From the listing for 2945 Baker Street #5: “…Baker at Greenwich is one of the most sought after Locations in United States.” We do like the location (not to mention having the Baker Street Bistro at your doorstep), but little did we know.

∙ Listing: 2945 Baker Street #5 (0/1) – $310,000 (TIC) [MLS]

Buyers beware of fractional financing. Interest rates are much higher and what are you going to do if banks decide not to provide them anymore? It seems unlikely but they are not completely institutionalized yet. Your loan will be valid but the only way you are going to be able to sell it to owner carry the loan.

If I was going to buy a studio in SF I would buy 237 Arguello Blvd #16. It has parking, it is a condo and it is blocks from the Presidio. When you find that special someone, it is a great rental.

This is it folks. One of the most sought after locations in the United States.

http://maps.google.com/maps?f=q&hl=en&geocode=&q=baker+and+greenwich&sll=37.0625,-95.677068&sspn=39.729049,84.111328&ie=UTF8&ll=37.802579,-122.444837&spn=0.009698,0.027573&z=16&om=1&layer=c&cbll=37.79768,-122.4458&cbp=2,320.5332972515062,0.5142841323218386,2

Perhaps I’m being a bit over-optimistic here, but it seems to me that fractional TIC loans are the least likely to be affected by the current credit squeeze. After all, they’ve always required high FICO scores, high downpayments and carried higher interest rates. Moreover, since there was never a secondary market for these loans in the first place they’re not going to be affected by the jitters in the secondary markets. In other words, the fundamentals for fractional TIC loans haven’t really changed. Of course, if the buyers start getting nervous all bets are off.

In the interest of full disclosure, Katy Dinner – poster of the top comment – might also want to let folks know that the realtor on the Arguello listing is one of her fellow Paragon realtors. Just something a little research will tell. Not to fully discount what Ms. Dinner has said, but i think that’s the kind of thing that should be mentioned when a recommendation that specific is given.

Is it realistic for a realtor to think that about individual TIC loans? As an amateur – and recent first time home buyer with such a loan – I thought this was a great new product that would only get better, and be offered by more and more banks – considering the number and popularity of TICs. Seems like common sense.

zzzzzzzzz – a nice property is a nice property, no matter how you look at it. Why difference does it make if Katy lets it be known this property just so happens to be listed by her brokerage or not? Would that discourage or encourage thoughts and feelings about the property?

I personally like disclosure.

movingback,

Even in a semi-anonymous online forum people still build up a reputation. Honest commenters reveal the extent to which they have a financial stake in the recommendations they make.

If a broker comes out and says, “My partner is representing this property, and I think you’d like it”, then that’s fine. I can judge the comment in the right context. If he or she doesn’t say that, then I’m being pitched by someone who is coming across as a disinterested reviewer but who is really selling me something. That looks dishonest. The onus is on the writer to reveal their bias. These rules apply to journalists, scientific writers, and anyone else who would like reader to think his or her opinion isn’t for sale.

I really think the place on Arguello is nice and overlooked. (plus negotiable) I have no financial interest in Arguello. All agents in the city no matter what company they are representing are colleagues and competition.

Disclosure? I blog with my name and a link to who I am. You are the funniest people alive.

Liz – yes it is realistic for a realtor to think that about TIC loans. Undoubtedly you are happy with your loan now, otherwise you never would have signed up for it. Your prediction that banks may improve this product and offer more of it could become true. However, there is also a risk that they will not – which is the point that Katy is making. If banks decide to change their loan products and offerings several years down the road, it may be difficult for a prospective buyer to get a similar loan. This will make selling more difficult and seller-carried financing may be necessary. TICs are easy to buy but harder to sell and Katy is absolutely right in pointing out what the financing issues are with TICs.

Buyers should be aware of fractional financing or “individual TIC financing”.

Even though most of these new loans suggest that the same lender that is making the loan now will also (1) make a new loan to a future buyer and/or (2) allow a future buyer to assume the existing loan, if that lender will not assist with future financing, the buyer may be in an unhappy position.

Most owners of real estate count on the possibility of either re-financing their loan in the future or selling the property in order to move or acquire a larger/better property. In order to do either the availability of fractional financing is very important.

If that type of financing is not available, the owner must provide financing to the next buyer, themselves, often without that new loan to be secured by a loan on the existing property. The ends up with the seller carrying back a 2nd loan, unsecured, for a portion of the Seller’s equity. The Seller normally wants all of their equity to purchase/remodel their next home and does not want to become a bank.

