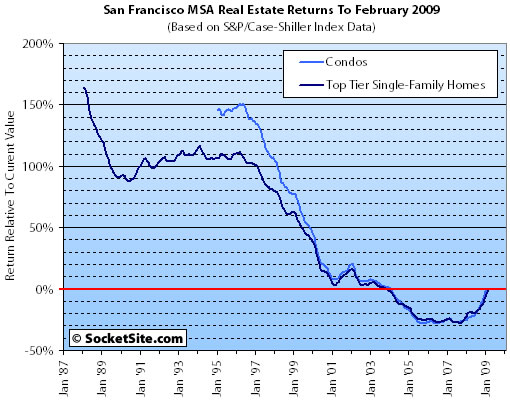

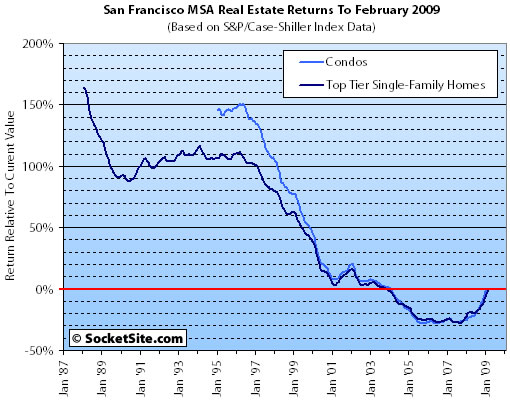

It’s a SocketSite bonus chart based on February’s S&P/Case-Shiller data for the San Francisco MSA and a chance to focus the discussion on analysis and numbers.

Plotted above, the percentage difference in index value compared to February 2009 for the top third of San Francisco MSA single-family home sales (by price) and all condominiums. Below the thin red line and the index on that date is “underwater” compared to February 2009, over and it’s above.

Once again, according to the Index single-family home values for the top third of the market in the San Francisco MSA have retreated to November 2003 levels having fallen 28% from a peak in August 2007. And Condo values in the San Francisco MSA have retreated to January 2004 levels having fallen 28.4% from an October 2005 high.

A closing thought to consider: according to a 2008 California Association of Realtors survey of 500 first-time home buyers in California, the average buyer planed on holding onto their purchase for just 43.6 months prior to selling.

∙ February S&P/Case-Shiller: San Francisco MSA Continues Slide [SocketSite]

Is this a complicated way of saying that Condos and top-tier houses are falling in tandem?

I think this is a pretty interesting way to depict it. The typical purchaser from late 2003 (SFRs) or early 2004 (condos) forward is now underwater in terms of home value. The deepest part of the pit will always be the 2006-07 period, when bears were really getting shouted down. This pit will continue to get deeper and wider over the next [take your guess] several years.

The similarity between condos and top-third SFRs is secondarily interesting.

I don’t get it.

The graph looks like it’s going up. Does that mean we’re out of the woods?

I don’t get it.

The graph looks like it’s going up. Does that mean we’re out of the woods?

No.

Think of it this way.

Someone who buys a house today is not arguably underwater (ignoring transaction costs). Ergo, the line will always “index” at 0% for the current date.

Some percentage of people who bought in January 2007 is underwater: this graph is estimating that group at ~25%.

Finally, if you go back to ~2004, the lines break back above the red-line. That is indicating that buyers prior to this date retain some appreciation, despite declines in the asset class.

Nice graph, SS.

Oooh, ok, now I get it. I’d say the other interesting thing is that a Jan. ’01 buyer might be slightly better off than a mid-2001 buyer (if this chart is to be believed) … that, and there could conceivably be multiple crossing points (when the red line crosses either blue line.

Put another way, it shows graphically that we are overall back to Jan. ’04.

Ongoing price declines would, in effect, move the red line up the Y axis.

Is this one adjusted for inflation?

It took me a minute to figure it out too. I think it would make more intuitive sense if it were flipped upside down, since “up” is really “down” in terms of home prices

it looks like Jan 01 buyers are almost underwater. Is the peninsula sinking?

Another way to think of it: the rightmost tip of that line will always push the red line up to meet it. You can see the slope of the rightmost edge of that line, and how it’s going to keep pushing that red line higher and higher. You can imagine how that will affect anyone who bought previously who doesn’t sell now.

Very nice graph. Business week gave us the map of misery, and now we have the tracing of the trapped.

What a great analysis!

This chart tells a lot by how screwed up this bull market has been. If you bought merely 12 years ago, you’re still more than 100% ahead even after the historical collapse in prices. I’d understand 40 years, even 30 years. But prices almost tripling in less than 10 years show how much more this bubble needed deflating.

Nice chart. Would be interesting to see as CAGR since time of purchase too.

when 99 is at sea level, i will be buying

Interesting graph.

People have already mentioned transaction costs, so that would tend to push the “underwater” event horizon a bit back in time.

However, the other consideration in all data like these is selection bias. Case Shiller is only measuring what has sold, so it’s not directly transposable onto the experience of the pool of existing owners. Because people are loss averse (and sepculators cannot short individual assets down to perceived value), generally over all but very long time frames there will be an upward bias in the reported sales data for all but the most distressed categories/segments. This is because at the margin people are unwilling to realize the losses on unforeseen large declines, while they are more likely to cash in gains (or cut losses) on unexpectedly favorable sales conditions. We see this all the time when listings are pulled.

Over very long periods of time, of course, properties ultimately change hands and thus the artifact of selection bias is washed out of the aggregate data, but at market turns or around inflection points, one can imagine that this selection bias is pretty significant.

Bottom line, imo more people are “stuck” in their assets than any Case Shiller analysis would imply, at least for current conditions in SF as a whole. Because of the ability of humans to delude themselves, many do not realize that they are stuck.

2 other interesting thing about this chart:

1 – The bubble build-up of the dot-com years. Most markets were pretty flat from 1995 to 2001. We all know what happened to THAT bubble, but still prices didn’t collapse which tells a lot about how prices were supported by both the thriving economy and the very lax lending rules.

2 – The last downturn lasted 4-5 years which is understandable in RE with its very long cycles. This downturn is around 18 months old which is just a bit more than a blip on this scale. It will take us a long time to reverse the course. RE is a long process.

No rush to jump in. This market will deliver better and better prices in the next few years. Buying now is still very risky, plus you’ll pay way more than renting for the same property. A lose-lose proposition.

“Some percentage of people who bought in January 2007 is underwater: this graph is estimating that group at ~25%.”

Debtpocalapse, I don’t think this is at all right – I don’t think this graph is estimating the % of people who are underwater.

I think it is suggesting that the index at jan 07 is ‘underwater’ by 25%.

And while transaction costs are not represented here, neither are downpayments and capital payments – which are important when prices fall.

the market may fall 20% but for those with 30%+ down they are not underwater.

Don’t confuse the “index on that date is “underwater” ” with the homeowener being “underwater”.

I am surprised everyone has missed this.

[Editor’s Note: We’ll take all the blame for any confusion and we’re trying to clear it up.

That being said, we think Debtpocalapse meant that group is “underwater” on their investment by 25% (which is correct) rather than that group represents 25% of the market (which is not). Also, if the market falls 20% those with 30% down are still underwater on their investment by 20%, they simply have more equity at risk.

The point we’re surprised no one has pointed out, a return to 2004 values (which doesn’t seem to be very contentious) isn’t much different than a return to early 2001 values (which does).]

