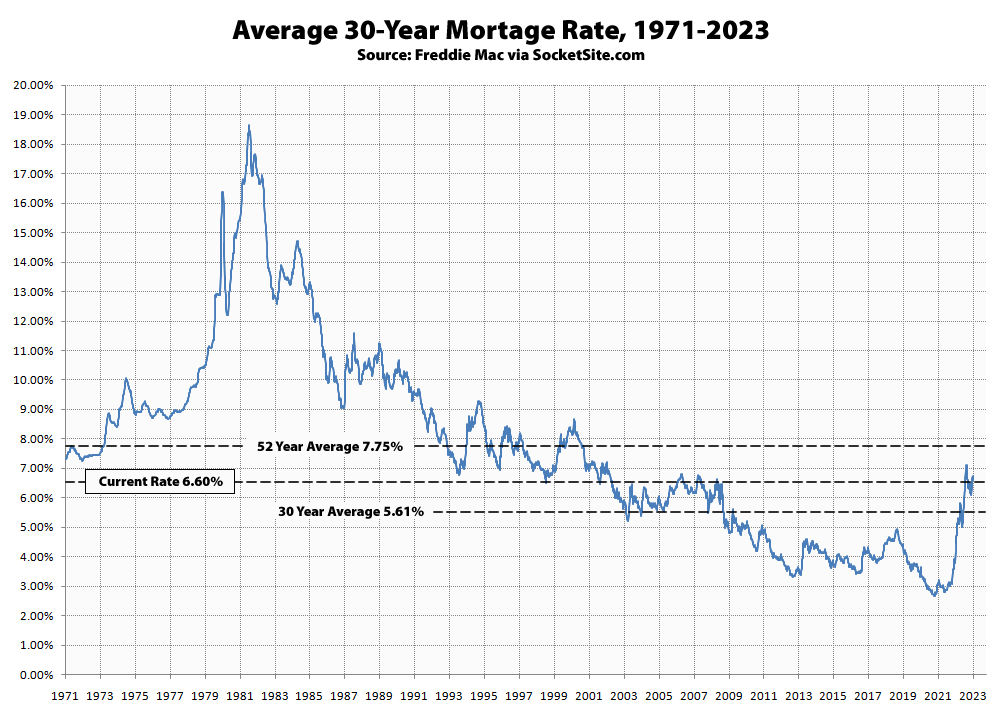

With all the volatility in the financial markets, the average rate for a benchmark 30-year mortgage ticked down 13 basis points (0.13 percentage points) over the past week to 6.60 percent but remains 244 basis points, or roughly 60 percent, higher than at the same time last year and 395 basis points, or roughly 150 percent, higher than its all-time low of 2.65 percent in early 2021.

At the same time, lending standards have tightened and mortgage credit availability has dramatically dropped. And while the probability of the Fed hiking rates over the next couple of months has dropped from 100 percent, the odds of a hike, versus an easing within the next quarter, are currently running at 95 percent, but the odds of a subsequent easing by the end of the year have jumped to 80 percent. We’ll keep you posted and plugged-in.