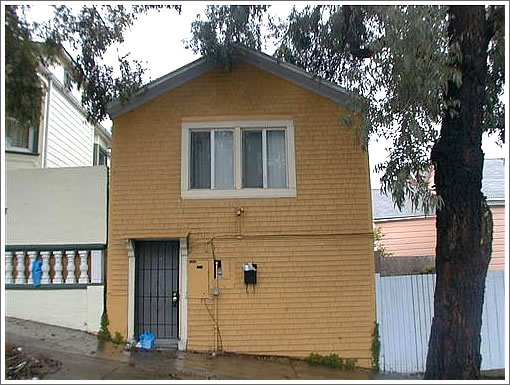

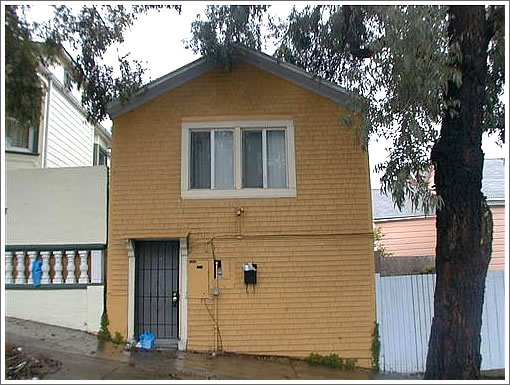

Eleven months ago 1487 McKinnon Avenue, a single-family home in Bayview, hit the market for $579,000. After two weeks the price was reduced to $559,000 (with the listing advertising “below market value!!” and “wont last!”). And seven months later it was owned by the bank and back on the market for $369,900.

Today? $269,900 and still seeking a buyer (other than said bank).

∙ Listing: 1487 McKinnon Avenue (2/1) – $269,900 [MLS]

∙ Reductions On Two Two-Bedrooms Approaching Two Months [SocketSite]

∙ Back On The Market And Below “Below Market Value!” In Bayview [SocketSite]

Well, here’s your chance for 2000 prices!

Of course, it’s not Noe Valley, so maybe you want to keep renting…

Looks like a teardown – I wouldn’t value it for much more than the land.

This would make for a lovely drug house.

That’s almost affordable!

I’m thinking of all these delusional landlords in the Bayview have been posting their houses forever at 450-550K. 200s is what it’s worth. I’ll keep waiting, thank you.

Then Bernal Heights will go back to the 300s where it belongs (most houses there need serious work), the China Basin flipping condos will go down to the 3-400s and the domino will all fall from there.

2000 here we come.

Neighbor and Realtor,

Not sure what its original use was. The street level with living room, eat-in kitchen, and bath have really short ceilings. Say about 7ft. So may not have been original living space. Upstairs only has 2 bedrooms and nothing else. It is very strange.

But it is built on the very end of a decent lot. So it really is lot value. And evidently not $269K as it has been at that price for about a month now.

My guess, it will become a garage on the lower level, with rooms above. Add on more house that what is currently there going down the slope of the lot. A 2 story structure would have pretty decent views.

Quiet street and not bad area for Bayview. Not Noe Valley, but not right next to the projects either. Offer $200K do some negotiation and build a nice starter home.

Hmmm… $269k does that come with a bullet-proof vest included? Also I’d like a credit for the $5000/year that my car insurance will cost while living in that zip code.

That, or we could do the rent/buy and figure out this plae is worth about $90k to anyone with the stomach to actually go collect the $600 rent every month.

People laugh because it’s ugly and in a ‘suboptimal’ neighborhood….”This could never happen in MY part of town”…right?

If PropertyShark is correct, purchased in 5/04 for $353K, reverted to the lender in 10/07 with a balance of $400K. Before that, it sold in 2000 for $200K. dub dub jokes, but this place really is approaching its 2000 price. Probably already there taking inflation into account. And there are many like it in the southern parts of town.

Hey, I agree it’s not the best area. But let’s not forget that gentrification works through financial osmosis. As areas like this one (and Sunnyside/Excelsior) get markedly cheaper, there’s less fueling the fires in Bernal, Glen Park, and Sunset. I’m not saying Marina trustafarians and the Noe stroller crowd are going to flock here. But a 25% hit to prices in Bayview will affect nearby parts of the city.

