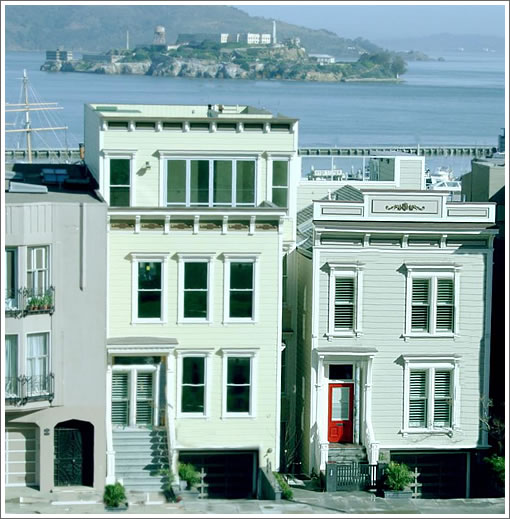

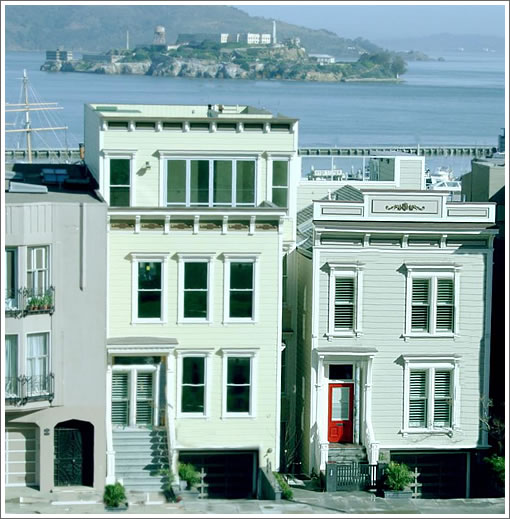

In 2004 844 Bay Street (the one with the red door) was a two-bedroom single-family home of two thousand and thirty-five square feet and sold for $1,550,000 ($761 per square foot). Having been completely rebuilt and remodeled, a four thousand and five hundred square foot 844 Bay Street closed escrow this past Friday (8/8/08) with a reported contract price of $4,600,000 ($1,022 per square foot). They were asking $5,249,000.

We assume no plugged-in person would ever make the mistake of confusing that 34% increase in the price per square foot with market appreciation (not that over one thousand a square foot is anything to be sneezed at). We have to note, however, that industry statistics will.

∙ The Same House In Address Only: A Contemporary 844 Bay Street [SocketSite]

Wait a minute, why is not going from $761/sqft to $1,022/sqft NOT a 34% increase in value? Isn’t that the whole point of price / sqft, to smooth out comparisons based on absolute price changes?

In fact, one can argue the price increase is even greater since the bigger the home up to a certain point, the cheaper it is on a price/sqft basis. Houses in the 1800-2600sqft mark should probably trade at the highest p / sqft, and the p/sqft should definitely start declining after 3,000sqft.

Bay:

numerically you are correct.

however the house was completely rebuilt.

so it’s old price was $761/sq ft for an old building. The new price was for an essentially new home.

This is the problem with discussing “appreciation” in Real Estate. Often the appreciation isn’t appreciation, rather increased valuation due to increased capital outlay.

for instance: Does my old Nintendo Wii appreciate if I sell it to you for $100 and you later sell it along with 50 games and 2 new controllers for $200?

“We assume no plugged-in person would ever make the mistake of confusing that 34% increase in the price per square foot with market appreciation (not that over one thousand a square foot is anything to be sneezed at). We have to note, however, that industry statistics will.”

Will all of you boneheads wrangling about price per square foot over on Caselli please read this – I don’t think I’ve ever seen two sentences better put to rest such a ridiculous bunch of nonsense.

Industry statistics that are shown on this site will not show this house at all. Those charts clearly state that don’t include anything where the price change is too high for any reason. Be it remodel interior, additional square footage, or an actual large appreciation.

So what “industry statistics will”?

I’ll give you my own example of “appreciation”. My house has appreciated. However, I have put a LOT of money into my house, and likely will need to put a lot more in.

Off the top of my head (VERY GROSS estimates)

-complete bathroom redo (that we did essentially ourselves). It cost around $6k (but it’s stunning…and a weeks and weeks of “sweat” equity. I will never do that again)

-new closet system in one of our changing rooms (cost about $1.5k?)

