“While many accounts portray resetting rates as the big factor behind the surge in home-loan defaults and foreclosures this year, that isn’t quite the case. Many of the subprime mortgages that have driven up the default rate went bad in their first year or so, well before their interest rate had a chance to go higher. Some of these mortgages went to speculators who planned to flip their houses, others to borrowers who had stretched too far to make their payments, and still others had some element of fraud.

Now the real crest of the reset wave is coming, and that promises more pain for borrowers, lenders and Wall Street. Already, many subprime lenders, who focused on people with poor credit, have gone bust. Big banks and investors who made subprime loans or bought securities backed by them are reporting billions of dollars in losses.”

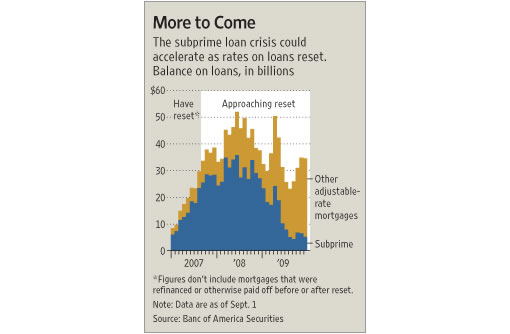

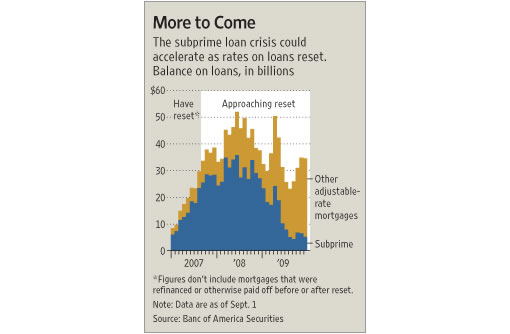

“Besides the $362 billion of subprime ARMs that are scheduled to reset during 2008, $152 billion of other loans with adjustable rates are set to reset, according to Banc of America Securities. The other resetting loans include “jumbo” mortgages of more than $417,000 and Alt-A loans, a category between prime and subprime. The latter category is the riskier, in part because it includes borrowers who provided little or no documentation of their income or assets.

The number of borrowers facing higher payments isn’t growing merely because the amount of loans with resets is higher. Another factor is that those with a looming reset now have a tougher time sidestepping it by refinancing or selling their home. “There is a large amount of borrowers who are in products that either no longer exist or that they no longer qualify for,” says Banc of America Securities analyst Robert Lacoursiere.”

[Editor’s Note: Keep in mind that in 2002 less than 20% of property purchases in San Francisco utilized interest-only mortgages [which are typically adjustable rate]. In 2005? Nearly 70%.]

∙ Rising Rates to Worsen Subprime Mess [Wall Street Journal]

∙ Interest-only loans meteoric rise in the Bay Area (May 2005) [SocketSite]

The real issue is that lending standards in 2006 were lower than previous years. This means that the default rate on these resets will be much higher than in previous years.

Anyone know the lifetime for Arnie’s giant mortgage put deal? I read a lot of hype but not many actual details.

Oh and when commercial collapses in 2008, this will be fun. Industrial in late 2008/early 2009.

Almost 70% of property purchases in San Francisco utilized interest-only mortgages in 2005? An astonishing figure; so basically 3 of 4 properties in The City were sold to buyers who could not afford to finance the purchase price.

This will be interesting. The question raised above is the size of the impact of re-setting rates on the very large number of SF buyers over the last couple of years who will face that situation. The obvious issue is how many will lose their homes because the cannot afford their new higher rates and cannot qualify for a refi. I can’t answer that question, but my bet is that it will be enough to further inflate SF inventory and depress market prices.

But I think a more interesting question is how many will simply walk away even though they CAN afford their new higher rates and they could qualify to refi. Given that a sizable number of SF purchases in ’05 through mid-’07 were I/O and no- or low-down, a significant number of these purchasers will be underwater in terms of equity come re-set time. Remember that if you walk away from your purchase mortgage, you really just walk away — the bank cannot come after you for the shortfall if the home sells for less than the amount owed. However, if you refi, you lose that protection — you are now personally on the hook for the entire mortgage, and the bank can garnish wages, etc. to collect it. So it certainly could make financial sense NOT to refi a mortgage that is now several hundred thousand dollars more than the home is worth, but to just walk away. Sure, that hurts your credit for about 7 years, but to unload hundreds of thousands in debt may make it a reasonable (and popular) decision. Even a big blemish on your credit report isn’t the problem it used to be years ago.

