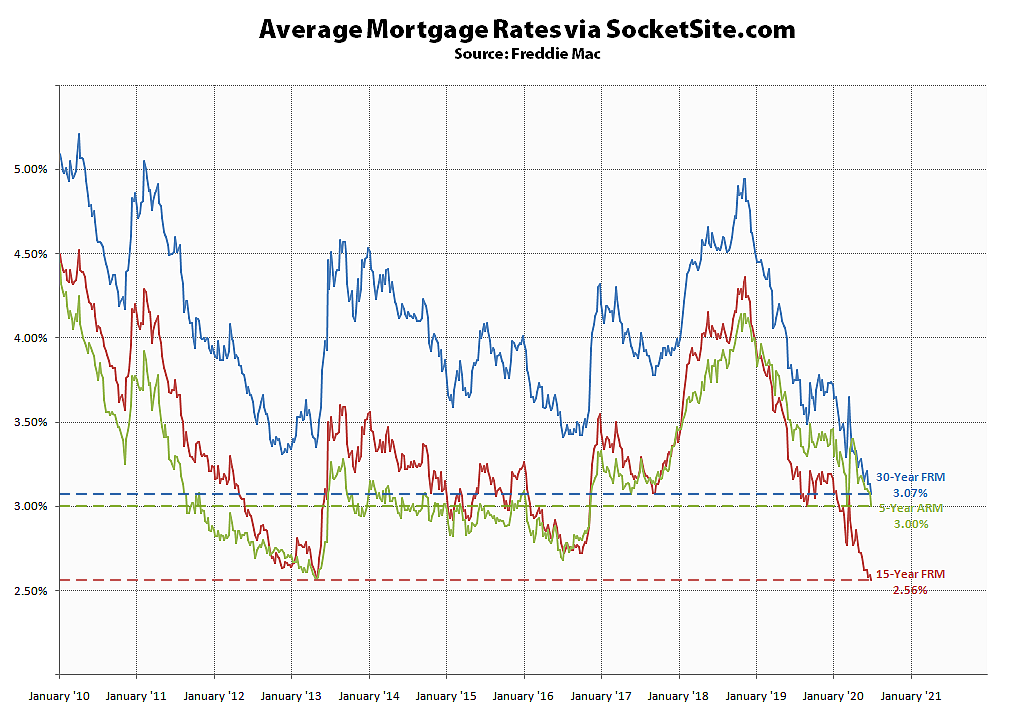

The average rate for a benchmark 30-year mortgage dropped another 6 basis points (0.06 percentage points) over the past week to 3.07 percent. That’s a new all-time low for the average 30-year rate, 68 basis points below the average rate at the same time last year, and within 8 basis points of an unprecedented sub-3 percent average rate, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has dropped to 2.56 percent, which is 62 basis points below its mark at the same time last year and an all-time low as well, while the average rate for a 5-year adjustable is down to 3.00 percent, which is 45 basis points below its mark at the same time last year but still 44 basis points above its all-time low of 2.56 percent.

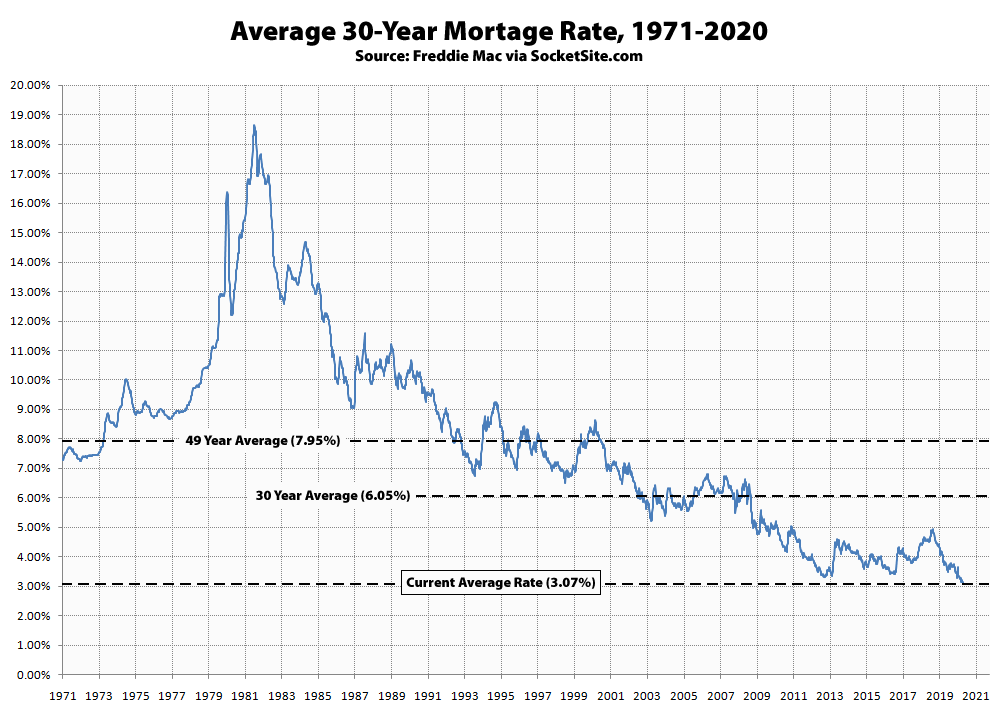

Keep in mind that the 30 year average for the 30-year rate is a little over 6 percent and closer to 8 percent over the past 49 years.