Qualitatively, isn’t this just the Case-Shiller graph, upside-down? Looks cool, but I don’t get the big deal.

REpornaddict, you’re exactly right in terms of using the term “underwater” as it is commonly used — owing more than the house is worth. This is why above I clarified that this shows the typical CSI buyer being “underwater in terms of home value.” And also why the editor put “underwater” in quotes.

But I’m not sure it natters that much. The distinction only goes to who is in the “first loss position” as LMRiM puts it.

True, I have heard the term “underwater” to mean both.

But where it’s used as in

“Bottom line, imo more people are “stuck” in their assets than any Case Shiller analysis would imply, at least for current conditions in SF as a whole”

that must mean the house being worth less than a mortgage, surely, not just worth less than what you paid for it. Because with the latter you aren’t necessarily stuck.

Remember as well of couse, that “in SF as a whole” includes CoCo, Alameda, San Mateo etc for the purposes of any Case-Shiller analysis.

Wow. This is a horrible graph. There is no information presented here that a standard plot of the C-S index over the last two decades would not have conveyed, and in a much more intuitive and rapidly comprehensible way. (The apparent “improvement” in market conditions from the 07 trough is particularly bad.) Someone needs to reread Tufte.

I’m speechless (like Adam probably is).

Who thought a simple linear xform could be so obfuscatory! 🙂

Sorry, I like the imagery of the rising red water line putting an increasing number “underwater.” This graph will become more interesting as it is repeated month after month to see the water line move.

If I understand the graph correctly, prior to roughly January 2000, buying a condo (any condo) instead of a “top tier” SFR was a better investment? True, or am I missing something? If true, any reason why?

I’ll echo that it is interesting how strong the correlation appears between condo and SFH’s

also:

I’m not surprised that housing values are starting to approach 2001 levels. As I’ve said before, RE in 2000-2001 was at levels never seen before, spured by the dot-com bubble.

it started to collapse, only to be eclipsed by an even bigger credit bubble. as the credit bubble collapses it would seem that a fall to 2000 (or earlier) valuations is a high possibility.

it is slightly surprising that we’re verging on these levels so early in the downturn though. not super surprising… many of us have known for some time that it was cheap financing, and not rich parents/rich people causing the rapid rise in RE valuations.

that said: disclaimer SF MSA vs SF city etc etc etc etc…

It’s interesting that on it’s current trajectory the upper tier will be back to Jan 2000 levels by the end of the year.

An alternative interpretation of the single family home and condo curves coming together is that distortions in the market raised the value of condos up to being the roughly the same as houses. This makes sense because the nature of the market was that any housing unit could be used to play in the Ponzi game until it all came apart. Because both single family homes and multifamily units, notably including TICs, were invited to the party they both went along for the crazy ride until it ended. As the market continues down condos should again seek a level lower than other housing units because the factors that go into that haven’t really changed. This may take a while, but once units are no longer investments the quality of life factors that keep condo values down will loom large.

As I’ve said before, RE in 2000-2001 was at levels never seen before, spured by the dot-com bubble.

A little perspective to bolster ex SF-er (set the wayback machine to Jan 2000 Peabody). According to the C/S Index historical spreadsheet (see S&P’s website), prices rose an astounding 30+% from Jan. 2000 to Jan. 2001 in the SF MSA. This is the year the Patrick (of patrick.net fame) was “priced out forever” and the last year I could afford to buy something that resembled a house (SFH detached TIC). Had to bid 10% over asking to beat an all cash offer (at asking) for two houses on one lot. Financing was 80/15/5; of course, the appraisal didn’t “hit the mark” so we had to pony up more cash for the down payment (lenders had not yet totally lost their senses). Ahh… those were the days. Should be interesting as we cross that mark on the way down.

Fast forward several years later, I still remember sitting across from my mortgage broker when we refinanced our condo and expressing my concern about losing the “non-recourse” status on our loan. Wish I had a recording of what he said (something about when have prices gone down like that) so I could call him and play it back to him every day. Memories…

Regarding what “affordable” is in San Francisco, could anyone point me to a good site showing statistics on incomes in San Francisco (and other major cities for that matter). Again and again people tell me it is expensive here because there is so much wealth in the city, but I would like to read about some of this for myself. (Hope this is not too OT)

“The point we’re surprised no one has pointed out, a return to 2004 values (which doesn’t seem to be very contentious) isn’t much different than a return to early 2001 values (which does).]”

Dear editor, i did point out that we Jan 2001 is almost underwater. BTW, where’s that CII that you keep promising?

regarding incomes

as of 2006

median income 65,497

top 20% make $242,318 or above

top 5% make $424,799 or above

I would assume that only those in the top 20% were buyers in last 10 yrs. No one making under $250K should have been buying anything over $750K

http://www.nytimes.com/packages/html/nyregion/20070902_RGLCENSUS.html

top 20% make $242,318 or above

Spencer, you have misinterpreted the NY Times information. it is because they do not explain it well. their source is the data I’ve linked below (US census data).

$242k is the MEAN household income of all households in the top 20% bracket (not the lower limit)

$467k is the MEAN household income of all SF households in the top 5% bracket. (not the lower limit)

per the censur bureau, only 9.8% of San Franciscan households make more than $200k/year.

the lower limit of the top 5% household incomes is $266,690

the lower limit of the top 20% household incomes is $138,878.

THUS:

if you make $139k you are in the top quintile of SF households

if you make 200k you are in the top 10% of SF households

if you make 267K you are in the top 5% of SF households.

SFers are affluent. just nowhere near as affluent as people would have you believe.

the complete breakdown is here;

US Census Data

No chime in from the realtors? Guess they are too busy closing deals.

ex-sfer.. sorry, I didn’t mean to misrepresent. i didn’t gt it until nw

Interesting, i would have thought income was much higher. How in the world did our median home price get to $800K+ if only the top 5% make $267K or above?

In my humble opinion, only those making this much or higher had any business buying the “median”.

no one in the bottom 75% could afford even to buy a studio

Some thoughts:

* That condos have performed better than single-family homes suggests that something is erroneous in the data. High-end SFHs are unique and many of the best in San Francisco trade below replacement value. Condos are much more like commodities; with two similar units on the market, sellers have little to differentiate.

* Median income in San Francisco — or anywhere with great wealth and (vs., say, New York) modest consumption — understates buying power. For every $1 million in invested index funds a person receives only $20,000 in taxable income, provided he doesn’t sell holdings.

* I found the graph to be easy enough to understand, although it would have made a lot more sense if the Y axis were compound annual change instead of total change. This would eliminate the big numbers from long ago and the fact that recent numbers must be close to zero.

Cheers.

ex-sfer.. sorry, I didn’t mean to misrepresent. i didn’t gt it until nw

there is nothing to be sorry about! You misinterpreted the data, you did NOT misrepresent it!!!!

The NY Times piece explained that table very very poorly. In fact, I’m not sure that the person who put that table together understood what the numbers even were! I would have made the same conclusion as you had I not already known the data myself, and had I not known where they actually got the data. thus, I simply posted the original source.

Interesting, i would have thought income was much higher.

Almost every San Franciscan that I know or have spoken to overestimates SF household income. It’s a commonly held (but incorrect) belief that San Franciscans are super rich. It’s simply not true. Like anywhere else, a very very small percentage of the people make exorbitant salaries (Like Sergei Brin and the Googleaires). the rest of SFers make a little bit more than elsewhere.

