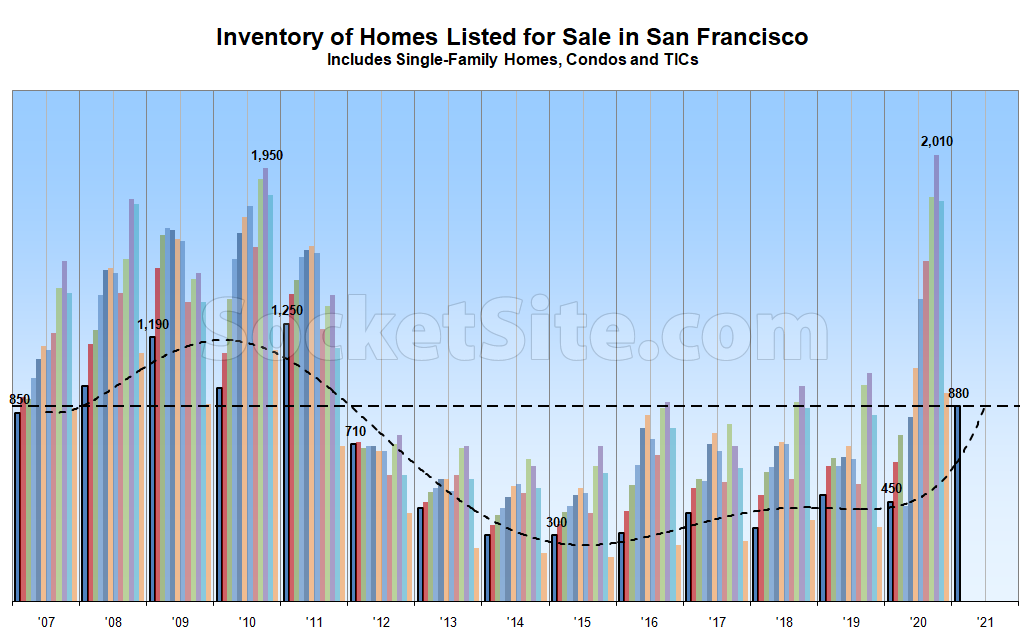

Having dropped at the end of last year with a typical culling of unsold listings and seasonal slowdown in play, along with nearly twice as many homes in contract than there were at the end of 2019, the number of homes listed for sale in San Francisco (880) has started ticking back up and there are now around twice as many homes on the market than there were at the same time last year and three times as many as there were at the start of 2015.

At a more granular level, there are currently 110 percent more condos on the market than there were at the same time last year and 55 percent more single-family homes.

And while the percentage of homes on the market in San Francisco with a reduced list price has dropped to 26 percent, driven by the aforementioned culling of unsold listings which are likely return to the market with “new,” but not officially reduced, list prices, that’s eleven (11) percentage points higher than at the same time last year with an “expectation gap” of around 6 percent between the average list price per square foot of the homes which are in contract and those which are not.

Expect inventory levels to climb over the next quarter and likely through the middle of the year.

Will the inventory level exceed 2020 peak. With so much exodus I wonder why prices haven’t come down yet in any meaningful way?

At these vacancies and rent reduction and general negative sentiment I would expect SF RE prices to drop like a stone but they haven’t in spite of almost a year into pandemic.

Depends on how you define “a stone”…. Condos have dropped maybe 20% on average? I have seen some really attractive condos going for 15% less in the last couple of months…

But MFH have dropped maybe 25%? and the number of listings of MFH is probably 10x of 2019?

But I think SFH and condos probably have hit bottom already… but MFH have a long way to go in terms of more price reductions….

Multi-family home inventory has been running an average of 75 percent higher on a year-over-year basis over the past quarter, slightly less than 10x.

I have to respectfully disagree with your stats on MFH. I ran a search in 2019 year end and there were 30+ maybe 40+ listings on Zillow. Cap rates were 1%+.

Today, there are 250+ listings on Zillow, so that is 7x, or 700%, not 75%.

We can’t account for your queries or source, but there were an average of 110 multi-family properties on the market on any given week in December of 2019 (versus 210 last month).

Zillow doesn’t capture nearly all the multifamily listings. Multifamily isn’t really their market (at least on the sales side) and they don’t seem to try very hard to capture all the listings, many of which may not be in the “normal” MLS.

