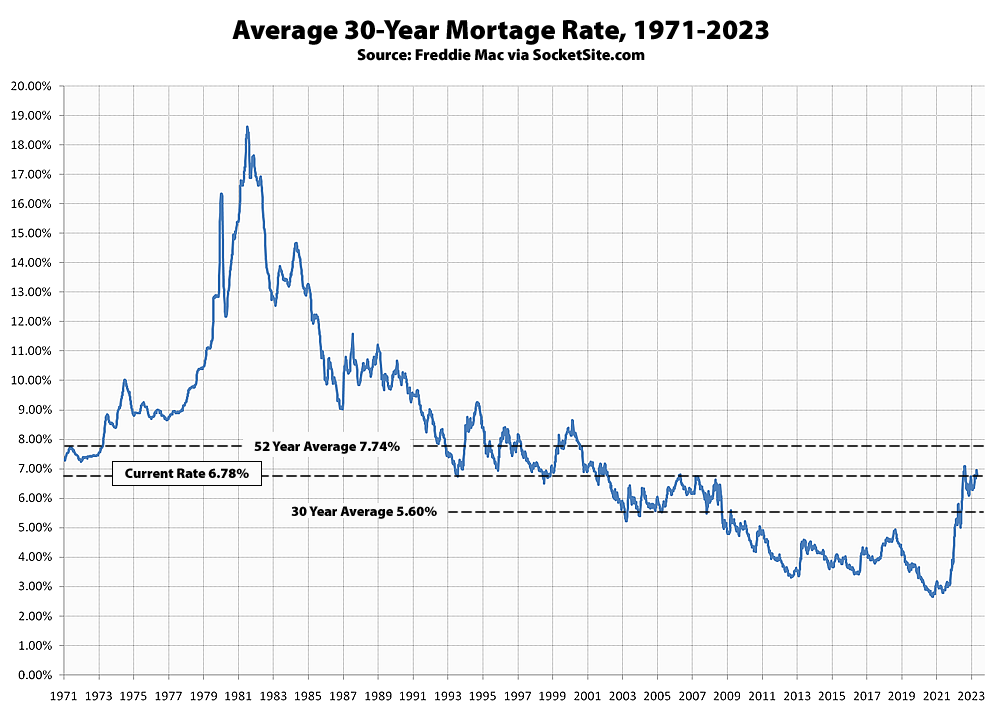

Having jumped 15 basis points (0.15 percentage point) to within 12 basis points of its 21-year high last week, the average rate for a benchmark 30-year mortgage dropped 18 basis points over the past week to 6.78 percent but remains 124 basis points higher than at the same time last year; over 400 basis points higher than its all-time low of 2.65 percent in early 2021; and well below its long-term average of 7.74 percent.

At the same time, the average rate for a 30-year jumbo loan, the availability of which has continued to drop, has inched back under 7 percent but remains at an effective decade high, with the probability of a rate hike next week up to 99 percent and the odds of an easing by the end of the year having dropped to zero, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

UPDATE: As projected, the Fed just announced a quarter-point rate hike, the impact(s) of which shouldn’t catch any plugged-in readers by surprise.