-in another room, ripped out the wall and turned a nonfunctional 1-door closet into an awesome 2-door closet. About $3500-4000

-changed out light fixtures throughout house($1k)

-new appliances ($2k)

-new front door ($1k)

-new entryway to back door (re-tiling, etc) $1500

-new sprinkler system $2500

-new landscaping (only god knows, at least $3k-4k)

-remove asbestos from boiler and boiler room $2k

-new boiler: $6k

I will soon need to reside ($25k), new roof (???), and fix garage ($3-4k). I will also soon need new windows (they are 100 years old). About $8k.

Also we’re talking about redoing the kitchen (cosmetic, about $15k) and basement ($10k) and add new bathroom ($15k)

so I’ve put around $32k into the house, and will soon NEED to put another $40k in, and likely will put another $40k in for “enhancements”.

so just to break “even” I have to sell my house for $30k more now, $70k more if I do needed repairs (that don’t even raise the value of the home) and $110k more if I do the cosmetic stuff I wanna do.

so let’s say I do all this work, and then sell my home for $110k more than I bought it for… then the math says my house “appreciated” $110k. And it did. But it’s a different product than I bought. (my house is night and day from when I bought it)

So what “industry statistics will”?

MLS statistics (if it was sold off the MLS).

If this sold using the MLS, then the NAR will use this data point to calculate Mean/Median values for SF and this neighborhood. Both last sale (pre-remodel) and this sale (post remodel) as example, it would be included in the data that Fluj/FSBO post on here at times.

one could argue that for every one of these types of homes (sold after large remodel for way more than pre-remodel) there is an equal sale of another property that sold after falling into disrepair, so it all cancels out.

however, as we all have seen, the houses that sell TEND TO BE the houses that are in the primest of locations on the primest of blocks in the primest of locations. Thus,only the cream of the crop sells and gets into the data. The not so prime properties don’t sell, so they aren’t included in the data.

this MIGHT BE in contrast to the height of the bubble, where EVRYTHING sold. People would put the worst thing on the market and it would sell with multiple bids (only a slight exaggeration).

in MY OPINION: the median/mean numbers UNDERSTATED market appreciation during the upturn (because you had a lot of crap properties selling which brought DOWN the median and mean) and it is OVERSTATING The market appreciating (or understating depreciation) now, as only the best of the best sell and the not-so-good are left out of the data pool.

it’s the so-called “mix” argument. difficult to prove however. But the Caselli block might be an example. (it’s also very difficult to overcome by the way… and I think all parties try their best, Case Shiller, OFHEO, NAR)

I personally know that my house appreciated FAR MORE than industry statistics said it did during the runup. how do I know? because industry statistics said my neighborhood went up 90% (almost doubled) from 1997-2003 but my own personal house went up 151% (up 2.5x) during that time (based on it’s selling price). And my neighbor’s house went up 192% when neighborhood statistics showed 95%.

now my neighborhood is theoretically down about 5-10% from peak… but there are houses around me that are for sale for 10-20% below peak that are just sitting there. but not selling. And the one house that did sell is a tear down remodel… that shows up as appreciation in the stats.

the mix can also work differently if there are lots of foreclosures (such as in SoCal) IF the foreclosures are added to the data (often they are excluded though)

back to the house:

despite not selling for $5.2M, I think this sale does show some market strength at $4.6M (assuming it’s “clean”… no kickbacks or cash back or free Maserati or something)

Nobody thought this place could command $5.2M. That was a wishing price at best. but $4.6M is a strong showing IMO.

I have had a hypothesis that we may see divergence of the market with the high end properties continuing to sell while the “pseudo luxury” markets and lower do poorly. the so-called “Brazilification effect”.

But I haven’t been sure as to what the magic number is for the “rich” people?

to me, it looks as though the current sweet spots are in the above-$3.5M places, and also that 1M to 1.3M SFH Noe sweet spot. others have a better feel for this though. fluj? FSBO? others?

You are all neglecting to address the clear market shift that happened in late 2004. This house certainly appreciated. Even if it were the same house apples to apples, does anyone really think a 2 BR 1 Ba on Bay would sell or 761 a foot now? Now, did it shift 34%? That’s another story. Rotely disregarding something that is north of 1000 a foot is also another story. I think we’re talking about three or four different trends here actually.