Of the 59 SFRs sold in Bernal Heights between 200 and 2001, only five were sub 400K. They were all earthquake cottages and decrepit shacks, and small. The nicer homes were selling for in the 7s and 8s and into the 9’s. The average was mid 5’s.

I’m beginning to understand that everything Fonzi says is hyperbolic. AAaaaaaaaaaaaaay!

Stop the presses! This place still has a lot of air in it to go back to 2000 prices!

PropertyShark.com has this info:

11/2007 – Repo by Bear Stern’s for 400K

8/2005 – Refi 468K (2 loans)

5/2004 – sold $353,000

2002 refi

12/2000 – sold $200,000

5/19/2000 – sold $162,500

10/25/1999 – sold $95,500

Refis, resale, repo. People who probably tried to live off the bubble. The market in one (ugly) nutshell.

So if it sells for 269K then it has seen a 282% valuation increase since ’99. I think you’ll find that that is fairly typical for Bayview. Like I’ve said before on here, SF was bookended. Both the top and bottom saw into triple digit appreciation. The middle? Not as much.

fluj, I’m not sure I’m following you with Bernal Heights.

1998-2000 prices were cheaper than upper Noe that was hovering in the low 400s. Noe will not go back to these levels, but Bernal Heights WILL.

I really tried to like the neighborhood but it lacks in transportation/commerce/neighborhood life compared to close by Mission/Valencia corridor. OK, you get to have a view, but you’re surrounded by ugly corridors (55MPH San Jose, 24/7 day workers at Army/Cesar Chavez with the Noe 101 people rushing thru and the 101/280 mess/stack) that make it a car-only living place.

Hey, but Bernal is gorgeous to look at from my deck.

So whoever bought it in 2004 for 353 got the highest and best use: the opportunity to pull out $115,000.00, use it to live there rent free for 3.5 years and then walk away.

They won!

What a country!

Wow, that’s cheaper than East Palo Alto! That’s hilarious.

Extra bonus: You only have to walk 2 blocks to get your crack and heroin!

And this is at a low risk – only FIVE drug arrests at the corner of 3rd and McKinnon in the last 3 months! Sure, the numbers go up if you include the other nearby intersections at 3rd, but who’s counting?

Bayview – what a dream!

The most incredible thing in all this Ponzi Scheme is that a bank actually accepted to do a refi for 468K in 2005. It handed up on Bear Stearns books which now tries to short sell it for whatever it’s worth.

Who will pick up the tab? Taxpayers maybe.

Lot Value would imply there is value to the lot. Anybody know anything about the underground toxic plume from the old navy base?

There’s nothing to “get.” First you said 2000 levels for Bernal were in the 300s. You were flatly wrong about that. Now you backpedal to ’98-2000.

You are going out on a limb completely here. You’re calling for a big fallback yet you were totally wrong with your first missive.

Dislike Bernal. No biggie. I agree the infrastructure is flawed. The streets are too narrow. Many of the homes need a lot of work. Not sure about “no transportation.” North side can easily walk to 24th Bart. Extreme South side can walk to Glen Park Bart. Many can use the Mission buses.

Consider 18th st. in Potrero versus Cortland. Not much difference, right? Now consider all of the restaurants on the East side of Mission between Precita and Cortland. Bernal has plenty to offer. You really can’t get a house with a view, with a neighborhood feel, a yard, and a garage, that’s fairly central, anywhere else in the city for less than you can in Bernal.

This is way up the hill from the Navy Base, so the toxic dumping there is not going to be a big issue. With a decade or two of serious gentrification this area could be nice as it is a dead end street up a hill on the sunny side of this hill. Location is everything, though. In my opinion this spot is currently extremely seedy and awful to the point of being unlivable. It is probably less than East Palo Alto because it maybe less safe, or at least less pleasant. Seriously, just driving around there means getting a cultural education. Yuck.

It is nice to see prices getting low quickly, though. This correction is happening very fast.

On the sunny side of the City, I meant. My errors, let me show you them.

“So if it sells for 269K then it has seen a 282% valuation increase since ’99.”

269K would be an increase of 182% since 1999 not 282%.

Too bad you couldn’t time travel back to 1999 to buy it, sell it in ’04, and fast forward to spend the money in ’08. You know realtors are desperate when they require a flux capacitor to flog real estate.

