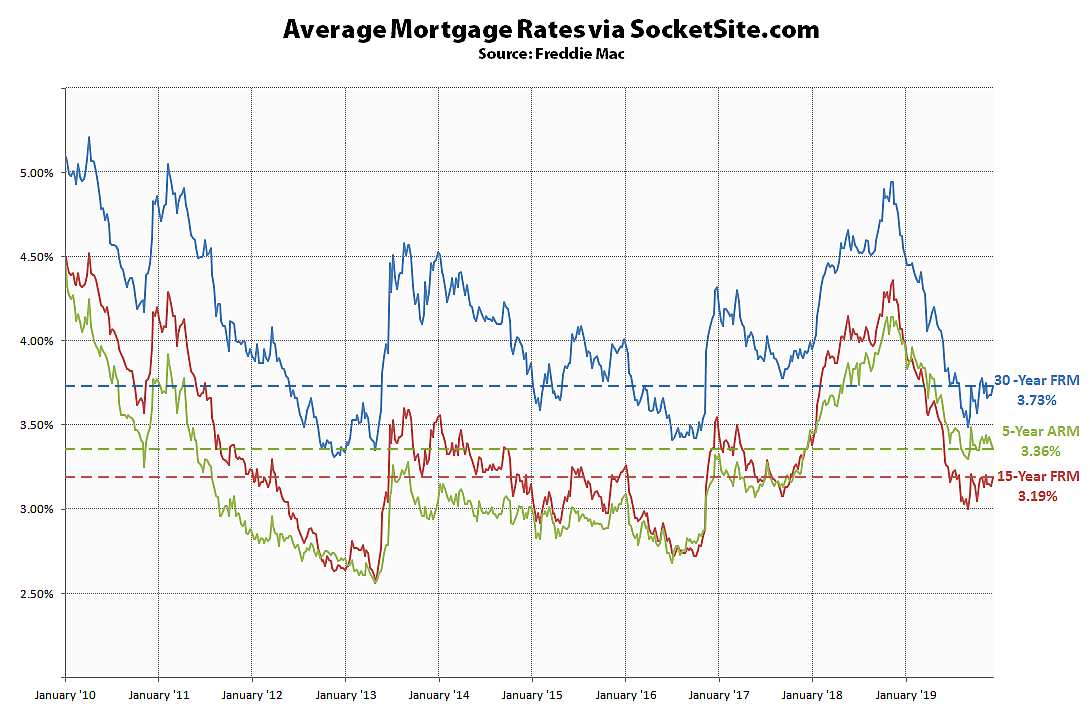

The average rate for a 30-year mortgage inched up 5 basis points over the past week to 3.73 percent but remains 90 basis points (0.90 percentage points) below its mark at the same time last year and within 32 basis points of a three/six-year low, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage inched up 5 basis points as well to 3.19 percent, which 88 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable inched down 3 basis points to 3.36 percent, which is 68 basis points below its mark at the same time last year, and the inverted spread between the 15-year fixed and 5-year adjustable rates has dropped to 17 basis points.

And with the Fed having signaled its intention to leave the federal funds rate unchanged over the next year, and then to start raising the rate in 2021, the probability of a rate hike in 2020 has dropped to zero (0) and the probability of a rate cut is down to 57 percent according to an analysis of the futures market.