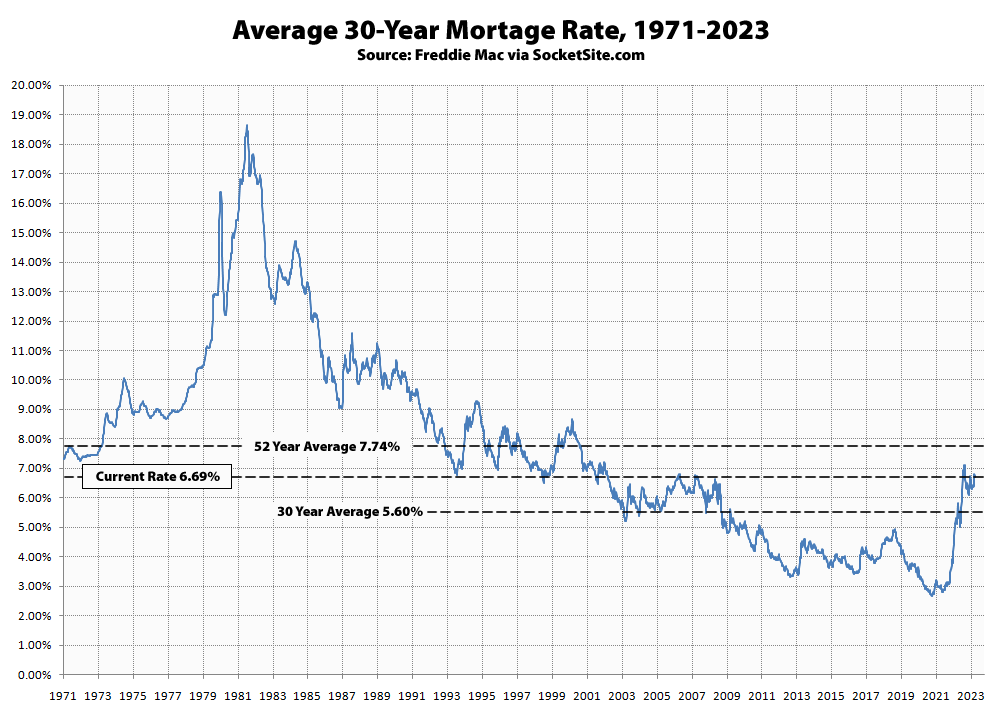

The average rate for a benchmark 30-year mortgage inched down 2 basis points (0.02 percentage point) over the past week to 6.69 percent, which is 91 basis points higher than at the same time last year, which shouldn’t catch any plugged-in readers by surprise.

At the same time, mortgage credit availability has dropped back to a new decade low, jumbo-conforming spreads have further narrowed, and risk premiums are on the rise.

And while the yield on the underlying 10 year treasury has dropped around 6 basis points since the most recent rate survey, following yesterday’s announcement by the Fed, the yield is trending back up and the probability of another rate hike this summer has actually ticked up to 69 percent and the odds of an easing this year have dropped below 10 percent.

UPDATE: The average rate for a benchmark 30-year mortgage inched down another 2 basis points (0.02 percentage point) over the past week to 6.67 percent, which is 86 basis points higher than at the same time last year. At the same time, the probability of another rate hike this summer is approaching 80 percent, with the probability of an easing by the end of this year now under 5 percent.