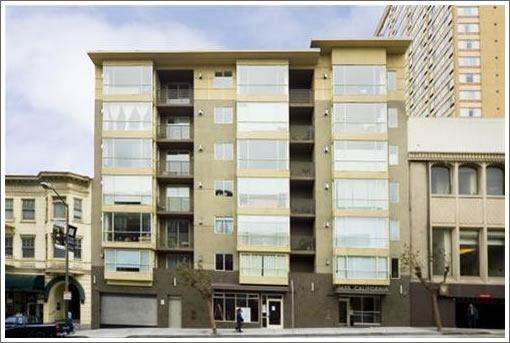

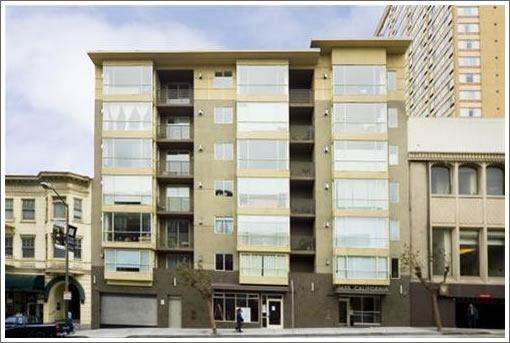

Two years ago 36 new condos at 1635 California Street hit the market. And based on tax records, it appears as though unit #33 first sold for right around $780,000.

Two weeks ago 1635 California #33 hit the resale market for $795,000. And a sale at asking would represent annual market appreciation of right around one (1) percent.

∙ 1635 California Street [SocketSite]

∙ Listing: 1635 California Street #33 (2/2) – $795,000 [MLS]

We looked at this building when we first began looking for a new place to buy and, sad to say, we thought even back then before the current real estate/ lending situation that these were a bad investment.

You know, correct me if I’m wrong, but how exactly does the math make this 1% appreciation for the owner?

You see this all the time. So-and-so says they bought at $X, sold at $X + $100K, therefore, their appreciation is implicitly $100K, or expressed as a percentage, $100K/$X.

But of course, there’s the mortgage cost! Taking this example, it’s unlikely this person wrote a check for $780K two years ago. Their bank did (minus the buyer’s down payment), and, depending on the loan and rates, a 30-year mortgage can cost as much as *double* the initial principal.

I know we have no visibility into individual financing arrangements for properties, but I just wish people would stop using the back-of-envelope math of “$100K higher selling price = $100K in the seller’s pocket.”

The property appreciated 1% based on the asking resale price. I don’t think at any point did Socketsite say the owner is going to pocket 1% in profits.

one of my 2 muggings in SF happened on the corner of California and Polk.

bad location.

Inflation has been getting pretty serious in the last two years. Factor that in and it’s pretty clear the owner took a loss. 🙁

The last time I walked by that building, there were some signs posted in the entryway windows alerting residents the be cautious about letting unknown persons enter with them, etc. It made me think that the area dictated a manned lobby, which it probably does. In any case, sticking up signs like that on a new, fairly pricey building doesn’t make a good impression..

Was that before or after the new “senior housing” sign went up on the building?

After the typical 5% to the realtor, that’s a -4% appreciation.

Spencer,

How many areas do you consider “bad areas”? Just curious…it seems like you’ve been mugged or seen someone shot or shenanigan after shenanigan has happened everywhere in San Francisco except for outside your place in Pac Heights. I’m still waiting for your post about how dangerous the Sunset is.

areas in central or Northern SF that I consider to be unsafe:

North beach

Tenderloin, including tendernob (above location)

Western Addition

mid market

6th street

mission (b/w guererro and potrero)

There are plenty of safe places including sunset

most of this unsafeness is due to poor policing and has gotten worse over the past few years. 10 years ago, I considered North beach safe

I live approximately equidistant between this property and North Beach, and I can tell you I would feel much safer living in North Beach. Aside from the safety issue, the location is completely charmless (good houseplants at the Plant Warehouse, though….).

