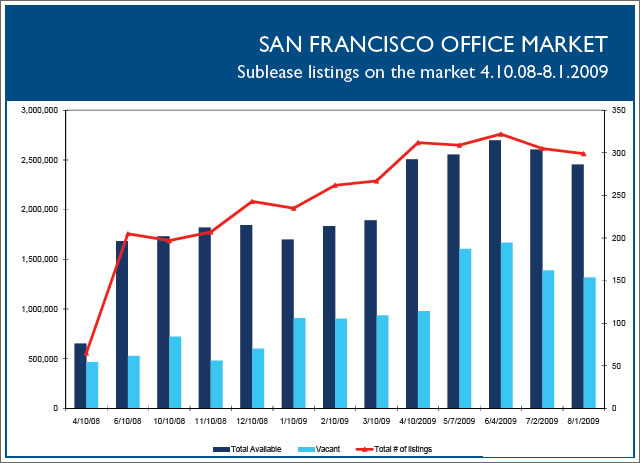

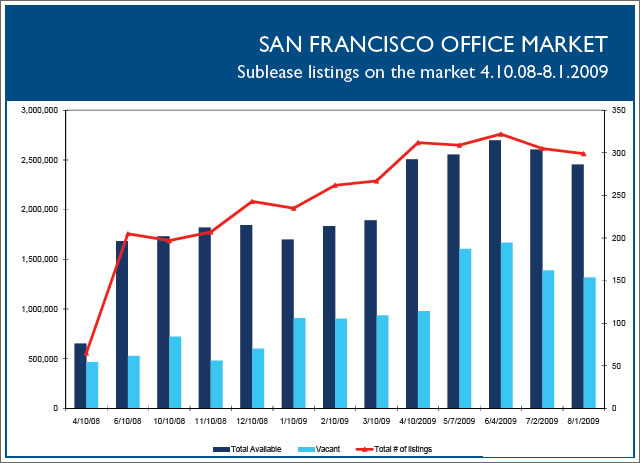

According to Colliers International, 2,454,475 square feet of commercial sublease space is currently on the market in San Francisco (54% of which is currently vacant), down a net 148,911 square feet over the past 30 days driven by withdrawn listings rather than newly signed subleases of which there was only one in July (for a total of 4,460 square feet).

Very roughly that 1.3 million square feet of vacant office space translates to 4400 jobs, or about 2200 people locally unemployed in San Francisco if you assume 50% are filled by people living outside the City. A large number to be sure, but not as dramatic as one might assume.

I don’t get it – why would anyone ever withdraw a commercial listing? I understand all the monkey-biz that goes on in the residential space, but a non-producing commercial property is not something someone decides to continue to live in until the market improves.

Very roughly that 1.3 million square feet of vacant office space translates to 4400 jobs, or about 2200 people locally unemployed in San Francisco if you assume 50% are filled by people living outside the City

Oh, the logic! What about those living in the city but working outside it — seems you need to account for external vacant space, too.

Moreover, CRE is vacant only when the whole office shuts down. You can lay people off without closing the entire office. That’s why CRE lags recessions and recoveries.

Besides, why not just go with the actual unemployment data?