How in the world did our median home price get to $800K+ if only the top 5% make $267K or above?

loose lending practices, and people willing to stretch.

when you look at the true income data (and not RE propoganda), it becomes obvious why negative interest and interest only loans became popular in SF post-2000.

incomes simply could not afford the prices otherwise.

In my humble opinion, only those making this much [267k]or higher had any business buying the “median”.

I agree. Only the top 5% of SFers can afford a median priced SF abode.

The problem: do you think those in the top 5% want a median priced SF abode?

of course not!

Thus, even the top 5% stretch so they can get into a prime neighborhood!. which means that even those in the top 5% often get into homes that cost 5-10x their income!

You can now easily see why current RE prices are unsustainable, when the top 20% of income earners have to stretch dangerously to get into a median priced home, the top 10% have to stretch to get into a median priced home, and the top 5% have to stretch to get into any nicer-than-median neighborhood.

no one in the bottom 75% could afford even to buy a studio

as we hear a lot, most SFers are renters.

but I agree for the most part.

===

in the end, SF Real Estate is not hard to analyze, unless you refuse to look at facts.

-Even the top quintile of people cannot afford the median priced home in the city

-The only way they were able to do it was with “innovative” (mostly toxic) loan products and very loose lending (meaning: they overstretched)

-the reason they were willing to do it is because they believed it to be a “no-risk” proposition as SF RE is “different” and “only goes up”.

-RE shot up the last 15 years mostly due to 2 bubbles (RE and then credit)

-it shot up so far it is no longer affordable, even to the affluent.

-thus, RE prices must come down OR incomes must go up OR we must re-liberalize our mortgage industry back to toxic standards.

-it will be difficult if not impossible for incomes to go up during a recession that may turn into a depression, especially given global wage arbitrage

-thus our govt is doing everything it can to go back to toxic mortgages. which will only delay the inevitable. I’m not sure we can ever go back to the horrific lending practices of 2005

-thus, if incomes are unlikely to go up, and lending standards unlikely to fall to 2005 levels, then the most probable course is that RE prices must continue to fall.

if 2/3rds of SFers are renters… then I predict that RE will fall until the richest 1/3rd of SFers can afford a median priced home using a nontoxic mortgage, plus a little premium.

The lowest limit of the upper 1/3rd of SF income is $100k/year.

Thus, I would not be surprised if RE fell until $100k/year could buy you a home in a working class neighborhood (like Outer Sunset, Potrero Hill) without stretching (let’s say 4-5x income) so for $400-500k, and when a person making $250k/year could buy a decent home in prime Noe Valley for 4-5x income ($1M-1.25M)

and no, I don’t mean a starter crappy fixer upper in Noe… I mean a decent home that a person makiing $250k/year would actually like to live in. 3-4 bedrooms, 2-3 baths, nice yard, renovated, etc etc etc.

people scoff.

but this is not far from how it was in the late 1990s, and SF was a rich city then too, and in the midst of one of the biggest bubbles of all time (to that point) that was centered on the bay area.

The realtors will chime in “but there are trust fund babies and rich foreigners”.

I’m sure there are. Just not very many of them, or at least not enough to prop up the entire SF market.

but again: RE is a very slow process. It will take years for this to work itself out. it will take even longer as govt is doing everything it can to prop up the banks and restart foolish lending (they are wasting your taxpayer money to do it as we speak). so a Japan-type downturn (10-20 years of falling real RE valuations) is becoming more and more possible.

Median income in San Francisco — or anywhere with great wealth and (vs., say, New York) modest consumption — understates buying power. For every $1 million in invested index funds a person receives only $20,000 in taxable income, provided he doesn’t sell holdings.

perhaps, perhaps not.

first of all, we’re not talking about median income. we’re talking about incomes of the various quintiles.

even so, there are very few people who have this vast amount of wealth. so although this is true, it is only representative of the very top income earners (top 1-5%) maximum.

in this case it also does not matter, as people like your example took an absolute beating this year as their investments have tanked with the recession.

but most importantly:

SF RE based pirmarily on wealth would not explain why:

-we see such a sharp divergence between income (even at the top) and RE valuations starting in 2003

-we saw such an expolosion of interest only and negative amortisation loans in the city starting in 2000.

-we saw such a rapid dropoff in RE activity when lending was tighened fall 2008.

nobody is arguing that there aren’t extremely affluent people in the city of SF. we are arguing that there are very very very very few of them, and they are not enough to cause the general RE pricing that you seee in SF.

“unless you refuse to look at facts.”

“the top 20% of income earners have to stretch dangerously to get into a median priced home, the top 10% have to stretch to get into a median priced home, and the top 5% have to stretch to get into any nicer-than-median neighborhood.”

Unless of course those people continue to be willing to pay a high % more than the national median for housing. Just because one has a higher % going to housing does not mean they can’t afford it. Should they – another question, most likely not but can they, in many cases- yes.

No chime in from the realtors? Guess they are too busy closing deals.

I am, actually. But what’s the use? Realtors have often made the point that we’ve seen non income money offset the picture that that census data paints. But we get shouted down by a chorus of “Show me a chart depicting all non income monies held by anyone who has ever set foot in San Francisco,” and it’s boring by now.

Ex-SFer,

A few things on your pricing from the perspective of a builder. $1-$1.5M for a remodeled 3 or 4 bed, 2 or 3 bath in Noe, is not going to happen. How did it get to be remodeled? Either a “flipper” did the work or the last home owner. The case of the last home owner: bought fixer for $1M paid $800K for the work. Or the “flipper” who bought for $900k did $700K in work and wants to make a profit. If the market goes down to the numbers you suggest neither of these will happen. The “flippers” won’t flip and the underwater people will hold if possible.

In order to sell a house in Noe, as a flipper, for $1-$1.5 totally remodeled you need to buy it at $400K and get the work down to $700(from $800+). The closing costs and carrying costs will be $150K, and then it cost money and permits and architects etc. up front, for say $80K. You sell at $1.4M and you make $70K. A lot of risk and money down for the that profit on what would be near the top of your market sale price.

And about the late 90’s; Total fixers we not that low in Noe(my example $400). More like $600K and more. Also, the cost of labor was much less. Good carpenters got paid in the $teens in the mid-90’s now they get in the high 30’s+. Will that get all the way back down, not if the unions (and therefore worker’s comp.) have anything to say about it. I couldn’t pay below 26 if I wanted to. Not to mention I don’t know a painter, plumber, or electrician that doesn’t own a house and pay that current mortgage. And most of my employees and most my other subs pay current SF rent rates. Anecdote: My cabinet maker has looked to move to a different shop for lower rent, but many cheaper one don’t have a spray booth (and can’t be put in now) or else he would lose 2 months of work setting up a different space and moving everything. So he stays at the high rent; and landlords know this. Tile stores aren’t moving, stone, lumber, etc. They have bills to pay and the price isn’t coming down.

So will the prices get down to the $’s you say?Maybe. But I think there is a very long trickle down before we see the costs of construction get to where it was in the late 90’s.

Finally, there is a whole other point about expectations. The expected quality of a finished house keeps going up and up, which drives costs higher. The mid-90’s finishes were not nearly as expensive as what goes in today (I’m looking at you SubZero). Noe/Mission/GlenPark/Sunset/etc. in the 90’s did not finish houses the way Pac Hghts. did. Now you cannot tell the differece. Prices will come down with expectations as well.

in the end, SF Real Estate is not hard to analyze, unless you refuse to look at facts.

