Stop the presses (or rather refresh that browser). While one plugged-in reader reports that “Riverstone Residential came through with the winning offer on the Argenta,” another shoots us the following note:

Riverstone Residential is not an investment firm. It’s a management company. They don’t invest only manage residential properties.

Give us a minute while we sort this one out. Or better yet, help set the record straight.

UPDATE: We hate to hypothesize, but as we haven’t been able to officially confirm (and we’ve already put it out there) here’s what we think happened: Anka couldn’t get their ask and has decided to keep the property and have Riverstone Residential run it.

Please feel free to prove us wrong (or right). And our apologies for any initial confusion.

UPDATE Redux: We might hate to hypothesize, but we got it right. Confirmation this afternoon from the San Francisco Business Times:

The decision came after a number of suitors, including Tishman Speyer-owned Archstone-Smith, made offers on the property. Offers were significantly below the debt the developers owe on the property, according to sources.

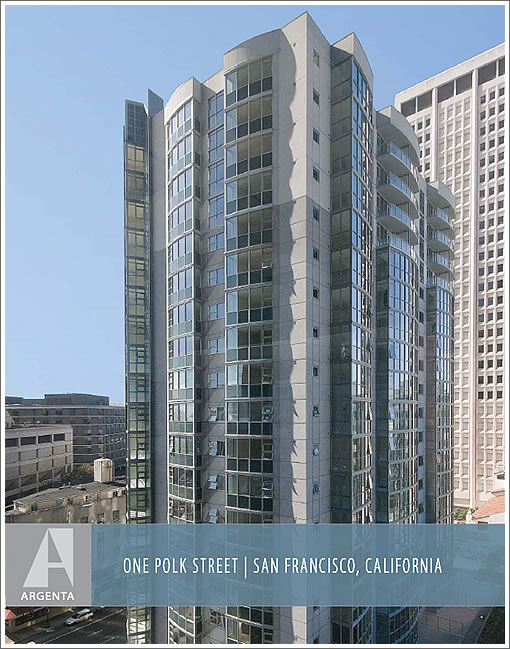

∙ The Scoop: Archstone-Smith Negotiating To Acquire Argenta (1 Polk) [SocketSite]

∙ The Scoop: Argenta (1 Polk) On The Market As An Apartment Building [SocketSite]

∙ Anka not selling Polk Street building, hires management company [Business Times]

We hate to hypothesize, but as we haven’t been able to officially confirm (and we’ve already put it out there) here’s what we think happened: Anka couldn’t get their ask and has decided to keep the property and have Riverstone Residential run it.

[Editor’s Note: Hypothesis confirmed, see update(s) above.]

Property owners, take a pick: sell for a loss, or rent for a loss.

This isn’t surprising. The discount inherent in a vacant building was probably so unappetizing that they will sit on it, get it leased up, put together a few years of actuals and sell it for a slight bump. Just hope their lender is patient.

Imagine the loss if they had actually used the original intended building materials instead of stucco? Are all new buildings going to have vinyl architecture? Or will they be hay huts?

It depends on their land cost. If they had the parcel for a long time, they can probably break even on construction and entitlement costs. If they can hang on for a few years they’ll be okay.

Qunitessential Socketsite.

[Editor’s Note: If by “quintessential SocketSite” you mean putting the pieces together and breaking the “rumor” which turns out to be the news…then yes, we’ll agree.]

“Qunitessential” –funny. Know I now why MLS listings are so badly written and full of mispellings.

If condos in this city can’t sell for more than the cost of building them, we’re not going to see new construction for quite a while.

Damn agents have short patience these days. Karma, biznatches! :-p

If condos in this city can’t sell for more than the cost of building them, we’re not going to see new construction for quite a while.

True. The cost or the rent, whichever is higher, will have to be the floor for the price. But I suspect the cost, both land and material, will fall as well. Overpaying for the land is no different than overpaying for a home in 2007.

Offers were significantly below the debt the developers owe on the property, according to sources

1 – Yet more millions going into money heaven. Someone bought this debt and is now on the hook. I am not too worried though, the taxpayer will be there to foot the bill ultimately.

2 – On the plus side, we have extra housing because of this type of miscalculation, making the cost of living here more affordable to many.

If I resume: the taxpayer will ultimately pay for more affordable housing. The market works in mysterious way, doesn’t it?

I looked up the cost of ORH just for curiosity, and it’s $310m for 709 units according to Wikipedia. That translates to about $437k/unit on average. It’ll be a long while before they sell less than their project cost.

Does anyone know the cost of Argenta project?

“Qunitessential Socketsite.”

Doh!

This is great news for mid-Market. Getting those apartments filled quickly is good, and as renters, they’ll have more cash for local businesses than equivalent buyers would.

Asking $2250 for a 1/1 on Craigslist:

http://sfbay.craigslist.org/sfc/apa/1059498152.html

Asking $2250 for a 1/1 on Craigslist

Good luck with that! The big plus is the view, of course. You can rent today on TH for less than 2K, and you’re actually somewhere where you can live and go out. But it’s all a matter of opinion.

TH?

Telegraph Hill. For 2250 you can get more than a 600sf 1/1 and be in an actual neighborhood, not a “Bucarest concrete meets the Tenderloin” area where the care-not-cash crowd hangs out day-in day-out.

Crazy pricing, yes. But a 664 sq ft. 1 Bedroom at FOX PLAZA, just across the street is renting for $2,700… Get ready for a price war!

“Crazy pricing, yes. But a 664 sq ft. 1 Bedroom at FOX PLAZA, just across the street is renting for $2,700… Get ready for a price war!”

Not anymore…

http://sfbay.craigslist.org/sfc/apa/1060014522.html

It’s not “renting” at that price. It is “offered” at that price. There’s a big difference. You can offer it at 5000 too, this doesn’t mean you’ll rent it.

The pricing at Fox Plaza is never what it has online, always better in the office. Waiting to see the units at Argenta, we are on the list for next week to see them.