Trip:

Are you talking about recourse vs. non recourse loans? I believe the rule is that the first mortgage is a non recourse loan, meaning that if you foreclose they cannot come after you.

However, if you did an 80/20, or the like, the second mortgage is a recourse loan and the bank can still come after you for the money after a foreclosure. This is also true of HELOCs.

However, if you file for bankruptcy in CA, both the first and the second mortgages are discharged and the banks cannot come after you for either.

At least that is how I have come to understand it.

it is laid out, pretty clearly, here … http://www.wwlaw.com/forecl.htm

“the bank cannot come after you for the shortfall if the home sells for less than the amount owed.”

True, but the shortfall will be considered and taxed as ordinary income on the part of the former owner. And the IRS isn’t in the business of debt forgiveness.

Also, the non-recourse aspect of purchase money loans doesn’t apply in cases of fraud and I could see a legal challenge to any stated income loan that doesn’t match actual earnings.

Almost 70% of property purchases in San Francisco utilized interest-only mortgages in 2005? An astonishing figure; so basically 3 of 4 properties in The City were sold to buyers who could not afford to finance the purchase price.

We bought our home in 2003 with an adjustable interest-only loan and refi’d last year to a lower-rate adjustable interest-only loan. We could payoff the loan tomorrow and may pay down some of it soon (and have already paid down some of it) but would rather have cash sitting under the mattress in case something comes up.

Not everyone with an interest-only loan took that route because they can’t afford to pay the payments on a P&I loan.

I don’t personally see forced foreclosures running very high. Those that will want to walk away and rid themselves of overpriced real estate will do so. They paid very little down and have little principal invested.

However, I think there will be large numbers of people who take the offer from their lender not to reset and keep paying the teaser rate. Yes, they will be offered this deal. It’s much easier for the banks to keep the cash flows coming and heading to CDO’s and SIV’s than it is to foreclose.

Personally, I think people in the latter will eventually get screwed and are looking at this completely wrong. You made a bad decision, deal with it. Dump (or walk away from) the property and start again. Don’t stick your head in the sand and hope it gets better because “real estate in the Bay Area only goes up.”

You are not your house. You are not your Swedish furniture. You are not your deeded parking spot.

Scurvy – regarding your prediction of a commercial real estate collapse in 2008, is there much evidence of that yet? I thought that Sam Zell selling EOP was a pretty strong sign of a top, but it looks like Blackstone was able to flip many of the buildings for a big profit. Will someone be stuck holding the bag – or will office rents keep going up and allow these buyers to make some kind of a rate of return.

Very interesting…yes there were lots and lots of buyers purchasing homes with interest only loans including myself. While some were definately buying a property that they really could not afford, many were choosing this option for other reasons..namely to maximize mortgage interest tax write off on a larger purchase price.

And in the article and others have discussed, there is a substantial chunk of mortgages to be reset in the coming 18 months. I believe we are in the early stages of feeling the impact here in “the city”. Especially in the up and coming areas of the last few years. However I don’t think SF will ever have the massive problems that plague outer suburbs of SF, LA, and SD. Not to mention Vegas and other notables.

The one factor starting to look quite good is on the interest rate front. 3yr, 5yr, and 10yr bonds are all increasing and thus pushing down the rates. At some point this will spill over into the mortgage market with lower rates…although for qualified buyers with decent down, credit, etc. I think we will see some very good interest rates in 2008 with probably fed cuts as well.

Will be an intesting year to follow

Enough with the strawmen. Did anyone suggest that EVERYONE was going to go into foreclosure, no. Did anyone suggest that EVERYONE took out an I/O because they had no other choice, no.

Of course there will be plenty of people who will make it through the correction still in their homes. Just like in a recession if the unemployment rate goes from 4.8% to, oh let’s say, 7% well 93% of the population is still employed that doesn’t mean that there isn’t a lot if pain to go around.

When I/O usage foes from 20% to 70% in 3 years that is a sign of something wrong in the market place.

Click the link and read the Chron stories posted in ’05. One of the buyers was an unemployed tech guy who put 100k down on a 1 Mil home and was going to start up a consulting business. He went stated income no doc. So know he has a jumbo I/O ARM mortgage to pay and start up costs for a business.

The overall point here is the mid 2000’s there was clearly a mania in the housing market, just like the Tech Mania, just like the Tulip Mania. During Mania’s individuals stop behaving rationally and start taking on irrational risks. When the mania ends and the market corrects you see a lot of paper wealth destroyed and a lot of pain as the hangover sets in. This time the hangover being resets, multi billion dollar funds going poof, and likely a recession as consumers cut back on spending while they try and pay the new higher mortgage payment.

