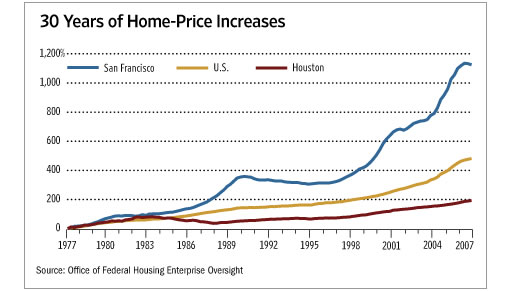

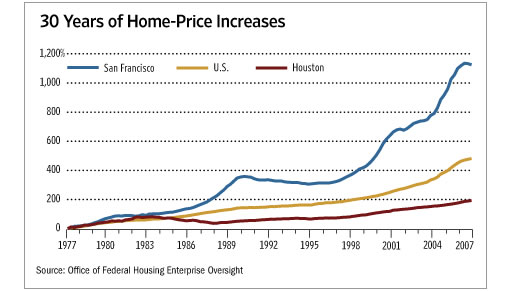

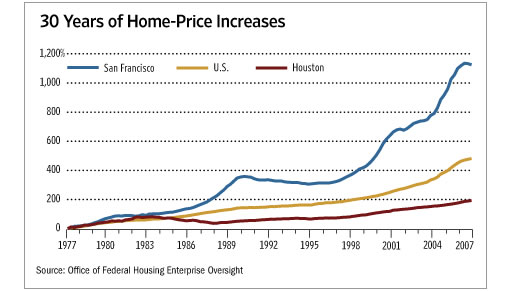

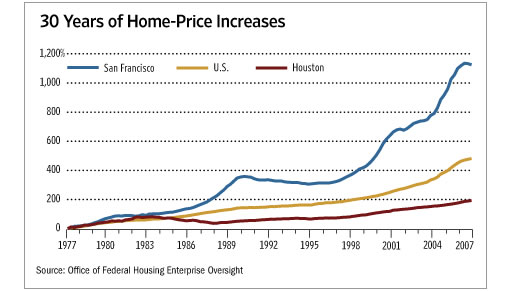

“In San Francisco, where it looks like prices may have hit their high mark in the third quarter of 2006, home values peaked in early 1990 before falling for the next eight years.”

∙ Why your home isn’t the investment you think it is [WSJ]

San Francisco real estate tips, trends and the local scoop: "Plug In" to SocketSite™

“In San Francisco, where it looks like prices may have hit their high mark in the third quarter of 2006, home values peaked in early 1990 before falling for the next eight years.”

∙ Why your home isn’t the investment you think it is [WSJ]

Finally! After years of being yelled at (really, literally) by our friends and family for “wasting” money by renting and not buying, a concise validation of our position, complete with oodles of numbers to back it up. I think I may print multiple copies of this article and carry it around with me for distribution. Thanks SocketSite!

I own a home, and this is a great article. I believe everything that it says. I also believe that owning a home has benefits which may not be captured by dollars and cents. Nevertheless, the validity of the points made can’t be easily refuted. Of course, it is interesting that these sorts of articles are being published now, and were nowehere to be found in 2003…

How many years are you talking about? And are you talking about SF in particular. From the chart above, it seems to me if you had purchased a place “years” ago in SF, you would of been much better off than renting. How’s that conversation with your friends & family going to sound like “see, if I had purchased back in 2000 I would have only doubled the value of my property, but luckily I didn’t succumb to the pressure.” What will you be saying in 2015?

Nobody can predict the future. What will those who bought in ’06 be saying in 2015 if prices have not gone up whatsoever? Like an ’89 to ’98 scenario?

That’s sort of my point, Dude. If you can’t predict the future, what makes people think they can time the market?

Several things. Since you asked….

One thing that characterizes the real estate market, especially in California, is cyclicality. Graph historical prices in Cleveland or Atlanta and the pattern is nearly linear. Regressing it yields an R-squared of ~ 90% (i.e. high correlation). Graph any major city in Cali and you get a similar pattern to the one above – not linear and obviously cyclical.