-the reason they were willing to do it is because they believed it to be a “no-risk” proposition as SF RE is “different” and “only goes up”.

So your opinion of what other people believed is a fact? Come on ex-SFer, you are smarter then that, you know better then to include that in a list of “facts”. Personally, I didn’t think it was “no-risk” because SF is “different” and RE “only goes up”, but I knew it was “low risk” because of a small downpayment and non-recourse loans.

Thus, I would not be surprised if RE fell until $100k/year could buy you a home in a working class neighborhood (like Outer Sunset, Potrero Hill) without stretching (let’s say 4-5x income) so for $400-500k

That’s what I did in 2007, $110k income buying a place for $485k. Sure it might have been better if I waited since I could probably get a larger place now, or a place in a slightly better neighborhood, but it is just as likely that I still wouldn’t be able to buy because now I would need a 20% downpayment. My place is most likely underwater (hard to value since no 2bd/1ba place in my neighborhood has sold for less then mine in the last year) but it won’t be the end of the world if the bank takes it back since a lot of the closing costs and downpayment came from selling stock options that would have been worthless if I held them till I left that company last year rather then exercising them in 2007.

Your generalization that SF buyers believe that SF is different and RE only goes up is just as bad as those claiming that SF buyers all made large cash offers.

even so, there are very few people who have this vast amount of wealth. so although this is true, it is only representative of the very top income earners (top 1-5%) maximum.

People got upset last time I tried to put numbers on this, but I am going to try again. I don’t know why it annoys people to see that there is so much wealth in San Francisco and the Bay Area: I am guessing that many of the “mere” millionaires that post on here are piqued when they realize how common this is.

ex-SFer, you have posted before that of the 120k SFH in SF, only 50K have mortgages. That would mean that 70k are paid off, right? And the median price of a SFH in San Francisco is still over $800k, so half of those people have equity in their personal residence close to a million. Now, it was controversial, but the Claritas studies I have pointed to before indicate that 13% of Santa Clara county households have $1M in investment assets. This excludes the value of their residence. I am going to make a WAG here and assume that San Francisco County is very similar, it can’t be more than a few percentage points different either way.

So we have 35k households that have approximately $1M in home equity and another 13% or so (50k) who have another $1M in other assets. Most of these sets are going to overlap. So that means 10-15% of the households in SF are multi-millionaires ($2M+) and there are probably another 5-10% right behind them with a total net worth of $1M+.

These families are going to tend to “squat” on the best properties. How many properties that are better than the 4bd/2ba 2000 sq ft SFH in Noe or The Marina are there in SF? How many are there in total in all of District 7 and 5? Does anyone know?

Now before you get all riled up and start attacking me personally, count to three and remember that I really don’t care if I am right or not here, I am just trying to dig into the numbers and get to the facts. I am an IT guy, so it is not like I have any professional reputation at stake or anything.

One big caveat: these are 2007 numbers, so I know that these have to be discounted heavily for the big drop in wealth that has happened in the last year or so. Even at 1/3 off, we see that there is a lot of “old money” propping up home values.

One problem with your analysis, NoeValleyJim, is that even if there is a lot of “old money” hanging out in SF, these people still sell once in awhile.

They still need to sell at what the market will buy. If we return to “normalcy” for whatever that means in the Bay Area (again, according to a pretty extensive report by HSBC — “Froth-Finding Mission” from Jan 2006), normalcy means for SF/Peninsula price/income ratios of about 6 and price/rent ratios between 18-22 for SFRs.

So if your typical household income in the Sunset is $80K, prices will be $480K or so, etc etc, Noe Valley with an income of $250K will be 1.25M. If it costs around $2000/month to rent a joint in the Sunset, the price of that house will be around $480K.

I happen to think ex-SFer is right on the money–SF has been renters’ land for decades, and if you assume it will continue to be so, the price will drop to about what a $100Kish income will buy, which is around $400-$600K, depending on lending standards, down payments, kids/other expenses, etc. At that point too, it becomes economical to buy rather than rent, assuming the same house rents for $2000+.

I know I’m an East Bay guy, but similar houses in my hood are rent for $2100-$2400, which was why I bought for $410K, plus improvements makes it $500K. My mortgage payments are $2117 (put 10% down originally, refi’d the improvement debt into a $400K loan plus 50ishK out of pocket expenses so it’s essentially 20% down etc).

All the starter houses in my area are getting sold with multiple bids. Just looked at one that was listed at $238K (yes it is half the size of my house, so it’s a pretty rational list price). It now has 22 offers, 8 days on the market.

SF will continue to drop, but eventually you’ll see things like I’m seeing. And then you’ll know it’s the bottom.

@ sparky:

yes. it is no fun when replacement costs are higher than home valuations. but it’s happened many many times before, ask anybody in the rust belt or in Texas.

as for higher end finishes… I agree with you. The finishes will have to be lowered.

in general, only rich people can afford luxury finishes (funny it even needs to be said). thus, I’d guess we’ll start seeing lower grade finishes to housing.

but to your more general point:

SF housing may not be too dissimilar to GM cars. GM cars cost too much for what the market will bear because its fixed costs are too high.

SF housing costs too much right now due to its fixed costs. Those will have to change. either through decreased materials (lumber, etc), decreased contractor wages, decreased land costs, decreased finishes, a mixture of the above, or a few other things I’ve neglected that you would know better than me.

I defer to you about what Noe housing costs in the mid 1990’s. remember: part of my point is that SF RE was in bubble land in the late 1990s too due to the .com fiasco.

my post was really meant to show how out of touch SF RE really got, when you compare it to even the highest income earners in SF.

—-

@gowiththeflow:

Unless of course those people continue to be willing to pay a high % more than the national median for housing.

that has nothing to do with the fact that high income earners are stretching to get into SF housing. I agree, that people in desireable areas will always pay more for housing as % of income compared to those not in desireable locales.

I also think this premium will drop to something roughly comparable to what it was in the 1990’s. (SF was quite desireable in the later 1990s, so the premium was already priced in then).

I don’t know why people think that SF has this premium over other areas, and then when other areas drop SF remains immune forever. If the other areas drop, SF drops too

let’s say the premium is 100% over City X.

If City X loft costs $500k

SF loft costs $1M

if City X loft drops to $350k

SF loft stays at $1M????

why did the premium go up?

—

Your generalization that SF buyers believe that SF is different and RE only goes up is just as bad as those claiming that SF buyers all made large cash offers.

perhaps. maybe I misunderstood the dialoge that I had with my friends in family throughout the 2000s as well as that which occurred here on Socketsite when I joined in 2007.

all generalizations in the end are false, although they may hold a kernal of truth.

but it was the absolute least important part of my above post, so I concede that point to you without qualm. It changes nothing of the rest of my argument.

I will reword thusly:

many SFers felt that RE valuations could not go down, and that SF was special, and thus stretched to purchase housing.

NVJ,

I agree that there’s quite a big number of people with cash (discounting home equity) in SF. I know a few in both Santa Clara Co and SF Co.

But some I know are renting, at least the ones still building wealth (a Google millionaire I know doesn’t really care if he overpays, the gravy train worked out well for him) because from an investment prospective, there’s nothing really interesting in today’s RE pricing at least in the prime areas.

