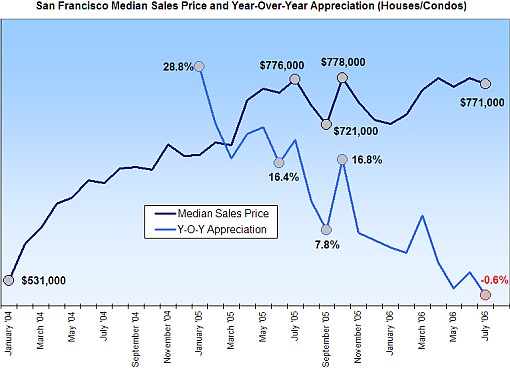

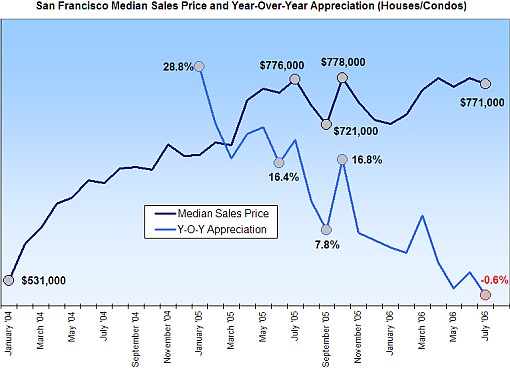

According to DataQuick, the median sales price for existing homes in San Francisco was $771,000 last month, down 0.6% from $776,000 in July ’05. Sales volume was down 23.9% year-over-year (485 sales versus 637 in July ‘05), and fell 25.6% from the month prior (652 Sales).

For the greater Bay Area, the recorded median sales price in July was $627,000 (up 3.5% year-over-year) and sales volume was 7,941 (down 30.8% from July ’05 and down 19.7% from June ’06). Marin, Napa, and Sonoma continued to record negative year-over-year sales volume growth, and Napa recorded a 2.1% drop in median sales price.

From DataQuick president Marshall Prentice, “One of the questions being asked is how much future activity was drawn into the present in 2004 and 2005 when interest rates were at their lowest levels in decades. How much of today’s demand has already been met?”

∙ Bay Area home sales decline, new price peak [DQNews]

∙ San Francisco Median Sales Price Rebounds Slightly [SocketSite]

YOY declines in the CITY. WOW! I was expecting SF to be late in the YOY decline – maybe early next year.

please oh please let this be true

One of the questions being asked is how much future activity was drawn into the present in 2004 and 2005 when interest rates were at their lowest levels in decades. How much of today’s demand has already been met?”

_____________________________________________

This sounds like the same comments being made by the auto manufactorers. Their 0% crap moved a significant amount of business forward and now sales are down dramatically.

Seriously, this is wishful thinking. As far as I can tell, prices in SF were up approx 17% this past year regardless of what DataQuick says. Homeowners are rolling in profits, and it will only continue.

Can you explain that 17% number? That is, what data are you drawing from to account for the descrepancy between your numbers and those published by DataQuick?

SFRocks – we agree, the Median Sales Price and DataQuick reports are a poor way to measure how home values are changing. Unfortunately, we’re fairly confident that they actually overstate (rather than understate) the appreciation.

Have you seen prices in the Marina? They are up about 30% YoY. The Marina is HOT. Go look at the Zillow 2Q report, or the SF Zip chart 94123.

The Marina goes up 30% every month as far as I can tell, doesn’t it Prime (hotprop)?

Do not hold your breath, kids.