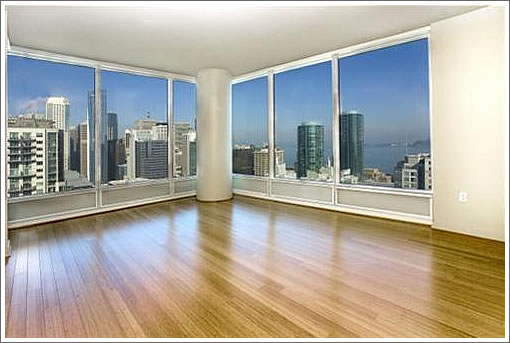

A recap for the resale of One Rincon Hill (425 1st Street) #2307:

Originally seeking $849,000 as a resale, the listing for One Rincon Hill #2307 was reduced down to $749,998 and then withdrawn from the MLS after 200+ days.

Returning to the MLS [73] days ago asking $699,000, the list price for the northeast corner and 819 square foot 425 1st Street #2307 was [then] reduced to $649,000.

The resale of 425 1st Street #2307 closed escrow on 4/17/09 with what appears to be a “confidential” sale price according to the MLS.

As a plugged-in reader comments, however, public records via the Chronicle report a sale price of $560,000 ($684 per square foot). And if tax records and the Chronicle are correct, that’s roughly 22% under what the seller had paid to the sales office ($873 per square).

∙ Trying To Catch The Market Over At One Rincon Hill (425 1st #2307) [SocketSite]

∙ One Rincon Hill (425 First Street): Secondary Market Stumbles [SocketSite]

wow — those people who sold their deposits a year ago are feelin’ smarty-smarty now. Thinkin’ “There but for the grace of god go I.”

Gulp.

“‘confidential’ sale price according to the MLS”

What a crock! It is public information! Need any further proof that the realtors who operate the MLS distort the facts to manipulate the market? What else on there is misleading? Some day, a hungry plaintiff’s antitrust lawyer is going to go after that unlawful conspiracy and receive a big payoff (maybe I’ll do it when I’m tired of defending corporate America).

No big surprise. Market experts already opined that prices at One Ronco Hill may be flat to slightly down in ’09.

What incentive does the seller/buyer have to make it confidential? Did ORH chip in to make it confidential? HOA paid for a year, perhaps?

This is a crazy price precedent. . .for the most desireable one bedroom stack in the building no less.

I’d like to hear the perspective of the self proclaimed “Number 1” broker in South Beach. Mr Paul Hwang – how can we justify 3000 rent for a 1 bed in ORH, when ownership + HOA would only come out to about 3200 on this unit? (Excluding tax benefits at that)

Just for fun, I ran through surrounding floors of the xx07 stack at ORH on the tax collector website (http://www.sfgov.org/site/treasurer_index.asp?id=98446 – you need to search for “Supplemental Tax” bill).

There do not appear to be “07” units above floor 27. With the caveat that I’m not familiar with the floor plans and so cannot say all these units are the same floorplan, amenities, etc., here are the raw sales price data implied by the tax assessments:

1707 $735K

1807 $840K

1907 $850K

2007 $701K

2107 $862K

2207 $732K

2307 $560K (RESALE from Chomicle published data)

2407 $802K

2507 $680K

2607 $720K

2707 $737K

I’ll leave further analysis to others, but just eyeballing, it looks like a lot of folks have to be pretty upside down there.

i wonder who pushed for it to be ‘confidential’

my guess is it might be the same folks who have a certain large obligation coming due to the city…

all real estate is theater, this looks like a greek tragedy

I’d justify renting this way: I’d rather pay 3k/month in rent and not be on the hook for a depreciating asset than pay 3200/month and risk my down payment for the privilege of “building equity.”

Of course, with tax benefits figured in, the numbers change and may make buying more compelling.

i wonder who pushed for it to be ‘confidential’

A good candidate would be the realty shops who currently have 410 D9 condo listings — nearly all of which do not (yet) reflect the real decline in market prices — who would rather keep that information from potential buyers.

Thanks, LMRiM. If those prices are correct, the losses are staggering – between $140K and $300K in loss on a ONE BEDROOM CONDO in under 3 years.

That money in Anytown, USA buys you a palace. Even if you compare other west coast cities like Portland and Seattle, you can buy your own condo for just the loss on some of these units. Really shows you how ridiculous our market got during the bubble.

