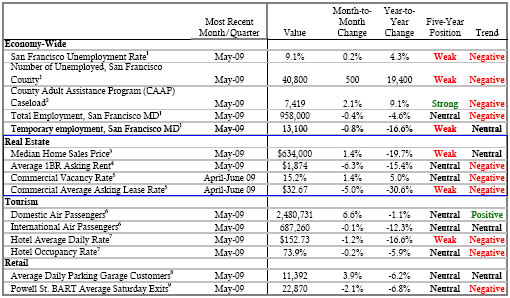

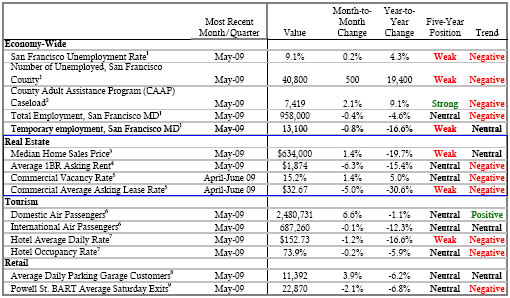

According to San Francisco’s latest Economic Barometer, the average asking rent for one-bedrooms in the city fell 6.3% from April to May and is down 15.4% year-over-year while the commercial average asking lease rate has fallen 30.6% year-over-year.

The City’s five-year position for Median Home Sales Price (currently “neutral”) and Commercial Average Asking Lease Rate (currently “negative”): “weak” on rising unemployment.

∙ San Francisco Monthly Economic Barometer – May 2009 [SFGov]

∙ San Francisco County Unemployment Up To 9.1 Percent In May ’09 [SocketSite]

It would be interesting to know these figures for other West Coast cities – Seattle, Portland, LA San Diego, Denver.

Another great employment trend – Cisco cut a massive 700 workers today in San Jose alone. Of course, they are doing a massive $50m+ expansion in Bangalore at the same time.

Folks, the long term trend here is an increase in Indian/Chinese investment and wages coupled with a decrease in US wages/investment. This is why I am very bearish on Bay Area real estate, particularly the upper half as the technology market continues to mature, commoditize, and move offshore to compete on price there will be fewer and fewer jobs here. My long run forecast (could be 5 years to get there) on the high end is a $600-800k price band versus $1.2m+ today.

Denver is on the west coast ? I need to brush up on geography then !

This analysis is pretty interesting, taking into account residential, commercial, hotel, and retail using some indirect metrics. I like the way that Powell BaRT Saturday exits are used as an indicator of retail traffic.

SFBanker – I agree.

IMO the US is going to see a decrease in the standard of living over the next decade. That will of course impact real estate prices generally everyhere.

The exception being perhaps if you live in Pac Heights or other very specific locales. The wealthy international disapora who maintain multiple homes will keep those prices up.

However, areas like the Sunset – which frankly, like many “middle class” SF neighborhoods, is unattractive – will see less demand as the workforce shrinks and the wages of those remaining fall.

The Silicon Valley is not immune either.

I think too the other problem for the bay Area generally is that it will be surpassed as a US hub metropolitan area by Dallas, Houston, Atlanta and even Seattle/Redmond.

Interesting. I wonder how they get the rental and home price trends? Is it based on repeat sales or something else?

I’m surprised that the YoY median home price was marked ‘neutral.’ A 19.7% drop is neutral?

Banker, Douglas,

Wow, let’s just all move out of SF to… HOUSTON? Oh what the humidity and pollution there aren’t your cup of tea? Dallas sounds like s better option. It’s perfect for spending summers at the beach and winters skiing.

WTF guys…the whole country is losing jobs and suddenly we’re pinning The Bay Area as the next Flint, MI?

I work for a major tech company about to go through M&A activity and the trend of “offshoring” has been a practice quite some time (well into the mid-90s). Globalization has enabled a cheap offshore diversification of labor strategy that is here to stay. But if you think that the wages overseas will rise because there is an abundance of highly trained talent that can replace onshore innovation, you’re wrong about that. Innovation does matter, and that’s what we have a lot of right here at home.

Also, what you aren’t accounting for is the ability for us to parlay the area’s skilled workforce into new growth industries – clean energy, biotech.

But for now, you don’t have to look far to see that the local tech horse has a lot more leg in her. Just look at Intel’s earnings announcement yesterday to see huge profits coming out of one of the fastest commoditizing markets (semiconductors).

With that said I can definitely agree that the standard of living will decrease, but mostly because of necessary credit regulations — really do middle class families all really need Sub Zeros and Escalades?

There was an interesting article about California versus Texas in a recent issue of The Economist. I’m not a huge fan of the magazine, but it’s interesting what the establishment financial media is thinking:

http://www.economist.com/opinion/displaystory.cfm?story_id=13990207

I heard on the radio today that the betting is that CA loses a Congressional seat and Texas picks one (possibly two) up after the 2010 Census.

