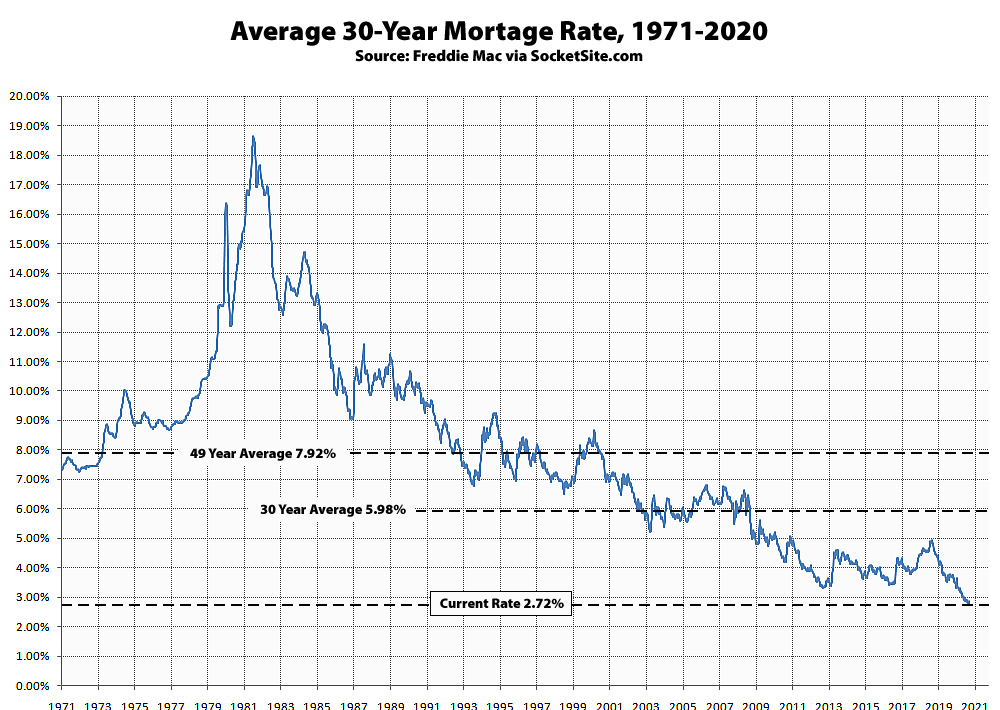

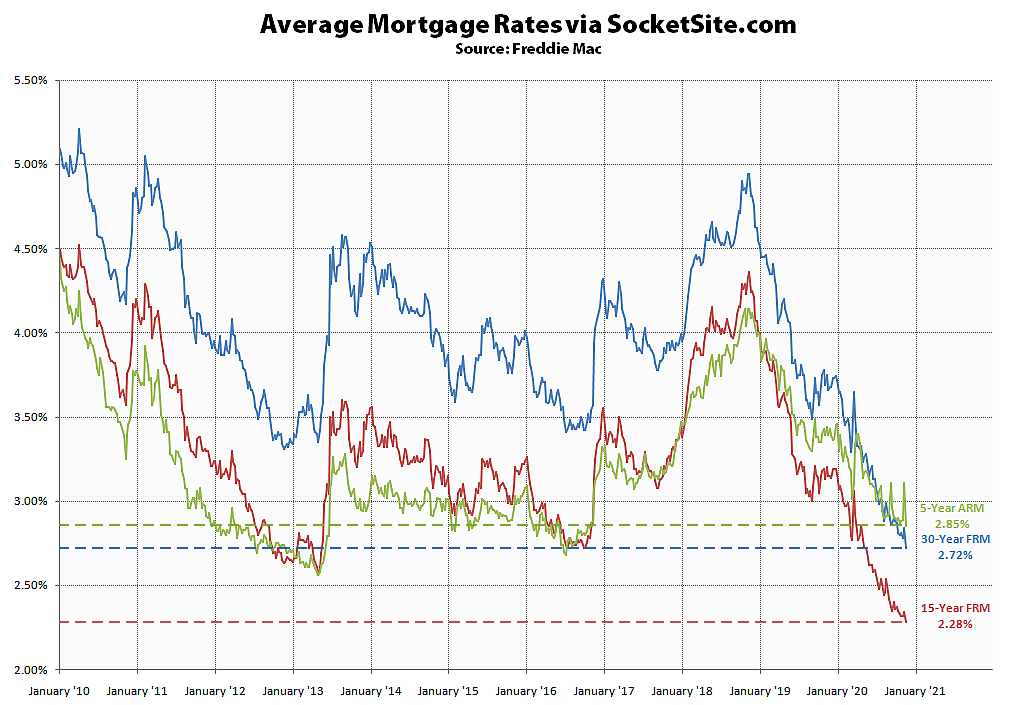

Having inched up last week from an all-time low of 2.78 percent the week before, the average rate for a benchmark 30-year mortgage has since dropped 12 basis points to 2.72 percent, which is nearly a full percentage point lower than the historically low rate that was on offer at the same time last year and the 13th new record low this year, according to Freddie Mac’s Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has ticked down 6 basis points to 2.28 percent, which is 87 basis points below its mark at the same time last year and a new all-time low as well, while the average rate for a 5-year adjustable dropped 26 basis points to 2.85 percent, which is 54 basis points below its mark at the same time last year and an inverted 13 basis points above than the average 30-year rate, all driven by weaker economic data along with a rise in both near-term and medium-term economic risks.

Good information

Where is my jumbo refi at 2.75% ;)?

Zillow has a pretty good “marketplace” search tool where you plug in some basic parameters about your loan and can see some indicative rates for loans. You’ll enjoy re-fi ads for the next 12-18 months on all of your devices, but maybe it’s worth it. If you’re eligible, I would start there. I just plugged in a low LTV jumbo and Zillow says Guaranteed Rate mortgage is offering 2.75% 30Y fixed. I am not affiliated with Zilllow or the lenders, so calm down Brahma and eight beers and Tipster and everyone on the real estate-industry-hate bandwagon.

Separately a good ruling today I saw in the WSJ requiring more transparency about fees paid to buyer’s agents. in a settlement with the NAR.

UPDATE: While the all-time low average rates for 15 and 30-year mortgages have held over the past week, the average 5-year ARM rate has since jumped 31 basis points to 3.16 percent.

And while refinancing activity increased another 5 percent, purchase activity dropped 2 percent but is still 19 percent higher than at the same time last year (versus 26 percent higher last week).