So any benchmark of listings using Zillow as the only source is suspect. Even more so a comparison of a year ago vs. now, as I suspect they may be capturing more of the MFH listings today vs. a year ago.

If Condos have bottomed why would MFH drop more? In then end they compete for the same tenants.

Also how long do you think MFH will keep dropping?

Condos are usually kept in better conditions and easier to compete for a tenant.

MFH, on the other hand, at least a lot of them, are under maintained and in marginally habitable conditions. Those will be vacant for a long long time, and hence force the landlords to put them up for sale.

At least, that is my theory. I am waiting until at least end of 2021…

A simple theory with plenty of explanatory power is that the “exodus” is a myth. Indeed, there is ample evidence that domestic mobility hit an all-time low in 2020, and little evidence in favor of the exodus.

“[…] little evidence in favor of the exodus.” !!!

Ignore all those moving vans, U-Hauls, sidewalk mattresses, empty flats, For Rent signs, and vacant storefronts! We’re in the middle a giant boom, I tell ya!

[Editor’s Note: Average Rent in San Francisco Dropped $1,000, or 24 percent, last year.]

Those aren’t evidence, they’re just memes. Census data for internal mobility shows the lowest-ever internal migration level in 2020. People are not exodus-ing, they are hunkering down. Census however doesn’t provide that data for individual cities, so it might not speak to SF particularly.

The whole U-Haul meme doesn’t even make sense. They got clobbered by covid and had a terrible 2Q ending 6/30 last year.

This Proposed Five-Year Financial Plan for San Francisco came out last week – Jan 15th 2021.

An excerpt:

The lack of online sales tax growth in San Francisco is difficult to explain without some loss of population. To be sure, consumer spending declined during the shutdown, and savings rates increased, but this is true everywhere, not only in San Francisco. And while it could be argued that, as an affluent and tech-savvy county, San Franciscans already heavily relied on internet retailers, the same could be said for counties like San Mateo and Santa Clara that saw double-digit growth in online sales. Even more dramatic evidence of out-migration can be found in indicators of the city’s real estate market, especially apartment rentals.

According to the listing service ApartmentList, San Francisco’s average asking rents had declined by over 25% from November 2019 to November 2020 – the largest drop of any large city in the country. While not direct evidence of out-migration, this trend is difficult to explain without at least a temporary reduction in population. Across the Bay Area, the ApartmentList data also indicates the highest declines in rent in cities where large concentrations of tech workers live, on the peninsula and in western Santa Clara County, as well as San Francisco.

This suggests that office workers, working remotely, are the group leading the exodus, and the not low-wage workers who are much more likely to have become unemployed. Out-migration, and not merely working at home, is another consequence of the shift towards remote office work during the pandemic.

As an extreme form of the spatial separation of the city’s economy during the pandemic, it also increases the stresses on the low-wage sectors and workers that provide in-person services, retailing, and hospitality. Because of the direct and indirect contribution of office industries to the city’s GDP, the prevalence of remote office work after the pandemic will have a powerful influence on the city’s economy over the next five years.

If widespread vaccination and virus abatement lead to a rapid return to downtown offices, then the city’s recovery to pre-pandemic levels of employment and GDP will be accelerated, and conditions could return to normal soon. On the other hand, if office tenants and their employees decide that the cost benefits of extended working from home – or outright relocation – outweigh any loss of productivity, then expensive office and real estate markets like San Francisco face an uncertain future.

The private sector office activities that drive the entire city economy, and the city’s tax revenue, locate in downtown to access and build a workforce from the highly skilled and specialized labor that resides in the Bay Area. If it is no longer necessary to physically bring workers into downtown offices – or for those workers to live in the Bay Area – then the consequences for the regional economy could be severe.

At present, there remains a great deal of uncertainty regarding what the post-pandemic future holds for remote work. Some surveys indicate a preference for a “hybrid” office – in which working from home is more common than in the past, but regular office time is still an on-going part of work-life. If such a practice were to become common, it would reduce office occupancy in the City over the short run, relative to pre-pandemic levels. This would tend to slow the city’s recovery, in comparison to a “rapid return” scenario, but should not lead to the painful economic restructuring of a “fully virtual office” scenario. While it’s important to stress the city’s loss of commuters and residents, the hard-hit leisure and hospitality sector also relies on visitors.

