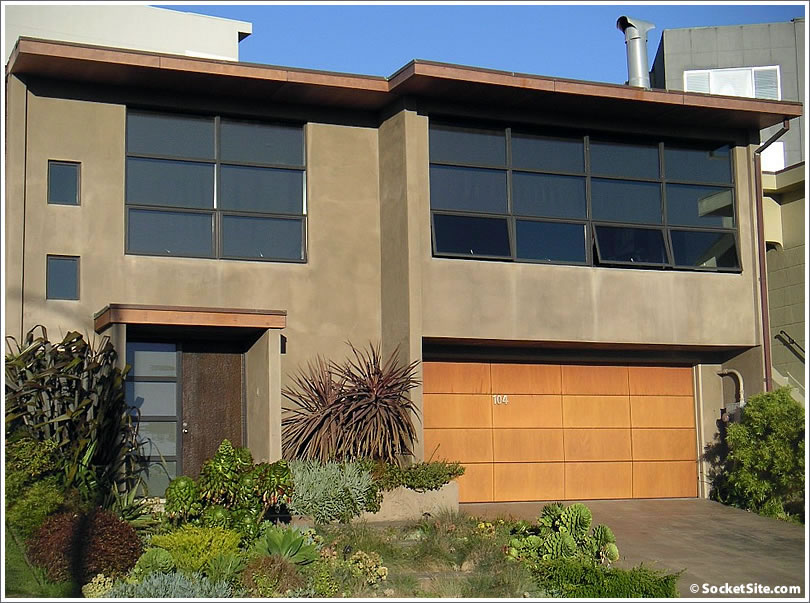

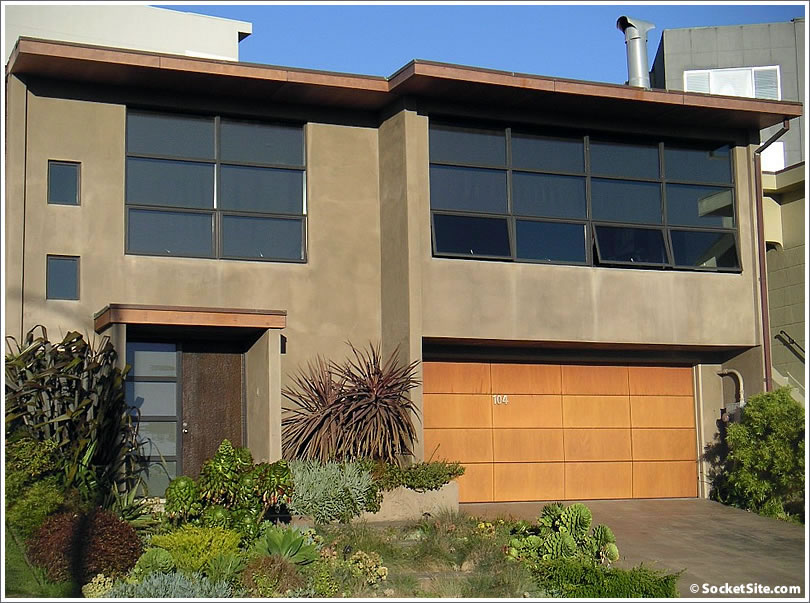

Added to our Curb Appeal archives in 2005, and answering questions about the architect (Brad Polvorosa) and landscape designer (Peter Kline) in 2006, the Laurel Heights home wasn’t on the market at the time. But now 104 Collins is and you get to peek inside.

∙ Listing: 104 Collins (3/3) – $1,795,000 [MLS]

∙ Curb Appeal: 104 Collins [SocketSite]

∙ 104 Collins: The Architect And Landscape Designer [SocketSite]

Those front windows look just like the grade school I attended. [shudder]

Nice home, some odd layouts inside and generally looks small, but I’d say it’s priced to move. I’d like to know where the pic of the GG Bridge was taken? I wouldn’t have thought a view possible from there w/o a serious tripod!

Also, nice blast from the past. This was a good reference back to the ~12th post on the current platform. Just a quick congrats and thanks to the Editor for feeding our SF RE appitite.