@ex-SFer re: sweetspots,

I honestly can’t call it. In my opinion the 850K to 1.2M sweetspot is going to cease being a sweetspot very soon if it already hasn’t. (This is due to new conforming limits coupled with 25% and 30% down lending requirements.) One point two to 1.5 has also been one for quite a while and perhaps still is. But where does such a home exist? No longer in A- or B+ ‘hoods, IMO. So will the 1.2M to 1.5M zone continue to spill over into Glen Park, Bernal, Inner Parkside, Richmond, etc? That has been the trend. If it ceases then we can start to talk about a wholly new era, completely detached from the past few years. We’ll see.

Yeah ex SF-er, the “rich” are different – but I’m not sure that they are getting a lot for their money with some of these recent sales (especially with this one on Bay St). So far in 2008, there have been 30 single-family homes that have sold for more than $4M. The mean price per sf is about $1,100; however, with a big caveat that 17 of the 30 sales showed no square footage data and, of potential great significance, 14 of the “selling” prices contained an * (which indicates that the true selling price is not being disclosed and the listing price is being shown as the selling price). There are also 24 listings at greater than $4M in active or pending status.

The pace of $4+M sales seems to be pretty constant in recent years. Here is Jan 1 – Aug 10 volume by year:

2008: 30 sales, about $1,100 psf

2007: 36 sales, about $1,100 psf

2006: 26 sales, about $1,200 psf

2005: 31 sales, about $1,100 psf

2004: 22 sales, about $1,100 psf

The mean psf seems constant too – but again about half the records have * selling prices and half are missing the sf data. (Some have both features – so only about 1/3 of the records have a “good” selling price plus sf data).

Not to re-open the discussions on square footage and masked sales prices – but the integrity (or at least the usefulness) of median price and price per square foot comparable data is really compromised in the high-end market.

Here is the key point that everyone really does seem to be missing. There are two types of homes in San Francisco.

Type A: Homes in some state of disrepair.

Type B: Homes in some state of modern upgrade.

Type A homes will sell for 25-40% cheaper than Type B homes. Type A homes are becoming more and more scarce.

Type B homes are what actualy buyers in the market people “want” and there are a lot of people that can afford them.

So why we all sit back and talk about how pices mayrevery back to 2004 levels — a home upgrade from “A” to “B” will obviiously be more valuable.

At some point in the next 10 years there will be very fiew “A” homes left and the the “B” averages will become the standard for pricing.

This happened in NYC and you continue to see west village 800 sqft 1 bedrooms that are massively modernized going for $1100-1200+/sp ft. There just aren’t that many Type A homes in NYC left so there is no “fixer” market.

This is happening here. Also, the more scare Type A homes become, the smaller the gap between Type B homes.

Anyway, back to this house in particular — this home is forever changed and it’s former Type A statistics are only relavant to other Type A comps. You now have a new Type B comp. That’s all really.

FSBO,

Excellent information about absence of square footage data in the MLS for 2008 sales in this segment. 17/30 means that more than 50% of the data points are missing.

Additionally, only slightly less than 50% (14/30) have masked selling prices. Again, it is probably reasonable to assume that most, if not all, of these asterisked listing prices are higher than true sales prices.

I’d be interested – if you had the time – in knowing the trend of these “missing” data observations. That is, what % of sales in 2004 contained no square footage data and what % asterisked sales prices, and the same for 2005, 2006 and 2007. An increase in these “omissions” would be consistent with a systematic attempt to distort statistics. With so few data points, it would not be tough to do (but I’d question whether it would matter much or be worth the time at this presumably somewhat value-insensitive part of the market).

Even given the dirtiness of the data, it is a bit surprising that there has been no trend increase in $psf in this segment since 2004. I suspect that with a little sleuthing, we may be able to discern a downward trend, as we did for those sales on Caselli.

If you don’t have the time, that’s ok. This is the type of analysis that I will do when I get access to the database.

Minor editorial nit: “four thousand five hundred square feet” – c’mon, don’t try to be pretentious. Write 4500 sq ft and make it easy to read. I don’t know of any publication that spells out numbers higher than 10 or 20. Certainly not “four thousand five hundred.”

Satchel – Here are the data for the Jan – Aug sales of $4M+ single-family homes:

2008: 30 sales, 14 *selling prices, 17 missing sf

2007: 36 sales, 11 *, 16 missing sf

2006: 26 sales, 11 *, 9 missing sf

2005: 31 sales, 7 *, 16 missing sf

2004: 22 sales, 8 *, 12 missing sf

In my previous post with the mean price psf by year, I made no attempt to search for missing sf data or “adjust” the * selling price. As with selling price, the median price psf is probably a better measure than the mean. Median price psf is not directly available from the MLS system. There is obviously a big variance among homes in this market (eg, 2845 Broadway is listed at $65M with 20K sf, 830 El Camino Del Mar is listed at $18M with 4K sf.)

