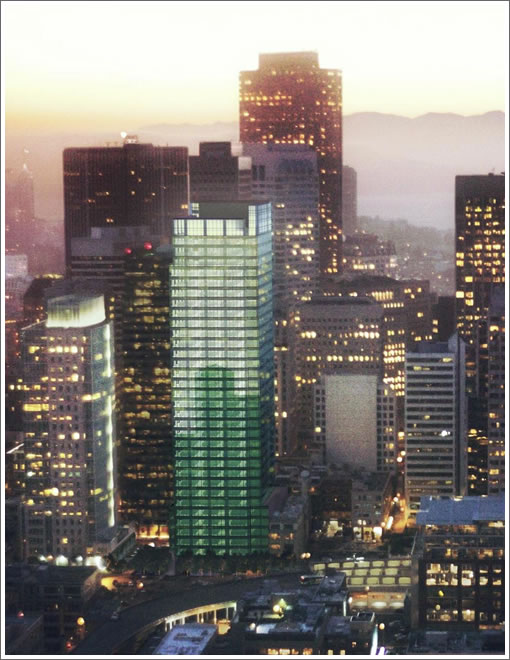

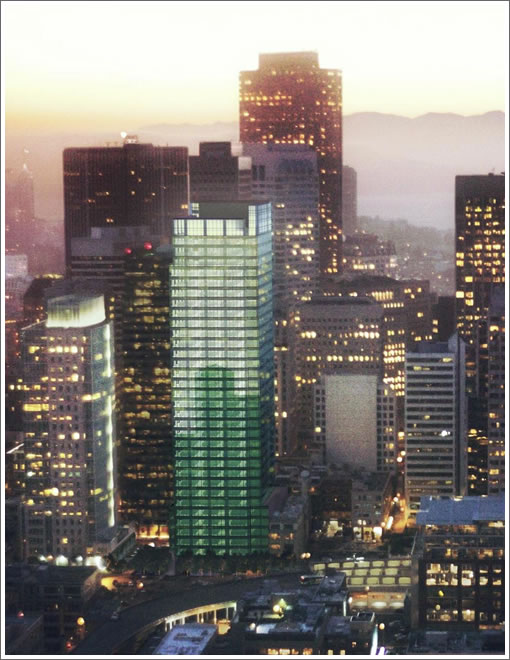

Last year Sequoia Capital secured the 14,718 square foot penthouse atop 555 Mission for seven years at a rate of $84 per square foot. According to the San Francisco Business Times, the law firm of Novak Druce Quigg has now subleased the entire space for the remainder of the lease at a 40 percent discount ($50 per square foot) without escalation.

And Included for free, “all of the super high-end and virtually unused furniture.”

∙ A Jonathan Borofsky Rises At 555 Mission (And 535 Is On Its Way) [SocketSite]

Now you know why your lawyer’s overhead is so high. Nice deal for them, but they have to do a lot of billing to cover the rental methinks.

$4 per square foot per month? Not really that outrageous a price to pay for Class A space (furnished, apparently).

Do the math on your average 2BR apartment rental in Pac Heights. Its not far off $4 psf/month.

This is a VC and is also an indication of the dearth of new business formation that can be expected in the area for the next 6 years. Some will be supported from Sand Hill Road, but there won’t be much, so a major VC expansion is killed outright.

How will that effect SF housing values.

VC is in for a bruising anyway, as their 10-year returns are about to go negative. Given the risk profile of venture capital and long redemption times for their funds (5-7 years minimum), combined with negative returns (once you exclude 1999, they are at about -6% over the past 10 years), the entire asset class looks much less attractive to investors.

Sequoia, however, will be fine. They are as blue-chip as blue chip can be. Just like Lehman Bros.

The city of San Francisco can’t really support the kind of industrial businesses (e.g. green tech, biotech, etc.) that VCs are investing in now anyway. Not surprised the pulled the plug on this foray north of Sand Hill Rd.

I have no idea if a VC retrenchment will impact housing prices. Perhaps at the high end, likely not at all in the middle and lower tiers.

Someone I know at a biotech VC firm described the current situation as this. Large stakeholders (pensions funds, etc.) allocate a certain percentage of their holdings to VC funds. When the stock market crashed, the value of their total portfolio declined and they became “overweight” in VC funds. Therefore, no new investments in VC funds for the foreseeable future.

Complaining that an internal presentation by Sequoia about tough economic times to come — headlined “R.I.P. Good Times” was leaked to the press, sending a shock wave through Silicon Valley’s entrepreneurial set, Valentine said, “We thought it was all in the family.

All in the family? If Sequoia is a family, it is surely the Borgias.

Very few VCs make Sequoia money. I doubt that VCs would have a material impact on real estate, even at the high-end.

Sequoia Capital intended to use this space for creating a new public securities investment fund, not for making SF-based VC investments. The fate of Sequoia and this office has nothing to do with VC, start-ups in SF or Sequoia’s venture capital business.