So this property has been marketed as “Below Market Value”, but I guarantee is sells for exactly market value. No more, no less.

A flux capacitor to “flog” real estate. Um, no. You know who’s flogging this? Socketsite is flogging this.

Why is it “the realtors,” Guest? I’d say the person who cashed out at 468 and change is at fault here, along with the lender(s).

Anna, yeah, i just divided quickly and forgot the initial sum’s value. You’re right.

OK fluj, don’t lose your cool. Chills are supposed to stay cool.

I know you like details, then let’s go to details.

Bernal is not “Central” by any means. Central means close to the center. Duh. Now, what is the center?

In SF, the center of gravity lies somewhere along upper Market in the 21st-22nd street vicinity. Or maybe it is the job center i.e. Financial District and the Civic Center. I think the latter would be a more common definition. Little Italy is Center. Nob Hill is Center, Tenderloin is smack in the center. But Bernal is not center. Or is there a big unknown Master Plan to attach a big rope between the Etrade building and up the Bernal Heights signal and have all the neighbors pulling? That would make it Central. Everyone makes mistakes.

About the 98-2000. 2000 is a round number. I believe property prices belong to the 1998 prices adjusted to inflation. Then 2000 is a good proxy to where I think things are going, just like 1997 in Paris was about identical in prices to 1984. Ouch.

I might be wrong. But we’ll see. I love bargains. Realtors don’t.

Anyhow. Let’s look at a sample:

518 Ellsworth St. For Sale at 995K. Sold 1.015M in 11/2007. sold for 265K in 6/98. Pretty close. And 1M is 20%+ over the BH median.

I forgot, you don’t like 1998 (I did my best deal that year though).

Oops. I meant shill, not chill.

Did you or did you not say “2000 here we come” to start? You not only didn’t say 1998-2000, but you accentuated your 2000 statement. So go back to ’98 now if you like. But you were wrong.

You’re out on a limb, man. Bernal hasn’t even taken the slightest monetary hit yet. YoY March SFR numbers are nearly identical.

Truth be told the geographic center is atop Upper Terrace street. It is marked by a monument. What I said was “relatively central.” Bernal is the last piece of relatively central high ground that is not completely gentrified. That’s a fact. I mean, you can argue against that if you like but few others would.

I myself love a bargain. Realtors with buying clients ABSOLUTELY LOVE bargains.

518 Ellsworth, which isn’t on the MLS, was priced at 995 last fall. It went for over. If they’re selling it now they’re using the same tactic. And when it sold in ’98 it was 700 feet smaller and a fixer.

You just called me a shill? Please. You’re full of shit.

These realtor fights are pointless without pictures. Please, take it to YouTube.

Calling someone who uses a pseudonym, someone who has never offered a sales pitch to any individual on here, a “shill” is pretty idiotic. The guy just overstates everything and then gets mad about it when you call him on it.

Insults, now.

Not even worth the response.

I took “shill” as an insult, as it was intended.

yea, ya gotta wonder why we put up with crap from fluj. such a hot head.

well, he is a realtor, so this does make sense.

A comment I loved was that “Realtors with buying clients ABSOLUTELY LOVE bargains.”

When you have nothing else, sure. Something is better than nothing. But bargains are something to avoid for Realtors in general.

And why is that?

6%. This is why.

The more you pay, the higher the commission. Salesmanship 101. The only person on your side is yourself alone. The rest of the industry is paid in fixed or in proportion to prices.

Now, with mortgage lenders in trouble and the money spigot screwed down to a trickle, maybe lenders will start fighting alongside the borrowers to get more deals done with smaller loans. One can always dream.

Oh my, must we troll here like they do elsewhere on teh internets ?

C’mon : insult fluj and he will defend himself. Is that so surprising ?

I usually disagree with fluj, but I’ll never fling insults his way or toward anyone else.

This name calling distracts from the important issues. If you have a problem with what someone says, attack their statement, not their person.

Fluj is like Chris Daly, a lot of people keep attacking the guy but he is still around because the people attacking him are just as unlovable.

I disagree San FronziScheme – a salesperson can make a lot more if a slight commission reduction results in much higher volume.