Limitations on international travel, consumer aversion to air travel, and a shift to budget destinations have played against San Francisco’s strengths as a high-cost, international destination. According to data produced by the travel consultancy Kalibri Labs, airplane ticket purchases to San Francisco were down 80% from last year over the late October and November period. Along with New York and Boston, San Francisco’s air travel performance was among the worst of the cities examined and significantly worse than the U.S. average.

But inventory hit a 20 year high a few months ago and is still at a seasonal 10 year high. Rents have dropped dramatically and vacancies gone up. There’s a whole list of properties that are going around or below 2015 pricing. Cellphone tracking data shows that people actually left. The New York Times even just did an article about all this.

Conversely, what explanatory power does “the exodus is a myth” hold?

Jeffrey W. Baker is in denial. The data showing a collapse in sales tax receipts for S.F. coupled with a lack of offsetting sales tax receipts from online retailers for local deliveries and the distinction between the same effect in nearby counties is damning evidence of a local exodus and it is, in fact, clear, convincing and compelling.

The census data will be a trailing indicator, at best. It might be true that domestic mobility hit an all-time low in 2020, but only nationally. The other indicators say that S.F. is being hit hard.

As far as anecdotes, I went to Enterprise Rental Trucks during the period between stay at home orders a few months back and the guy at the counter shook his head and told me I was lucky to be able to rent the cargo van I was picking up. He said he had a veritable endless stream of demand from people moving out of The City.

Come on. You’re being willfully obtuse.

No exodus. Suuuure. All facts say otherwise, realtor.

Well, is year over year single family homes sales data a fact? Because it says otherwise.

By definition, wouldn’t an increase in the number of people selling their homes be evidence of an exodus?

Well maybe if it was only people in the process of actively selling. I’m talking about single family homes sold. They were up in both volume and average dollars per foot price. So, no.

Three of my friends have sold their homes over the past 6 months, all left the area. None of them were planning on moving prior to the pandemic.

But it isn’t as if everyone is leaving. With decades high inventory it isn’t that surprising that sales would be up. Some people leave and sell and some people here take advantage of price weakness to buy into more space/out of an apartment. You see people on this site and elsewhere talk about buying for investment purposes as well. Very premature IMHO, but some folks think otherwise.

“This suggests that office workers, working remotely, are the group leading the exodus, and the not low-wage workers who are much more likely to have become unemployed. ”

Also not surprising that average psf would go up if most of the exodus is from the high end of the market. The New York Times looked at the NYC market and saw the same thing as the SF controllers report regarding the exodus being from the high end. The SF controllers report looked at sales tax data while the NYT looked at cell phone tracking and USPS mail forwarding data. So you have quite a variety of different data sources all pointing the same way regarding the exodus from dense coastal cities.

But Wilson, to your point “some people here take advantage of price weakness more space/out of an apartment.” More space? yes. Out of an apartment? yes. Price weakness? Not supported. Not for SFRs as of last YoY.

Just look at the apple to apple list of all the places that went for 2015 or below pricing. And mortgage rates are down a good bit (Maybe 15-25%) since 2015. And there has been just a bit over 9% inflation since then. So all together some sellers are making very big concessions on price.

Do you do a breakdown of 2 unit buildings vs 3 or more? Since I’m looking for a place eligible for condo conversion, I’ve noticed a big gap in price and time on market between the two.

It looks like the January ‘21 inventory is lower than Dec ‘20, which hasn’t happened in a single year on this chart, so the worst might be behind us…

Google up another 6% today… lots of free money newly printed from the FED needing to find a home in SF real-estate

So, you’re saying tech’s a paper tiger Ponzi propped up by instability- and inequality-exacerbating loose monetary policy? Can’t argue with that, although I think the days of tech stock gains pouring into and propping up SF RE are done. Guess we’ll find out.

Yeah basically what I am saying, and have been saying sine 2009…go figure. Think the Fed made a massive policy mistake in early 2020 by pumping this much new money into the economy so fast. It isn’t doing anything beneficial to the laid off workers other than permanently pricing them out of a middle class lifestyle forever. The top 10% who buy SF property can’t really complain however… Hold TSLA stock? Enjoy your free unearned condo…

Alternatively, you could say the market continues to be unfazed by these companies having most of their workforce remote.

Or that the market thinks that remote working is actually profitable by way of reduced wages and office RE expenses.