Eddy,

I suspect there are more type A homes than you might know. Could it be that when a home is presented to listing agents, the agents tell the seller to upgrade and that the upgraded home will fetch a high enough price to make the upgrade worthwhile? Or could it be that there is an incentive for people to locate the non-renovated ones and grab them to flip them? That works in a strong lending environment where money for purchase is cheap and easy to get. Why bother buying something and renovating it yourself when you can just get a higher $ loan and have it done for you.

When everyone needs 20% down, price may be more of an issue, and so people who have un-renovated homes to sell will be told not to bother renovating: the goal will be to keep the price as low as possible, or as fluj noted, under the jumbo-conforming limits. That can change the way properties are marketed, as anything over the limits requires the buyer to come up with a higher down payment.

Finally, stuff that’s 10-15 years old is now starting to look dated. So a property that may have appeared to be in the renovated camp will soon fall in the older camp.

Thanks FSBO. Doesn’t really look like any sort of trend – there’s really too few observations to conclude anything.

Still, I for one am actually pretty surprised that reported $psf is flat since 2004. Again, though, I don’t think it’s possible to conclude too much, especially in this segment where as you note variability is high and numbesr of data observations are low.

Eddy – your A/B summary matches what I’ve been seeing as well. I’m part of the minority looking for a type-A who’s not a contractor or flipper and got outbid on those pros who could accurately compute and produce profit by upgrading to a B.

The movement from A to B isn’t irreversible. B’s gradually decay back to A’s over time and perhaps because that rate is so slow compared to flipping A->B that this reversion is imperceptible. Prop 13 has a lot to do with this slow reversion.

The really well done remods will depreciate/decay quite slowly. However the superficial flips will rapidly revert to “A” properties. I’ve seen plenty of cases where moisture intrusion problems were simply masked by paint, flooring, or sheet rock. The original chronic moisture problem persists but the new owners of these properties won’t find out until a few wet seasons take their toll. I predict that there will be many new homeowners who find that their “MBR down” is not livable and really only good for storage for stuff that can handle dampness, much like the basement it originally was. Unfortunately enough time will have passed that there won’t be any recourse to recover damages from the contractor or seller.

Is it just me, or does everyone else read Sparky’s comments three or four times and still wonder what the point is…….

I don’t want to sound mean, I just don’t understand.

My only comment on this thread, was questioning the editor’s note to start the article that industry statistics will count this as appreciation. My point being that Case/Shiller, for example, won’t count this data point at all. It appreciated too much, therefore is ommitted from there data (per there formula).

Ex-Sfer answered the question with MLS and realtors. I think that they would show the square footage change, and therefore it wouldn’t show as pure appreciation there either.

Again I will ask if anybody on here could actually say they think this house sells for $761 a foot today if it had never been developed. No. More like 900. There is your appreciation.

Fluj, do you have pictures of the interior before the remodel? If so, could you provide a link? If not, what are you basing your opinion on? I’m not sure how you expect people to guess at prices if we don’t even know what the place looked like.

No, I don’t. Again it went for 761 a foot, gmh, with big Alcatraz views out the back. The North Point properties behind and below are quite a ways downhill and Alcatraz would have been unobstructed. Plus the lot is 30 X 137.5. So imagine a hovel. Think a corrugated tin quonset hut sells for 761 a foot, there on that lot, now? I don’t.

Fluj, Okay, you answered your own question: none of us actually has any information at all, so no one is willing to make a totally uninformed guess. Incidentally, if the place wasn’t nice, having a tin hut could increase the sales price of the lot, since it could cost less to just start fresh rather than to totally gut/demolish the old place.

Plus a tin hut would naturally go for more $/sq ft since it has so few square feet. The square footage of the structure is basically irrelevant at that point (if you’re planning to gut or demolish), so it doesn’t even make sense that you’re trying to focus on it as a statistic.

I actually found pictures of the property before the last sale, from 2003. It looks like your typical cosmetic fixer. I see what you mean. Hazharding an uniformed guess — why do it? That makes sense. The thing is that my question was more rhetorical in nature anyway. There was a tremendous runup from 2004 to 2008, anyway, and that much isn’t really debatable. Here’s another. Would a high 4Ms property on this stretch of Bay even have existed in 2004? I don’t think so.