The Wall Street Journal article: Residential-TIC Tack Hits Snags.

The Quote:

The problems facing residential TICs, which are found mainly in San Francisco, are different and reflect tighter mortgage underwriting standards. Banks across the country have pulled back from all types of mortgage lending, but especially for nontraditional types of mortgages. As a result, borrowing costs for TICs have shot up, causing home buyers to avoid the structure.

Sterling Bank & Trust FSB recently raised its rate for TIC loans to 7.75% — a loan for a similarly priced condo would require only 6% to 6.25% interest — and now requires a down payment of at least 20% of the purchase price. Other banks are now requiring 30% down. In the past, lenders required buyers to put 10% down.

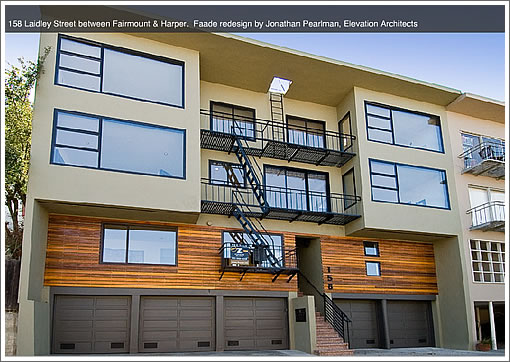

The listing: 158 Laidley (“Price REDUCED. Cut-rate financing! Stunning eco-modern…”).

∙ Residential-TIC Tack Hits Snags [Wall Street Journal]

∙ Listing: 158 Laidley (5 TIC units) – $359,000 to $699,000 [158laidley.com]

My fractional TIC required 25% down and the rate was 6.5% … I bought it in August.

This may be good news for long-term minded TIC owners, because it will prevent so many TIC’s from entering the conversion lottery.

Given how this election played out with Comrade Chris Daly stuffing the board, TIC owners need all the help they can get.

Funny that this was posted on the front steps this morning…

[Editor’s Note: Well, it’s good to know they don’t only plug in to SocketSite for the scoop but the WSJ as well…]

As recently as May it was only 10% down @ 6.75%.

You just can’t win: as these things get more affordable, they become less obtainable.

“You just can’t win: as these things get more affordable, they become less obtainable.”

They never should have been so “obtainable” in the first place! This will drive down prices even more as the pool of qualified buyers continues to shrink.

TICs seem to do best when they are in quaint buildings in prized locations. These new finishes are nice and green, but this building isn’t exactly a midcentury showpiece and Glen Park is still rather Earthy. The speculator involved needs to admit this is the wrong remodel in the wrong place at the wrong time and keep the focus on the pricing and not the Prius. This property could still be quite valuable as premium rentals.

Question about the fractional ownership–– what happens if one of the units sells for much above or below asking and throws the balance out of whack?

I’m thinking about 4077 23rd St in Noe Valley. There are three units, two flats and a separate cottage. http://www.paytonslist.com/index.php

The two TIC flats sold quickly, but the larger and pricier cottage has been sitting on the market and has had its price reduced. Do the flat owners have to wait until the cottage sells to find out what portion of the property they own?

Yes, TIC rates are way up as are down payment requirements. There is a big dip in TIC sales this year from last.

See: http://spedr.com/hfaj

This will drive TIC prices down as less and less people enter the pool. Supply will become greater than demand. Not sure if I agree with TIC buyer. It may increase your chance in the lotter from 2% to 2.5% in 5 yrs. The market ahs been flooded with TICs over the last 3-4 yrs and people will begin to stay away.

meant to also say by statement above that many of the TICs bought in the last few yrs haven’t even entered the lottery, so lottery chances will get worse before they get better

That building is trying way too hard to be trendy. Usually I love wood on the front of buildings, but this isn’t working.

MoleMan, premium rentals in Glen Park? Good one! You just said it was all wrong, but that it would be a good rental? Wouldn’t renters be looking for the same things as buyers?

According to propertyshark, the developer paid $1.725M in Feb 07. The renovation (to my amateur eyes) looks kind of schlocky and characterless, but so does the buiding. Views look nice.

All the units combined are now asking $2.95M. Sounds like there’s plenty of room for this developer to cut the prices some more. Stop bellyaching to the newspapers, and give the potential TIC buyers a break.

Rates are up, the market is down, and there’s room for him to cut prices further. Enough with the gimmicks (from the article):

“Now Mr. Burnett is offering to personally lend buyers money for down payments.”

Cut the prices.

