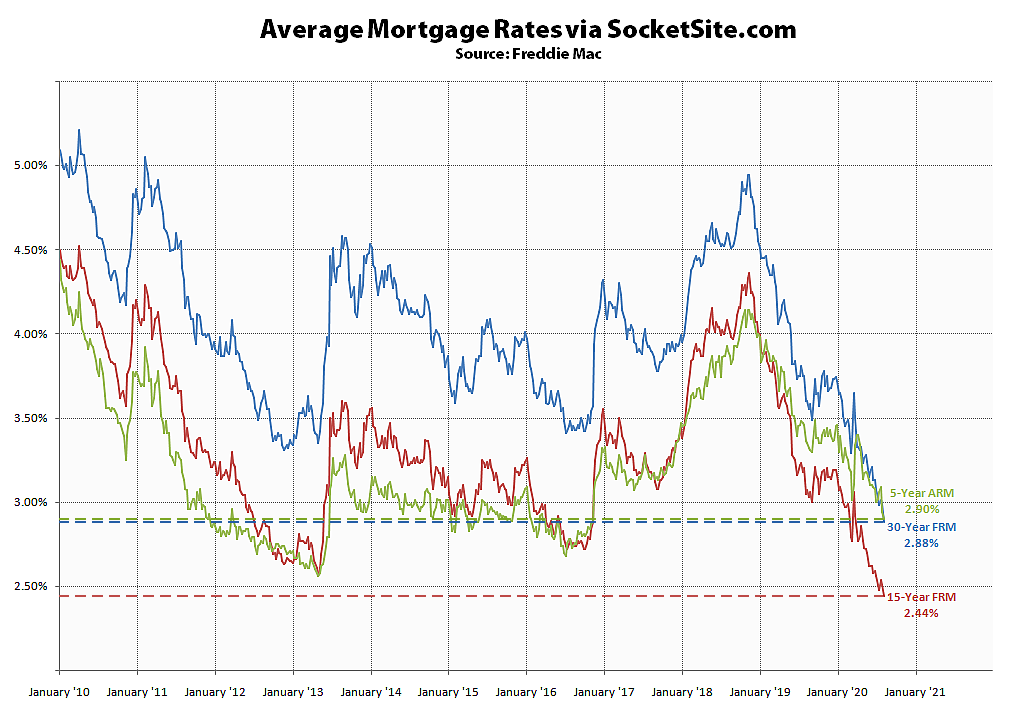

Having slipped back under 3 percent last week, the average rate for a benchmark 30-year mortgage has dropped another 11 basis points to 2.88 percent, which is 72 basis points below its mark at the same time last year and a new all-time low, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has dropped to a new all-time low of 2.44 percent, which is 61 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable shed 4 basis for an inverted average rate of 2.90 percent, which is 46 basis points below its mark at the same time last year.

And in terms of mortgage market activity, applications to refinance actually dropped 7 percent over the past week, despite the drop in rates, but were still 84 percent higher on a year-over-year basis, while purchase mortgage volumes slipped another 2 percent but were 22 percent higher versus the same time last year, according to the Mortgage Bankers Association.

This is for federally backed mortgages though, right? Wonder how the jumbo rates are looking.

3.125 no cost to refi for 30 year jumbo in sf

Where are you getting those Jumbo rates? I ask because my mortgage broker told me things are on hold for jumbo refi

that is what i heard… No jumbo anymore…

That’s incorrect. While qualifying standards and/or requirements have been raised, jumbo loans are still being written.

How long did it take to close the refi? Just curious about the runway I have if I were to start shopping around now.

we haven’t closed yet. are 14 days into what I was told would be a 60 day process. i am self employed as well which complicates things. They require at least 30% equity and 2 appraisals.

If one considers where 5/10/30 year treasuries are, the story in not how low mortgage rates have gone but rather why they haven’t dropped even more.

Crazy demand to refi has created a lender’s market.

Those rates are available at big banks like Wells Fargo.

Got a recent quote for 3.25% with 0.035 points for a jumbo refinance for a single-family home in Berkeley. Wells offered me 3.75% and required 18 months of PITI reserves (50% of which can’t come from retirement accounts). Wondering if there are better rates over the horizon as the jumbo-conforming spread narrows. Fingers crossed.

Two months ago I applied for a refi…..65% value to debt….conforming loan….800+ fico….low debt to income ratio….three years of returns….20years of ownership and a partridge in a pear tree.

Two months later after three pounds of documents we closed on a 2.99% fixed 30yr.

Two months. I talked to the loan originator and he said I slid under the wire…..no jumbos….and the underwriters are putting the processors through the wringer….i’s not dotted…..t’s not crossed…..package gets kicked back for another round.

Sure rates are low….but be prepared for a long drawn out process….did I say no jumbos?

and jumbo for investment properties dont exist anymore….

Strange. I have had no problem so far refi’ing my $2M loan on $3M place at 3%. Appraisal came through and the process is moving forward fairly seamlessly.

Thanks @CVLawyer. Good to know. Who is the lender?