06/01/business/01nopay.html

Throwing more good money after bad is not a good strategy.

[Editor’s Note: QuickLinks: Another Foreclosure Wave Forming Just Offshore?]

interesting that this thread was posted because I just counseled my best friend to think about foreclosing on his property

the condo is down around $200k+ based on comps (in the same building), and he can rent a similar unit in the same building for $1500-2000/month less than the current mortgage.

options:

keep paying $1500+/month more than comparable rent every month in the hope that the housing market will rebound.

Even if it does rebound, it will take time and every month my friend is down another $2000 or so!

or

try to short sell

or

try to rent it out (and lose $1500-2000/month)

or

foreclose and walk away.

he technically can make the payments but he and partner both have had to work a full time and a part time job to do it (with no vacations, etc).

if they foreclose they will get 6-24 months of free rent to build up their savings (that’ll add nearly $6k/month that they won’t pay out of pocket!) and then they don’t have to worry about the $200k loss on the home. their new rental place will for sure be cheaper for a nicer place. Sure, the credit card is dinged but for $200k or more it is worth it.

there were a lot of Alt A loans originated in the mid 2000’s, and in general the underwriting was as bad and sometimes worse than the subprime loans.

=====

on a side note:

this Corelogic chart not surprising at all.

This uptick in higher priced foreclosures/delinquencies has been completely 100% expected, in exactly this time line, based on the reset timetables that I’ve posted on socketsite ad nauseum (Ivy Zellman’s wonderful analysis from 2007)

as always, look at the chart from Page 47.

of note: this is a bubble website, but the actual data/report is from Credit Suisse (the international bank), hardly a doom and gloom fringe organization. I just googled the name of the report and this was the first website to have the actual report.

http://seattlebubble.com/blog/wp-content/uploads/2007/10/2007-03-credit-suisse-mortgage-liquidity-du-jour.pdf

If the owners have refinanced (which given historically low interest rates is just about everybody), then they cannot “walk away” with their other assets secure. “Nonrecourse” only applies for purchase money loans.

Though complicated, I believe someone here has posted links to an explanation of this before. editor?

To J’s and ex SF-er’s point, that strategy really is the ruthless one — living free for a year or more and sticking it to the lender. I’m sure that is quite common, but I wonder if it is the majority modus operandi? I really have no idea, but I’m betting that when most people in higher-end places decide to stop paying and cut their losses, they tend to move out sooner both because they can and just because it doesn’t feel as “wrong” that way. The timing does matter as it will impact whether we take a couple more years of declines before leveling off or several more beyond that as “walk-aways” continue to flow into the market.

AT:

I agree with you.

however in my friend’s case it makes sense to walk anyway because they are down so much ($200k, and more every day) AND paying so much in monthly housing costs.

they found nice (but not exactly comparable) rentals for $3000/month less. that’s $36,000 a year!

I think it is stressful to live in a delinquent home (calls etc) so I agree it may be easier to just move right away.

but I’ve heard of people living for free for YEARS in their home.

===

SanFranTim:

I agree that one has to be careful about recourse vs non-recourse.

on a practical point: in general the banks have not gone after owners even for recourse loans, as it is time consuming and expensive.

this may or may not change as the flood of delinquencies and foreclosures continues. nothing is assured these days.

Question on that strategy, ex SF-er:

Every time I’ve ever rented (including when we moved last fall), the owner has run a credit check. I’d expect someone with a huge foreclosure ding would have a tough time getting a decent rental.

I suppose one could use some of the accumulated extra savings from the “free rent” period to offer 12 months rent up-front (or something) and still come off quite a bit better in the end though.

I wouldn’t feel bad at all about staying after defaulting. The banks are getting tax payer funded bailouts after their own low standards led to the whole mess in the first place. Make them go through the formal process(and document a loss) if they want the property to be vacant.

sanfrantim:

Anyone who bought near the peak never had a chance to refi, since their equity(if they ever had any) has been dropping ever since. Still, at some point, it is worth walking away, even from a recourse loan.

Oh yeah, one of my friends did recently walk, and he had no problem finding a rental. There are so many landlords to chose from these days…

He just showed that he had good credit except for the home loan. Otherwise, yeah, I would just offer a year’s rent up front. Just make sure the new landlord won’t default though!

I bought a second, Sonoma vacation home in 2005, which now may be under water or close to it. At one point, a refi at attractive rates was possible, but I chose not to do so in order to preserve the walk away option.

I strongly think that customers, especially high-end customers, need to be educated about the risks that refinancing poses to the alleged “walk away” option.

It is very easy for banks to hire debt collection law firms on contingencty to go after highly liquid consumers. The cases are straightforward and easy.