And:

“is offering a free Toyota Prius to the first buyer.”

Gas is $2/gallon and going lower. Cut the prices.

Did I mention? Cut the prices.

For 4 units and under, the fractional loans almost made sense when the rates were better. Now you are better off doing a group loan (or a seller wrap). New limits are:

$625,500, $800,775, $967,950, $1,202,925

Not too bad actually. Its a full doc world for all loans now, which makes one of the advantages away for condos.

wait. glen park is “earthy?” what the hell does that mean?

Here is an Ellis Act Question:

To by pass the rent control, developer has the right to evict rental tenants in order to convert into TIC units for sale. My question is: can the new buyer use the new unit as a rental? And rent out the property in a higher rent than before.

MLS shows Units 2,3 & 5 as active and Unit 1 as contingent. Don’t see listing for #4. The whole 5-unit building is also listed $2.900 million. As LMRM pointed out, the asking price for the 5 units is also about $2.9M. Building was purchased in Feb 07 for $1.725M. The total square footage is listed at 4,140. Based on the 2007 listing photo, it looks like the two garage spaces on the right used to be open parking spots. Any estimates on the total remodel costs? $400K ($100/sf), $800K ($200/sf), more, less?

Unit 1 that is apparently under contract is listed at $699K and 1,172 square feet (the largest unit). This is $596 per sf – at the full asking price. The other 4 units are asking about $730 per sf. If these units end up going for $596/sf, the total gross sale amount will be about $2.4M. There’s probably no profit left at that price (and that doesn’t count the Prius).

Send out the bat signal… where’s Paco?

And to think, I was worried that the fractional lenders couldn’t take care of themselves (10% down appeared a bit foolhardy to me). This would seem to be a positive development for condos — and, quite frankly, the specUtowers could use some good news these days.

katebear-

No. And a buyer would be a fool to pay the same price as a non-ellis’ed comp. Why? An ellis that evicts people from more than one unit can NEVER EVER be converted to condos, no matter how many people and resales it goes through.

You can rent again, but only after 5 (or is it 10?) years.

RenterAgain-

Usually, the TIC draft created by the developer fixes the percentage of ownership, regardless of price, and it’s usually drafted by square footage. Property taxes are usually based on share of purchase price, though.

The rationale is that after a resale in 5 years, percentage of ownership shouldn’t changed based on market appreciation or depreciation, whereas the new tax assessment is directly caused by the change in value, so the only person’s taxes who change should be the new party who effected it.

he he yeah batman, riddle me this 🙂

158 Laidley is a bloodbath… paco will agree. Here’s how I see the numbers:

Purchase price $416 psf (in Feb 2007)

Selling Costs: $50 psf (7%; conservatively)

Holding costs: $50 psf (7% over 18 months; conservatively)

Remodelling

cost: $200 psf (very conservatively considering it’s a “down-to-studs remodel finished to highest standards”)

Cost basis: $716 psf

Asking Price: $712 psf

If they sell at asking price, someone is losing their shirt. The market changed under these guys.

The listing states no Ellis or evictions, so the units should be able to rent at market rate. The previous listing from 2005 indicated that one unit was occupied at that time. That tenant is obviously gone – and, if he/she was paid to walk, that’s another cost in the developer’s basis.

What are you talking about, chuckie?

Bloodbath? You don’t know what you are talking about, like that other guy from a vague European city who is on here to learn. Remember, the developer here only paid $1.725 million for the whole thing. He probably paid all cash (everyone in SF is rich) so there were no holding costs. Remodelling costs? One of the most overestimated expenses. A smart handyman can manage a crew of Home Depot parking lot workers. I’d budget $10K per unit ($3K bathroom, $1K electrical, and maybe $5K for the kitchen), $10K for any facade/structural work, and maybe $5K for miscellaneous painting. All in, maybe $65-75K of expense. Nice flip. At the asking price, he’s making $800K, easy. Now, if this flip were only on Caselli….. you’d be looking at $900 per square foot, easy, as long as it *flowed* well.

As I said, plenty of room to come down on price. Everyone makes money in SF real estate. You’re just jealous because you didn’t spot the opportunity, and I’m just bitter because I can’t afford such a palace.

Satchel,

You’re sounding kind of bitter these days. I hope your those puts you sold on the S&P500 didn’t hurt your portfolio too bad.

UAUA is closing in on $5 again, it’ll be time to buy and get on board for the next ride up to $15 as the price of crude plunges even further.