Furthermore, real estate cycles are long – 3 to 5 years on average. So I can’t predict the future or perfectly time the market. But if I want to guess when prices may go down in a market, I’d wager it would be after a long boom period. When will the trough be? Who knows. Maybe ’08, maybe 2011. Maybe it’s a “new paradigm” and prices won’t stagnate. But if mean reversion holds and history repeats itself, the next 3-5 years will not be good.

Forgetting technicals and on to fundamentals:

California real estate is the least affordable it’s ever been in history (prices vs. wages). Source: NAR.

California has a disproportionate amount of adjustable and neg-am loans, Bay Area included. Source: BusinessWeek.

Credit is now tightening and lots of people who bought previously will no longer be able to buy or refinance when their loans adjust. Source: any newspaper.

2007 and 2008 are big reset years for ARMs. Source: any newspaper.

Thousands of new units are coming on the market throughout the city soon – supply increasing. Source: SocketSite.

Summary: Combine all these stats, and I just don’t see how prices can continue to climb. No, I can’t predict how much they’ll fall or when, but I believe a correction is overdue and coming. And I lose nothing by renting and waiting.

I debated this last year when I sold my loft in soma. Renting passed my mind, but in the end I bought instead. With 28% down the after tax charge (not counting principal payment) was around $3k. That amount gets me roughly 1900sf, 2 car garage (additional 3rd in driveway), backyard, ton of storage. No the house isn’t updated, no granite kitchen, but we refinished the old hardwood floors that were covered and it is in better shape than most rentals. Next door has 2 flats, each roughly the same size, they are getting $2800/$2700 respectively. Now I’m paying not much more. Yes I have to pay for the upkeep, but for me the intrinsic value of it being my own, and being about to do whatever I want to do to it makes the extra more than worth it.

I’m very suspicious. My grandfather invested solely in real estate and was worth 8 million dollars when he passed. My father spent the past 30 years investing in stocks and if he were to die today would be worth maybe $500k after we paid off his debts (most of which is appreciation in his current home).

Other friends of mine also have invested heavily in the stock market and adjusting for inflation their money would have done just as well stuffed under their mattress. These are 30 year holds they had in their retirement accounts. Over the same period of time their real estate investments have realized some really healthy gains.

From a day to day practical standpoint the real estate investors I have watched have done much better over the long term than the average stock investors. I completely disagree with this articles assessment.

“From a day to day practical standpoint the real estate investors I have watched have done much better over the long term than the average stock investors. I completely disagree with this articles assessment.”

Just go to CNNFN and get the facts: average real estate annual return in San Francisco since 1979: 4.7%. Average stock market return is a few times that. Maybe your stock investor friends were poor investors.

When comparing the average real estate return to stock market return, you need to look at the capital invested and tax considerations. For example, home appreciation up to 250 or 500k is tax free. Not true for stocks. Also, home appreciation is based on the home’s value, not on the capital invested (i.e., the down payment). A valid comparison is therefore more complex.

renting vs stocks,

When your grandfather was investing in real estate it was typical for a rental property to rent for more than its carrying cost (ie, loan payments, taxes, insurance, etc.). So all you had to do was come up with a down payment and find a renter and the property would carry itself while appreciating. In a few years the rents went up (there was no rent control, at least not in SF!) and there was a positive cash flow.

These days carrying costs on property usually outstrip rents. This is why it’s not as easy as it used to be to amass a fortune through real estate and this is why owning your own home is not such a good investment (as the article says). The monetary value you receive from your home each year (putative rent) is less than the amount you have to pay to live in it. The larger the loan (percentage wise) the worse the discrepancy.

I think that there are real advantages to owning. But they are intangible and hard to put down on a spreadsheet. Perhaps the most important is control. If you rent your house from the bank, the bank doesn’t care if you paint your living room puce or have three dogs, five cats and a hamster. All the bank cares about is getting its check on time and it will leave you alone. If you rent from a landlord, though, it could seriously cramp your style. Plus he/she could sell the property or even kick you out – with an alarmingly short notice.

Everyone who says real estate has been a great investment is right. But think about the LONG term. It is hard, VERY hard to do, but that graph shows that real estate returned 20% annually in SF over the last 30 years. But what about the next 30 years? Will it be so good. I think we are going to find that “investing” in real estate is not going to get returns that good over the next 30 years. But buying can still be good, just not as an “investment”. These things have cycles, and on the UP part it is good to “invest” but on the down term you should look for something else

This chart tells you that San Francisco appreciates in the long term, and it appreciates faster than Houston and the US b/c of its desirability with over 40 years of history.