Be forewarned: One should not count on banks walking away from these debts simply because collecting them is inconvenient or time-consuming. Rather, count on banks “sending a message” by pursuing these debts from high-value consumers, no matter what it takes.

Would you walk if you were UP $200k?

The logic doesn’t follow the money…

I strongly think that customers, especially high-end customers, need to be educated about the risks that refinancing poses to the alleged “walk away” option.

My MB chuckled in my face when I mentioned losing my non-recourse status during my refi in 2003. His comment was that it would only be a problem if prices went down dramatically and “when has that ever happened”. If I had a recording of that I would call him every day and play it to him.

sanfrantim, Practically speaking, you really only have to worry if you refied with a first and second as the first almost always goes the non-judicial route. Still waiting for someone to bring up a case where a lender has gone the judicial foreclosure route on a SFH; simply not worth their time. IANAL…

@Shza

You don’t have to worry about the credit check. If you have a good job and can show that you have the ability to pay the rent on time, any landlord would let that person in. I’d much rather have a person who strategically defaulted on his loan move into my place than someone with iffy credit and an iffy job. In addition, most likely people with million dollar homes won’t be moving into these large apartment complexes but rather another SFH. If that’s the case, I don’t think the credit check is as robotic as you would find in a large apt complex run by some uptight management complex

Anyone who bought near the peak never had a chance to refi, since their equity(if they ever had any) has been dropping ever since

be careful though, many people bought with “piggy back” loans. (so like an 80% loan and a 10-20% loan). If they did this it converts the non recourse loan to recourse.

Be forewarned: One should not count on banks walking away from these debts simply because collecting them is inconvenient or time-consuming. Rather, count on banks “sending a message” by pursuing these debts from high-value consumers, no matter what it takes.

I agree it is a gamble. however, to this point the banks have not been going after the defaulters.

I think of it like music/video pirating. Sure, the entertainment industry busts people here and there. but your INDIVIDUAL chances of being busted are very low and thus people pirate stuff all the time. that said, there was that woman who got sued and lost a multimillion dollar case in MN so it can happen…

I’ll start worrying about banks going after individuals when they start going after people like the infamous Casey Serin.

on a side note:

my friend has high income but NO savings. all of their assets go towards the mortgage.

thus, there really isn’t much for the banks to go after except future income.

like I said above: I counseled my friend to THINK about walking away, not to do it for sure. part of that thinking process is hiring a lawyer who is an expert in bankruptcy and real estate law (which I of course recommended)

“my friend has high income but NO savings. all of their assets go towards the mortgage.”

Boy, you must have the same circle of friends I do! I know an awful lot of people who make around $300k as a couple but bought and live in a $1.5M-$2m home “as an investment” — their only one (with taxes, big mortgage payments, and private school tuition, $300k does not go far). I do like going to their houses for dinner — and we get invited a lot, I think because I’m able to bring way better wine to their big homes than they bring when invited to my little one.

As for collectibility with no assets, keep in mind that a judgment is good for 20 years in California. And a judgment creditor can garnish wages. That said, even if a bank came after you and won a deficiency judgment, you just break even and have to pay it. So the worst you can do from walking away from an underwater place is tie.

These statistics are way overblown. Lots of homeowners are strategically defaulting in order to be eligible for mortgage modification programs. I know two such owners personally. Its a valid strategy and if the mod is permanent can be a real savings over time.

No one wants to have to live in a rental if they can help it. Especially with pets, those are a real complication.

Jimmy wrote:

I’m crying a river over here, listening to the world’s smallest violin playing.

Excuse me, but someone strategically defaulting on a “loan in excess of a million dollars” (the types of loan under discussion here) is someone that shouldn’t be contemplating, much less actually getting, a mortgage modification, IMHO.

From the administrative website for servicers of the Home Affordable Modification Program:

Of course there are other programs than HAMP out there, and perhaps some of the people referred to in the N.Y. Times article have paid down more than $271,000 already, but I hope the mortgage modification programs targeting million dollar mortgages are few and far between and funded solely by private, preferably foreign, investors.

“be careful though, many people bought with ‘piggy back’ loans. (so like an 80% loan and a 10-20% loan). If they did this it converts the non recourse loan to recourse.”

Where are you finding that? All the information I have found is that your 80% loan is still absolutely non-recourse. There is some question on the HELOC/2nd mortgage being non-recourse or not but nothing I have seen imply that absent a refi the 80% would be anything other then non-recourse.

Rillion:

please take my last recourse/non recourse comment with a grain of salt. the proverbial I am not a lawyer.

the conversation came up on another mortgage-related website years ago, with various legal types commenting. I could easily be mistaken.