Some fun with numbers: assume the market just hit bottom, right now, and normal appreciation of 3% annually comes back to all SF real estate. 2307 would return to its peak value in roughly 8 years. Call it 9 if you throw in selling costs. Rough proxy for how long the neighbors may have to wait to sell to break even. If the market has hit bottom. Which it hasn’t.

So from the SocketSite Greatest Hits archive, I repost one of tipster’s best:

“Here is a riddle: how can you have a building in which half of the condos have a bay view and yet all of the condos are under water?”

Classic.

Redfin shows 3 units for sales at ORH (425 1st)for prices $651 psf to $804 psf.

http://www.redfin.com/search#lat=37.78677775538555&long=-122.39381611347198&market=sanfrancisco&sf=1,2&status=1&v=4&zoomLevel=19

Redfin also shows this sales for Unit 2202 in March for $1,150,000 for $878 psf.

http://www.redfin.com/CA/San-Francisco/425-1st-St-94105/unit-2202/home/17304935

Wow, this is interesting… Thanks LMRIM.

Shortly after this unit got dropped from 699 to 649k, a few people posted that it was in escrow. I wonder how it got dropped all the way down to 560k? Someone on this blog threw out that it was a short sale too. Can anyone confirm this?

If so, as i understand it, the seller’s bank had to have hired an assessor who confirmed this as within 10-15% of the current market value. Can any of you realtor’s confirm this?

Does anyone know if this unit was damaged in any way? i guess that would throw these calculations off.

Anyone considering buying right now should consider what complete idiots every single buyer in ORH feels like right now. The same feeling is being repeated all across the city: Mint Plaza, Esprit Park, you name it.

How horrible must these people feel right now! 1807, 1907 and 2107 are down 33%! Thirty three percent! Does it feel good to lose your life’s savings for something you could have easily rented? How many marriages will fall apart over something like this? How many kids won’t go to college?

And they get to make higher payments than they could have made EACH AND EVERY MONTH. By 33%!! It’s the gift that keeps on giving! Or taking, I should say: vacations, cars, all those things are now off the table for these buyers.

Anyone buying right now should be asking themselves some very hard questions, because being that far underwater feels like crap and it can really change your entire life for the worse.

Think of what a difference $300K can make in your life. How many years earlier can you retire with that? Then ask yourself, is it really necessary to buy now? Unemployment at 10%: do you think house prices are going to go zooming back up and you’ll miss it? If you don’t care, then go ahead. You’ll certainly make a seller very happy!

Think! These people wish they had!

And if your spouse insists on buying now, ask yourself whether that spouse will stick around when the money is gone and the payments are sucking the oxygen out of your life.

I suggested all along that all of the buyers at ORH would be financially better off if they walked from their deposits. It’s just as true today as it was then.

33%!

It was a short sale, and I’ll bet it was a cash transaction. Still, $560k is stunning. At that price, it’s much cheaper to buy than rent at ORH, assuming 2307 fetches $3400/mo that it was asking previously. It would be a break-even even as a rental property. Which means it’s unlikely the unit will further depreciate. Not much downside for the new owner, if you ask me.

“It looks like the original purchaser paid $715K (I’m guessing that’s a preconstruction price). That sure was a quick way to blow up about $190K (after typical transaction costs)!”

$190K to live in a 1Br condo for 14 months comes out to roughly $13,500 /month not including HOA fees. That’s assuming, of course, that someone actually lived there.

tipster, don’t tell that to Recent_ORH_Buyer!

I guess there’s no more Infinity VS ORH battles anymore? Those were very entertaining.

Great post and post name Ouch Rincon Hill. Some folks defend “experts” like the one you mentioned – “they are doing their job.” In reality the “experts” are just RE salespeople without a crystal ball, just guesses, a sales script and wild fantasies that SF is bulletproof (no pun intended). Wonder why the “experts” haven’t replied yet – maybe because actual data is involved? Hmmm.

Great post and post name Ouch Rincon Hill. Some folks defend “experts” like the one you mentioned – “they are doing their job.” In reality the “experts” are just RE salespeople without a crystal ball, just guesses, a sales script and wild fantasies that SF is bulletproof (no pun intended). Wonder why the “experts” haven’t replied yet – maybe because actual data is involved? Hmmm.