Does anyone know how the sales are at 2828 Greenwich? I saw these units months ago, and the website has not been update since. Anyone know what’s going on over there?

Bloodbath? You don’t know what you are talking about, like that other guy from a vague European city who is on here to learn. Remember, the developer here only paid $1.725 million for the whole thing. He probably paid all cash (everyone in SF is rich) so there were no holding costs. Remodelling costs? One of the most overestimated expenses. A smart handyman can manage a crew of Home Depot parking lot workers. I’d budget $10K per unit ($3K bathroom, $1K electrical, and maybe $5K for the kitchen), $10K for any facade/structural work, and maybe $5K for miscellaneous painting. All in, maybe $65-75K of expense. Nice flip. At the asking price, he’s making $800K, easy. Now, if this flip were only on Caselli….. you’d be looking at $900 per square foot, easy, as long as it *flowed* well.

As I said, plenty of room to come down on price. Everyone makes money in SF real estate. You’re just jealous because you didn’t spot the opportunity, and I’m just bitter because I can’t afford such a palac

I don’t know whether you’re Satchel or not, because your goofy flame with its paraphrase/expansion upon fake number posted by someone who is uninvolved/tired pan-realtor bashing/ put words in fluj’s mouth routine is completely devoid of civility.

Not that Satchel wasn’t a jerk sometimes. But he typically wasn’t bitter and petulant right off the bat. Seemingly your post had but one purpose. To get me to post something. Well, nice one guy. Here I am. It’s too far away from Thanksgiving for me to waste much time on turkeys like you, tho.

And if you are Satchmo, gee whiz, something bad happen in the interim? We find you a changed man. Even your new name is calculated to offend, right? Who on earth calls themselves a “millionaire” ? I picture the Monopoly fatcat getting sloshed and crying in his beer at Sam’s in Tiburon. Why so mad, bro?

You don’t know anything about this deal. There is no widespread downturn. Good places, priced right, are still selling. It’s all very micro, bro.

You don’t know anything about this deal. There is no widespread downturn. Good places, priced right, are still selling. It’s all very micro, bro.

Remind me why I don’t post here as much any more. Oh yeah. That’s right. Can’t you even bother with a username if you’re going to flame?

You know what? You set yourself up so I’ll bite. 1. They know zip about what was spent. Inarguably true. 2. There is no widespread downturn. Haven’t said that recently. Said it a lot eight months ago when many armchair Philip K Dick’s on here were writing about imagined future times. Now? down is the general trend, of course. 3. See the Delmar post. 4. It’s all very micro, bro. Still true.

LMRiM, I can’t stop laughing at your last post. Hilarious.

But both you and Chuckie overlook the crucial fact that this building isn’t even in San Francisco. At least not the real part. So it doesn’t count. I’m sure your detractors would be keen to point that out if they weren’t so busy counting their millions in rental income.

And fluj, please don’t get offended. LMRiM is not targeting you. It’s just satire. After all, we all know it’s IMPOSSIBLE to be both a millionaire and a renter, right?

@Mole Man

“TICs seem to do best when they are in quaint buildings in prized locations.”

You hit the nail on the head!

TIC’s often exist in Russian Hill and Pac Heights because there aren’t a lot of condos, especially new ones in new buildings.

MY TIC is in a building from shortly after the Earthquake. I love the charm and the location. But the concept would not work so well in other parts of SF, let alone other parts of the country.

To me, the term “TIC” is practically synonymous with nice old neighborhoods in this town.

Agreed with LMRiM: it is pricey. Don’t know whether the seller still makes a killing at asking price or not though. Remember I’m a guy from a vague European city (next time I’m in Paris, I’ll remember to quote that one to my friends) and here to learn. And I am sure learning. Not about civility, though…

As for the rental question – TIC buildings are still considered apartments until they convert to condos, so you can do ONE owner move in eviction in the entire building and then that unit is designated as the “owner unit” thereafter. So in a five unit TIC building you’d be wise to determine who’s unit is going to be the owner unit and not rent out any of the other units as you will not be able to evict these additional tenants at will without penalizing the building with a 10 year delay to enter the condo lottery.

As far as lending getting tight for these properties – well, that was definitely an obvious risk when you only had a handful of banks providing these small niche loans – it doesn’t take a lot to completely change the playing field with only a few participants. As for getting a shared loan – good luck with that, a lot of the small apartment lenders are completely out of the market or have cut way back with most deals being done with FNMA backing now (which these deals won’t qualify for as there is no income).

