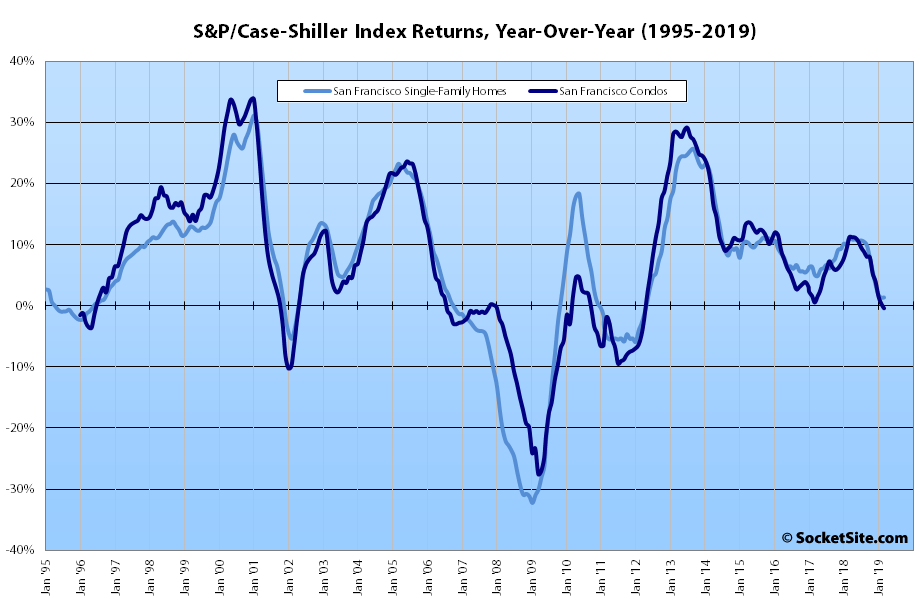

Having eked out a 0.6 percent gain in February, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area (which includes the East Bay, North Bay and Peninsula) ticked up 2.1 percent in March. That being said, the index is still down 1.7 percent since the third quarter of 2018 and its year-over-year gain has dropped to 1.4 percent, which is the second smallest year-over-year return for the index, behind a downwardly revised 1.3 percent return in February, since the second quarter of 2012.

While the index for the bottom third of the Bay Area market ticked up 1.3 percent in March, its year-over-year gain dropped from 3.1 to 2.5 percent (versus a year-over-year gain of 11.6 percent at the same time last year). While the index for the middle third of the market ticked up 1.8 percent in March, its year-over-year gain dropped to 1.4 percent (its smallest year-over-year gain since the second quarter of 2012 and versus a year-over-year gain of 11.7 percent at the same time last year). And while the index for the top third of the market ticked up 2.8 percent in March, its year-over-year gain dropped to 1.0 percent versus a 10.8 percent gain on a year-over-year basis at the same time last year.

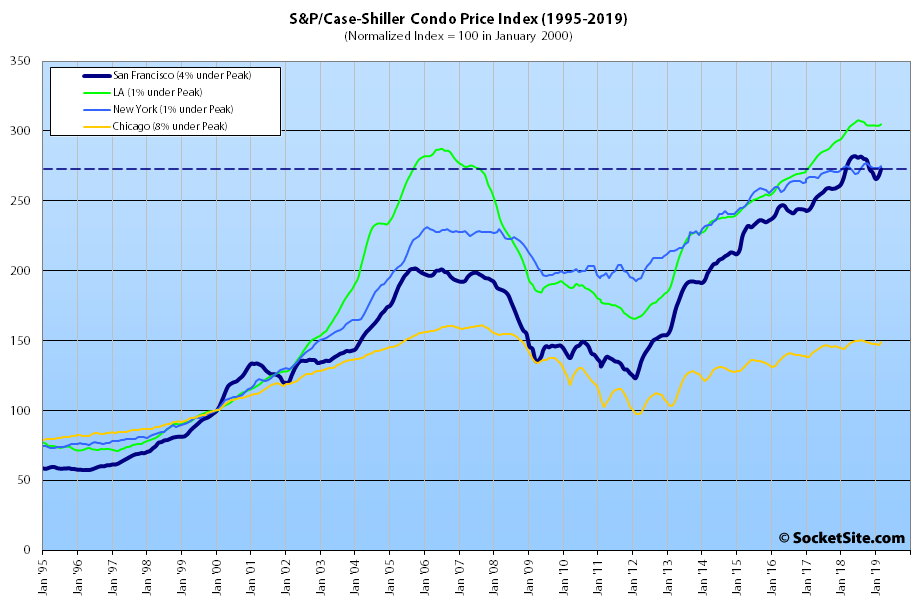

At the same time, while the index for Bay Area condo values ticked up 2.0 percent in March, it’s down 3.2 percent since the second quarter of last year and down 0.4 percent versus the same time last year, representing the first year-over-year drop for the index since the second quarter of 2012.

As we first noted in the third quarter of last year, Las Vegas is still leading the nation in terms of home price gains, up 8.2 percent on a year-over-year basis, versus a national average of 3.7 percent, followed by Phoenix (up 6.1 percent) and Tampa (up 5.3 percent).

And at 1.4 percent, San Francisco ranked second to last in terms of year-over-year gains in value across the county, outperforming San Diego and Los Angeles which both recorded gains of 1.3 percent.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

This basically affirms that the Bay Area is starting to see home appreciation that tracks the national average (give or take). Long gone are the days of outsized appreciation fed by rapid job expansion and significant population growth. This likely will be a prolonged phenomena as the Bay Area sees very sluggish job and population growth – at or slightly less than the national average.

In terms of year-over-year returns, the index for Bay Area homes has actually underperformed the national average since November of last year and by an average of 2 percentage points (53 percent).

Yes – that is why I qualified the comment with “give or take”.

Bay Area is dependent on the stock market which is highly dependent on RSU supplemental income to qualify people.

When the RSU’s go…so will the local market

That YoY chart is a great example of downward price stickiness. It would be helpful to add some macro indication like interest rates or recession bars to put things in context.

“representing the first year-over-year drop for the index since the second quarter of 2012.”

2012 was a great time to buy.

That’s certainly true. Of course, that was on the back of a decline that had effectively commenced back in 2006, at which point the index for San Francisco index recorded its “first year-over-year drop since second quarter of 2002,” and bottomed in 2009.

“Of course, that was on the back of a decline that had effectively commenced back in 2006”

And even 2006 was a decent time to buy. Anyone noticing a trend?

With the San Francisco index having dropped 46 percent from 2006 to 2009, and having not recovered until the fourth quarter of 2015, it was a much decenter time to buy in 2009/2012.

2009 and 2012: times I called bottom and a good time to buy on this site in real time.

And you’re still missing the point. Anyway, with your precision market timing skills, you should raise capital, make billions, and retire your armchair economist gig.

hodl

Follow the big boys! Blackstone bought into housing in 2012 and is selling out now that it’s topping.

So you’re saying that in hindsight, the local low was a good time to buy?

“Having eked out a 0.6 percent gain in February, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area (which includes the East Bay, North Bay and Peninsula) ticked up 2.1 percent in February.” Is this confusing? Did we see a 0.6 percent gain in February or a 2.1 percent gain? typo?

Typo (which has since been corrected above). The index for single-family homes inched up 0.6 percent in February, gained 2.1 percent in March (with seasonality in play) and is now up 1.4 percent year-over-year.