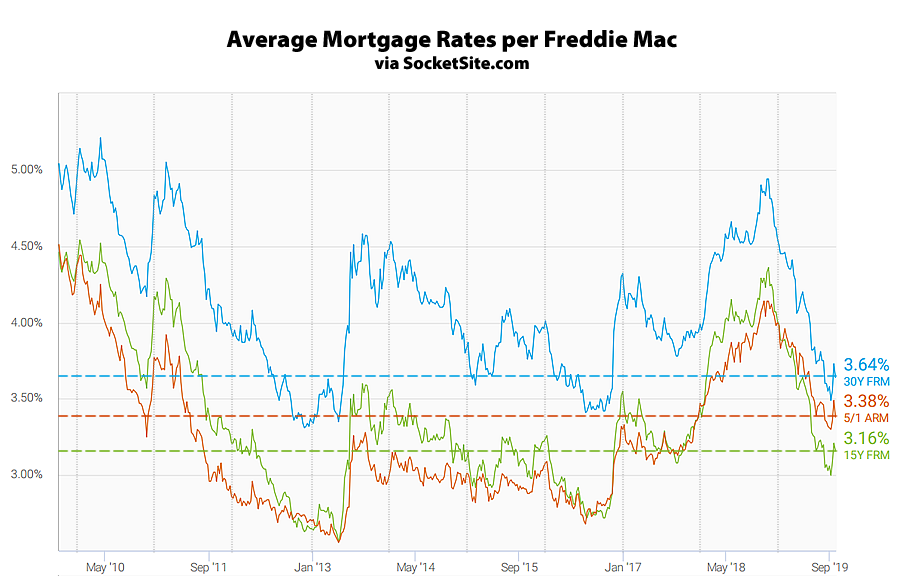

Having jumped 17 basis points last week, the average rate for a 30-year mortgage has since shed 9 basis points and now measures 3.64 percent, which is 108 basis points (1.08 percentage points) below its mark at the same time last year and back to within 23 basis points of a three/six-year low.

At the same time, the average rate for a 15-year fixed mortgage has shed 5 basis points for a current rate of 3.16 percent, which is exactly one percentage point lower than at the same time last year, while the average rate for a 5-year adjustable has dropped 11 points to an inverted 3.38 percent, which is 59 basis points lower than at the same time last year.

And with respect to the odds of the Fed instituting a third rate cut by the end of the year, according to an analysis of the futures market, the probability has crept up to 73 percent.