And a bit more on the rent control issues — even after a TIC converts to condo, it is still subject to rent control. It is only after it sells once (to a bona fide purchaser) after it goes condo that it is then completely outside the rent control ordinance (but still subject to some protected tenant provisions).

TICs are complicated and sell at a discount for all these reasons.

Regarding my suggestion that this go rental, it seems like rental markets have more customers in the City and also there is less delusion about which price levels work and which don’t with rental units. Either it gets rented or it doesn’t. This scenario of units left empty over a long period does also happen with rentals, but more rarely.

“If this were Caselli” is a good way of framing the problem. There are some similar, but better built structures around Yukon and Eagle that are probably good TIC candidates. This is close to Noe without being Noe. It’s not even Bernal or Outer Mission. For some who get turned off by even the early stages of gentrification that can be a selling point, but not so much in general.

Issues with the location are apart from grading the remodel. That kitchen is nicely outfitted with a trendy look. Including laundry and parking with all the units is a plus that renters might notice and put a relative premium on. That’s is relative premium as in location plus some extra for features. That might be wrong, but the advantage with the rental market is that finding what price level works is usually easier. The result might still be a loss, but at least there would be some cash flow. Is thinking about cash flow simply too old fashioned nowadays?

Holding costs aren’t limited to loan servicing.

Think taxes, insurance, city fees, DRE fees etc

he he heee… from ” real estate” this thread seems to have taken a little detour into Surreal Estate… very funny nonetheless 🙂

And, of course, I am loving:

It’s all very micro, bro.

god, would you guys just stop staying “bro”..

it’s so..like…touchy and sensitive and all that huggy stuff.

hmmm,

late ’07, fringe (at best) neighborhood, interminably banal building, and $1.75M…?

can’t say i’d go near it but good luck to them for trying.

creative destruction and all that..

btw, estimating the cost of a remodel by using $/sq.ft is similar to using a blunt instrument where a scalpel is needed.

I agree with paco’s comment about estimating the remodeling costs with an overall $/sf approach. paco – based on the photos and the description at the property website, do you have a ballpark estimate of what was spent?

“…fringe (at best) neighborhood” – WTF? Have you ever been on this block?

ok,i’ll bite at analyzing if the developer will make money on this (rough estimates):

18 mo’s holding costs ~ $13k/mo * 18 = $234k

sales cost/trans fee 7% of $2.9 mil = $203k

construction cost* @~$150/sq ft = $600k

* i think a smart contractor can do a nice down to the studs remodel for $150 sq ft., as long as they are not doing a ton of structural (i.e. repl. foundations, additions, steel framing, etc.)

so total costs of $1037k + $1725k purchase = $2,762k. and they hope to sell at $2.9mil?

funny, i saw this thing come on the market early last year. the only thing i really liked was that 4 of 5 units were vacant. it didn’t sell right away, and i was wondering if anyone was going to bite on it…and i was wondering if the #’s were going to work. well, now i have my answer (as another developer will soon get their ass handed to them…and having to do so while pimping a prius, just adds insult to injury:-) ouch!

6,000 layoffs announced at Sun. Not good for the south part of the city.

It’s all very Sun Micro, bro.

“Not good for the south part of the city?”

Why? A lot of Sun employees living in Ingleside and Viz Valley? I’m completely counfused by that statement.

Trip-

Sun employees weren’t the one’s driving up home prices anyway (unless they made their money elsewhere); their stock has had no meteroic rise. Sun, as a company, has been struggling for years, not making millionaires by the hoards.

It was just a silly pun playing on a discussion in this thread.

But the broader point is that the booming tech industry in the valley was a significant piece of the strength of the real estate market in the southern parts of SF or anywhere with freeway access toward the valley (Noe Valley, Mission, Potrero, Glen Park, etc.). Remember all the excitement over Google millionaires buying up places with cash? We are now entering a period of huge tech layoffs (see Sun as one of many examples). I’m simply pointing out that this is yet another factor that is going to have a substantial negative impact on the market, particularly in the southern half of the city (which is much more than Ingleside and Visitacion Valley).

True that Sun didn’t churn out millionaires ala Google. Therefore, they must be renters, since “all renters are poor”. How long can these poor renters continue to pay high rent to their rich landlords?

this is definietly not the real san francisco. very far away and foggy

I don’t know why anyone would want to become a landlord in San Francisco, it sounds miserable with all the bs you have to put up with, and the rents don’t seem to cover costs unless you (or aunt jemima) bought in 20 years ago.

I have noticed that there have been quite a few TIC listed in Pac height now.