In the end, the markets correct and life goes on and different people are impacted differently. But that doesn’t mean that there isn’t plenty of pain to go around.

Recourse and non-recourse are kind of out-dated terms not really used in California. This state has an anti-deficiency statute that prohibits going after anything but the home where the loan at issue was provided for the “purchase price.” It should not matter whether the loan was for the first 80% or the second 20% of the price, but the terms of the second obviously come into play to determine whether it was “really” a re-fi.

Michael — good point about being taxed on the shortfall. That certainly affects the calculus. But I might reasonably choose to pay $84,000 income tax on a $300,000 shortfall (at 28% bracket) rather than take on a $1.3M mortgage on a home that is now worth $1M — still come out ahead by $200,000+. And yep, if you’ve defrauded your lender, they might come after you (but my hypothesis was that the owner was a solid, creditworthy buyer who simply might choose not to refi an asset that is now underwater as a reasonable financial decision).

True enough, the one problem here is many of the ARM adjustments are pegged to the LIBOR which has been increasing steadily.

*ok I won’t monopolize this thread anymore*

FSBO – Commercial always follows residential, and industrial always follows commercial. It’s part of the economic cycle. In stock terms, residential is small caps, commercial is transports, and industrial is well, the industrials.

Small caps and residential real estate = canaries in the mine shaft. First to rise and first to fall.

This reset chart looks pretty rough all the way through June 09. Do people expect to market to bottom by that time or will the bottom occur 6-9 months after the last major reset time? I was initially projecting Q1 09 to be a good time to buy, but this chart suggests that I should rent, save and invest even longer.

Q1 2010?

I can continue to rent for 2100/month for 2 more years. The same place would cost $4500/month to buy + 200K downpayment.

So i can invest the 200K, and invest an additional $2400/month for 24 months and then buy for 15% LESS THAN CURRENT PRICES.

i must talk to my financial advisor

“True enough, the one problem here is many of the ARM adjustments are pegged to the LIBOR which has been increasing steadily.”

Are you kidding me? LIBOR (BBA) has been dropping like a rock! It maxed at 5.8% in September and is now less than to 4.8%.

Trip – good points, but it’s not going to be at the 28% bracket as an extra $300K of ordinary income will bump the person into the 33-35% bracket.

it’s not only a question of which baseline benchmark is used (LIBOR, 10 year treasury, etc)…

it also then depends on the risk premium placed above the benchmark.

many people fully expect that LIBOR and Treasury may come down as the Fed and BOE start/continue cutting rates… however, many of us feel that risk premiums may go up, more than the decrease in the benchmark.

we saw this in reverse from 2003 to 2006. The Fed Funds Rate went up from 1% to 5.25%… but the 10 year treasury hardly budged, and mortgage rates barely moved… (due to very low risk premiums)

The wild card: govt intervention. (such as expansion of the FHA loan program, increased support of Fannie/Freddie, etc).

As for Commercial Real Estate, I believe that it’s done well so far, but there was a 1.2% drop last month. (the first drop in a time) That said, one month is NOT a trend… so we’ll have to see… typically, depending on who you believe, CRE follows Residential with a lag of 6-18 months… but it isn’t always that reliable.

http://online.wsj.com/article/SB119544317917297651.html

Michael — again, good point re taxable income on any shortfall. I guess a broader point is that if we continue to see price declines (or accelerating declines as most predict) many recent buyers are going to face a terrible dilemma when these loans re-set even if they have the resources to refi. The Hobson’s choice would be to (1) keep paying at the higher re-set interest rate for a home that is now likely worth significantly less than you owe; (2) refinance — which will either mean taking a new loan for much more than the home is worth or, more likely with stricter lending standards, coming up with a big chunk of change to put down (which will instantly vanish as far as equity goes) to get the lower rate, or (3) walk away from a lot of debt but have to pay a hefty bit of income tax.

I feel bad for those who will be in this position. But I also think that a fair number will choose number 3 as the lesser evil (hey, I sold a lot of stocks in 2002 at a big loss — sometimes you have to just cut your losses) and this is above and beyond those who have no choice but to bail because they cannot afford any other option. This re-set wave will have a not insignificant impact.

Prices are still high enough and the market is strong enough that anyone who expects to be in trouble when their loan resets can get out now with no harm done.

If they choose to wait until ARMageddon… then they will just have to suffer!

@ Michael – any idea if the $250K deduction for gain on a primary residence counteracts debt forgiveness issue?

“@ Michael – any idea if the $250K deduction for gain on a primary residence counteracts debt forgiveness issue?”