Employees now have to bear the cost of real-estate, power, cooling, internet, facilities maintenance, liability insurance etc. I think its a trade-off that works to the employers advantage IF the productivity levels remain the same or improve.

I agree completely. Many media articles cover the employee side of the remote work shift, but the employer cost saving side is at least an equal if not a bigger driving force. And it can even be a win win for both sides if the cost of living is much lower in the remote location. It’s not what you make, but what you keep that really matters.

Landlords have been saddled w/ the rising utilities from people WFH. Not looking for a violin to play just stating a fact.

@wilson — I really think 2020-21 will be recorded as the years of BYOO/D — bring your own office/devices. A kind of a mass switch to gig-economy. The WFH model breaks the (traditional) tight binding between employee and employer. The employee gains the time flexibility (to pursue multiple gigs) and in exchange the employer(s) gets cost savings. Its a really smart way to cushion inflation.

or that the market is chasing yield due to incredibly low interest rates

this is going to be like 2011 with a lower spike year over year heading into summer

Can Socketsite share the .csv format of this data?

It’s really difficult to determine the true state of the housing market when there’s major factors affecting liquidity. Right now anyone with a conforming government-backed loan is protected by a moratorium, so anyone in the affordability margins — perhaps by buying during the last dip — is able to wait this out if needed.

The same is true for multi-family units, their value is greatly depressed by tenants that cannot be displaced, so mainly those who have no other choice are the ones being pushed to sell in this market. There are a lot of properties that would otherwise be vacant, and likely sold. Please note I’m not for pushing out tenants during a pandemic, but merely pointing how it’s affecting the market.

Furthermore, if rents continue to stay depressed, the “rent vs. buy” calculus changes, and will start putting downward pressure on the market.

Perhaps SF really has bottomed out, but imo there is too much uncertainty for anyone to call it either way.

Can we see this by neighborhood and price bands?

All right, how bad is the exodus situation? I still do not know. But YoY Total Electricity Consumption for City of San Francisco, between 2019 and 2020 is, on average, down by 41% (Source PG&E).

That number of course is inclusive of both commercial and residential districts. The data trove is huge and it will take me some time to parse through it. I’ll put it up this weekend (if I find time — no promises).

Hadn’t heard about the PG&E data. It’s just one more indicator of a population drop. Add that to the U-Haul stats, the change of address requests, the drop in rents and the curb parking availability index. There is no doubt the population has dropped – the only question is how large is the drop. And how long will the decline in population continue. My guess is YOY this spring the drop will be 10%.

And for NYC the NYT also looked at trash collection data which tells the same story, not only of exodus in general, but specifically from wealthier denser areas:

“Some of the shifts are counterintuitive. Even though more people are staying home all day, the total residential garbage collected has dropped in all boroughs except Staten Island. One reason is that, as cellphone data shows, some residents — especially in wealthy, dense neighborhoods — fled the city for country homes. Garbage plummeted 22 percent in Manhattan; in affluent Greenwich Village, volume was down 35 percent.

The largest increases took place in some of New York’s poorest areas, where people are more likely to hold essential jobs and less likely to have the means to leave. For instance, Morrisania in the South Bronx saw a 5.6 percent increase in trash.

Some higher-income neighborhoods with single-family homes — where people have yards and gardens to escape to and basements to tidy — also saw increases, like Tottenville in Staten Island, where trash volume was up 5.8 percent.”

The reduction in electricity usage is largely commercial office buildings. Prior to covid, San Francisco’s daytime population was multiples of its nighttime population. Not any more.

Also, don’t forget interest rates. Property prices could be flat in a market with otherwise reduced demand because of low capital costs, which inflate asset prices: the very purpose of federal reserve policy.

A thought from my old boss John T. Chambers: “Does this opportunity create opportunities for Texas, North Carolina, Ohio, my home state of West Virginia? Absolutely,” he said. “You have to create the right environment for start-ups and we’ve learned that, with the pandemic, you can put your resources anywhere.”

“Chambers resides in California with his wife of more than 40 years. He enjoys fishing, swimming, and spending time with his two children, as well as his two grandchildren”

I guess, then, he’ll soon be updating his bio…as well as removing the panorama of SF from the top of the web page.

Chambers belongs to 1% of 1% wealthy club. He can afford to own several homes in several cities around the world. His main point is the falling desirability of California/SV as a startup/tech destination. The reason why he’d make a statement like that is to express the business sentiment to TPTB. Business would much rather stay in SV. But if the staying is expensive, they’ll pick up and leave. These are weighted words.