Good luck to the sellers here. They should be fine. This is a good, well located SFH at sub $2M levels. Not PH or D7 but this is a nice area and very good for families. Somewhat ironically listed by the same agent as our favorite condo in PH 2041 Sacramento. 🙂

The view is from the hot tub, the roof you see in the foreground is the property.

This property is about 1500 – 1600 square feet, and therefore peak pricing for this less tony part of Collins street. I think it will probably get near asking. Doom and gloomers take note. That’s 470K over its 2003 sale.

That part of Collins really isn’t that awesome. I kind of like the house, though. The windows remind me of Laurel Hill Nursery school.

Anonn, what did it look like before the 2006 remodel? I don’t think anyone would pay this asking price for a rundown house on this block.

Err, I have reading comprehension problems this morning. Was the remodel after 2003?

This remodel was done back in 2003. The way the editor posted it is confusing. 2006 is not a relevant date.

The remodel was 00′.

Wow. I remember some of my friends working on this one. Time flies. OK, well then it was not a spec sale in 2003. This is in fact the second time it’s been on the market since the remodel.

I like the outside space better than the interior…but baby its cold there from June until October with summer fog and wind. I think I’d rather buy a seacliff home (on the avenue portion) for a tad more money and space.

The remodel was done in 2000-2001, the permit records show it completed in 6/2001, work done by Nova Designs Builds.

It was not a spec project, though it is the second time it hits the market.

Purchased with a $900k variable first mortgage from Chase (7/1?) and a small ($20k second). The owner appears to be a banker, and, I’m sure, would be fine with any profit (especially if it’s near the $500k tax-free limit!) after renting the home from the bank with low monthly payments. Will be interesting to watch if it doesn’t sell immediately as they have plenty of room to negotiate on price.

590 Spruce is also for sale in the same hood and appears to be better lay out than 104 Collins. It will be interesting if this sells quickly as 590 Spruce has been on the market for a while.

104 Collins is not in a great location. You’ve got a lot of wind since you’re at the top of the hill. Also, since you’re right across the street from the playground, you’re going to see a lot of private school mommies dropping their kids off for soccer or baseball/t-ball practice. i.e. traffic and lack of parking after 3:00p.m.

Satchelfan~

Don’t public school children play sports as well?

Taking a step back, does $1.8M for a modestly sized 3BR in a good, but not great part of San Francisco sound a little strange to anyone other than me?

590 Spruce is a nice home, but that’s a huge cut through street and very busy. It’s looks great online but it doesn’t show very well and it suffers from some finish quality / floorplan issues. I see a price cut coming soon from 590. 104 on the other hand, has a view, great curb appeal and the interior looks to be in OK shape. No idea on floorplan or layout. I suspect both homes could see a 10% adjustment from current levels, but they could both also sell at current price. I’d say 104 is appropriately discounted from 590. If 590 cuts, than 104 should as well. IMO.

Taking a step back, does $1.8M for a modestly sized 3BR in a good, but not great part of San Francisco sound a little strange to anyone other than me?

Sure, to a lot of people who used to post on this website with a great deal of self righteousness. Stridently talking about the certainty of 20%+ price hits and the like. They don’t seem to post very often these days.

Well, those people may yet come back when things change, but that’s not really the conversation I want to have.

I guess my question is – are there really enough rich people in the SF area to justify this kind of price? To me, $1.8M is a rich person’s price, and this doesn’t seem like a rich person’s house.

I know this number may seem antiquated around here, but using the old “you can afford 3 times your income” rule, a price tag like this on a house like this seems inappropriate.

Perhaps there is more money in the bay area than I realize?

Iceweasel — there is more money in the bay area than you realize.

iceweasel, this is the question I have been asking myself since 2002. If I had a 1.8M budget, this house, which is really in a kind of blah area, wouldn’t make my list. Either I’d want something in a better area or I’d want something in the avenues that that was nicer. But that’s just me.

I think we bat the idea of an intrinsic value to these houses around quite a bit here but I’ve never seen a concensus. It’s like houses are just another beanie baby or collectible trading card to some folks. “The value is whatever people are willing to pay.”

