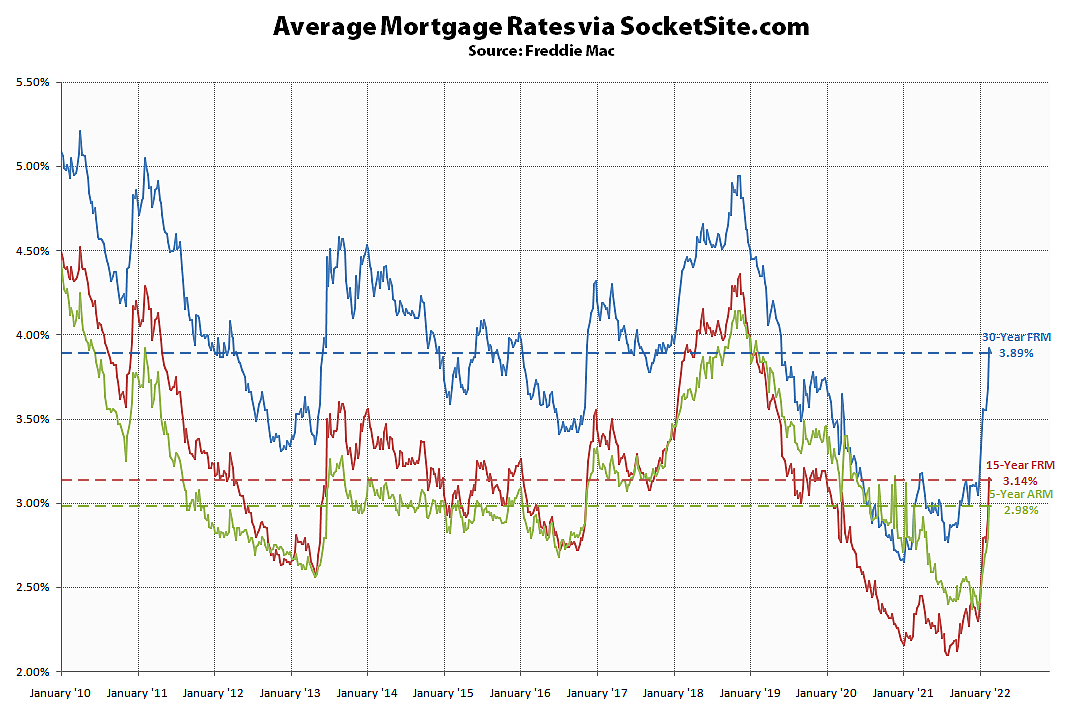

Having jumped nearly 30 percent over the past two months, the average rate for a benchmark 30-year mortgage pulled back 3 basis points (0.03 percentage points) over the past week for an average rate of 3.89 percent, which is 92 basis points, or 31 percent, higher than at the same time last year and the second highest average rate in nearly 3 years.

At the same time, lending standards are tightening, mortgage loan application volumes have dropped to a two-year low, and bond traders are still projecting a quarter-point rate hike by the Fed next month with another hike in May and a total of six quarter point increases by the end of the year (which should translate into higher mortgage rates, less purchasing power for buyers and downward pressure on home values).