The idea that someone paid $780k to live at that location is truly amazing. I’ll be even more amazed if they get anything like that now. I’m guessing that if you live there you can here your neighbors shouting “D’oh!” at night…that is if you can hear much over the traffic noise and the wailing lunatics on the street…

California St. is tendernob? Where does Nob Hill begin? California St. is almost, or is, at the top of the hill. (physically, or “terrainally,” speaking)

California is also only six blocks south of the “traditional” northern boundary of Nob Hill, i.e. Broadway. Given that and the fact that it crosses east/west over the highest point of the hill, I really don’t see how it fits the “Tendernob” moniker at all.

I like the building…certainly not a perfect location, but still not too bad. This unit is located on the back side of the property (not facing California Street) and is actually pretty quite. Relatively new and well appointed 2BR-2BA apartments priced in the 7’s are not that easy to find (even in this changing market)…but again, it will be interesting to see how the market reacts. Could end up being a good buy for someone…

I almost, I mean really almost, bought a unit (#31?) in this building last year. I probably visited this building 7 times so I know it well.

The reason I didn’t buy was because the layout really sucked. The bedroom window is literally facing the walkway where people walk to and from the elevator. You pretty much have to keep your curtains closed otherwise someone can walk by and watch you sleep. Take a closer look at the second to the last picture on the MLS, I think you can see your neighbors door, which is how I remembered it.

Also, the price was way too high, my unit was selling for about 715k and it felt like it was 800-850 sf. Everything in this unit was tiny. My gut feeling told me that this was not a good buy and I was right.

Although it is true that his unit faces the back part of the building and is quite quiet, your living room probably has a view of the ugly satellite dish and wall (to be fair, it does add privacy though) from the Holiday Inn on the other side of the block.

Based on my analysis of this building, this unit is most likely worth about $740-750k, at best. And contrary to popular belief, I actually liked the location. Lots of restaurants, cable cars, and very close to the financial district.

Hi;

I helped another Realtor from my office sell a unit in this building several months back. The units are nicely laid out and well constructed. I met a few of the other owners and found the building to be pleasant. The location is great, I am sorry about the guy who got mugged on the corner, but that can happen anywhere in the City.

M.R.

“California St. is tendernob? Where does Nob Hill begin? California St. is almost, or is, at the top of the hill. (physically, or “terrainally,” speaking)”

Well, parts of California are clearly Nob Hill, but I would personally consider the part of California that runs from Van Ness to Hyde to be part of the Tendernob. That area of polk st at california is overrun with transexual prostitutes, homeless and high crime stats.

East of Hyde, when you get on the hill is more traditional nob Hill. The Polk St is pretty bad until you get to jackson.

If you don’t believe me walk around Californai and Polk after 11PM

here are the crime stats for the past 90 days within 1000 ft. of 1635 California.

If you want to lvie int he area, i would demand more from the police, DA, Board of Supervisors and Mayor

ASSAULT 28

BURGLARY 21

DRUG/NARCOTIC 21

LARCENY/THEFT 135

ROBBERY 15

VANDALISM 39

VEHICLE THEFT 22

Grand Total 281

For all the negative talk on this site, you would think the market has gone to h#ll, so all the real estae haters should be delighted with 1% appreciation, since the market has only been going “downhill”….will the seller loose money to sell so soon, yes. Real Estate should be a longer term investment and any buyer should be prepared to hold for 5 years, or to take a loss if need be…it is just the cost of doing bussiness.

^ i might be delighted with 1% appreciation if my realtor hadn’t told me to expect 10%.

“any buyer should be prepared to hold for 5 years”

so you agree that the teaser rate loans with periods of 2-3 years were never an appropriate loan for anyone.

East of Hyde, when you get on the hill is more traditional nob Hill. The Polk St is pretty bad until you get to jackson.

If you don’t believe me walk around Californai and Polk after 11PM

LOL…Polk is bad until you get Jackson? Alrighty then…

Sold for $740k in March – 5% depreciation from 2006 to 2008.

Wow! PotreroResident was right on the money!

Unit 21 just sold for $789.000. It is a great buidling and the location can not be beat. This unit had a HUGE patio and amazing space – it was very upscale in it’s furnishings and had the right washer-dryer, window treatments, storage space and even screens.