Personally I’m still going off that old fashioned 3X your salary rule as well and have to wonder why if this is your income bracket, you’d choose this place.

iceweasel, I’m with you. There have not been a whole lot of places selling in this price range, but what there is is heavily concentrated in D5 and D7. And there have been tons of withdrawns. This neighborhood is okay, but this price seems way out of line for an okay neighborhood, particularly so for such a modest home. I must admit that other than a run to the Trader Joe’s around the corner once in a while, I don’t come to this area much so don’t know it too well. This area has not seen many SFR sales, so the data are spotty, but it looks like about a 25% decline from the peak would be fair:

http://www.rereport.com/sf/index.html [click on “Northwest”]

This place has an awful lot of competition from bigger homes in better neighborhoods, and not many buyers out there at this price slice anywhere. Maybe there is some substantial draw to this architectural style that will attract a buyer, but my bet is it goes for closer to the 2003 price than the current asking.

iceweasel asks a fair question. And it’s a question many on here ponder regularly. The answer is this is a rich persons city when it comes to “ownership”. The rental % is very high and there are limited homes for sale at any given point of time. This creates a lot of demand. Compared to NYC, SF is still a relative bargain, but that comparison opens a whole can of worms.

I was looking at a great apple comparison recently that showed from 89 to 99 a SFH in LPH that sold for 699k and 899k respectively. The same house, relatively unchanged from the 99 sale sold in 09 for $1.8M. At this point, I’d say that there is zero chance this home is worth $3.6M in 2019. I think the last decade resulted in some heavily overvalued real-estate here in SF that is not really supported by income, rent ratios, or any other metric other than recent sales comps. Comps are a good metric for recent prices, but has nothing to do with intrinsic value. We’re seeing the rest of the country correct to longer term averages and giving back a lot of the gains. SF is holding pretty well, but we’ve seen 20% drops here and there; and certainly 10-15% drops in prime SF. Maybe that’s why people are making those statements anymore. There’s been a correction.

Are we done correcting? I’d say probably not, but the worst is probably behind us, for now. Maybe we lose 1-2% a year for 10 years. If we lose 15% in the next decade, it would put the LPH house at around $1.5M. The same house appreciating at the decade return between 89 and 99 would be valued at right around that same number ($1.48M).

I say trust your instincts and know your financial limits. If you can’t afford to lose 1-2% a year on your leveraged investment than you probably shouldn’t be buying a home.

590 Spruce was purchased in 2006 for $1.6 and pretty heavily remodeled for what I’d say is around 100 to 150k. He’ll be lucky to sell at $1.9 and more realistically is looking at $1.7. That’s not a terrible outcome considering the last 12 months has taken the wind out of this market. I’m very interested on where both these homes sell at actually. Should be telling.

Well, those people may yet come back when things change, but that’s not really the conversation I want to have.

I guess my question is – are there really enough rich people in the SF area to justify this kind of price? To me, $1.8M is a rich person’s price, and this doesn’t seem like a rich person’s house.

I’ve routinely made the case that there is more cash around than most people realize. Someone the other day pointed out that over the course of the last decade, thousands of new millionaires were minted around this area. The same crowd I mentioned in the first post refused to acknowledge that as well. Yet here we are.

I do agree that ~$1.8M for B-grade area 1-C is very high. I feel that’s especially so considering the square footage here, we’re talking about nearly $1200 a foot.

Throughout all of this, the very good SFR has proven to be the wildcard. It can and will still generate near peak type sales. This has proven to be the case almost citywide IMO, with the exception of the astronomically high true luxury estate at the very top of the metric. Often people on this website, and this in fact the editor’s express opinion, want to link condos directly to SFRs. I never bought into that. There was a tremendous amount of condo development in San Francisco from the late ’90s until late in the first aught decade. But the SFR remained the prize of the SF marketplace. Small wonder. Look around at the city sometime.

Adjusting for inflation this would be about $1.25 million in 1995. Back then that amount of money would buy a lot of house–much more than this. Gentrification getting ahead of inflation can happen, but this listing reeks of speculative frenzy. Sure this might sell and some high priced houses do sell, but the market as a whole is dictated mostly by incomes and inflation and has continued to fall.

