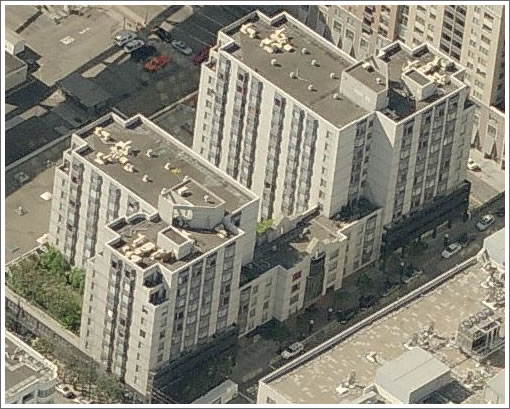

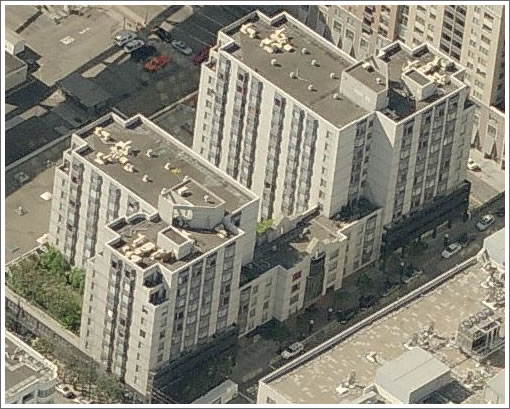

We don’t have any insight into the relative merits of these three. But we will note that 201 Harrison #924 hit the market last week at $375,000 which makes it the least expensive ($375,000 versus $384,900 and $435,000), largest (432 versus 410 and 347 square feet), and highest floor (ninth versus third and first) studio condo currently on the market within Baycrest Towers. Or in agent speak, “Priced to sell. Motivated seller.”

∙ Listing: 201 Harrison #122 (0/1) 347 sqft – $384,900 [MLS]

∙ Listing: 201 Harrison #324 (0/1) 410 sqft – $435,000 [MLS]

∙ Listing: 201 Harrison #924 (0/1) 432 sqft – $375,000 [MLS]

What about #1121? Penthouse 1-bedroom currently listed for $549K, or $826/square foot, so even less than #924.

Won’t you be my neighbor? 🙂

This building has top floor units with patios, but there is no penthouse and the roof appears to be reserved for contracted engineers.

Somebody actually wants to sell their studio quickly and is pricing it aggressively. That’s news?

Jimmy, it is still news. It was not long ago at all (less than six months) that the zeitgeist was you just needed to throw something on the MLS and wait for “multiple offers, bidding war, over-asking, Google millionaires . . .” We now have a 180-degree turn — a pricing war among sellers to drop the listing price and undercut each other in the hope that SOMEONE will buy my place instead of yours. It’s a pretty monumental shift in a very short time.

You’re right, Jimmy, this is not news. In any market, there have always been those who need to sell quickly, even if it means taking a loss or not selling at the wished-for price.

To Trip’s point, yes, the froth has mostly gone out of the market, and that probably is a good thing for everybody except speculators who had hoped to turn a quick profit on a short-hold strategy.

That said, despite the doomsayers on this site who for many months have been predicting steep (20-40%) declines in median prices for SF homes – no evidence of that.

Median price acceleration for SF city, having returned back down to normal rates where it belongs, continues its slow, steady rise in San Francisco city.

sanfrantim, I read that the data showed that $800k+ properties (the top tier of Case-Schiller, which would include anything in SF proper) rose only 0.8% yoy, which would be something like -2.7% inflation adjusted. Not exactly a slow, steady rise when inflation is taken into account.

This board has seen a half-dozen examples of properties where owners took substantial losses after transaction costs even over a period of two or three years.

To somehow fail to make a profit in a market that is supposed to have risen 25% since 2004 is pretty remarkable (as in, remarkably bad), don’t you think?

Yea, I would never advise friends to buy property if they plan to hold only two years. But then I’m not a gambler.

I think some of the communities included within the Case-Schiller index as “San Francisco” (e.g., Alameda) will not stabilize as quickly as the City.

November stats showed median prices for San Francisco SFH’s (based on 178 sales) significantly increased (11%) over the same month in 2006. See http://www.rereport.com/sf/

Granted, you cannot vest too much precision in median pricing numbers, and the Case-Schiller index, if one could isolate San Francisco, might be more predictive. But whatever numbers for SF you rely on, I’m just not seeing the market crash that some here have been predicting.

Well, if I’m going to leverage my entire lifetime economic output on one single asset… I want it to go up in value. A lot.

I don’t think I’m alone in that regard.