It was a short sale, and I’ll bet it was a cash transaction. Still, $560k is stunning. At that price, it’s much cheaper to buy than rent at ORH, assuming 2307 fetches $3400/mo that it was asking previously. It would be a break-even even as a rental property. Which means it’s unlikely the unit will further depreciate. Not much downside for the new owner, if you ask me.

Break even? 3400/month?

Of course if you call breaking even having mortgage amount = rent amount, sure.

With 700+ in HOA, all the special assessments you are bound to get after a few years, the fact that expenses supposed to be supported by 2 towers are now spread among only the sole tower owners, property taxes and so on and so on, I wouldn’t see this place breaking even at more than 400K, even 350K. 500K+ is still pricey and the fall is not over yet.

“At that price, it’s much cheaper to buy than rent at ORH, assuming 2307 fetches $3400/mo that it was asking previously”

That’s quite an assumption you make. And don’t forget the HOA fees.

tipster,

I’m definitely in the bear camp, but pointing to this unexpected loss and saying things like “How many marriages will fall apart over something like this? How many kids won’t go to college?” is grossly biased. One could just as readily ask -reflecting on the unexpected gain of the seller- “How many marriages have been saved over something like this? How many kids have been able go to college?”. Yes, even if the seller is the original developer. They have cash-strained marriages and college-hopeful kids too.

I don’t buy the theory by which that “first-loss position” is in money haven. It’s in someone else’s pocket, believe me. And is doing just as much good there as it is ravaging the lives of the suckers that parted from it.

Oops, a bit late there. San FronziScheme elaborated on that better than I did. Trying to watch soccer match and post at the same time.

Don’t forget rents are falling. Here’s a few 1/1 at ORH trying to get $2700 to $3000.

http://sfbay.craigslist.org/search/apa/sfc?query=425+1st&minAsk=min&maxAsk=3000&bedrooms=&neighborhood=

Considering posts like tipster’s at May 5, 2009 11:42 AM, the builder’s choice of inoperable windows seems almost prescient…

Anyone considering buying right now should consider what complete idiots every single buyer in ORH feels like right now. The same feeling is being repeated all across the city: Mint Plaza, Esprit Park, you name it…

You seem to take great satisfaction in others misfortune. Your post says a lot about you – and it is not flattering.

realtors can’t make the decision on whether a sales price is confidential in the MLS or not…only the buyer (or i imagine the seller) can do that. typically its the buyer who doesnt want the world to know how much they paid (though there are other ways of figuring it out). So hey TRIP, stop being so bitter with agents, in fact, just stop being so bitter in general.

I find it fascinating that people often look to markets and pricing based on who is made to look like what depending on when they bought.

Real estate is a necessary market no matter the economic climate. Sure you have the decision to rent or own, and that never will change. But in terms of when to buy, the factors should be consistent:

1) Can you afford it and do you have a secure source of income.

2) is it a fair price for what your getting and should you buy, wait or remain a renter.

3) Have you been waiting to buy and is this pricing a good opportunity to do so?

The only people who really suffer in sever down markets are those who HAVE to sell for various reasons, or those who are highly leveraged or couldn’t afford the property in the first place.

Weather right now is an ideal buying opportunity, each person has to answer for themselves. There are no absolutes in any market, and valuation only comes into play when you buy, sell or finance.

I admittedly know nothing about “confidential” sales, but if it’s confidential, how did the price end up in the Chronicle? This seems to be a bit of an misnomer. Can someone provide insight on these so called confidential sales? Does is cost more to do these, and is it a pretty common place activity?

I think that shows that ORH was always a crappy location and always will be. I don’t think I’d be a buyer even at 560K — the location and the unfinished amenities and the valet parking are deal breakers.

BUT…

If real estate is truly a long term investment, does it really matter that’s it down so much? If you’re going to be there for a while, just hang in there (if you can). Of course, it’ll hurt, but frankly, anyone who bought there wasn’t thinking rationally.

anonymous:

I am not going to defend tipster’s comments, but what I value in the persistent posters on this site (such as tipster) is that over time you build a perspective on how these people think and what they bring to the table.

tipster and LMRiM are consistently on the negative side while anonn and Paul are more supportive of SF Real Estate. As a long time market participant, understanding and working with this consistency has value to me.

If you can get past the hubris and plain old “flaming,” at some point you are going to see a subtle change in the tone of bear posts that could be a sign of a bottom.

So – tipster, LMRiM, annon and Paul keep up the posting. I may not agree with all of it, but your consistency allows me to understand your perspective and weight it accordingly in my analysis.