Closing a deal quickly enables an agent take on another client. It matters little if the sales price and the commission drops 10%.

Milkshake speaks the truth. And a smart realtor will know that repeat business is more valuable than 6% of an extra 50-200K on a single deal. I’ve been through 4 transactions with the same realtor. If and when I buy or sell next, I’ll go to her. She knows this, and acts accordingly.

I too generally disagree with Fluj on future outlooks (sorry if this is piling on!), but I think he is one of the most valuable posters on SS…

(A) He definitely knows what is going on in the market right now, what is selling and isn’t, and is willing to share that data. Very helpful to everyone, no matter how you interpret his data…

(B) He sparks conversation, leading to comments from others, more debates and general input, which is also very helpful if and when it is not insulting.

(C) I have never seen him ask for clients or otherwise act inappropriately or without integrity.

So, let’s not get carried away and take it all out on fluj!

I also think that it is pretty clear that realtors do or should love bargains. Like anyone else that benefits from sales volume, price certainty and a stable market are the key. If bargains are out there because prices have stabilized, buyers will move in from the sidelines, increasing volume to the benefit of realtors.

With all that said, I think that Fronzi generally adds a lot as well.

I really don’t understand why crap like this gets posted, other than to stir the pot. I suspect not one single person who reads this blog is remotely interested in buying a dilapidated crack house in the worst neighborhood in the City. But here it is, with 30 comments about what a harbinger this is or isn’t. I truly wonder what this site is about sometimes.

“Dave” – Part of the RE bubble was a beginning wave of gentrification into Bayview. All of this stuff is connected and I’m glad that the editor sees fit to track these properties over the long term.

Milkshake of Despair,

Agreed. The Bayview tells a lot about one end of the market and it is connected to all the rest. Actually I have bought a few places in this type of neighborhood as rentals in another city and another country. They were great rentals for a few years when purchased right (think 10Ks, not 100Ks). Sold them when the place got gentrified. I expect to make great similar deals in the next 5 years.

Fluj is a good contributor and I am a pretty new guy with bad habits. I’ll learn to be more civilized and try to chill out constructively. Shill is not an insult in my book, just a social function that has a big part of the great game of the free markets. He is probably an enthusiast. But he’s constructive, if sometimes a bit too upbeat.

About the “Realtors love bargains”. They have had an extraordinary roll and it’s hard to accept the times are changing. Realtors have to stop thinking “high price/high volume” because today we have either low price/low volume (bad) or high price/low volume (so-so). But SF is definitely stuck in the latter when Realtors are dreaming of coming back to 2006. I wish we were in the former situation, but I have a vested interest in this. I always love bargains.

People. 51% seems a perfectly reasonable discount on the property if any ‘community preservationist types’ have been seen snooping around.

If the preservationists take to this baby with the same enthusiasm they did to the equally uninhabitable property a few blocks away at 900 Innes.. there goes the your tear down option.

I’m only half kidding when I say: Watch them pop-up claiming to have found something ‘historic’ about the dump that justifies a Landmarking campaign – (see “900 Innes” at YouTube.com)

Fonzi,

Not to beat a dead horse, but the criticism you levy upon realtors is the wrong one. They aren’t all about getting the highest price on the buying side (or sometimes on the selling side). What they are all about is getting the job done … many realtors are loath to have their clients jump out of something. When that is what they should do, sometimes. They are to be an agent, not simply makre sure that the transation moves forward.

There is your criticism. NOT, “all realtors try to sell people on big money, because bigger X 5% or 6% = more.” Further, 1,000,000 X .05 X .5 = 25,000. 1,100,000 X .05 X .5 = 27,5000. That 2,500 is not worth potentially losing a client.

No, it is a zero sum game. Finding a bargain for 40% less means getting paid with relative ease. Any realtor who has been working with people for two months would leap at that opportunity. And again, referrals are paramount. It stands to reason that the buyers would be complimentary from that point forward if they felt they obtained a good deal. They would probably tell their friends/relatives.

@Fluj:

“That 2,500 is not worth potentially losing a client.”

This analysis misses the point, IMO. It’s easier to make a sale when you’ve got a buyer who’s willing to bid an extra $100k to buy the house, whether it’s necessary or not.

That’s why realtors don’t have an incentive to keep sale prices down. It’s the classic principal/agent problem.

