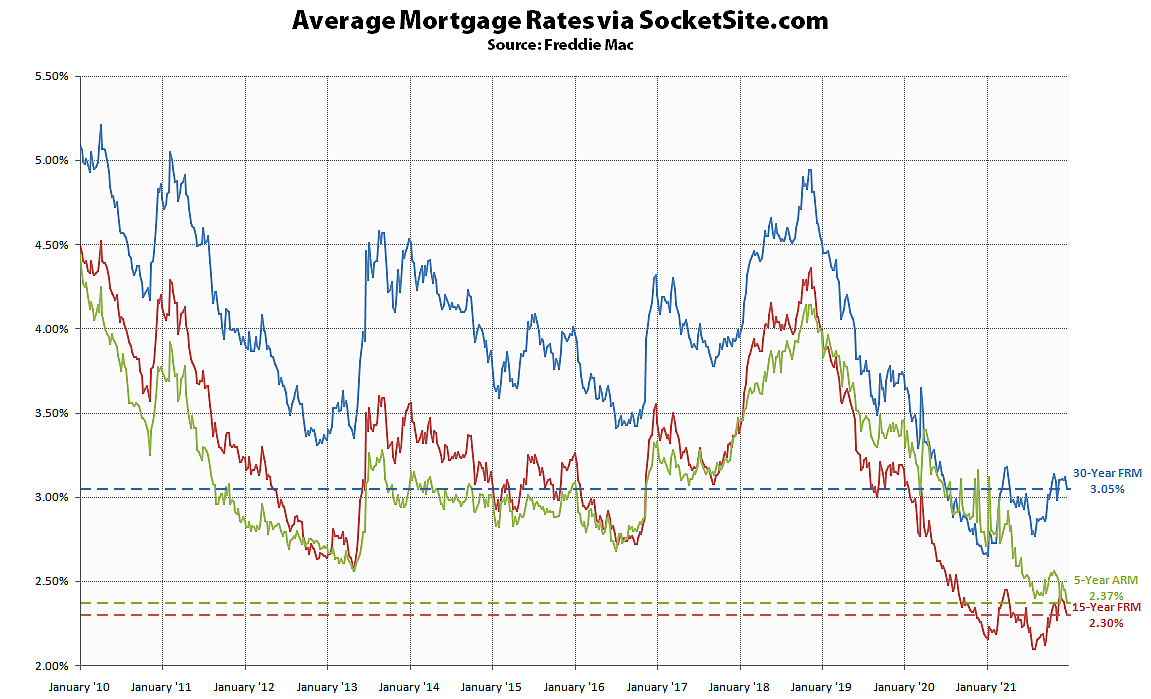

With the Omicron surge rattling the market, driving bond yields down, the average rate for a benchmark 30-year mortgage slipped 7 basis points (0.07 percentage points) over the past week to 3.05 percent, which is 39 basis points above its mark at the same time last year but still over 50 percent less expensive than average over the past 30 years and within 60 basis points of its all-time low of 2.65 percent earlier this year.

At the same time, the average rate for a 5-year adjustable rate mortgage dropped to 2.37 percent, which is 42 basis points lower than at the same time last year, and the average rate for a 15-year fixed-rate mortgage inched down to 2.30 percent, which is 11 basis points higher than at the same time last year. But the Fed is still positioned for multiple rate hikes next year, which should result in higher mortgage rates and less purchasing power for buyers.