Anybody who is negative on the housing market using this chart to say ‘see, look what happens’ is not thinking straight. This is definitely a graph for those bullish on the market.

It also tells me there was an eight year period when home prices fell in San Francisco. That’s right, fell in San Francisco. And before you blame the economy, take a look at the other two lines during that same eight year period.

How many people do you know that have an eight year plus horizon? Amongst those buying a studio or one bedroom?

Dude, I appreciate and respect your analysis – all valid points. The negatives definitely outweigh the positives right now. Not to single you out, because I know a lot of people share those views and are holding off until some of these issue work themselves out. But with all the negative sentiment in the market, couldn’t this be the time to consider entering the market? Uncertainty often creates opportunity and maybe taking a contrarian point of view may pay off? Would you rather be in the market to purchase when supply is high, choices are abundant and negotiating power is in your favor? Or do you wait until supply tightens, bidding wars become more prevalent and you end up in a neighborhood at the bottom of your wish list.

I’m just more curious as to when people think it’s the right time. Are they waiting for all the delinquencies to be made current, the last subprime loan to be retired, the supply overhang to be entirely absorbed, a correction of 10%, etc? Not to sound too facetious but what exactly is the magic statistic that will convince those on the sidelines that it’s now safe to enter. For instance, after the tech crash many people felt bay area real estate would be depressed for quite some time as so many jobs were lost. The population decline in SF over the last 5-6 years or so would indicate a lower percentage of potential buyers. Many ARM’s reset or refi’d in 2005 & 2006 without much disruption in the bay area. When was the last time bay area real estate was affordable in relation to price vs. wages? Yet local real estate boomed and yes, I know low interest rates, creative mortgages, and loose lending were contributing factors but they weren’t the only factors. I almost get the impression people believe if they wait a couple of years then there’s not going to be any more negative forces weighing on property values in the future while we all know some other new concern will arise so why do people delay purchase? Are they waiting for all the buyers of some recent Sacramento real estate development to default on their loans so they can purchase a house in Pacific Heights? Are they expecting significant foreclosures in Noe Valley so they can swoop in on a sweet Victorian? Let’s say they do actually manage to time the trough in the cycle and purchase…what action do they take when the next down cycle occurs in 3-5 years? Are they honestly going to sell out and stay on the sidelines until the cycles turns and then re-purchase or do they ride the cycle out? Logic would indicate most homeowners (i.e., long term as opposed to speculators) would stay in the market as transactions costs are high and there may be tax consequences. So, can you really quantify the benefits of attempting to time a purchase if you are going to remain in future market cycles 5-10-15 years down the road and if so, do they outweigh the opportunity costs.

I have friends who have been telling me since 1998 that they feel real estate is overvalued and are waiting for a pullback. I also have friends who tell me when prices decline 10% they will purchase when in reality if that were to occur, they would only re-calibrate their expectations and come up with another reason to wait. As if, some magical moment exists where the market is at the bottom, there will be loads of supply to choose from, interest rates will be at an all time low, and everything is poised for immediate appreciation. I don’t make any claims to be an expert but after my pathetic attempts trying to time the stock market, I have no illusions that I can time a real estate purchase.

I do believe the current market is fairly steamy but I’m not expecting any sort of major correction in SF. From my perspective, if you are financially capable, understand the risks, and ready to make a long term commitment to homeownership, as opposed to speculating, then take the plunge. If you feel the market is ready to crumble and aren’t going to be able to sleep at night if you bought a place, then wait until you are more comfortable with the decision.

“I do believe the current market is fairly steamy”

Are you looking at the same graph I am? “fairly steamy”? I wonder what it would take for you to write “very steamy”, or how about just plain “steamy”?

My first real estate purchase was a condo in 1986. I sold in early 1990 at the top of the last wave, and that buyer was the highest purchase price for a 2bd in my building for the next 7 or 8 years. He had to wait until about 1997 before he could get his money out without a loss. I myself rented for about two years and then purchased a home(true fixer-upper at the time) for not much more than what I sold my condo for at the peak. If you are planning on living in your purchase for over 8 years, go for it, otherwise I would be a renter.