And the whole “referral” argument is a red herring, since it assumes perfect market information–the buyer must 1) realize he’s overpaid and 2) affix responsibiltiy to the realtor instead of the market. Is it any wonder we hear so many stories with “OVER 15 OVERBIDS!!!!!” A “winning” buyer feels almost lucky to have put in the highest bid.

Well, IMO I am spot on. (You also ignore a couple other points I made.) Any realtor will try to get the property for his/her client for the smallest amount possible. It is up to the client to determine what the limit is. It is up to the realtor to try to determine what can and will take it down. You are not hearing abour 15 overbids these days, either.

Foolio – I agree that it is in the buyer agent’s interest to coax their client to bid higher to increase the odds of closing the transaction. The same works in reverse : seller agents are motivated to convince their clients to accept a lower offer if that’s what it takes to close.

I’ve got a hunch that seller agents are expending increased effort this year to convince their clients to lower their sales price expectations to counter the bubble psychology of 2004-6. Sellers who insist on living in the past might end up holding stalefish. Are there any seller agents out there who can comment ?

@Milkshake:

“The same works in reverse : seller agents are motivated to convince their clients to accept a lower offer if that’s what it takes to close.”

Good point, although over the last 5 years this hasn’t been as much of an issue, because of the low-ball pricing strategy used by many sellers and their agents.

Fortunately for me I guess I had a stupid realtor because he actually advised me against bidding higher on a property. We submitted our bid then heard that someone else had submitted a higher bid right before the deadline on our bid expired. Our agent advised against upping our bid and to continue looking. I guess he hadn’t got the memo about only looking out for his own interest and instead helped us take another month to find a place we liked better that cost less and earned him a smaller commission.

Two men shot dead in San Francisco

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/04/19/BAA8108MB1.DTL&tsp=1

Nice, someone was killed right in front of this place last night (1500 McKinnon).

I attempted to buy 13 different homes in Bayview in 1999 and got overbid each and every time.

I wanted an SFR near the UC development site in good weather with parking and a yard, for a price less than a condo in hayes valley.

No more that 2 blocks off of Third. Loved Quesada Street, Newcomb and Lane.

Saw lots of interesting properties that I could not afford.

I was going to get an extra dog for security.

.There are still some beautful Victorians out there just waiting to be rehabbed. Its too bad the banks wont lend the money anymore. The only money going there is mutli family developers like Lennar.

That is not what that neighborhood needs, it needs regular people talking back those homes one by one and staying put and putting a healthy face on a crime-challenged community.

Take it back one block at a time. I still love Quesada. Bayview Rules!

This property was reduced again today. Now down to $214,900.

You mean the murder didn’t help sell the property? Surprising!

Not that Zillow is the benchmark of accurate appraisals, but their zestimate for this house is now $499K. Down from the peak of $618K.

This is a particularly distressed property : bank owned, sub-par house in a sub-par neighborhood, and recent bad news.

I think this one may have reached the bottom. Almost back down to its 2000 sales price.

Looks like John was right.

Bottom?

If the gang wars are the only action in this street, they should PAY people to OWN the place.

No good deal is worth risking your life.

To support my assertion that realtors will advise their selling clients to lower their expectations, check out this post from Luba : http://www.lubasf.com/blog/san-francisco-home-sellers-its-time-to-get-serious.php

She takes a practical position and an example that realtors don’t necessarily try to push prices upwards at all times. In reality choosing realistic price points is the best for everyone : buyers, sellers, and brokers. Some here say that realtors would never shoot for a lower price because that directly impacts their commission check and therefore is a conflict of their interest. I say just the opposite situation is occurring right now : by advising a seller to shoot for a higher price, the property stagnates and the realtor shoots themselves in their foot, especially of the seller gets impatient and fires their agent.

We’re at an inflection point in the market. After years of shooting up, prices are trending downwards. Seller psychology is lagging behind reality and that momentum is resulting in inertia that prevents properties from moving. (yeah, that’s a lame physics metaphor but I hope you get the idea 🙂 Low sales volume translates into lower RE industry revenue. That volume effect has a much bigger impact on a RE agent’s paycheck than lower sales prices.

Great post, Milkshake. Could not agree with you more.