I’m not Michael nor a tax professional, but I would doubt it. It’s being treated as income rather than a capital gain because the lender is writing off the loss against their income and the IRS is looking to be made whole.

Why do people assume that anybody taking an interest only loan “can’t afford the property”? I argue that wealthier people take out i only loans b/c they are more sophisticated, and have better use of their excess cash.

renter — you and I are in exactly the same situation (although I was a penniless grad. student out east for 5 years and then was a penniless entrepreneur up until last year when things started moving…and for some stupid reason, was laboring under the (false) assumption you needed a downpayment and income to buy an apartment!) but I digress.

The fact that for your and my entire “adult” lives, prices have been rising at unprecedented rates due, some might suggest (heresy!) to an excess of liquidity in the mortgage market rather than any underlying economic fundamentals other than greed, should not cause you to despair that things will never return to “normal,” by which I mean that some day, even in magical California, the majority of buyers will take out fixed-rate loans that self-amortize over 30 years, and that in order to acquire said loans, lenders require them to document their income and so forth…

However, it is widely accepted that buyer and seller psychology takes a very long time to adjust to these newfangled notions of affordability, and that prices are historically very “sticky” on the way down. Quick to rise, slow to drop. For the sellers, especially, real estate is an emotionally charged issue and simple mathematical reasoning doesn’t enter into the equation for them. What’s more, there is a huge pool of buyers out there who may wish to simply sell one overvalued asset and replace it with another overvalued asset of roughly similar value, for whatever reason. Those people will always have the upper hand over people such as you or I who are starting from “zero.”

But in the end, inflation and the slow, almost imperceptible lowering of expectations will take its toll on “real” prices, and in due course everything will return to balance…. Just in time for the next surge in prices to take root.

Then, fifteen years from now, you can go on an internet message board and brag about how smart you were to buy a house, how it was cheaper than renting at the time, and now you’re rich (not to mention brilliant) too! And all that glory just for participating in the most pedantic activity imaginable: paying the mortgage.

Why do people assume that anybody taking an interest only loan “can’t afford the property”? I argue that wealthier people take out i only loans b/c they are more sophisticated, and have better use of their excess cash.

One more time. I guess it interprets a less than sign as the start of an html tag:

The question for me is why did I/O loan usage in SF go from less than 20% in ’02 to 70% in ’05? Because I/O loans became so much easier to obtain for “sophisticated wealthy people” over that time period? Or because more people could only buy the property they did by going the I/O route?

[Editor’s Note: Bingo (on both accounts).]

I would like to point out that for non-recourse, purchase money loans the choices for a buyer that is underwater (and sinking) are:

1. Foreclosure (no tax consequences, but the credit score will take a hit).

2. Short sale (credit is intact, but you get 1099’d for the difference between selling price and loan amount).

Which would you choose? Which will the majority of evacuees choose (oops, I forgot, no one actually leaves the City)?

You folks need to quit worrying about those ARMs. I mean, the California Association of Realtors recommends them for first time buyers (see FTB-HAI), so what could be wrong with them?

Boy, there’s a reason I don’t do my own taxes. EBGuy, I believe you’re right that foreclosure (as opposed to a short sale) does not result in taxable “cancellation of debt” income where the loan was non-recourse (e.g. a mortgage in CA used to buy the home). See this IRS pub.:

http://www.irs.gov/newsroom/article/0,,id=174034,00.html

So my initial hypothesis (out of ignorance) appears to correct — it could result in a serious financial gain to simply walk away from a home that is underwater rather than refi and let the lender foreclose. The only downside is a hit on the credit rating. Refinancing your resetting loan, by contrast, could have big costs.

Backing up a couple of comments – as for the Equity Office/Blackstone purchase, most commercial real estate people think he timed the sale pretty perfectly with the peak of the commercial market. Blackstone flipped quite a few of the properties right away, but had to hold on to more than they would have liked and now is having trouble unloading them as underwriting for commercial purchases is tougher than it was 6 months ago. Blackstone’s stock price has been consistently more than 30% below their IPO price earlier this year – they are not looking like the wise party at all.

Scurvy,

If I’m not mistaken, Sam Zell bought a portfolio of buildings in Berkeley. Can anyone confirm?

Cary

Amen Corner, I suspect there is not one simple reason for the increase in interest only loans in SF since ’02. It would be just as correct and incorrect to say the increase was because people were purchasing homes they couldn’t afford as it would be to say the increase was because wealthy people realized that they could use interest only to keep their money invested elsewhere.

