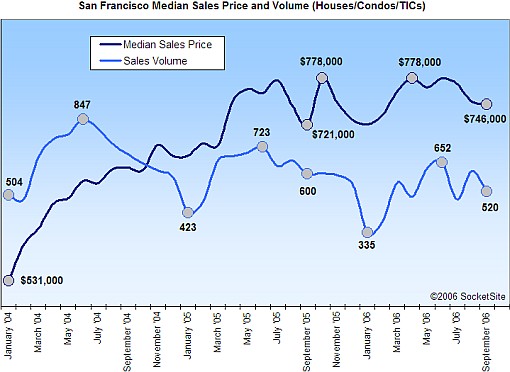

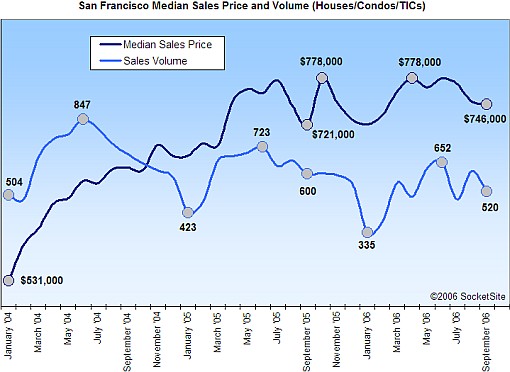

According to DataQuick, the median sales price for existing homes in San Francisco was $746,000 last month, up 3.5% from $721,000 in September ’05, but down $4,000 (0.5%) from August ‘06. Sales volume was down 13.3% year-over-year (520 sales versus 600 in September ‘05), and down 15.2% from the month prior (613 Sales).

Based on slowing sales and increased inventory, we estimate that the “months of supply” of listed Single Family Homes, Condos, and TICs in San Francisco increased ~35% from August to September, and has continued to increase over the past couple of weeks.

For the greater Bay Area, the recorded median sales price in September was $611,000 (down 0.8% year-over-year) and sales volume was 7,907 (down 29.4% from September ’05, down 13.4% from August ’06). Year-over-year sales volume dropped 39.1% in Marin, 34.4% in Napa, and 32.2% in Sonoma (which also recorded a 7.7% drop in median sales price).

And we can’t help but notice that while DataQuick noted “Indicators of market distress are still largely absent” just last month, this month’s report notes that “Indicators of market distress are still at a moderate level.” (Still?)

∙ Bay Area home prices decline, sales slow [DQNews]

∙ San Francisco Median Sales Price Takes A Little Hit [SocketSite]

This month’s data is much like last month’s data….San Francisco appears to be outperforming the rest of the bay area. Both the number of sales and the sales prices are holding up better than regional averages. As an SF homeowner I’m pleased, but I’m curious why.

Someone else once pointed out (think it was tipster) that the medians are skewed by cash back and incentive arrangements at closing. Basically, Realtors(tm) are “painting the tape” trying to make it look like prices aren’t falling while in fact they are. Like the article in today’s paper about buy a house, get a free Maserati.

dude (and tipster, i suppose)–your take on cashback is itself skewed.

if you get cash back at the end of a deal, unless your purchase is financed 100%, you’re still paying the “purchase price”, you’re just doing it with less cash down. Same loan amount (usually) and same tax base.

Dude, I’m not (necessarily) saying the sky isn’t falling; I’m just asking why it apparently isn’t falling as quickly in SF compared to our eight neighboring counties.

Skewed? Not quite. If the seller pays for any cost in a transaction that is typically paid by the buyer – like paying closing costs that a buyer typically pays – then the effective purchase price of the property is lower. It is usually done in order to get a higher loan or to make the sale appear as a higher sale price to the market, but the effective price paid by the buyer is lower. Generally though, it’s my understanding that these cashback incentives are not as big of a part of the local market as they are with the new home market in the central valley where a large supply of finished new homes makes it more common.

Wisn’t it falling here like the neighboring counties? I guess because we’re San Francisco and everybody wants to live here. I know it sounds like stupid rhetoric, but I suppose there’s some element of truth to it. I could probably afford a SFR in parts of the east bay, but I’d rather wait a year to buy a condo in the city. Supply constraints + pent-up buyer demand makes prices stickier on the way down. Just my guess, though.

In the recession of the early ’90’s, prices in SF fell less than in the suburbs.

There is a limited supply of single family homes in SF, and more aren’t being built (by and large). Unless we hit another recession or a big increase in interest rates, I doubt that we’ll have a crash in SF single family home prices.

I think it just has to do with supply and demand. More people want to live in SF than there are available units. The people who are buying at these prices can afford it and there are plenty more buyers where they came from.

Does Dataquick break things down into SFH versus Condos? I can see the limited supply argument for the former – they really aren’t building any more – but not for the latter.

Dataquick lumps it all together (sf and condos anyway).

To buy a SFH in SF you are not the typical home buyer on a budget. You are wealthy and have the cash, and cash flow to be able to purchase a $1M+ home. The truth is that SF (and other major metro markets) have an abundance of these types of buyers. This fact should by and large keep the prices in SF proper a bit more stable.

That said, who knows how many people took out option-ARMs to leverage up their finances in order to buy into this market. All I know is that there are/were a lot of $1M+ TIC’s sold into this market and only time will tell how these potential time-bombs will play out. I point out TIC’s specifically, but I suspect a large portion of the rapid price appreceiation in SF came from a bubble-like atmosphere where prices got way out of alignment with typical household incomes. The only difference here is that there are enough wealthy buyers to protect the downside.

There is truth to the cliche’ that San Francisco is a “world city”. People around the world want to live in San Francisco like they want to live in New York, Paris, Rome, Hong Kong. This has a certain effect on our local SF market, certainly on the upper end of the market and most all of SF is defacto in the upper end of the market. These people do not end up in Union City if they cannot afford South Beach, nor do they end up in Jersey if they cannot afford the upper west side.

I guess DataQuick DOES separate condo and sfh home sales, though it’s not evident on their website. SFH home sales ARE stronger than condos, which are the weak link, apparently.

From the Chron article on the DataQuick figures this morning:

“The median price of a single-family home posted a modest gain since this time last year, increasing 1.1 percent in the nine counties to $653,000, according to DataQuick. In San Francisco, the price of a single-family home rose 5.5 percent to $800,000, the biggest increase of any Bay Area county.”

Yeh, and to add further the Chron’s graph in that article has condos in San Francisco declining 1.3% y on y to $676,000.

There is truth to the cliche’ that San Francisco is a “world city”. People around the world want to live in San Francisco like they want to live in New York, Paris, Rome, Hong Kong. This has a certain effect on our local SF market, certainly on the upper end of the market and most all of SF is defacto in the upper end of the market. These people do not end up in Union City if they cannot afford South Beach, nor do they end up in Jersey if they cannot afford the upper west side.”

That is right on. SF is its own market. There are plenty of people with plenty of money from plenty of places around the world and country that want to live in SF. That fact that there is not many more units being built besides condos keeps prices up.

I also think that all the new condos being build especially the highrises are filling a desired gap. These types of units are very popular in the other “world cities” and are pretty much non existent at this point. That is why some of these buildings are attracting people like Gore and the guy who bought the three penthouses at the Regis. They are not worried about property values.