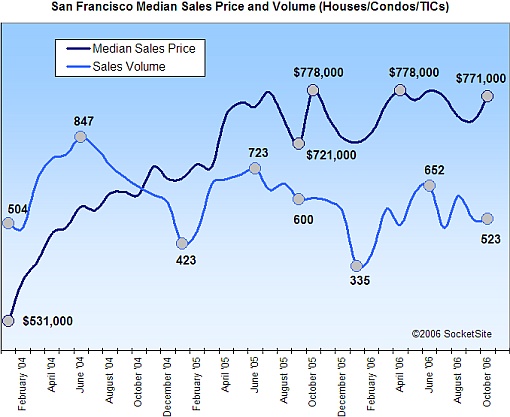

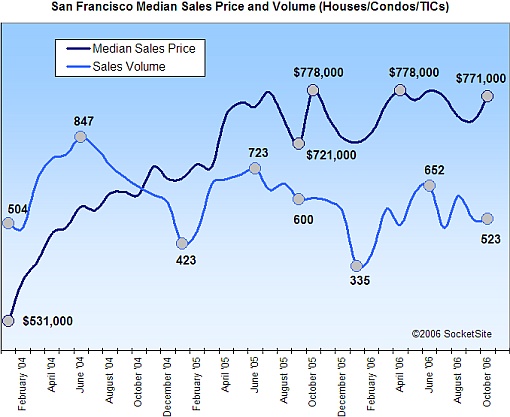

According to DataQuick, the median sales price for existing homes in San Francisco was $771,000 last month, down 0.9% from $778,000 in October ’05, but up 3.4% from September ‘06. Sales volume was down 13.6% year-over-year (523 sales versus 605 in October ‘05), but remained strong compared to the month prior (520 sales).

Based on steady sales and a nominal increase in Active inventory, we estimate that the “months of supply” of listed Single Family Homes, Condos, and TICs in San Francisco remained relatively flat at 3 months from September to October. Over the past three weeks, however, Active listings have declined ~10%.

For the greater Bay Area, the recorded median sales price in October was $614,000 (flat year-over-year) and sales volume was 7,979 (down 24.1% from October ’05 but up 0.9% from September ’06). Both Napa and Sonoma counties continued to show signs of weakness as year-over-year median sales prices dropped 8.7% and 5.9%, and sales volume dropped 25.1% and 28.9%, respectively.

From DataQuick President Marshall Prentice, “The market is in the midst of its post-frenzy rebalancing phase. The sky is probably not falling, as some have predicted. But there will be those who bought near or at the peak, and who could find themselves in financial trouble if they need to sell and move sooner than they had planned.” Yep, but it’s still too soon to tell just how “soon” is soon. (Got it?)

∙ Bay Area home sales slow, prices flat [DQNews]

∙ San Francisco Median Sales Price And Sales Volume Continue Declines [SocketSite]

“be those who bought near or at the peak, and who could find themselves in financial trouble if they need to sell and move sooner than they had planned”…

Or if their ARM resets and breaks the bank.”

That’s what I was going to say.

778….721….778….771….

Yawn…..wake me up when the foreclosures start.

How stupid do you have to be for your property to reach foreclosure around here? If you miss a payment and get in trouble, just put it up for sale for way below market value and it will go.

if people do what the Anon poster suggests that will drive down prices.

which is exactly what people who believe in the bubble argue when people call SF ‘bubble proof’.

That all the ARMs resetting in 2007 will result in a significant amount of foreclosures, combine this with people who ‘have’ to sell because of job loss/relocation, divorce, medical emergency.

These are the people who always drive down prices in a slow market.

The big question in SF is, is there enough pent up demand for housing ,at even a slightly reduced price, to keep prices from falling substantially

Of course even if prices ‘hold steady’ for a few years inflation will erode the real value of the home.

In the end I predict everyone will be right. people who believe in a bubble will argue real prices did fall and people who believe SF is bubble proof will argue prices simply remained flat for a few years and no one really lost anything.

