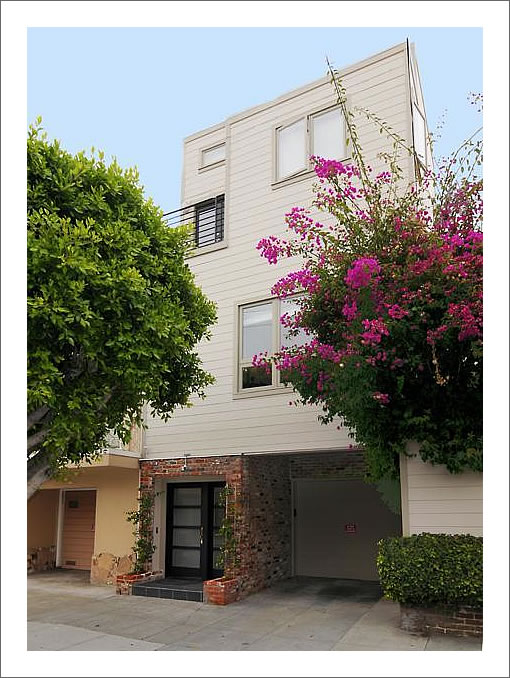

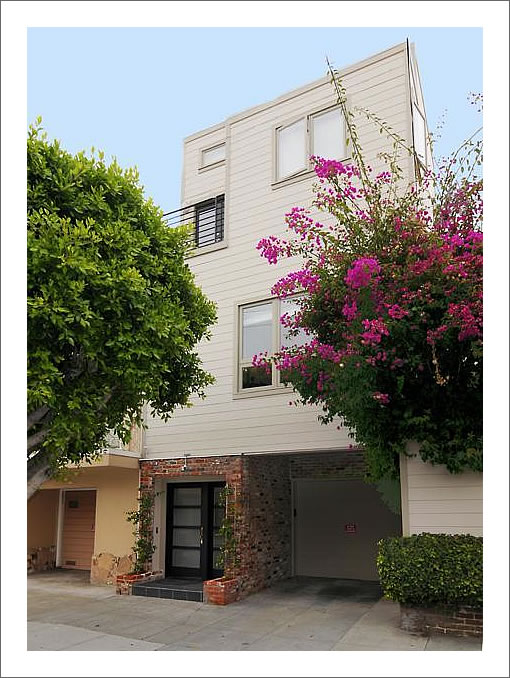

After four weeks on the market the asking price for 1968 Greenwich has been reduced for the second time, now asking $1,800,000. Once again, purchased in May of 2005 for $2,100,000. And bonus points for the best rationalization of how we “cherry picked” this renovated District 7 apple four weeks ago when it just as easily could have sold for more.

UPDATE: And on the topic of apples, the sale of 632 Ashbury Street closed escrow today with a reported contract price of $870,000. That’s $5,000 over its purchase price in November of 2005.

∙ Listing: 1968 Greenwich (3/2.5) – $1,800,000 [MLS]

∙ A Renovated Cow Hollow Apple On The Tree: 1968 Greenwich Street [SocketSite]

∙ Two Cow Hollow Apples On Greenwich Get A Little Less Green [SocketSite]

$1.95M estimated selling price

Posted by: spencer at October 6, 2008 3:43 PM

Who would have thought spencer of all people would be over on this one??

$109 HOA – awesome.

apparently, i’m too bullish. will need to readjust as my thinkning didn’t consider the OCt. market meltdown

This may be the most beige interior so far.

I know it’s off topic, but any update on that place right next to the fire station?

[Editor’s Note: No change since the last update: Two Cow Hollow Apples On Greenwich Get A Little Less Green.]

$8,000 per month of non-tax-deductible depreciation really screws up the rent vs. buy calculation. That doesn’t include the mortgage, taxes, insurance and maintenance ($10,000 after income taxes).

$600 per day, every day for 3 years. I could have had a much better time with that cash than the owner is probably having right now.

Real estate is proving to be the most voracious destroyer of wealth in a generation. Hope they enjoyed themselves!

“Real estate is proving to be the most voracious destroyer of wealth in a generation.”

For every dollar of “free money” that falls from the heavens onto someones head while the bubble is inflating, a dollar gets forcibly removed from someone else’s pocket on the way down. That is the bubble mechanism.