I agree with annon with the exception that I don’t really buy the flurry of millionaires running around buying up SFRs with reckless abandon. I think rentals, condos and SFRs move in some coordinated lockstep up to certain points. Rentals peaked out and stopped correlating to ownership a wile ago. Condos and SFRs got pushed up due to creative financing AND competition from wealthy buyers. The creativity has been taken out for the most part; and this has created less competition for prime properties; and prices have responded. Condos are taking the biggest hits, and SFRs are still selling below peak. UberPrime properties are still commanding near peak prices, curiously.

What is the meaning of “spec project”?

“What is the meaning of “spec project”?”

Built or developed without a specific buyer in place. A spec(ulative) project.

Bonbon wrote:

> Satchelfan~ Don’t public school children

> play sports as well?

Public school kids play sports, but very few have “soccer moms” that drive them to practice.

Most mini van/SUV driving “soccer moms” are white and it has been at least 10 years since even 10% of public school kids in SF were white.

P.S. I have a cousin (who I visit often) that lives near this home (on Jordan) and while the area has more fog and wind than Noe Valley you can’t even compare it to Seacliff. It is amazing how many days the fog just stops at Presidio with light wisps of fog in Jordan Park/Laurel Heights, medium fog west of Park Presidio and thick fog in Seacliff…

really buy the flurry of millionaires running around buying up SFRs with reckless abandon

Not any more they’re not. But if they’re buying at all, they’re buying SFRs.

Except for those condos in South Park. Those 2 are exceptions.

I’m floating in the Gulf of Mexico looking at this photo- and recognize what’s probably my favorite garden in San Francisco.

While I was doing garden construction in SF, I would drive by it just for inspiration. Check out the plant combination: it’s varied, colorful, and very modern. And tough- it’s held up!

Agreed, I am a big Peter Kline fan. I have him do all my projects.

The list price for 104 Collins has been reduced $50,000 (3%) to $1,745,000.

Reduced another $50,000.

590 Spruce has also reduced their asking price – now at $1.894M.

As noted above, the list price for 104 Collins has been reduced another $50,000, now asking $1,695,000 (6% under original asking).

“I think it will probably get near asking. Doom and gloomers take note. That’s 470K over its 2003 sale.”

370K and closing.

Yeah, 6% down from list. You left out the other post where I said, “I do agree that ~$1.8M for B-grade area 1-C is very high. I feel that’s especially so considering the square footage here, we’re talking about nearly $1200 a foot” ? At this point it’s validating the 5 – 10 % off for SFRs comment of mine. So thanks, Michael.

$370K less $170K in remodeling costs (inside and out), $100K in selling costs, they walk away with $100K max over their 2003 price if it sells at asking.

6 year hold during the greatest run up of all time and that’s it?

It’s an apple from 2003. Bad posting day for you already @ 9:30 a.m.

And a note about this property. They stopped marketing the lower, windowless bedroom as a bedroom. It’s now shown as a 2/3.

The MLS listing for 104 Collins has been withdrawn from the MLS after 64 days on the market without a sale.

“I think it will probably get near asking. Doom and gloomers take note. That’s 470K over its 2003 sale.”

See also

http://www.redfin.com/CA/San-Francisco/2552-Hyde-St-94109/home/939985

[Editor’s Note: A Rather “Junior” Russian Hill Resale For 2552 Hyde.]

Wow, huge drop on 2552 Hyde. Did it move to 2552 Jekyll between 2007 and 2009?

“I think it will probably get near asking. Doom and gloomers take note. That’s 470K over its 2003 sale.”

Two things. One, this isn’t a wrap. Two, I should have known better. I forgot that that lower room was windowless. You think changing the bedroom stats from 3 to 2 took it off anybody’s parameter searches?

You think changing the bedroom stats from 3 to 2 took it off anybody’s parameter searches?

I can’t tell if you are serious or not, but it certainly would have dropped off my radar. Sort of unusual that they would change the marketing after it was listed on the MLS as 3bd for so long. I wonder is someone made a complaint.

