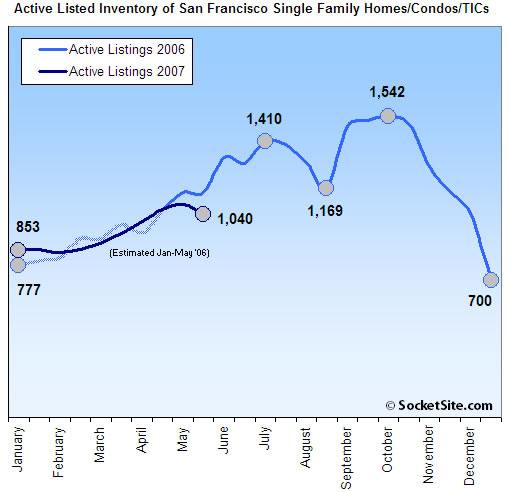

A typical decline in new listings in the week prior to Memorial Day combined with an uptick in sales (based on our calculations) resulted in a nominal decrease in San Francisco’s total Active listed housing inventory over the past two weeks (now down ~10% YOY).

At the same time, both the number (250) and percentage (24%) of listings that have been reduced continues to build with the majorty for properties now listed under $800,000 (and about half single-family homes).

∙ San Francisco Housing Inventory Update: 5/14/07 [SocketSite]

Wow — even with the number of listings down, 24% of those have reduced the asking price. I don’t think anyone can seriously dispute that the downturn is upon us (although we can still debate the breadth or scale). And this is another reason why the anecdotal reports of this property or that going for “over asking” must be taken with a grain of salt.

In addition to the fairly commodity item condos that were plainly listed too high, I see some very nice places in good neighborhoods with significant price reductions — I think buyers have wised up and realize there is no reason to rush because you’ll likely get a better deal a year from now, and it’s pretty much assured prices at least aren’t going up:

20 Villa Terrace — reduced from $2,500,000 to $1,719,990

1703 Octavia — from $2,195,000 to $1,950,000

428 28th St — from $1,199,000 to $999,000

20 Vulcan — from $1,200,000 to $995,000

(and 246 others)

As further anecdotal evidence, I’m sure we’re all familiar with the Pac Union website. I just noticed that their property search tool recently added a new checkbox: “Recently Reduced.” Never saw that before.

Anon at 8:30 — I think you will get a better picture of the market if you looked at what has sold in the past 3 months. You will find that the market is as hot as ever!

Pricing is key in any market and these properties that have price reductions, or are sitting on the market for 30+days, obviously were not priced correctly when they hit the market.

Talk to my many buyers who have been in bidding wars on numerous properties and they will tell you what is going on in the market.

Here are some sold property (SFR, Condo’s and TIC’s) stats straight from the MLS:

750 properties sold in less than 30 days at an average of 106.02% over list price.

362 properties sold in 31-60 days at an average of 100.66% over list price.

136 properties sold in 61- 90 days at an average of 99.10% under list price.

73 properties sold in 91- 119 days at an average of 98% under list price.

100 properties sold in 120+ days at an average of 98.48% under list price.

So that means at least 1,112 properties sold on average over list price over the last 3 months. And 1,421 sold total. Looks pretty solid and HOT to me!

Sold over asking is a worthless industry statistic in San Francisco which anybody with access to the MLS should know. The vast majority of listings in this city are deliberately priced under market from the get go in order to generate interest/traffic and what the agent/seller hopes will be an emotionally driven bidding war. Also, “percentage over list” statistics are based on the most recent list price rather than any pre-reduction list price.

can you run those numbers again with out district 10 in the picture?

You don’t see one out of every four listings being reduced in a HOT market. Reductions were extremely rare 2 years ago. This is class session #1 in econ 101. High prices can result from high demand or low supply (or both). Here we have fewer places being listed, which would spark high prices if the demand were there, but we have a huge percentage being reduced in price. I suppose it’s possible that every one of these 250 priced their place way, way out of line with comps. But they didn’t — they priced them at 2005-06 comps, and buyers are not willing to pay that price anymore. A few anecdotal examples of bidding wars on extremely desirable places does not change the basic calculus.

I think anon has the more defendable position.

“Sold over asking is a worthless industry statistic in San Francisco which anybody with access to the MLS should know. The vast majority of listings in this city are deliberately priced under market from the get go in order to generate interest/traffic and what the agent/seller hopes will be an emotionally driven bidding war. Also, “percentage over list” statistics are based on the most recent list price rather than any pre-reduction list price.”

Not so worthless industry stats are the DOM numbers and they are hovering around 30 days.

Again, friends — San Francisco is not Madison. The San Francisco real estate market is not, and not in recent memory, has it ever been, for the faint of heart.

Not so worthless industry stats are the DOM numbers and they are hovering around 30 days.

Does that DOM include the time before the listing was pulled and then put back on, or does it only include the time after those stunts were pulled?