As to the possibility of a TIC becoming a condominium in San Francisco, the average wait, considering the present condo conversion laws is 9 years. That includes the 3 years that an applicant has to wait, after purchasing an apartment, before applying and the time it takes to win the lottery.

9 years is a long time to hold a property that is difficult to re-finance or sell!!

Andrew Sirkin, an attorney that specializes in TIC conversions has helpful info on his web site:

http://www.andysirkin.com/Index.cfm

Frederick

I think Katy sufficiently disclosed herself. Now, if she was the listing agent or owner, then I’d be offended.

As for TICs, I personally am very skeptical as the the value against a condo. I wouldn’t buy in on one … The condo process is not an easy one and is ripe with risk. (I’m currently on my second condo conversion in the last 12 years and each one has cost significantly more money to do than expect and took a much longer time. I can’t imagine trying to go thru the process with a TIC.)

and to add to Frederick’s comment, if tenants were kicked out of the building, you can’t ENTER the condo lottery for ten years. THEN you wait 9 more.

As for whether the loans will be around for long, none of the banks I am aware of does anything longer than a balloon payment in year 5. THEY don’t even know if they’ll be doing this for 5 years, but YOU get to commit to 19.

So you’ll be standing there with your pants around your ankles for the next 14 years after your first balloon comes due hoping you can refinance and won’t have to sell to a very limited pool of all cash TIC buyers who will all look up your loan payment due date on property shark know that your options are limited.

All for a TIC discount of about 5% off what a condo would cost. Sounds like a great deal (sarcasm) to me.

Well said, Katy! The more I read this blog, the more I am beginning to believe there are very few actual homeowners who post comments here. Just renters and market speculators.

our firm provides portfolio financing products for the 2nd home market across the US and offshore.

Our Fractional and Condo Hotel underwriting guidelines have not changed with the current market conditions.

A Tenant in Common agreement has all borrowers on the same loan, whereas a fractional loan has separate deed and separate title therefore making the transaction both from an entry and exit standpoint much more desireable.

With TIC’s approaching 20% of SF’s residential real estate market, I don’t see fractional financing going away. There is also a huge untapped market for lenders to tackle all the group TIC loans that are considering refinancing and often opting for fractional financing. The lenders for fractional loans hold the note and require full documentation to qualify. In interest of disclosure, I am a realtor. I own a TIC that I am currently converting to a condo. I list and sell a lot of TIC’s.

Yeah David, but that’s what they said about 100% down 2/28 ARMs right up to the day they disappeared. No matter how big the market, if the lenders think they are going to lose money on the deal they won’t enter it. If they charge enough to make it worthwhile, the buyers won’t want it.

Full disclosure: Jealous Bitter Renter, PermaBear, Economic Fundametalist

Jealousbitterrenter,

Comparing a 100% financed 2/1 ARM stated income loan to a 25% down 5/1 ARM full documentation fractional loan is apples to oranges. The fractional financing has much stricter underwriting criteria. The lenders like the terms and the buyers like the security.

You can all relax the unit sold.

Did anyone seriously think a $310K studio in the middle of SF wouldn’t sell? It’s not Pacific Heights, but the area around the Pesidio rocks. I could have bought this sucker with cash (and in the unlikely event that it dropped 20%, I would have), and I could have put 20% down on it at that price 9 years ago (heck I bought my first house at $285K back then). There are *plenty* of buyers well-qualified in this nearly non-existent segment of the SF market.

Doom, gloom everywhere, but a bargain is still a bargain.

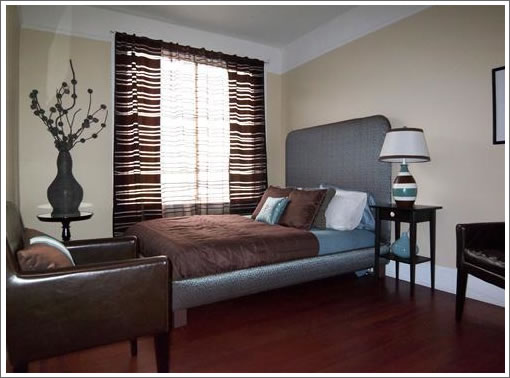

Any idea what the square footage on this baby is? Is that a twin bed? Damn that thing looks tiny?