Looks like its time to refi!

Anyone finding jumbo refinance loans available on attractive terms?

Chase just quoted me a 2.99% rate.

For refinance?

I got quoted 2.75% 30yr refi through Owning. Let’s see if the underwriter comes through with the plug

Purchase.

I’m in process now. I’ve been in process for 4 weeks. I’m refinancing a 355K balance on a 710K appraised property. I’ve been locked in at 2.99 for 4 weeks. The underwriter is shaking and sweating, I can tell because of her questions to me. My FICO is above 800.

The reason I’m telling all is I have never been through more scrutiny for a simple refi in my life. Never. Sure rates are low, good luck closing a loan. Be prepared to give the bank your first born, but they will want you to provide a food allowance for the kid. Be prepared to give them ALL your financials, bank accounts, 3 years of tax returns, P&L’s and Balance sheets on any LLC’s you might own……and then drip….drip….drip for more info never seems to stop and for me this after they just issued me a 3.2% 30y on a home I purchased a month ago. Since we closed on that loan the lender seems to have gone bat sh_t crazy.

If you want to know which lender…”Please to meet you……..hope you guess my name”……Woo….who….

You’re getting a refi from the Devil? I think that’s a bad idea. That, or my Rolling Stones knowledge is shaky.

The Devil? Must mean Bank of America. :p

Maybe my closing delay will work to my benefit. My lenders rate just dropped to 2.87% and I asked that they give me the lower rate since we haven’t been cleared to close just yet. Considering I have nothing left to give them except for 6 pints of blood I think I’ll get the lower rate. Stay tuned.

If you want to know which lender…”Please to meet you……..hope you guess my name”……Woo….who….

My pet theory is that this is driven by the results of the Stress Test that the Fed put the banks through and there’s a big need for solid securities to fill in the gap in their long-term capital planning.

Has anybody had luck with a Jumbo refi on a 15 year load? If so what was the rate and institution?

Like ExSFLandlord, we are also in process.

For our primary residence, we’re rolling our existing mortgage and HELOC, about 750K total on a 2.2M property, into a new loan. We started the process in late April, decided on May 7th to go with the same place holding our current mortgage, and it still has not closed. Our credit rating is just over 800, but we are self-employed (and have been for 30+ years), so they have been asking for more and more and more documentation, definitely more than we’ve ever had to show in the past. The last request was for recent invoices we’ve sent to clients (to make sure we’re still in business, they said), and what they call an “audited” P&L from our accountant, tho’ I explained to them that he’d just be printing out the QuickBooks file we’d send him, as we do our own bookkeeping. I keep thinking they’ve run out of documents to ask for, but they keep proving me wrong. We had decided to go with an adjustable, 2.75% for a 7/1, LIBOR +2.25, which was definitely their best deal way back on 5/7. I am wondering if they have better programs now, and may ping them to find out, as we’ve usually gone the Fixed route.

We are also refinancing our live/work loft in SF, which we use partly for business, so that one can be a tricky loan. The same company that has our current house mortgage also holds the loft mortgage, but they do not seem very interested in refinancing it. So, we had to look elsewhere, and found a 3% 30 year fixed, for 510K on the 1.3M loft. We started that loan on June 4, IIRC, and it has not closed either. So far they have not asked for as much documentation, but only time will tell.

Don’t take this personally. Many people have stopped paying their mortgages or are in forbearance. This is creating a minor panic in banking circles and is causing lending standards to tighten up. Nobody really knows who is going to end up taking the hit for the mounting pile of unpaid rents and mortgages. Things are slightly better now than in 2007, but there still isn’t really that much margin for widespread mortgage defaults.

So I asked for the lower rate and was told we would need to start the application process over. I decide to pass and asked to proceed to closing. Yesterday the lender said, ” you are cleared to close” except we need a few additional documents from your HOA…..hello?

Hoping to close in the next couple of days……what an ordeal this has been. My originator told me it’s all about forbearance……then asked me if I had stopped paying on any of my mortgages? Can’t say I blame the lender for the extra scrutiny.

Just closed on a 30 year refinance, $720k @ 2.99% (3% APR) with Chase for a single family home in SF. Yes, they wanted lots of documentation, but nothing out of the ordinary. Surprisingly smooth process. The whole thing took about 7 weeks from when I first applied. I like how the closing happened here at home – we were all masked and gloved up.

Finally closed our 30yr fixed @2.99% (3% APR) refi….only took 60 days and about 3 pounds of documents, 6pints of blood, my wife’s wedding ring and a $1 M life insurance policy on me…….only kidding about the blood, ring and life insurance….

congrats