Many valid and diverse points of view here. Buying my little condo in the East Bay was the smartest business decision of my life. It in turn has enabled me to buy in the city again after six years of wild appreciation. If you would have told me in 2001 that my 828 sq. ft. would double in value by 2007 I would have laughed in your face.

For me, it was a means to an end, which was to move back to the city, and I have bought something brand new and low maintenance. I will move in to The Hayes in December, and am thrilled about it. I was fortunate, but fortune favors the bold, and I did not want to rent forever.

Having said that, home ownership is very much about timing and understanding who you are and what you want. Is it for everyone? Maybe not, but the interest deduction alone makes it very compelling. In the end, it can be an effective part of a broader investment and asset gathering strategy for your financial plan.

To answer Anon at 10:54PM: admittedly time horizon has a huge impact,if not the biggest impact, on one’s decision to buy. If you can hold a piece of property for 10-15 years (i.e. through a cycle) you’ll eventually make out just fine. But I think many don’t realize that the recent run-up in home values (2000 – 2006), unlike previous booms, is unprecedented in its size and scope as well as its drivers. The SF real estate market, like many other markets, is in uncharted waters right now. I can’t be sure how long I’ll live in SF because of career, which makes me additionally skittish. But even those who are sure they’ll be here forever would be well served by waiting to see what happens with the mortgage market in the next 6-12 months. But to your point, if you know you’ll be here for 20 years and can swing the payment under conventional lending standards, your risks are much lower than those buying that starter condo and hoping to trade up in 3-5 years.

“But I think many don’t realize that the recent run-up in home values (2000 – 2006), unlike previous booms, is unprecedented in its size and scope as well as its drivers.”

Actually, the year over year percentage price appreciation in SF from 1996-2000 was much greater than it’s been from 2000-2006. Check out this graph:

https://socketsite.com/archives/2007/01/a_decade_of_movement_in_san_franciscos_mean_sales_price.html

Seems like the majority agree that in the ‘long run’, real estate pays off. And ‘long run’ would suggest a house as a comfort/ lifestyle component not necessarily as an investment. Smart investors would be able to put a number and time it. I guess in general 5 is better than 3, 7 is better than 5. Goodbye mobility.

I read somewhere that the average time span of an adult that moves to SF after his/ her 20s’ doesnt exceed 5 yrs. We’re one of the most transient places in the country with a relatively young work demographic.

Maybe for a large number of people, myself included, we have blogs and sites like this to thank to rectify our myopic historical data.

I got here in 2001 after graduation and all I had seen since then is real estate appreciating astronomically. But now I know better.

Since the early 80s, I have bought and sold 7 properties in other urban areas with relatively strong job markets and high real estate prices. (I am about to buy a condo in SF, where I am now working.) I never really tried to market-time, but bought and sold for family reasons. Have I been house poor? Yes, almost always, until very recently. From the mid 1980s until 1990, it was almost impossible to sell a home without losing money. The difference between then and now is that then we had a real recession with poor job growth and interest rates were REALLY high (as high as 17%). My experience is that in an urban area with a dynamic job market, as long as you aren’t looking for a quick buck, and if you’re willing to put effort into maintaining and improving your home, real estate is in fact a good way to build wealth. You just can’t quit your day job or forget to put away money in retirement funds and other investments. If you want complete mobility, you should probably be renting, or be prepared to rent your home or to take the financial hit. Also, many may not realize that a large proportion of condo buyers in urban areas are empty nest baby boomers unloading their larger homes in suburban areas in favor of smaller, more convenient quarters in the city. Some middle aged people are buying condos for their children while they go to school or get started in their careers. And there are lots of young couples with 2 good incomes who really want a place of their own. There are also plenty of foreign buyers who can afford to have 2nd homes in cities like SF or NY given the weakness of the US dollar compared to most foreign currencies. I think the prices here are ridiculous, but also doubt they’ll drop much, if at all, from where they are now. This is a lovely area to live in, and there is just too much demand for housing, and interest rates are still incredibly low. You just need to make the rent vs buy choice based on your personal circumstances and crunching your own numbers. Sorry if this sounds like Suze Orman!