I’d not advise anyone to leverage their entire economic output on a house, only a conservative percentage of it.

Chances are, if you live in a place long enough, it will increase enough in value to at least be a hedge against inflation.

IMO, a house is always a home first, an investment second.

I find something odd about the rereport.com numbers. First, if I’m reading their chart correctly, the median price has fallen in 8 out of 10 districts in the city YOY. Only districts 1 and 2 showed gains. Furthermore, districts 1 and 2 accounted for 45 of the total 178 sales (25% of sales in the city). So prices have fallen in 8 out of 10 districts, which represent 75% of total sales, yet the city median went up by 11%?

Hmmm….not sure if I need another lecture on how medians are calculated….or if I’d just like to see the raw data behind the calculation for San Francisco overall. Something seems fishy. I’m also curious if their numbers include short sales, foreclosures, and private sales?

They also report identical median prices for SFHs and Condos…. look at the summary tables at the bottom of their report.

Furthermore, SFH prices are down in most of the city except districts 1 and 2. But district 1 (wherever that is) had only 15 SFH sales.

sanfrantim, here are some real numbers from the last week (from Altos Research) that illustrate why the median sales price data reveal nothing useful re the SF market.

There were 432 SFRs listed, thus 108 in each quartile. The median price for the 1st quartile was $1,849,500 (~3100 sft), for the 2nd quartile $884,000, for the 3rd quartile $699,000, and for the 4th quartile $599,000.

But the SALES were not distributed evenly — instead there were 26 sales of the highest-priced 108 SFRS, 20 sales of the 2nd 108, 15 sales of the 3rd 108, and 13 sales of the lowest priced 108. The overall median is going up because there are no sales at the bottom end of the market. Even if prices come down at the top (which they have), the median goes up because the top quartile represents a higher percentage of sales. Volume is way, way down at all levels, but the wealthy have not stopped buying to the degree that the not-so-wealthy have. This skews the median. It is meaningless until the mix levels out and we get some meaningful comparisons.

Trip– why would the mix ever level out?

All I meant was that as time passes, the ratio of high-priced sales to low-priced sales may (or may not) remain somewhat constant for a while rather than shifting in one direction or the other. If that were to happen (and in a very large sample or a locale with a fairly homogeneous mix, it should almost always be constant) then comparisons of present medians to past data reflecting s similar mix would yield a meaningful results. But comparing the present period to past months where the sales mix was quite different reveals little.

We could discuss (again) the relative significance of median sales prices, but I think most on this board have seen that debate already. Somebody apparently believes that such data is important, because it is consistently tracked and reported across all markets.

If the median prices for SF were way DOWN, I wager that so-called “bears” or “bubblists” on this board would be extolling the significance of median price data. If SF prices are going to decrease 20-40% across the board as some here predict, then that would be reflected in the median price data, notwithstanding some marginal skewing according to ‘mix’ or other variables.

To Trip’s point about “mix” – yes, the data shows that sales are more brisk at the higher price points. To substantiate the point that this skews a comparison with 06 to any significant degree, one would need data on the 06 “mix” to compare with 07.

Even taking Trip’s ‘mix’ point, what does the relative sluggishness of the market at the low price points tell us? Certainly it does not point to any trend of over-extended owners panic-selling into a down market. Yet, the low end is the portion of the market, we are told here, that has been most affected by subprime lending, defaults, and foreclosure activity. Apparently, these phenomena are not significant enough to show up as a trend here.

Though hyperbole is fair play here, I must point out that Trip exaggerates when he reports that sales volume is “way way down” across all levels. The numbers actually are 178 (11/07) from 224 (11/06). I think these numbers show that sales activity is returning to a more normal pace.

My thesis here consistently has been that 1) the froth is pretty much gone from the market (thank goodness) and the market psychology has changed (buyers and sellers waiting in a ‘stand off’); 2) the lower ends of the market — where the 04-06 run-up in prices was most profound — have seen / will see downward price adjustments; and 3) many, if not most, areas of SF already have returned, or shortly will, to normal (as opposed to speculative) appreciation. The November 07 sales data is pretty consistent with my point of view.

“Yea, I would never advise friends to buy property if they plan to hold only two years. But then I’m not a gambler. ”

Right now, I think it would be silly to buy unless you plan to hold for 7+ years. It’s hard to imagine that the prices will be higher than the current level in even 5 years.

I personally think we have 2 years of slow deflation left,1-2 years of steady prices before the market starts back to its normal 4-5% gain per year.

I think if you buy now, you would have to hold 6 yrs, on average, to break even.

i agree that the market will return to normal in the medium term and at a rate slightly higher than inflation. And buy to let is now a difficult game..