If real estate is truly a long term investment, does it really matter that’s it down so much?

That’s a reasonable way imo to look at certain classes of properties (say, a nice big SFR in an established nabe, or a view 2/2 penthouse now that the kids are gone and you want to be an empty nester for however many years you;ve got left in the city you love).

But 1-bedroom condoze at ORH? These were speculative vehicles, nothing more. Some were speculating that they would become mini-trumps with a real estate rental empire, others thought they’d “get on the ladder” and trade up later for their ideal property. I’m sure there were some other reasons, too, but I can’t imagine too many people were buying these as primary residences that they thought they’d live in for 10+ years.

They speculated and lost. Class is in session, and they are getting a good lesson. No reason to celebrate (except insoar as you avoided a bullet yourself), and likewise no reason to feel bad for the hapless purchasers (why not feel good for the future purchasers?). Perhaps market conditions will turn around in a few years, but fwiw I bet these sorts of places will spiral down in value more than most think possible, and will not be back to those peak purchase prices for more than 10 years. In nominal terms, of course. In real terms, I don’t think they’ll ever get back there.

“In real terms, I don’t think they’ll ever get back there.”

This is what most people overlook when they figure real estate will “always go up eventually.” A lot of people could be trapped in these condos for a decade, if not longer, just to make a single nominal dollar on their largest investment ever. They would have been better off renting a unit here and keeping their savings in a passbook account earning 1%. Or just stuffing it in a mattress, literally.

There is something to be said about having your own placing vs living in someone else’s and I think that alone is worth some money. If you can afford the mortgage and are happy with your place, then it doesn’t really matter what it’s worth as long as you’re not forced to move. You haven’t lost anything until you sell.

Some were speculating that they would become mini-trumps with a real estate rental empire, others thought they’d “get on the ladder” and trade up later for their ideal property.

And others thought they would make a career out of it. If you can pull 200K out of a sale, do that a couple of times and retire at 40. No-one can blame these expectations.

Of course the key is getting out on time. Human minds adjust to a new reality very fast and expectations go higher as successes pile in.

Ask anyone how much income/net worth he wants to be truly happy, and people will respond 1.5X their current level. If they reach this 1.5X, they’ll want 1.5X more as they’ll be already used of their new status.

This is the way we all function. And this is also a reason why we always take on too much debt: we want the life of the people who are at the next level. And themselves are attracted by the lives of the people one notch higher. Want never stops until we reach the apex of our potential.

And when we do, we usually buy a humble abode in Omaha, Nebraska because that’s what we actually need…

“You seem to take great satisfaction in others misfortune. Your post says a lot about you – and it is not flattering.”

The whole point of the post is to help people stop and consider the potential consequences of their actions.

I don’t take satisfaction in others’ misfortune. I take satisfaction in thinking for myself, not with the herd, and succeeding when I am right.

Next

“If real estate is truly a long term investment, does it really matter that’s it down so much?”

Yes, because if it is a long term investment, you will be making payments far higher than you need to for, well, a long time! And you may be trapped long term. And when you sell, you still make less, even though you kept it for a long time. If the buyer of this unit sells and the buyer of 2107 and the buyer of 2307 sell in ten years for 900K, this buyer gets an extra $300K for waiting one year. I’d say that’s worth it. What does it matter? It matters a lot. That’s a good downpayment on a house! Or a decent start to a retirement plan. Or a one year first class around the world vacation. Or just about any car you could want. What does it matter indeed!

Finally:

“If you can get past the hubris and plain old “flaming,” at some point you are going to see a subtle change in the tone of bear posts that could be a sign of a bottom.”

There won’t be *a* bottom. There will be many bottoms.

“A lot of people could be trapped in these condos for a decade, if not longer, just to make a single nominal dollar on their largest investment ever.”

That’s the true question facing those under water. Take a big hit now or spread out the loss for several years. If you’re happy living at ORH and can afford it, why not just take the monthly hit and enjoy your life? If it’s causing you major grief on a daily basis (as Tipster noted) it’s probably better to cut yourself loose of the albatross around your neck and move on. There’s very little in between.

“Break even? 3400/month?”