590 Spruce finally did sell @ $1.815 ($715/psf) Not a particularly good comp for 104 Collins. This would put 104C at $1.35M. Too low, as this home should sell for more than that amount, but still not a good comp.

Sold Price: $1,550,000 $815/psf

“6 year hold during the greatest run up of all time and that’s it?”

um, that’s two years into the greatest correction of all time (or in ss bear language “collapse”).

so where are your 40-50% haircuts? you keep talking it down and you continue to be wrong.

Not bad, 17% nominal increase in 6-7 years. Less than inflation. Less than a 2003 CD. Lucky they bought before the bubble really got going and sold well before it was done popping.

lucky this thing provided shelter during that time as well. how’s that return look after subtracting that little detail (the shelter part) out?

“how’s that return look after subtracting that little detail (the shelter part) out?”

If you factor that in, they lost a bit, maybe broke even. What they spent living in this place vs. the rent they would have paid (you can rent shelter too) puts them in a hole.

got it; put your money into a 7 year cd and rent a place and you’ll come out ahead of these folks.

that’s your advice then? or that’s your 20/20 hindsight advice? and going forward what would you propose?

“and going forward what would you propose?”

If you’re considering buying a place in SF — wait 2-3 years. It’s 100% certain that prices aren’t going up, and they are likely to fall at least another 20% or more beyond what they’ve fallen already. And it is still far cheaper to rent a place rather than buy a comparable place, so you only come out ahead by holding off.

“still far cheaper to rent a place rather than buy a comparable place”. not sure about that at all.

that may be the case if you are talking about a newly built place. and that means you do not have the protections afforded by rent control/eviction wise. but it is very unlikely if you are talking about a sweet old vic or edwardian. i know that to be the case after spending so many years fixing up places and scouting out places. those for rent are never as nice as those for sale.

as to your comment “It’s 100% certain that prices aren’t going up” well, i beg to differ. now could be an excellent time to find a fixer in a depressed market. now could be an excellent time to negotiate a great price on a multifamily building seeing as the lembi portfolio is flooding the market and financing is tight. and now could be an excellent time to get creative finance wise seeing as the fed is punishing prudent savers and cap/grms are more attractive than they have been in many years. seems to me you are a bit behind the curve idea wise. (does this post count as adding value, editor? or must it be all bear, all shadenfreude, all the time?)

“…now could be an excellent time to find a fixer in a depressed market.”

I see that prices on fixers in good neighborhoods have gone down a little bit. But they still seem to carry some of the “flip premium” into their sales prices. I don’t know whether basic 30-100K moderately superficial renewal investments are still paying off, but the sales prices still seem to have that effect baked in.

It is annoying that you have to pay for the stainless and granite treatment whether or not you want it, even in a fixer. It might take another year or so for the perception that all flips are highly profitable to work its way through the market.

Like I said in another thread, I wrote an offer for a client on a fixer last week. Thirty three friggin offers. This market is so annoying. It’s not good for anyone other than people who have had houses in their family for decades.

Anonn,

Did you see 1057 Valencia? That one sold for $700k, which seems like a reasonable deal for a fixer in that location.

Anonee,

Not so sure about the renting v buying assertion. There’s a lot of great rental stock out there. I looked at a place yesterday to rent. Condo, 2000 sf, built in 1920s, right next to Lafayette Park. 3/2 plus a small office. Fully Viking’d kitchen, great baths, properly renovated with all fireplaces/built in cabinets/moldings intact and in great nick. Deeded parking. I can rent it for $4200/month, maybe less. I seriously doubt I could buy it for less than $1.4M. I see this all over the north side of town. Renting is still much cheaper than buying in the high-end nabes.

I saw it. Clients viewed it. I dunno. It needed a lot and it was right next to Aquarius. Not so sure about the resale value when it’s 700 + 450 and it’s MAYBE 1.3M as an exit strategy? That’s necessarily a pass.( And I’m sorry, but 1.3M on Valencia as a given actually is a LOL sparky. More of a SHIB. Shakes head in bewilderment.)

Apparently Susan Ring’s Cumberland place got into contract. ~3.3M or so. Mish. Yeah, good, big SFR properties are really taking it on the chin right now. Not.