Both of those likely contributed to the increase. But one or both of them is unlikely to be the sole reason. Another reason is that there was likely an increase in the number of people buying properities to flip them, for those people (regardless of if they could “afford” an standard mortgage or not) interest only made more sense.

Another reason is that interest only loans became more readily available as they became the fashionable product being pushed by mortgage brokers.

To quantify the amount all the various factors contributed to the increase of interest only loans someone would need to do a large survey of all home buyers in SF to discover their reasons for chosing an interest only product. Absent that we can only speculate (something people seem to do a lot here).

@ Trip – It is a common misunderstanding that if you refinance your loan you lose your 580b protection (the case usually cited for this proposition – Union Bank v. Wendland – has some very shaky reasoning).

Although sometimes stated as a certainty, the law is very unclear under what circumstances a refinance may or may not be considered “purchase money” for the purposes of 580b. Refinanced loans with the same lender appear to be safely within 580b protection. Refinanced loans with another lender may or may not be. A refinanced loan to pull out money to pay off another debt probably are not within 580b (but there are strong policy arguments that they should be – e.g. lenders are in the best position to determine value of the home and should bear the responsibility for overvaluation).

Not surprisingly, CA courts haven’t had much opportunity to deal with these issues in a long while. Also, under past circumstances home-owners would only walk away under seriously adverse economic conditions requiring bankruptcy.

I am very interested to see if these issues become resolved in the next several years. As you have suggested, some may consider it a good economic decision to walk away from a home. This may happen even where they have refinanced.

Here are the buildings bought by Sam Zell’s Equity Residential. I had some neighbors who moved to Oaktown last year to get more bang for their rental buck, and I think the downturn will only put more pressure on rents as people look at alternatives… but then again, Berkeley and Ess Eff have that special urine in the doorway smell only found in select cities.

The seven buildings built by developer Patrick Kennedy, a Piedmont resident, and UC Berkeley Professor David Teece, include the Gaia, Fine Arts, ARTech, Bachenheimer and Touriel buildings as well as the Berkeleyan Apartments and Acton Courtyard.

The buildings, which consist primarily of smaller apartments rented by UC Berkeley students, represent the largest group of rentals under private ownership in the city.

The properties were acquired by Equity Residential, a Chicago-based firm that represents itself as “the largest publicly traded owner and operator of multifamily properties in the United States.”

http://www.berkeleydailyplanet.com/text/article.cfm?archiveDate=04-20-07&storyID=26859

Some quick thoughts

1. Blackstone’s purchase of the Zell properties was an arbitrage trade; they pulled their equity out of the deal with the properties they flipped, so they can’t lose money (although their lenders can… a familiar situation?). Also, three properties were included in that trade that Zell didn’t document (and presumably didn’t know about or value), creating more upside for BX…

2. Any rational buyer who purchases a property when (i) there is a normal (i.e., non-inverted) yield curve and (ii) he expects to sell the property house within 5-7 years should use an IO loan. In taking a 30-year mortgage, you pay a premium to lock in a rate for that time period; if you don’t need the option because you plan to move, there’s no incentive to go with a standard loan.

3. The real pain in IO loans is a result of “teaser”/”intro” rates that are below market even for floating loans, e.g., 1.99%; that’s why the carnage was so quick for these loans.

4. Rates may continue to fall over the coming years as the recession sets in next year, making resets less painful.

This may be obvious to everyone, but not all interest-only loans have adjustable rates. I have an interest only loan (IO for 10 years) with a fixed rate for the entire 30 year term. Yes, my monthly payment will go up in 10 years but I was willing to take that small(ish) risk to enable the purchase of a home that I thought made sense economically – great neighborhood, great bones -and yes, that I just plan wanted … um … now. I guess I’m expecting that at least one of the following will happen in the next 10 years: I’ll be able to afford my increased payment, I’ll be able to refinance, or I will have sold at a profit. The possibility of NONE of these things happening seems unlikely.

just a thought

What do you do if the value of your home isworth less after 10yrs than you paid for it, and your interest rate nearly doubles?

even if you can afford it and decide to amke much higher payments, was it worth it when you have to finance for more than you did origninally and your house is worth less?

Having lived in the Bay Area for almost 20 years(Palo Alto and SF),and watched property values bounce around a bit, but usually – in the long term – rise, I find the possibility of this home dropping in value to below what I paid 1.5 years ago consistently for 10 years EXTREMELY unlikely. It also seems very unlikely that there will be no alternate financing available with more favorable terms. But I guess this is all possible and then this will not be the best investment I’ve ever made, but I like where I live and can live with being “stuck” here.