$2300 (5% of $560k) + $690 (HOA) + $460 (Tax) = $3500

Whether it can fetch $3400 is another matter.

i’m curious as to whether a low ball offer was made and accepted by luck of the draw, or if a long bargaining process was involved to lower the price to 560K.

jj,

Duly noted. This does not include the extra costs like the many small and not-small special assessments every building gets with time. Then you’ve got extra expenses in rentals like repainting between renters, the few weeks with no rent while you look for a renter. Plus who’s paying water/heating? It all depends on what the rental contract stipulates. And what about insurance?

With your loan fully amortized, you’ve got 5000+ getting out of the door every month over the long term, and whatever rent you can get to offset some of your expenses.

Talking of which, 3400 asking rent was pretty high. The original post stated “assuming 2307 fetches $3400/mo that it was asking previously”. Obviously the seller didn’t get an offer close enough to asking rent, or he wouldn’t have sold 😉 It’s sub-3000 imho, which makes buying still a losing proposition if you want pure plain rental income.

Not cash flow positive. Not an income investment.

condoshopper, i think the agent knew the lowest price the bank would go and she got a great deal for one of her clients.

Question re: valet parking: are you expected to tip the valet each time you arrive home? What if you are a traveling contractor and come back to the home office 4 x a day or so?

While we’re on the subject on non-sensical “investments” there are already Infinity Tower 2 rentals listed on CL:

http://sfbay.craigslist.org/sfc/apa/1155939435.html

Assuming this cost at least 1 mil, who in their right mind, at this time, would be buying to rent it out?

“Whether it can fetch $3400 is another matter.”

Put aside the question of whether $3,400 (and not a higher number) is the “break even” point.

If you put the assumption that it can fetch $3,400 into doubt, then the two following conclusions you based upon that assumption become equally dubious.

1) It’s unlikely the unit will further depreciate.

2) Not much downside for the new owner, if you ask me.

Same plan on the tower 2 14th floor on can be had for $4000:

http://sfbay.craigslist.org/sfc/apa/1151620823.html

The agent thought it would be a cinch. No such luck. It goes to show you the state of high end rental.

nnona, my conclusions were based on buy/rent, not buying and then renting out.

Hey LMRIM or anyone else that knows.

Can anyone help me figure out how to get these tax assessment numbers? I went to the link that LMRIM posted and put down the one rincon hill address with the apartment number (on the supplemental tax option of course). However, i’m having trouble figuring out where the $560k number came from.

None of the old, new, or net totals match the $560k figure. Am I supposed to work backwards from the assessed tax figure of $3,456.58? If so how do I go about doing that?

Assuming this cost at least 1 mil, who in their right mind, at this time, would be buying to rent it out?

I think it’s nuts, but I’ve seen it before. In Tiburon, someone purchased a SFR in December for $1.075M on San Rafael Avenue and imediately advertised it for rent for $3500/mo. It sat for a few months, and rented finally – I assume at less than $3500/mo.

My guess is that there is a class of real estate investors have gains that they need to roll into a 1031 eligible exchange, and aren’t thinking too clearly about the benefits of tax deferral of the gain from existing investment versus the opportunity cost/projected path of future asset prices regarding the new 1031 property.

@ Tax questionr –

If you’ve found the search screen for the “Supplemental Tax”, input the address (425 1st, apt 2307), and the query will return a new screen with two “Select” buttons, which correspond with specific tax bills (two bills are sent out per year). Selecting one of these will return assessment information, and you will see that the “new” assessment is $715,057.

That assessment value is the current owner’s basis in the property. Prop 13 means that (generally) every year the assessed value will rise by 2%, so sometimes you will have to discount back by 2% compounded to get at the original purchase price. There is, however, a lag built into the system (taxes are assessed for the following year based on the June 30 value), and because ORH is so recent (and there are still supplemental assessments), the assessed value will be the purchase basis.

As time goes by, these “supplemental” taxes just become regular secured taxes as the new tax basis is rolled into the existing tax base, and the supplemental bills disappear. Thus, you will only see supplemental bills for properties that have changed hands relatively recently (within the last 1-2 years), except in cases where properties get assessed upwards because of additions/remodels, etc. Again, though, even in those cases, within a year or two of the reassessment upwards, the new tax basis just gets rolled into the regular “secured tax” bill cycle.

Perhaps others out there have more experience with the system and can explain it better/correct my understanding. I hope that helps.

In case this gets lost in the fray, someone, and probably more than just one, purposely tried to hide this price collapse.

I really appreciate that the editor disclosed it for all the world.to see!