And money is not chasing only Noe, but Cole, Telegraph Hill (my new Nabe after living in upper Noe), and many many other nice areas this city has to offer. If that were true, then you’d see all these puffed-up 3500sf victorians going for 4M+ like in PH. And they are not, proof the market is not indefinitely elastic. 2.5M is more like it. Pricey but not as much as what we thought it would be per sf.

agree with NVJ in the sense that the likes of exSFer need to play devil’s advocate with themselves if they actually want a complete and accurate picture. exSFer is wrong to only rely on census data and ignore family money (gifts, inheritances, trust funds, co-loans and co-ownership) and personal wealth created and kept from people who cashed out on the dot com bubble, recent overall stock bubble, and even 7+ yr old real estate buyers now trading up with their cash equity. where does census data on incomes account for this????

with baby boomers getting older we are already going through the biggest transfer of wealth in the history of the world. and what I see in my own business, and that of my colleages in regards to wealth and cash leads me to quote Jim Cramer…. “you have no idea”

so HH income is only a piece of the story… i still have cash buyers when they could lock in sub-5% 30 yr fixed loans. doesn’t that tell you something? of course it doesn’t tell you anything…. but try to have fun playing devils advocate for a day… it’s ok, it doesn’t hurt

Then we look at the properties that were in play:

i just used the MLS to look up total sales for the 6 yr period ’03 to ’08. total 35,816 sales of SFR’s & apartments. let’s assume that’s accurate if non-MLS sales are balanced out by repeat sales.

that means only 28% of 125k homes were in play… someone pointed out NAR said recent buyers only plan to stay under 4 years… and I’m using 6 years of data, so maybe cutting that by a 1/3 is accurate for what was really in play… but i’ll stick with 28%

In addition, let’s go wide and say 1/2 the homes were in “real sf” – more accurately “prime sf”, so only 14% were of interest to the wealthiest.

how much HH income, combined with parents money, stock options, co-borrowing and co-ownership, etc, etc, does it take to keep SF prices high?

i don’t give a crap if you think i’m right or not… but if you really do want the truth, then you ought to play devils advocate with yourself using either the numbers above… or get out and actually talk to people.

How many rich kids and stock option babies will say, “gee, I could overpay and buy a $2M house in Noe Valley, or I could buy a pretty cool pad in Manhattan…or a penthouse in Miami…or a ocean-front house in LA or San Diego…or a ski-out mountain house in Boulder or Utah or Tahoe…or a townhouse in Boston or Lincoln Park (Chicago)….AND HAVE MONEY LEFT OVER…to party for, oh, 10 years” Heck, they could have enough money left over to rent an apartment in SF for parties.

How many rich people leaving due to higher taxes etc does it take to blow a hole in your hypothesis?

Yes, there will always be people who want to live in SF. Will they be willing to pay higher premiums as these other cool places drop in prices?

SF is supported by high-INCOME people. not high wealth. Wealthy people sell to high-INCOME people, and that keeps the market up. Otherwise you just get a bunch of old-money trading houses with each other, and that doesn’t work.

These high-INCOME people have to live here because they have a job at Google or wherever and want a house, can pay for a house, but aren’t wealthy enough to just up and move.

Prices will drop to where these high-income people can afford it. That’s why ex-SFer’s analysis is more correct

One thing I’ll add is it’s now “generally obvious” that real estate is heading down, even in the real SF, and this may affect folks’ behavior, even if they are in the google industrial complex, etc.

It’s now hip to be a renter, for example, and we all know how smart everyone wants to seem 🙂

David – i expect your repetitive argument. now get out there and actually survey buyers and you might understand where i’m coming from.

few people i know read socketsite and see renting as “smart”. I just talked to another potential trade up seller/buyer. has equity from an ’03 purchase (trust me, CS is does not apply to Pac Hghts – he’ll pull a minium of $150k cash out of that). he buys a trade up thus supporting a higher price point, and his place will sell to someone looking for a first place… and since his place is down 10-15% from a year or so ago it certainly looks like a deal to a LOT of renters.

so we have corrected, we will probably correct some more. but another difference is very recent “prime sf” buyers turned sellers will lose some of their wealth, not their shirts. some who lose their shirts will get bailed out by their parents… and not have to live in tent cities. so “prime sf” will never have any where near the rates of foreclosures that Sac or Solano are having and the resulting 50% drops.

there is, and will continue to be very little distress selling.

my caveat…. SOMA is in deep doo doo

Now before you get all riled up and start attacking me personally

in general I try not to attack personally, so it sorta saddens me that you think I’d jump right to that.

I will attack someone’s arguments mercilessly however.

ex-SFer, you have posted before that of the 120k SFH in SF, only 50K have mortgages.

I did not post that data (or don’t recall it)

the data I have is this:

# of owner occupied housing units: 123,498

(incidentally, this is 1/3rd of the number of domiciles in SF which is about 357k domiciles… which gives us the 1/3rd of SFers being renters info)

Housing units without a mortgage 35,933 (29%)

(this is in line with national data, no higher than the rest of the country)

Housing units with a mortgage, contract to purchase, or similar debt: 87,565 (71%)

With either a second mortgage or home equity loan, but not both: 24,066 (19.5%)

Second mortgage only 4,098 (3%)

Home equity loan only 19,968 (16%)

Both second mortgage and home equity loan 1,422 (1%)

If you look at houses that have a value of >$500k, the percentages of those with and without a mortgage are similar. this makes sense since most of SF housing is >$500k.

77,460 of them are mortgaged

30,003 of them have no mortgage

of people who live in owner occupied domiciles who make more than $150k/year: 32,074 have a mortgage and 4,938 have no mortgage

**OF NOTE: only about 37k out of 124k owner occupiers in SF make more than $150k/year. (30%)

THIS IS IMPORTANT as it takes out the “1/3rd of SFers are renters” argument.

Median household income for units with a mortgage: $116,216

Median household income for units without a mortgage: $54,215

so out of 124k owner occupied units:

30% have no mortgage, 70% do have mortgage

only 30% are owned by people making $150k/yr or more

if you do, look through the income demographics that are below

More Census Data with all the above info held within

let’s say the premium is 100% over City X.

If City X loft costs $500k

SF loft costs $1M

if City X loft drops to $350k

SF loft stays at $1M????

why did the premium go up?

Because it is San Francisco 🙂 Really, I get what you are saying and do agree prices are and will continue to fall. However I don’t think it will be as bad as some on SS state. Why? I think SF is coming into it’s own, growing up, etc. on it’s way to a larger SF version of NYC. This changes the entire dynamic of who will buy, and who can afford to buy. Many people in NYC can’t afford (ever) to purchase and they rent for life. If one decides not to rent they move and others happily take position. Is it possible that SF is picking up big city habits as well?

Again I am not saying prices won’t continue to fall but I do think things have changed around here.

Don’t get me wrong, I am definitely in the camp that SF prices will drop, I just don’t think they will drop as far or as fast as many of the more vocal posters. I think that the economy will start to recover soon and that there will be little distressed selling. The economic recovery will probably be anemic though.

I do believe that prices in San Francisco need to return to some kind of long term trend line, perhaps with a 10-25% increase for increased desirability of The City over the mid-90s. All of ex-SFer’s points are valid, I think just think that he (she?) is overly pessimistic.

Sorry for using the word “you” in the above post, implying that I meant you specifically ex-SFer. You have always been very gracious in your discussions here. I meant the generic “you,” which is usually some anon poster here.

hangem.

So you admit that his place is down 10-15%.

Ok.

Another year, another 10-15%, and even in “prime” SF, you have a decent correction. Even you state “we’ll probably correct some more.” So where’s the disagreement?