The gigantic payday that the original owners received in 2001 and the smaller payday the flippers received in 2005 was funded by loaned up funny money. Now someone has to make good on that funny money. If not the current owner, then the bank shareholders, or your pension plan, or your 401k bond fund, or the taxpayer.

@tipster –

Sure, these guys will wind up having spent maybe $18K per month to live there. IF it sells at the current price and doesn’t have to get slashed further.

But, ahhh, how I wish I could switch places with the owner of this palatial 3/2 condo with a shared lot in the “real” SF…

Have you SEEN what you can get for a measly $18K per month in the rental market? Well, I assure you, NOTHING that you would want to live in. Dark, dank, moldy 1960s boxes…

Why, don’t believe me, a mere *renter* – in other words, a 40-year old loser who can’t get a girlfriend because I can’t even drive a nail into the walls or repaint them in more pleasing hues. Then perhaps you’ll listen to “Prime” opining on point about this very condo:

“Trust me, you’d much rather own real estate now than lose 40% in the stock market. At least you had a nice place to live. There’s no rental stock out there that can compare. It’s all about living life to the fullest.

Posted by: Prime at October 23, 2008 7:41 AM”

Yes, tipster, it’s all about living life to the fullest. Even when that includes absorbing a capital loss in excess of $400K, secure in the knowledge that even though you in 2005 were hoodwinked in the largest financial fraud since, oh, about 4 or 5 years prior, for a magical 3 years you OWNED a very litle slice of the “real” SF….

I grow wistful and become overwhelmed with emotion. Ah yes, a full life….

This is a great price reduction to $1.8M…obviously a seller who understands what’s going on and is trying to stay ahead of this market…the comps should support this price all day, but now there really aren’t any true comps. The market is still trying to sort this mess out and know one really knows what anything is “worth” any more. Any house that went into contract or sold over 30 days ago is no longer a very good comp. If this house does not trade soon at about this price then I think all bets are off…and I’m not super confident that it will.

the comps should support this price all day, but now there really aren’t any true comps.

As much as I like to value my 4/2 single family detached condo like other 4/2 single family homes in my neighborhood, the reality is that they are different… and in a downturn, the “parity” that condos have reached with private residences quickly begins to fall away. This home is part of a CID; you are buying a 50% share of the land on that lot — and said land it starting to depreciate at a rapid rate.

Zero curb appeal.

No view.

Weird floor plan. Odd color scheme. And would you want to face all those stairs at the end of a long day?

Built in 1900 = structural problems and everything ready to fail at any moment.

Forget the maket problems, this is a very odd, unattractive home.

U-huh.

And I suppose that in May of 2005 this place had high curb appeal? A better floor plan? Better color scheme? Fewer stairs? A fabulous view?

One has to wonder what the owner was thinking when he got rid of all those things. Oh wait, it’s exactly the same house in exactly the same place. That’s what makes it an “apple”.

Or perhaps it’s that in 2005 anyone could get a loan for whatever amount of money they wanted and now they can’t.

As an apple for seller, the market is flat.

As an apple for buyer, the market sucks. The mortgage rate is 30% higher (6.5% vs 5%), so a flat price is bad for buyer.

As an apple for then-buyer-now-seller, loses big.

“As an apple for seller, the market is flat.”

A drop of $300K since 2005 is flat? That’s some “prime” agent math.

“A drop of $300K since 2005 is flat?”

A 15% drop is defined as flat. I think we have a candidate for chief economist of the CAR.

“As an apple for buyer, the market sucks. The mortgage rate is 30% higher (6.5% vs 5%), so a flat price is bad for buyer.”

Totally disagree. An overall cheaper price is more important thatn a cheaper mortgage payment. you can always refinance or pay in cash later.

CASH….CASH…..CASH….IS…..KING….people are getting way too analytical on the market correction…..people, understand that there is no cash right now….the Federal Government that just gave banks $ 700 BILLION dollars for a bailout, will only sit there for so long before they make these banks get off their hands and start giving people some F@*$%^G money……I give it 6 – 8 months before things get back to (“normal”) here…..and “normal” understands that it will be awhile before it gets back to the way it was, but in the meantime, 80% of that …” ‘Aint Too Shabby” !!!!!