Or, as Richard Florida would have it, the Bay Area is a Talentopolis that generates higher growth rates than other areas. Jobs being shipped out is a symptom of local job creation more than a risk to it. Other places like Dallas make important contributions, but are not really in the same league.

The Pacific Heights crowd is running on fumes right now. All of our “rich” clients are out of money. We cut the last one off today. A very famous person that everyone would know. Hasn’t paid us in months. The guy has such a lavish lifestyle, that when the income drops, he’s out of money in a heartbeat. Think Ed McMahon, or Michael Jackson. Broke.

To be sure, there are rich people who can afford anything in PH, but the people who move there to pretend to be rich are done. And there are lots of those.

And biotech? Where have you been? No funding. those guys are on fumes too. Cean energy can’t get funding: those guys are down to a skeleton crew. Every major one has had layoffs galore.

I just don’t know where this “info” comes from. Biotech and clean energy! Two of the industries in absolutely terrible shape right now.

Jobs being shipped out is a symptom of local job creation more than a risk to it.

I would agree with this statement IF

-local unemployment was low or falling

and

-local wages were rising.

the statement “is a symptom of local job creation” doesn’t make sense in a time of falling wages and rising unemployment. (which indicate local job destruction)

California has some major structural problems that it needs to address. Sky high COL, sky high business expenses, and bankrupt state just to name a few. The most recent CIA factbook placed CA as now the world’s 10th biggest economy (remember when it was 7th?)

One thing is certain: as internet tech companies continue to mature there will be continued pressure on local salaries since mature companies don’t pay as much as new technology companies. (think of Google’s salaries from 2003 and compare to today as example, or compare Microsoft’s salaries to the next big startup). In order to get salaries rising again, CA and SF must find a way to reinvent itself.

I think that clean energy and biotech are definitely areas to explore, but everybody is exploring these areas. Unfortunately, CA is so high cost that it makes it uncompetitive.

in the end it all comes back to costs IMO.

Luckily, as RE values fall it makes CA more competitive, which will help to hold some of the industries in CA. CA is by no means doomed, but it has significant hurdles.

Of course SF has amazing knowledge workers. But as I wrote before SF is far from the only place like this. There are a good 10-20 cities that have excellent highly trained workers. SF may not have to compete with Akron Ohio, but it sure does have to compete with those 10-20 cities, many of which are cheaper by multiples.

We are in a recession, so it is not surprising that unemployment is rising. It is lower in SF than California in general or even the nation.

Here is a graph of CA vs. TX population:

http://www.google.com/publicdata?ds=uspopulation#met=population&idim=state:06000:48000

The LA Times reports that CA is not likely to lose a Congressional seat and in fact will gain one if the States population estimate is correct.

Texas is likely to pick up as many as four.

We shall see.

Mature companies in general pay more than start-ups, btw. Wages are much higher at Microsoft than at a start-up and salaries are higher at Google than start-ups. At a start-up, you get some options that make up for some of it, but most options expire worthless.

Mature companies in general pay more than start-ups, btw. Wages are much higher at Microsoft than at a start-up and salaries are higher at Google than start-ups. At a start-up, you get some options that make up for some of it, but most options expire worthless.

I see that I miscommunicated leading to misunderstanding. I should have worded thusly:

total compensation is much higher in successful startups than in mature companies.

salaries may be quite lower in startups, but a big engine that powered SF real estate was the amazing bonuses and stock options that people garnered through the dot com and then credit bubble economy. there were so many successful startups (or at least startups that lead to option/bonus riches) that there was a never ending stream of money into the SF market.

I’ve already said this but I have first degree relatives in GOOG. I watched as they made big bucks in Microsoft, then as MSFT matured made much less (salary was still low 6 figures) so jumped to Google. As GOOG matured and the options dried up jumped to Facebook.

The mature companies don’t pay all that well comparative to SF’s COL. Most of the Google programmers as example make maybe $100-150k/year. Project managers a little more than that. Not much when homes cost $1.2-2.0 M in desirable areas.

SF needs an ever continual stream of successful startups in order to maintain the status quo IMO.

It’s not enough if the big boys just sit and mature. mature companies end up having to trim expenses. (employee reduction, reduction in salaries and/or bonuses, etc). that’s what Google is doing right now. it’s stealth since they’re doing it by laying off up to 10,000 “contractors” as opposed to employees if reports are to be believed. those are still 10,000 less people working and getting an income.

EDD released the latest CA unemployment figures for June. State’s rate (11.6%) stayed about flat, but SF’s rate ticked up quite a bit — from 9.1% in May to 9.8% in June with the number of SF unemployed increasing from 40,800 to 44,100. Not good news, and from everything I’ve been reading from the pundits, this trend is unlikely to reverse itself for quite a while, but hopefully the rate of increase will at least slow.

http://www.edd.ca.gov/About_EDD/pdf/urate200907.pdf

[Editor’s Note: San Francisco County Unemployment Jumps To 9.8 Percent In June.]