I didn’t say SF would see 50% drops. A drop to $500K in ex-SFer’s or my example in the Sunset would be about a 30% drop from a lot of average largish-2/1’s to small 3/1 “entry-level” SF houses. (there are plenty listed and selling for $700-$800K in the Sunset. Friends of mine just bought a 3/1 with a potential downstairs in-law for just under $800K, and yes, it was renovated). Similarly, it would be about a 30% drop from your “typical” move-up Noe Valley house currently selling for $1.5-2M to get back down to $1.25M.

I didn’t say the wealthy would lose their shirts or anything of the sort. I said I agreed with ex-SFer that prices would come down to the usual levels in SF, and I agree with him that it’s closer to $500K in the Sunset and 1.25M or so in Noe Valley to use a couple examples.

(incidentally, this is 1/3rd of the number of domiciles in SF which is about 357k domiciles… which gives us the 1/3rd of SFers being renters info)

should say “this gives us the 2/3rds of SFers being renters

Hanghemi:

I’ve already played devils advocate with myself on this.

if you recall, my income is well within the top 5% of San Franciscans. I have several FIRST degree relatives who are Googleaires and Millionaires. I have connections due to my training, some who are the richest 0.01% of Americans. So I clearly understand that there is this demographic out there.

I only remind people that this is a SMALL demographic.

the median income of a household with no mortgage in SF is only $54k. Hardly the kind of income that lets you buy your kid a $2M Noe home.

70% of people in owner occupied SFHs in SF are owned by people who make less than $150k/year. SEVENTY percent!

is it your contention that this 70% of the SF market is primarily made up of

-trust fund babies who got money from mom/pop.

-VERY affluent people who live off of interest/difidend income and allows them to buy luxurious things, but DON’T have reportable household income that puts them above $150k/year

-rich foreigners

?

(rich out of towners are captured in this survey, because the income is captured by Federal sources).

I have a hard time believing there are all these people out there who make LESS than $150k in reported income, yet still have tons of wealth where they can buy their kids (or themselves) housing in CASH.

does it happen? you betcha. does it make up 70% of SF RE market? no way.

FWIW:

I’ve said before that I expect the uber prime areas (Pac Heights, Sea Cliff) to perform relatively better. THAT is where these trustafarians and uber-wealthy live (not Noe)

also: I totally believe that many parents took money to help their kids. and despite that you can see the numbers of properties with mortgages and without mortgages, and the numbers of properties with second mortgages and HELOCs. not much different than the midwest.

Those numbers from the census make more sense to me. I also realize that the 35k who have paid off their mortgage include all dwellings, not just SFH, so the value goes down quite a bit.

What I do notice right away is the following:

Of the 123k owner occupied domiciles:

37k make over $150k/yr

31k own their own homes and make less than $150k/yr

This leaves 55k who have a mortgage and make less than $150k/yr. This is the group that is most likely to end up distressed. I wonder how many of these are under water.

One thing is certain. It’s been my hypothesis that the sub-prime fallout is essentially done, as evidenced by the cratering of ‘starter homes’ in the East Bay (inner East Bay, i.e. Oakland/Berkeley/San Leandro/Alameda/El Cerrito) getting multiple bids over ask.

The Alt-A/option ARM fallout is just beginning and will peak in 2010-2011. I believe that this will effect what I call the “strivers” or “stretchers” or people with relatively high income but little personal wealth. These people (think young engineer/doctor/lawyer couples) have incomes > $100K but were just starting out and stretched through Alt-A’s no-money down etcs to buy in ‘hoods where you would expect such people–family friendly, good schools, but not old money (because they’re not old money). maybe they thought they’d move up in a few years, maybe they thought with the low teaser payments they could save up money. but then the stock market crashed, or one lost his/her job etc, and their payments are going from $2000 to $4000/month with full amortization, and even if you make $120K/year, $4000/month is really hurtin.

This means that Noe Valley (sorry), Inner Sunset/Richmond (and other hoods I”m not as familiar with in SF) along with Montclair, Redwood Heights, and Alameda in the inner East Bay will be hit the hardest in the coming ‘prime’ debacle.

Just like sub-prime hit marginal ‘hoods & immigrant areas. The declines won’t be as bad because you might see people like me movin’ on up, but I think they will be ~30%.

We’ll see if I’m right in about a year.

i personally haven’t see many “foreign” buyers. i see LOTS of parents getting involved…. some from Marin, many from all over the U.S. And that includes helping on mortgages. sometimes they’ll provide 50% cash down and co-sign the loan. also inheritances provide the down payment – the cash means a managable loan on normal HHI… so yes, many new buyers still get loans… but they get help being able to afford them.

one thing I find pretty funny about SS comments is the level of stock sophistication where supposedly a few have side stepped the 50% market correction. while i know many buyers who paid all cash or 50% cash on real estate here, I don’t know anyone personally who claims they didn’t get crushed in the stock market.

So there are many here who see real estate as a safer place to stick their cash vs. the stock market. they don’t trust their own picks, and they certainly don’t trust the advisors who let them lose 50% of their portfolio.

as for the price correction. i think anyone who bought from late ’01 thru ’03 will remain above water. ’04 thru ’08 depends – do you have a “have it all” property. if so you can sit on your price and get it – that includes 1BR condos – have it all for those means location, parking, in-unit w/d, deck, views and the like. that seller can refuse to sell. his neighbor staring at a wall with tandem parking and no light might have a 30% correction even in Pac Hghts. Avg out to 15%

those who bought in ’99 to early ’01 are flat, like those in early ’04. ’98 or earlier they are now trade up buyers, or happy campers sitting tight restricting properties “in play” like the many long time residents who will likely die of natural causes in their homes

Fun with the numbers (all posted by ex-SFer):

so out of 124k owner occupied units:

30% have no mortgage, 70% do have mortgage

only 30% are owned by people making $150k/yr or more

Median household income for units with a mortgage: $116,216

***

So using these we can come up with a rough breakdown of:

50% of owners make less then $116k

20% of owners make between $116k & $150k

30% of owners make more than $150k

I fall in either the 20% or the 30% depending if my friend that rents a room from me is consider part of my “household” or not. Which I guess can be an example of even how variable these numbers can be.

***

Personally I find these endless debates over the exactly what % the RE market is down, is going to go down before it bottoms, and what adjetives to use to discribe said decline to be highly entertaining. 0-5%!?! 10-20%?!? 20-30%?!? 50%+?!? Only time will tell.

i would like to see more very, very specific SF data for Option ARM/Alt-A loans. i can think of only one buyer of mine who got a crap loan like that, and he sold within one year when he realized he couldn’t carry the mortgage. his “college buddy” mortgage broker talked him into the loan that also had a huge pre-payment penalty.

what a d***

anyway… he’s already flushed out.

since i only have one anecdote for that, i don’t even trust my own anecdote… so I’d like to see actual data for “prime sf”. i know there was a LOT of junk in D10 and new SOMA condos…. I just didn’t personally see it in D7 and Noe

Hangem

http://www.newyorkfed.org/mortgagemaps/

You’ll notice that the Inner Richmond are dark red for 90+ days delinquent, i.e. conditions have gotten much worse over the past 6 months. Of course this is the precursor to foreclosure, so in T+6 months to T+12 months, you will see a significant increase in distress sales there. Sunset is a lighter red, but getting worse.

Almost all portions of SF have seen the share of current loans drop.

[Editor’s Note: Subprime And Alt-A Statistics By County: The Feds Mortgage Map.]