“i think the agent knew the lowest price the bank would go and she got a great deal for one of her clients.”

i need an agent that will do some homework like this. i feel like i’m doing all the legwork research and my agent just submits the offer and waits for the answer, instead of pulling strings and doing some old fashioned bargaining.

“My guess is that there is a class of real estate investors have gains that they need to roll into a 1031 eligible exchange, and aren’t thinking too clearly about the benefits of tax deferral of the gain from existing investment versus the opportunity cost/projected path of future asset prices regarding the new 1031 property.”

LMRiM: Wow! Now there is an absolute golden nugget of truth. I made that mistake myself (admittedly almost three years ago)thinking 1031 EXCH was the smart thing to do. The tax advantages are way overblown. It makes sense if it’s the right property but can be very costly otherwise. I wish I had my time over again…

Nnona is anonn backwards. Dat you? Not pickin’ on ya or nuthin’, but jus wunderin’ is all. 😉

Hey LMRIM

Thanks for the info. I did see that the “new assessment” is $715,057. But I thought the unit was sold for $560k. Wouldn’t the new basis be that which the unit just sold for (or $560k)? I’m sorry if this is painfully obvious and I just missed it, but I just don’t know how they got the $560k figure.

Yeah, letting the tax tail wag the income dog is common in many investment decisions. I know a couple who built a fantastic home in Noe last year. The plan was to sell it immediately, but they decided to live in it for two years to get the $500k exemption on capital gains and “two more years of appreciation.” Well, the house is too expensive for them and has also now lost far more in value than the tax benefits they could have received. They’re just waiting for the market to turn around, which “should be soon” . . .

What keeps me from buying one of these condos is the extreme HOA fees. And unless one is stupid rich, I’ve never understood the incentive to pay such a beast.

A gym? A top of the line health club is maybe $100/month (though I pay more like $25 and pass up the wine and cheese parties).

A swimming pool? See the bit about the health club. And it’ll probably be better maintained too.

Parking? Yeah, a lot of houses come with 2 spaces and even a little driveway, imagine that!

The neighborhood? Wow, nothing beats watching the city build the Transbay terminal.

Maybe it’s the view? But what a premium…

@ Tax questionr – I don’t think a new bill has been generated yet. They’re desperate for dough, but they’re still government workers, after all 😉 I got the $560K sales price from the Chomicle (www.sfgate.com/homesales), which shows that the property changed hands on 4/17/09.

Seriously, though, I think the bills are sent out on some sort of mechanical schedule in October and installments are due December and May (I think). Perhaps someone out there knows whether supplemental bills are sent out between the regular billing dates and/or after a set number of days after the change in tax assessed value?

BTW, there’s no reason to assume that there weren’t some “inducements” wrapped into that $560K reported price. Free HOA, closing costs wrapped, cash back even – who knows? It’s anything goes in real estate these days. Free HOA for a year (for instance) might sound implausible, but think about it from the developer point of view: do they really want a foreclosure so soon (with 30% of the building unsold), when there are still some dollars to be extracted from suckers?

Thanks LMRIM,

That really cleared things up for me. You definitely do your homework. Now I know who to go to for RE questions.

Last year we talked about a time when prices in SF got down to 200 times monthly rent. LMriM and others talked about fair value being under 200 e.g., 150 times rent (correct me if Im wrong LMRiM).. well I guess we’re at the 200 mark now.

ORH,

2307 was a good deal for the buyer. The seller got hosed, well actually probably the bank.

Don’t really understand your question.

Paul

I think the question is, given the high demand for ORH 1-bedroom units, how could/why would the bank accept such a low offer … when there are presumably buyers lining up to pay more?

Surely $560k is way below appraised value.

“nnona, my conclusions were based on buy/rent, not buying and then renting out.”

jj, here is what you wrote in your original post (11:58 am)…..

…..”Still, $560k is stunning. At that price, it’s much cheaper to buy than rent at ORH, assuming 2307 fetches $3400/mo that it was asking previously. It would be a break-even even as a rental property. Which means it’s unlikely the unit will further depreciate. Not much downside for the new owner, if you ask me”

……jj, I’m not quite following what you’re trying to say. Are you saying that your conclusions WERE NOT based on the assumption that the unit fetches $3,400???

As chuckie shows above (12:28pm), ASKING (we can safely assume they will be rented for even less) prices on craigslist for a 1 Br in ORH are $2,700-3,000.