You foreclose if you bought at the bubble and and have massive negative equity, which isn’t hard when you consider a 10% decline on a $1.5M property is 150k, plus 6% RE commission = 90K and transfer tax ~17k. If you came in at 5% down, interest only, NegAm loan, and don’t have the cash to make up the difference, than you walk away. Bank forcloses. There will be a few of these, but it’s still too early. The market has only just started to take a hit, and SF is still much more resistant. But I gaurentee you, somewhere out there in SF-land is someone in this type of a situation. Most likely a condo-owner. Maybe they ride out the storm for as long as they can, further delaying the outcome, or maybe avoiding it. I just don’t see how these prices can be justified in the long run.

If someone took out a 1 or 3 or 5 or 10 year ARM in the past 5 years and had to refi now… guess what? Their payments are pretty much exactly the same! The 10-yr yield is at 4.6% folks. Look where it was over the past 5 years. You gotcha, under 5%.

Also, anybody see the median price of homes sold in 94123? According to DQNEWS, the median is up 52% YoY to $1.822 mil! WOW! I can’t believe things are that on fire in The Marina and Cow Hollow area! I guess it really is all about LOCATION, location, location.

San Francisco 94123 8 -38.5% $1,822,500 51.9% $3,308,000 $968 -4.8%

http://dqnews.com/ZIPSFC.shtm

Hey, Marina booster: That 51.9% increase was based on just 8 home sales, and the price per square foot actually declined 4.8%

So the 94123 numbers are pretty meaningless.

Not quite Anon/Prime. While it’s true that rates for the 30-year fixed (which is the what’s based off the 10-year treasury) have hovered around 6.25% over the past five years, keep in mind that over the past three years short-term rates have increased dramatically. The rate on a 1-year arm has jumped from around 3.25% to 5.25%. That represents a 25% jump in monthly payments (from $3000/mo to $3800/mo on a $700K loan).

And Dan’s right. You’re confusing a change in mix with actual appreciation.

http://mortgage-x.com/trends.htm

I don’t think people realize how liquid the current lending environment is, how low rates still are, and how strong our economy is.

Granted if you got a 5/1 arm back in 2002 (chances are you refi’d 1 or 2 times from then, but forget about that right now) then your fixed rate will turn adjustable in 2007. So the worst case scenario is that your payment may go up to 1000 per month (assuming a 700k mortgage like Michael said which was a big mortgage back in 2002). Here’s a few options you may have.

1. Sell your home. If you have a single family home in SF, that should not be a problem so long as you sell at a reasonable price. Trust me, that will still sell your home for a BIG PROFIT over what you paid for in 2002. Not a bad deal considering the owner will probably have a hunk of cash now.

2. Get an option ARM to reduce your monthly payment. I don’t really like this option but if you really want to stay in your home and can’t afford the extra bones, then it’s not a bad deal. Although your real rate may be higher, the minimum monthly payment can provide positive cash flow for you (and keep you in your home).

3. Pay the higher payment. I don’t know about you but my salary increased a whole lot since 2002. Don’t forget that rates generally follow the economy, and when the economy is good, wages go up which causes the feds to increase rates to battle inflation. Things don’t happen in a vacuum and I’m guessing many people might be able to afford an extra 1000/month from their previous mortgage. The average mortage back in 2002 was probably around 400k-500k so your payment may only increase by about 400-700 per month in reality.

I’m not saying that the market may slow here in the near future but I’m not so sure it’s the doomsday that people think it may be with the whole fixed rate coming due and all…. And aside from a few isolated situations, I don’t think people will be in a panic to sell at a lower price.

If you bought pre-2004 you’re probably not in too much trouble unless you have no equity at your buy-in price. If you bought in 2004, 5 or 6 and are forced to sell there is an increasing (increasing in each year from 04 – 06) chance that you will lose money.

What the chart above doesn’t show you is pre-04 volumes. The trend line grows dramatically from 2002 – 2004 so there is still growth. Some of that growth is certainly justified. It’s the “froth”.

Dan – You do realize that the -4.8% for p/sqft is for that ONE highest price sale and not the median don’t you? [Removed by Editor]

Cheers! 🙂

Michael – Who cares about a 1 yr ARM btw? It is IRRELEVANT! Why? B/c the curve is inverted, which means long term money is cheaper than short term money.

Cheers.

Education is key!

Anon – As you said, education is key.

In terms of mortgages, although the spread between long-term money (30 year) and short-term (1-5 year) has narrowed over the past couple of years, long-term money is not currently cheaper. And the point seems to be that the cheapest money currently available (be it long-term or short-term) is significantly more expensive than it was one, two, or three years ago.