That’s a pretty cool map. Do I need to download something to make it work bettr? The box on the right is blank. Also, only the souther parts of the city are dark red for SF? the Richmond appeared pink?

i can’t get SF to split out any data. it shows the California numbers and won’t recalibrate for SF. is it just me?

without being able to see data…. the dark red is in “non prime SF”. i know there was a high level of toxic loans in southern parts of SF. they ate up the subprime, and then they dined on Option Arms and anything else they could get their hands on to continue to party.

the very light pink, with no data, in “prime sf” leaves me wanting for data.

ex-sfer,

To your point about fixed costs and cars. The difference between GM and SF house building is that you can choose to buy a different car with less fixed costs, but you can’t choose to remodel a house in SF and not pay for these fixed costs.

Like I said they may come down, but I don’t see when. My workers comp. told me I need to give all of my guys @ $25/hr a raise to $26/hr to keep them in the carpenter category. So, costs are still going in the wrong direction.

but you can’t choose to remodel a house in SF and not pay for these fixed costs.

but people can move. or not remodel. or not buy a new house.

If new domiciles in SF can’t be built cheaply enough for the population to purchase them, then they simply won’t be built. or they’ll be built and then go into foreclosure and the renovator/developer/builder etc will take a loss.

it’s like Versailles or the Pyramids. Those can’t be built in this day and age. not economically feasible. Thus, nobody builds them anymore. likewise, ORH2 is on hold as are many other SF towers, not to mention other smaller projects around the city.

if SF RE cannot lower it’s input costs, and the populace can’t afford the output price, then I guess that no more domiciles will be built/renovated/etc.

of course in reality what will happen is this:

-people will be unable to purchase properties.

-thus, contractors/builders/renovators/etc will start to starve. they will thus be willing to work for less.

-raw materials won’t be used as much, and thus their prices will fall as well. (lumbar, steel, granite, etc)

-land values will fall (since everybody won’t want to be a flipper/homeowner)

eventually, labor and materials and land etc will fall enough to where it is affordable to the populace again.

It’s just like Detroit. You can buy a house there for $5k. you certainly can’t build a house for that.

that doesn’t mean nobody is building/buying/etc in Detroit. just means that it’s far fewer people doing that compared to the 1950’s.

Likewise, it would appear that SFers cannot afford RE at 2006-7 valuations evinced by tons of data that we’ve discussed (incomes, loan types, lack of sales at current pricing, etc).

“cannot afford”

choosing to not pay higher prices when you think prices are coming down, and not being able to afford are two very different things

Detroit? odd comparison

i clearly agree that what a carpenter wants, and what i’ll pay him, are two different things. unless of course you really what THAT carpenter. if only that carpenter will do

i find this to be a VERY interesting time…. i read this site more than i comment…. i’m open to other arguments…. i post what i experience which is definitely counter to what all you data-jockey’s submit…. i’ve got skin in the game as a home owner and a realtor…. i also feel no need to convince clients one way or the other….. if I KNEW you bears were right I’d make my homeowner friends/clients sell right now…. and not let my buyers buy now. I’d also sell my place and rent. i’m just not convinced since i find the counters to my arguments lacking

Detroit? odd comparison

I’m not comparing SF to Detroit. I’m only giving an easy concrete example showing that housing valuations can indeed fall below their replacement costs. We’re seeing it all over the country, not just Detroit. that’s what happens in recessions and depressions. Asset valuations fall and incomes fall.

choosing to not pay higher prices when you think prices are coming down, and not being able to afford are two very different things

I know. I believe SFers cannot afford SF valuations. That is the whole point of my posts above. This is based on many numbers, but specifically

-the income of the top 20% of SFers

-the income of the top 10% of SFers

-the income of the top 5% of SFers

-the income of homeowners in SF

-the types of loans being used (which changed alarmingly to IO and Option ARMs over the last 10 years)

-the DTI ratios of loans being used, or you could also use the house price:income ratio. both of which went up significantly

-the rapid dropoff in sales that happened when lending was tightened

and so on. It is not my contention that SFers don’t want to pay current prices. It’s my contention that the vast majority can’t without “creative” (toxic) lending practices. the government is doing all it can to bring back toxic lending, and also reignite inflation through a bubble. Let’s see if they’re successful.

other people claim that incomes don’t matter. that the majority of people pay cash only, or have rich family members that pay cash only, or some variant of that. None of the housing data supports this claim. the “cash only affluent” crowd is a small part of the SF market, although present.

don’t you find it interesting that ONLY 1/3rd of SFers own their homes outright? That’s no better than the National Average! don’t you find it interesting that so few people make >$150k/year? the SF stereotype of free-wheeling cash laden 20 year old DINKS is just as valid as the toothless Southern Yokel (sp?) or the Fargo-speaking midwesterner. A small kernal of truth but a stretched overgeneralization.

I agree wholeheartedly that many kids get financial help from their parents when buying a home. and there are probably lots of kids who get LOTS of help from their parents. but then look at the data. DESPITE help from their parents, SFers have huge mortgages and a HUGE debt to income ratio and still need to resort to interest only and option ARMs. thus, the parental support is still not enough to make SF “affordable”.

also, not to be obtuse: but does anybody think that SF is special in that parents help their children purchase a home? that dynamic happens EVERYWHERE and has not been enough to keep asset valuations up.

tracking the same data over time negates many of the arguments.

-SF was still special in 2000. it really isn’t that much more special today than then.

-Parents helped their children in 2000 as well

-there were rich foreigners and rich .commers in 2000

-it was still beautiful then

-actually, there was LESS housing then (so more supply now)

-incomes were very high then too (many would argue higher back in 2000)

-non-salary income was clearly higher in 2000 (middle of a stock/equity/.com bubble)

so I come back to: what has changed since 2000 that would make it reasonable for SF to have higher RE valuations? I can’t think of anything. Thus, I’d be completely unsurprised if SF RE fell to 2000 valuations (in real terms), and even a bit further due to the “overcorrection” effect.

^^^Significantly higher population, in both the region and in SF proper.

One clear piece of supporting evidence (hearsay anecdotes are not evidence) for ex SF-er’s points is that sales have dried up at the higher end — not only in SF but everywhere. I agree that the likely cause is that there are simply fewer buyers who can buy in the over $1.5M price range now that high down payments are required and “creative” loans are gone. But even if these armies of cash-hoarding people are out there, the fact is they are not buying. Why is that? One would think the high end segment would see the least of the slowdown if the “cash-rich” theories were right.

So there is clearly a limit to what SF residents are either willing or able to pay. Both lead to lower prices, and the only real debate is over how much of the freeze is based on lack of ability to pay — which would lead to a longer, steeper decline.

THANK YOU ex SF-er! As someone who used to live in London, I have given up trying to explain to friends here that this city is not nearly as wealthy as it pretends it is. Live in a world financial capitol for 5 or 10 years and your outlook tends to change. Your postings about the incomes of the top 20% are shocking in that I would be in the top 2% and yet I certainly do not feel wealthy when it comes to my current housing buying power.

what has changed since 2000 that would make it reasonable for SF to have higher RE valuations

The city has gentrified southward in numerous areas since 2000. Do you not agree?

And @ Trip,

There have been 53 1.5M or higher sales since 2/1/09. There are also 31 in contract or pending, and almost all reflect late March or April contracts. The stream has shrank greatly. But “dried up” it has not.

[Editor’s Note: For context, recall a plugged-in FSBO’s comment that sales above the $1 million mark in San Francisco were running 60% lower on a year over year basis as of a few weeks ago.]