If we replace “$3,400” with “$ somewhat less than 2,700-3,000” in your original post, do your observations still hold true??? Common sense says no.

It would no longer be “much cheaper to buy than rent”. It would no longer be “a break even even as a rental propery”.

And if it’s no longer “break even”(as a result of the decrease in your assumption of rent), it would no longer be unlikely the unit will further depreciate.

If it becomes more likely that the unit will further depreciate, then yes, there would be considerable downside for the new owner.

What many of you do not understand is that there are a lot of buyers – ordinary people, not flippers or speculators – who, once they have bought a place, just make their payments and, assuming they can comfortably afford them, don’t think that much about it. Once it’s time to sell, in 5, 10, 15 years, the reality may sink in. But by that time they will probably no longer be under water. They certainly don’t sit around kicking themselves. They just get on with their lives.

mac,

150 vs 200 times rent.

2 comments:

1 – my ratio for real rental income investments is closer to 100. 120 maybe, but at 150+ you’re usually subsidizing your tenants when all is factored in. Of course appreciation quickly puts you in the black if it comes into play.

2 – Rents are coming down due to oversupply. That’s one side of the equation that won’t help ratios or prices.

I guess Mike Kriozere has stopped advertising in the Chronicle.

mac,

Yeah, fair value imo for practically all residential property assets is going to be below 200x attainable monthly rent. Really nice SFRs in really nice nabes perhaps might make sense at 200-250 for owner occupied structures, b/c the stability of the living arrangement, tax benefits, ability to remodel at will, etc. (including all the “psychometric” benefits that 45YOH talks about).

Conversely, undesirable apartments (like 1/1s or studios) in less than desirable nabes, should build in a premium for renting b/c of the inherent risks. So, less than 100 (maybe even as low as 60-70x) might only be appropriate for them. Between these two extremes, I tend to think of fair value as being on a spectrum, with most properties falling somewhere between 125 and 200x for owner-occupied structures. Investors would want slightly better ratios, as Fronzi notes, b/c many of the “psychometric” benefits are not available to investors (also, tax benefits are not as straightforward as for owner occupied structures).

For 1-bdrms in ORH, they’re pretty cookie cutter, not a particularly nice nabe or anything, etc., but some obviously have views. I’d say fair value is below 150x on those, perhaps around 125x or so. We’re not there yet, so buying a place is not a good bet imo at these prices.

nnona, you are right. Looking back what I wrote, that’s what I said. But it would be break-even at $2700 if you buy and live there as tax deduction will take care of HOA at least. Will I pay $3400/mo for it? Nope. $2700? Likely. It has both city and water view, so it’ll be worth more to me than most 1brs in ORH, Infinity or Met.

they are still asking over 800K for the remaining 1 bedrooms, although I think they are above 37th floor. probably can deal something better but the sales staff is probably the reason the units have remained unsold for so long. Talk about used car salepeople.

“…they are still asking over 800K for the remaining 1 bedrooms…”

The ORH sales team are living in Fantasy land. What gives?

who at a bank gets the authority to decide what the lowest price is that an REO property can sell for, and what accountability is there for such a decision? it seems that since nobody stands to personally lose anything (bank eats the loss), is it prone to “insider activity” where they accept a super lowball bid from a family or friend?

Various cities in California are actually starting to raze unsold developments in forclosure; a good sign in my opin.

Various cities in California are actually starting to raze unsold developments in forclosure; a good sign in my opin.

You sure about that? I saw the WSJ article about the unfinished homes in Victorville that are being razed, are you talking about completed homes? If so, where are they located?

“A Texas bank is about done demolishing 16 new and partially built houses acquired in Southern California through foreclosure, figuring it was better to knock them down than to try selling them in the depressed housing market.”

Yes Victorville but some were completed and many partially built.

Either way the more this happens, less stock and we get back to normal quicker.

Funny, Victorville way out in the Mojave desert. Land is very cheap out there. You can bag an acre in Homestead Valley for less than what it costs to remodel a bathroom.

I certainly hope that the excess inventory is simply mothballed rather than razed. Tearing them down seems like such a waste (even in the desert). About the only practical reason I could see doing this would be for houses still in the framing stage. With a sawz-all you could salvage 70% of the lumber value. Still an inefficient use of resources though.

They only razed the homes that would cost more to finish than they would sell for. They did not raze any home that was finished or one that would be economically feasible to finish.

How bad are prices falling when homes won’t even sell for what it costs to finish them!!