Consider the following example: A small startup with 20 people. Each paid an average salary of $200K/yr, $4M/yr burn rate. Startups have finite time to prove their execution – typically 1, 2 years. That’s $4M-$8M before the feasibility is proven.

And VCs have finite amount of capital. And not every startup is likely to be a success. So they spread their bets across several different startups to both hedge their risk and diversify their holdings. If the cost per bet is high, the number of bets they can make is lowered increasing their risk. If situation gets to a point where it is so expensive to make these bets and the number of bets is below a certain threshold for risk diversification, investors are better off making their bets elsewhere.

In other words — build more housing, improve service infrastructure AND be business friendly.

The lack of a regional government with real power has hurt the Bay Area immensely. All the tech jobs concentrated in SV as well as far too many office jobs in SF – with both areas failing to build housing. Forcing housing to the periphery and leading to long commutes. The housing that is built in the SV or SF is limited and becomes too expensive for even many tech workers. The housing on the periphery is significantly less expensive but comes with a 3, 4 or 5 hour daily commute.

A regional government would have capped office construction in downtown SF a while ago and directed it to Oakland and other designated hubs. Sites zoned for offices in SF would be converted to residential zoning. The same goes for the SV. The planned massive Google campus in San Jose should have been built in the Tri-Valley area.

The transportation situation is hurt by a lack of co-ordination. SamTrans and Muni should be merged as well as the separate East Bay districts. The 3rd St subway is an example of crony government. A massive waste of funds that could have been better used in other parts of the Bay Area to build up much more pressing regional transportation needs. HSR was a pipedream but it should have been planned to come up the East Bay side and not the Peninsula. And to directly connect to AMTRAK. And on and on.

The Seattle/Bellevue/Tacoma region is increasingly more vibrant and robust because it has large office hubs spread throughout the metro area. And it has a far belter transportation system with major new lines set to be opened every 3 or so years in this decade. SF’s failure to build housing is in stark contrast to the massive amount of new housing that has been built in the past decade in Seattle.

There are too many fiefdoms in the Bay Area battling one another for funding and failing to work towards a sustainable future for the region.

Fossil businesses like EMC, HP, Oracle, and eventually Cisco will all vacate the SF Bay Area because they are in terminal phases of their lifecycle where saving money on office space and paper clips is important to profits. To be honest I can’t even imagine why a Cisco would relocate to any American jurisdiction instead of Bengaluru where 99% of their staff already lives anyway.

Point is, it has been a long time since these fossils were relevant to the future of the local economy. They were here on inertia and if Austin wants to collect them all, I wish them the best of luck. Landing HPE, Oracle, and Cisco isn’t going to make a city be the next Silicon Valley because the whole Silicon Valley thing is cranking out new companies, not perfecting old ones. If it was about the old stuff it would have been a fatal blow to Silicon Valley when National Semiconductor, Linear Technology, and Lockheed were in their declines.

Even if we accept this at face value, the fairly obvious problem to me is that companies such as National Semiconductor, Linear Technology, and Lockheed were better places to work for employees than companies such as Uber, Lyft and DoorDash.

The so-called “gig economy” companies that specialize in using mobile apps, developed by a small number of highly-paid people (wherever they are located) to immiserate millions of other people who slave away as “contractors” with no benefits and most of whom earn less than the minimum wage are, admitedly, “new companies”, but are they better? I would argue, No.

And if they are “the future of the local economy”, then that does not bode well for anyone, except the VCs which make out like bandits upon “liquidity events”. And local employees who are fairly compensated are the ones who purchase real estate locally; most “gig workers” won’t be able to.

You will find no greater critic of those garbage companies than me. However I certainly was not talking about them. The prime movers in the Bay Area tech economy are Apple, Google, Facebook, Intel, AMD, Netflix. You could lose DoorDash in a corner of one of Google’s less important offices.

Startups thrive on HR and Capital investments made by these “fossils”. Once an idea is proven, the personnel required to scale these ideas are “borrowed” from these fossils. There is so much else that goes on where both the fossils and newbies are inter-dependent on each other for their survival and growth. I know exactly how this works having seen this up close and personal myself. These big companies vacating from the Bay Area is summarily not a good thing.