“You don’t have to worry about the credit check. If you have a good job and can show that you have the ability to pay the rent on time, any landlord would let that person in. ”

I wouldn’t rent to someone who foreclosed, especially if it looked to me like they did it strategically. What’s to stop them, here in SF, from just stopping paying rent? It would take me months and many thousands to evict them… More free rent for them.

This article really misses the whole point with their headline. Leveraged debt is NOT wealth! People who have lots of debt are actually poor.

If you “own” a million dollar home but your mortgage on it is $500,000 you are quite a poor person.

Agree with R. I have many family members who are SF landlords. I would never rent to someone who strategically defaulted on their mortgage. It just brings up a big red flag that this tenant could be a trouble maker. And in this town, having a difficult tenant could cost you thousands in legal fees.

If you “own” a million dollar home but your mortgage on it is $500,000 you are quite a poor person

No you’re not actually.

“If you “own” a million dollar home but your mortgage on it is $500,000 you are quite a poor person.”

sooo, half a million in equity only reaches the ‘quite poor’ level in your world?

and the mortgage interest deduction giveaway is to be avoided in favor of buying your principal residence without the use of debt?

Yeah, this is how the grinding process of slowly bringing down home prices works, a few defaults at a time. A usual housing cycle in California is 5-7 years from peak to trough, there is no reason to think this will one will go any quicker. It will probably take a bit longer this time because of the fact that housing led the economy into the recession, we have more of an overhang of excess capacity to work through.

and the mortgage interest deduction giveaway is to be avoided in favor of buying your principal residence without the use of debt?

Do you know how ridiculous that sounds?

Putting aside 16.5K in your 401(k) to defer 5K/Y in taxes is rather sound practice.

Spending 6K/month in interest for the sake of getting 2K back from the Guv’t is NOT sound practice at all. You are still giving away 4K/month to the bank. Sucker!

lol,

but you’ve got to live somewhere and thus will be paying something (sucker!). as for that amount going to an ira or 401k, i agree that sticking money into tax deferred accounts is sound practice-but then you have to figure out what to invest that $ into. i believe you are able to loan it to yourself to purchase some form of real estate which could close the circle nicely…

Borrowing from a 401k for a house(or pretty much anything) is stupid. You have to pay it all back as soon as you change jobs. And you never know when that will be, or what condition the housing market will be in.

As far as “you have to live somewhere”, yeah, and in SF, you can usually rent for less than you pay in interest to buy(aka rent money), even after taxes and including property tax+HOA+maintenance.

j,

that is likely true depending on your choice of where to live. and it is true that one should not buy full retail if you only plan to live there for a short time. clearly this is not universally recognized as evidenced by so many of the posts on this site, which tend to highlight people’s unwise choices.

in general, i would say if one were to pick a cookie cutter luxury condo it is better to rent than to buy unless you can find a distressed sale and plan to hold the condo for a longer period.

even then, it had better have a good view and be in a convenient rental location.

i forget that real estate 101 is not a course taken by all.

Well, in the good ole days, you’d purchase what you could afford. And debt would be a temporary situation, not a permanent staple like our lives today.

Sure you could say this is not a realistic way of thinking, but one of the biggest and most resilient economies of the world manages to live that way: Germany.

The main reason Germany had no big property bubble is because Germans are big believers in spending only what they have. Traditional germans will always have a good amount of cash on them. It’s a very capitalist society where “capital” is taken on the first degree, whereas our society confuses debt with capital.

Overleverage is shameful practice in Germany. But the PIGGS did that overleveraging for them thanks to the Euro.

Now, that our culture embraces debt so deeply tells more about our brainwashing than our financial smarts.

Like people buying up a property for the 8K credit, only to see a similar property slashed by 20K the day the credit expires!

“clearly this is not universally recognized as evidenced by so many of the posts on this site, which tend to highlight people’s unwise choices.”

From the mid-70s through the mid-00s, it actually was a pretty wise choice to buy SF property to live in, even if that meant paying above comparable rent (although, as I’ve oft-noted, it is a double ’00s phenomenon that buying was more expensive than renting). This is because of the anticipated appreciation, which was reliably realized. The problem that people ran into was failing to recognize the tide turning around 2006. Now one not only lacks a reasonable anticipation of appreciation, but the far stronger likelihood is prolonged depreciation. The developing zeitgeist that RE appreciation is uncertain or unlikely, and thus that there is no point to paying more than comparable rent for a place, will be a driving factor in bringing prices back to earth — takes years, but it is clearly in process now. As I’ve also said before, in a few years we will be shaking our head in disbelief at the absurdity of 2007 (and 2010) prices.

“But the PIGGS did that overleveraging for them thanks to the Euro.”

don’t you mean PIIGS?

Yes, PIIGS. Wrong acronym, same crazy indebted people though.