“The city has gentrified southward in numerous areas since 2000. Do you not agree?”

Prices are set by what people are able to pay. Gentrification just changes what they get for that price.

That’s fine — your terminology is more accurate. The stream has shrunk greatly even if it has not completely dried up. Can you post the greater than $1.5M numbers year-to-date 2009 vs. 2008 and 2007? I suspect the shrinking is indeed great. But my point is: why would it shrink greatly at all unless something other than a high income and/or cash-rich buyer class is out there? There may be some reasonable explanation, but I haven’t heard it and can’t think of one. The low-down, easy lending theory certainly seems like a more plausible explanation.

Prices are set by what people are able to pay. Gentrification just changes what they get for that price.

Actually gentrification changes WHERE they get what they get for A price. This can change the look of a city. Regardless, I answered ex-SFer’s question, about change. Do you not agree? South Beach, Bernal, Glen Park, Potrero, Central Waterfront — all are now different than 2000. Irrevocably so? Who knows? For the time being? Definititely (IMO).

Prices are set by what people are able to pay. Gentrification just changes what they get for that price.

And changes the demographics of an area. Different demographics typically mean different prices for things, as well as what types of things are sold.

I can post the YoY figures, sure. I’m pretty certain that what Socketsite said about 60% declines is going to be about accurate. Maybe a bit more. However, the 31 $1.5M or more in contract or pending since mid March is a spring bounce I personally did not expect. Viewed against the 53 total sold since February, anyway.

I’ll post them. But please refrain from your typical hyperbolic doom and gloom overstatement dismissals afterward, OK Trip? You already played that card with “dried up,” and I’m doing you a favor here.

(Single family and condo/TICs only) 1/1 – 4/30

2009: 68

2008: 203

2007: 187

I would not have thought that 2008 would have been higher than 2007. (Nor would any one of the dozen or so bears who were on about imminent collapse at this time last year.) Regardless, though, 2009 is way down. “Dried up” ? No. Shrank by 2/3? Yes. Again, stay tuned for a month from now, the numbers will be a little bit better. But it’s a very clear shift.

Thanks for the numbers. If my “dried up” comment was hyperbole, it was only so if one interprets language in the most extremely literal sense. I’m afraid I can’t take the time to edit blog posts that carefully, but I certainly don’t mind being called out when I don’t do so.

On the broader point, I don’t know the answer to the question of whether SF residents have so much access to wealth that we can ignore the income data, and whether that vast wealth will prop up home prices. This steep decline in higher-end sales, which coincides with the end of low/no money down jumbo loans, sure seems to cast doubt on that hypothesis. I am curious if someone has an alternative explanation.

I don’t want to get into semantics too much because I have a feeling diemos is going to argue that his gentrification “what” expressly included my gentrification “where.” It’ll resemble, “That depends what your definition of is, is” in about five seconds. But dried up means there’s nothing there to most people. It’s absolute. You can’t get any liquid, at all, from a dried up Kool-Aid stream. Some people still seem to be having a pitcher or two around parts.

Maybe you guys should consider that you’re all partially correct. The realtors claim that sales happening today involve lots of cash and/or family money. And they’re probably right. Because those are the only people left who are willing & able to buy something at current prices. More wealth being destroyed in the bubble through what I call the “generational HELOC.”

Most of the folks who need to service a mortgage purely from income (and save for their own downpayments) are either on the sidelines or can’t get financed. That’s why sales have dried up (I would’ve used “tanking” myself, but whatever). And these people clearly comprise the majority of the bay area and city. Witness the jump in sales volumes in parts of the east bay, where prices have come down 30-40%.

So is the first crowd enough to sustain current price levels in SF? I doubt it, otherwise prices wouldn’t be falling, would they? So I agree with ex SF-er on his prognosis.

“so I come back to: what has changed since 2000 that would make it reasonable for SF to have higher RE valuations? I can’t think of anything. Thus, I’d be completely unsurprised if SF RE fell to 2000 valuations (in real terms), and even a bit further due to the “overcorrection” effect.”

I think this is a given and anyne who doesn’t believe this is seriously deluding themselves. While we havn’t suffered the central valley or east bay losses, SF RE ahs clearly come down, even in the most prime areas. Again, 2bd 2ba in pac hts region (limited data) that i am looking at is down about 20% from Q1 08. Most of those properties that were listed in the $1.1M area are now in the 900s, and a few >$1M properties are in the $800s

anonn:

yes, I would consider gentrification an important change. an intriguing idea, and one that is very hard to model. of course, places can “de-gentrify” but it doesn’t mean one shouldn’t consider it. You bring a good point.

I still find it intriguing that this gentrification required all these interest only and Alt-A loans.

nonetheless gentrification is a very good point.

as an outsider, I didn’t feel that the gentrification of the city from 2002-2008 was as significant as it was from 1994-2000 when I lived there…

I actually expect many areas to de-gentrify. i’ve spoken about this before… specifically I’ve oft wondered if Noe will stay in “uber-prime” land, or will it fall to “very desireable”. will SoMa and Mission fall to what they once were… but now I’m just rambling.

gentrification is a very good argument for higher Re prices.

The Mission in particular continues to offer up some very noticeable CW defiance. For some clients I looked at 1M Mission condos recently. There have been three or four in the past few months, and one was on Shotwell! Prior to 2005 I think I saw only one, and it was 3500 feet big.

ExSFer- I think you have a misperception on ‘high income is needed for SF RE.’ I am an example of someone with a decent size asset base, living off my investments. And guess what? My ‘income’ is quite meager numberwise, but that is by design! Why would I want to pull in $20k per month and pay all the taxes, when I can draw a positive cashflow (my income) to match and slightly exceed my monthly cash outlays.

I also know of many other small time SF landlords who have a modest income, but sizeable asset base. Matter of fact you don’t even need ‘investment’ property to have this status. Anyone who brought even as late as the mid 90’s not only has alot of equity, but alto low mortgage payments. Sh!t, if I kept my orig noe condo I could make my PITI of $1100 per month with a slacker job! But I chose to leverage it and get into additional property, this my SF-PAM status (SF poor ass millionaire). There are alot of people (different permutation of early SF RE purchase/ipo money/stock market gain) who live here already, with of without large dalsties. I think you should not underestimate this group.

45yo hipster, if your positive cashflow only slightly exceeds your monthly cash outlays, what do you live on? How do you buy food, a car, vacations, clothes, insurance, etc.? How could you buy a $1 million condo to live in?

I know a lot of small-time landlords. Like you, they are slightly cash flow positive. But because of that, they all have day jobs so they have money on which to live, and they have to pay taxes on the earnings from both the day job and the rental income. I guess I just don’t get your point. Your situation seems to support ex SFer’s view.

Maybe he lives off of equity withdrawals — the debt is serviced by the rental income. Everything is nicely in balance and no income taxes are owed.

I said my cashflow slightly exceeds my monthly expenses, which includes all my living expenses. The point though is that I’m not building wealth via cashflow or income. The asset base was built from developing and improving properties to highest and best use, and from appreciation. You don’t need to make bank to do this, especially if you got into SF RE years ago and knew how to leverage properly.

“You don’t need to make bank to do this, especially if you got into SF RE years ago and knew how to leverage properly.”

Indeed. Just out of curiosity, how leveraged are you? How far would SF values have to fall to wipe you out?

^ when I cease posting on SS ’cause I have to get a real job.